The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

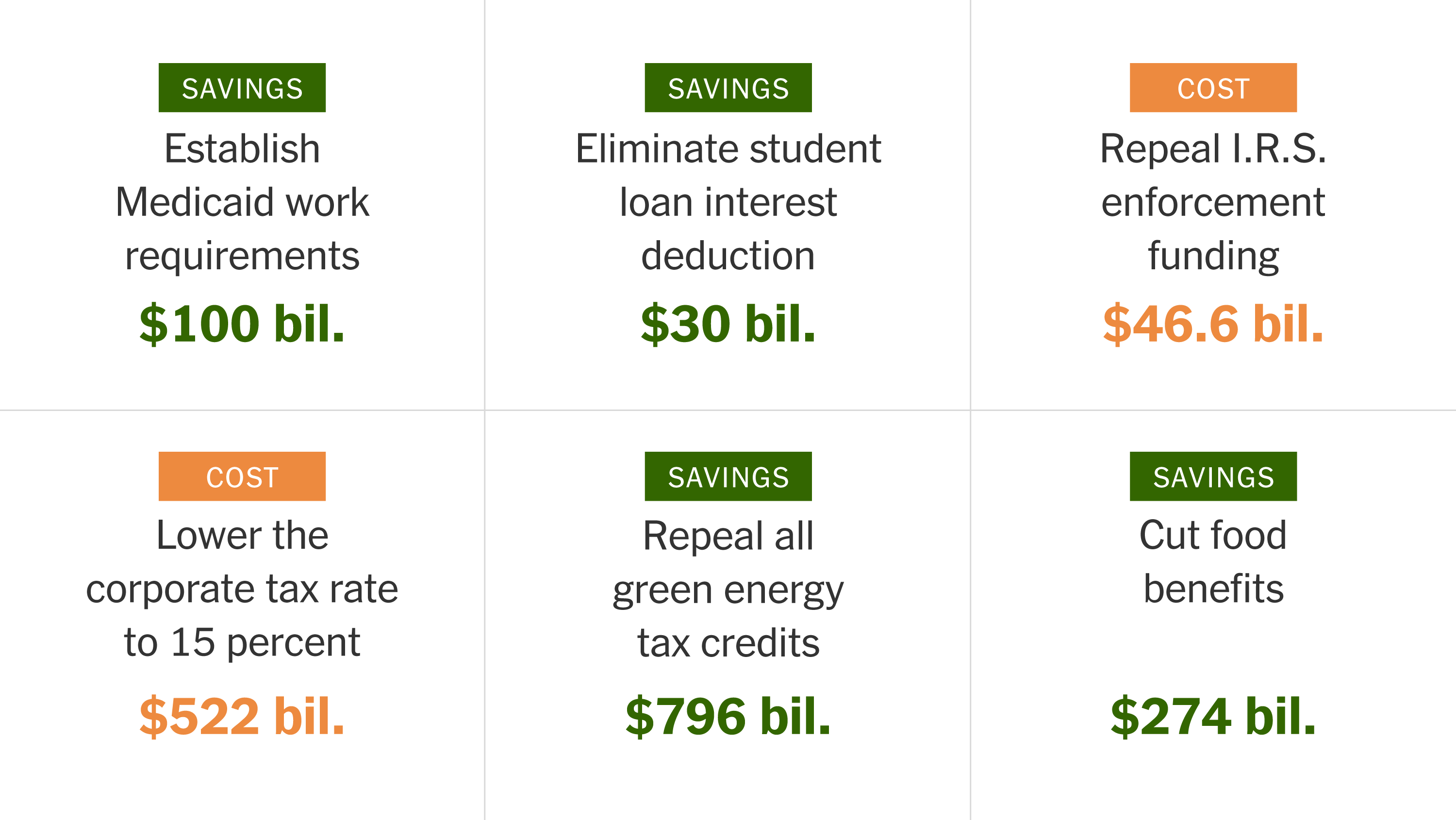

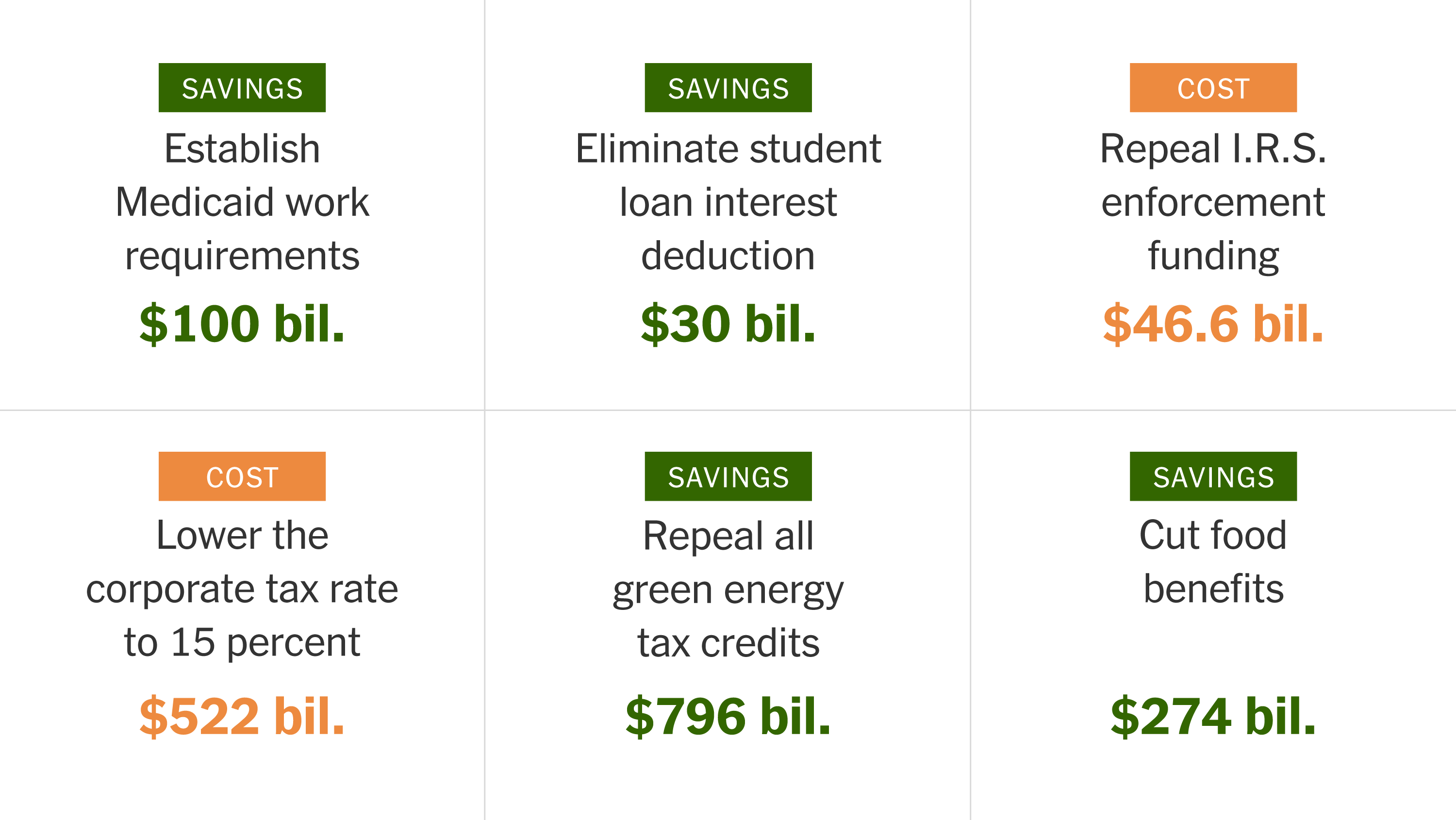

Projected Revenue Losses Under the GOP Tax Plan

The core of the GOP Tax Plan Deficit Impact debate lies in the projected revenue losses stemming from proposed tax cuts. These losses are projected across both individual and corporate tax brackets.

Individual Income Tax Cuts

Proposed cuts to individual income tax rates significantly impact federal revenue. Analyses from organizations like the Congressional Budget Office (CBO) and the Tax Policy Center project substantial revenue shortfalls.

- Reduced tax rates for high-income earners: Lowering top marginal tax rates disproportionately benefits high-income individuals, leading to significant revenue reductions. This aspect of the GOP tax plan is often a central point of contention in the debate surrounding its deficit impact.

- Elimination or reduction of certain deductions and credits: While some deductions and credits might be eliminated or reduced to offset some of the revenue losses, the net effect is generally still projected as a revenue decrease. The impact of these changes varies widely across different income levels.

- Potential impact on tax revenue from capital gains and dividends: Changes to capital gains and dividend tax rates also play a role in the overall revenue projections. Lowering these rates can stimulate investment but also reduce tax revenue collected from these sources. The effect of these changes is debated, with some arguing they will be offset by economic growth.

Corporate Tax Rate Reductions

Lowering the corporate tax rate is another key component of many GOP tax plans. While proponents argue this will stimulate investment and job creation, the impact on government revenue is undeniable.

- Lowered corporate tax rates compared to previous years: Significant reductions in corporate tax rates directly translate to lower tax revenue for the government. The magnitude of these reductions varies across different proposals.

- Impact on corporate profitability and investment decisions: The expectation is that lower corporate tax rates will increase corporate profitability, leading to increased investment and job creation (a supply-side economics argument). However, empirical evidence of this effect is varied and often debated.

- Potential for increased tax revenue from economic growth: Proponents argue that the economic growth stimulated by lower corporate tax rates will eventually lead to increased overall tax revenue. This "dynamic scoring" approach is contrasted with "static scoring," which only considers the direct impact of lower tax rates.

- Concerns regarding reduced tax revenue outweighing economic growth: Critics argue that the projected increase in economic activity may not be substantial enough to offset the direct revenue loss from lower tax rates. This is a key area of disagreement in assessing the GOP tax plan’s effect on the deficit.

