The Simplest Dividend Strategy: Maximizing Your Returns

Table of Contents

1. Understanding Dividend Investing Basics

What are Dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. They represent a share of the company's earnings distributed directly to investors. These payments can be made quarterly, annually, or even as special one-time distributions. Understanding dividend types is crucial for planning your income stream.

Selecting Dividend-Paying Stocks

Choosing the right dividend-paying stocks is paramount to success. Several key criteria should guide your selection:

- Dividend Yield: This represents the annual dividend per share relative to the stock's price. A higher yield might seem appealing, but be cautious as excessively high yields can sometimes signal underlying company problems. Analyze the yield in context with other factors.

- Dividend Payout Ratio: This indicates the percentage of a company's earnings paid out as dividends. A sustainable payout ratio (generally below 70%) suggests the company can comfortably maintain its dividend payments, even during economic downturns.

- Company Financial Health: Thoroughly research the financial health of any company before investing. Check its balance sheet, income statement, and cash flow statements to assess its stability and profitability. Look for consistent revenue growth, positive earnings, and low debt levels.

- Dividend Growth History: Companies with a history of consistently increasing their dividend payments demonstrate a commitment to rewarding shareholders. This is a positive sign of financial strength and long-term stability. Prioritize companies with a track record of dividend growth.

2. Building a Diversified Dividend Portfolio

The Power of Diversification

Diversification is the cornerstone of any successful investment strategy, including dividend investing. By spreading your investments across different companies and sectors, you significantly reduce your overall portfolio risk. Don't put all your eggs in one basket!

Sector Diversification

Diversifying your portfolio across different sectors is crucial. Instead of concentrating your investments in a single industry (e.g., technology), spread your risk by investing in companies from various sectors such as:

- Technology

- Healthcare

- Consumer goods

- Financials

- Energy

This approach reduces your dependence on the performance of any single industry and improves the resilience of your portfolio.

Portfolio Size & Re-Investment

The ideal portfolio size for a simple dividend strategy depends on your individual financial goals and risk tolerance. Start small and gradually increase your investment as you gain experience and confidence. Crucially, reinvest your dividends to harness the power of compounding. Reinvesting allows your earnings to generate further earnings, accelerating your long-term growth.

3. Implementing the Simplest Dividend Strategy

Buy and Hold

The core principle of this strategy is remarkably simple: buy high-quality dividend-paying stocks and hold them for the long term. Avoid frequent trading based on short-term market fluctuations. The focus is on the long-term growth and income potential of your investments.

Regular Monitoring

While the "buy and hold" approach emphasizes long-term investing, regular monitoring is essential. Periodic reviews (annually, for example) allow you to assess the performance of the companies in your portfolio, identify any potential issues, and make informed adjustments if necessary. Avoid impulsive reactions to short-term market volatility.

Tax Implications

Dividend income is typically taxable. It's crucial to understand the tax implications in your region and consider seeking advice from a qualified tax professional to ensure you're managing your tax obligations effectively.

4. Managing Risks in your Simplest Dividend Strategy

Market Volatility

Market downturns are inevitable. The key is to maintain a long-term perspective. While your portfolio value may fluctuate, the consistent dividend income provides a buffer during periods of market volatility. Focus on the long-term growth potential of your investments.

Company-Specific Risks

Every company carries inherent risks. Thorough research is vital before investing in any company. Assess its financial health, competitive landscape, and management team to understand potential risks. Diversification helps mitigate this risk.

Inflation

Inflation can erode the purchasing power of your dividend income over time. To counter this, consider investing in dividend growth stocks—companies that consistently increase their dividend payments over time, ideally at a rate exceeding inflation.

Conclusion

The Simplest Dividend Strategy hinges on diversification, selecting high-quality dividend-paying stocks, adopting a buy-and-hold approach, and regularly monitoring your portfolio. This straightforward strategy offers significant advantages: simplicity, passive income generation, and the potential for substantial long-term growth. Start building your passive income stream with the simplest dividend strategy. Begin your research now!

Featured Posts

-

Crazy Rich Asians Sequel Jon M Chus Executive Producer Role At Max

May 11, 2025

Crazy Rich Asians Sequel Jon M Chus Executive Producer Role At Max

May 11, 2025 -

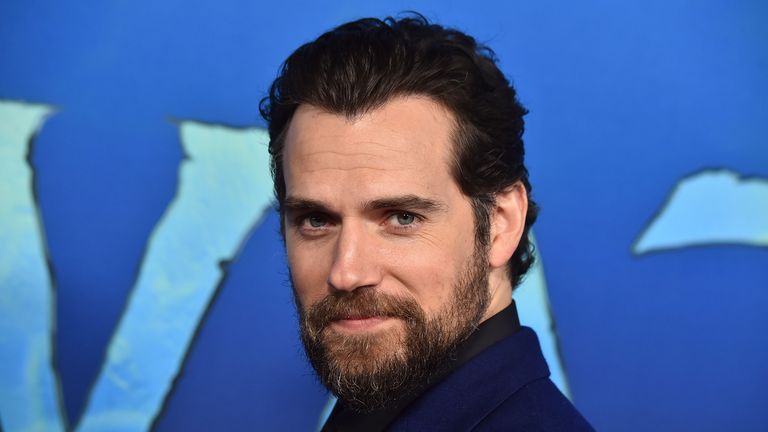

Is Henry Cavill The Next Nova Examining The Casting Speculation

May 11, 2025

Is Henry Cavill The Next Nova Examining The Casting Speculation

May 11, 2025 -

Cooyah Unveils Grand Slam Track Collection Performance And Style Combined

May 11, 2025

Cooyah Unveils Grand Slam Track Collection Performance And Style Combined

May 11, 2025 -

Eurovision 2025 Can Sissal Bring Victory To Denmark

May 11, 2025

Eurovision 2025 Can Sissal Bring Victory To Denmark

May 11, 2025 -

Valentina Shevchenko Vs Zhang Weili A Superfight At Ufc 315

May 11, 2025

Valentina Shevchenko Vs Zhang Weili A Superfight At Ufc 315

May 11, 2025