Increased National Debt and Deficit Projections

The projected revenue losses under the GOP tax plan directly translate into increased national debt and deficit projections. Independent analyses provide crucial insights into these consequences.

CBO and Other Independent Analyses

The CBO and other non-partisan organizations have consistently projected significant increases in the national debt under various GOP tax plans. Their analyses typically involve complex econometric models, considering various factors like economic growth, interest rates, and government spending.

- CBO projections on deficit increase over 10-year period: The CBO regularly publishes reports detailing their projections of the deficit increase over various time horizons, often focusing on a 10-year period. These projections vary depending on the specific details of the proposed tax plan.

- Impact on future government spending and borrowing: Increased national debt leads to higher interest payments on government debt, potentially crowding out other government spending. The long-term consequences are a subject of ongoing debate.

- Potential long-term consequences of increased national debt: A continuously growing national debt can lead to several negative consequences, including higher interest rates, reduced economic growth, and increased vulnerability to economic shocks.

Dynamic Scoring vs. Static Scoring

Understanding the difference between dynamic and static scoring is crucial to interpreting deficit projections. These two methods provide vastly different estimates of the tax plan's impact.

- Definition and explanation of static scoring: Static scoring assesses the revenue impact of a tax plan without considering any potential changes in economic behavior (such as increased investment). It provides a more conservative estimate of revenue changes.

- Definition and explanation of dynamic scoring: Dynamic scoring attempts to incorporate the potential effects of tax changes on economic activity, such as changes in investment and labor supply. It aims to predict the effect on both revenues and the economy.

- Comparison of results obtained using both methods: Dynamic scoring typically produces more optimistic revenue projections than static scoring. The difference between these two methods reflects the uncertainty inherent in economic forecasting and is a source of much debate surrounding GOP tax plans.

- Discussion of the inherent uncertainties in economic forecasting: Economic models are inherently complex, and their ability to accurately predict future economic outcomes is limited. This uncertainty contributes to the wide range of revenue projections found in different analyses of the GOP tax plan.

Alternative Policy Proposals and Their Deficit Impacts

It's important to compare the GOP tax plan to alternative proposals to better understand the trade-offs involved.

Comparison with Other Tax Plans

Analyzing alternative tax plans proposed by Democrats or other political groups provides a valuable comparative perspective on the GOP tax plan's deficit impact.

- Comparison of revenue projections for different plans: Different tax plans have vastly different revenue projections. Comparing these projections highlights the key differences in their approaches and economic assumptions.

- Evaluation of the distributional effects of each plan: Tax plans have different impacts on different income groups. Evaluating these distributional effects sheds light on the equity and fairness implications of different policy options.

- Consideration of long-term sustainability of each plan: A crucial aspect of comparing tax plans is their long-term fiscal sustainability. Some plans may lead to lower deficits in the short term but higher deficits in the long term.

Conclusion

The analysis of the GOP tax plan's potential impact on the national deficit reveals a complex picture. While proponents argue for increased economic growth offsetting revenue losses, independent analyses consistently project significant increases in the national debt. Understanding the stark math behind the GOP Tax Plan Deficit Impact is crucial for informed political discourse and responsible policymaking. To further your understanding of the potential economic consequences, we encourage you to explore additional resources from the Congressional Budget Office and other reputable sources on the GOP Tax Plan Deficit Impact. Further research into the GOP tax plan and its potential long-term effects is essential for forming an informed opinion on the GOP Tax Plan Deficit Impact.

Featured Posts

-

The Goldbergs A Retrospective Look At The Popular Sitcom

May 21, 2025

The Goldbergs A Retrospective Look At The Popular Sitcom

May 21, 2025 -

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 21, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 21, 2025 -

Lazios Late Equalizer Secures 1 1 Draw Against 10 Man Juventus

May 21, 2025

Lazios Late Equalizer Secures 1 1 Draw Against 10 Man Juventus

May 21, 2025 -

Klopps Future Agents Remarks On Potential Real Madrid Move

May 21, 2025

Klopps Future Agents Remarks On Potential Real Madrid Move

May 21, 2025 -

Gma Shakeup Robin Roberts Response To Layoffs And Uncertainty

May 21, 2025

Gma Shakeup Robin Roberts Response To Layoffs And Uncertainty

May 21, 2025

Latest Posts

-

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 21, 2025

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 21, 2025 -

Kaellmanin Ja Hoskosen Puola Ura Paeaettymaessae

May 21, 2025

Kaellmanin Ja Hoskosen Puola Ura Paeaettymaessae

May 21, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Laehtevaet Puolasta

May 21, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Laehtevaet Puolasta

May 21, 2025 -

Kaellman Ja Hoskonen Loppu Puola Kaudelle

May 21, 2025

Kaellman Ja Hoskonen Loppu Puola Kaudelle

May 21, 2025 -

Kaellmanin Potentiaali Uusi Aikakausi Huuhkajissa

May 21, 2025

Kaellmanin Potentiaali Uusi Aikakausi Huuhkajissa

May 21, 2025