The Student Loan Crisis: A Looming Economic Threat

Table of Contents

The Soaring Cost of Higher Education

Tuition Inflation Outpacing Income Growth

The cost of higher education has skyrocketed in recent decades, far outpacing the growth of wages. This dramatic increase has made college increasingly unattainable for many, forcing students to rely heavily on loans to finance their education.

- Tuition increases: Over the past 20 years, tuition at four-year public colleges has more than doubled, while private college tuition has nearly tripled, according to the College Board.

- Income stagnation: Meanwhile, wage growth has remained relatively stagnant, leaving many families struggling to afford the ever-increasing cost of college. The gap between tuition increases and income growth has widened significantly, creating a financial barrier to higher education for many.

This widening gap fuels the reliance on student loans, transforming what was once considered a pathway to financial success into a potential lifetime of debt.

The Role of Student Loans in Funding Higher Education

The escalating cost of tuition has led to an unprecedented reliance on student loans to finance higher education. Students are increasingly forced to borrow substantial amounts to cover tuition, fees, room, and board.

- Loan dependence: A significant percentage of college students now rely on loans to cover their educational expenses. The average student loan debt upon graduation continues to climb.

- Loan types: Students borrow from various sources, including federal student loans (subsidized and unsubsidized) and private student loans. Federal loans often come with more favorable repayment options, but private loans frequently carry higher interest rates.

- Long-term implications: The burden of substantial student loan debt can have significant long-term financial implications, affecting major life decisions such as homeownership, starting a family, and retirement planning. Early-career professionals burdened by significant debt often face considerable financial constraints.

The Economic Ripple Effects of Student Loan Debt

Impact on Personal Finances

The weight of student loan debt significantly impacts borrowers' personal finances, hindering their ability to achieve key financial milestones.

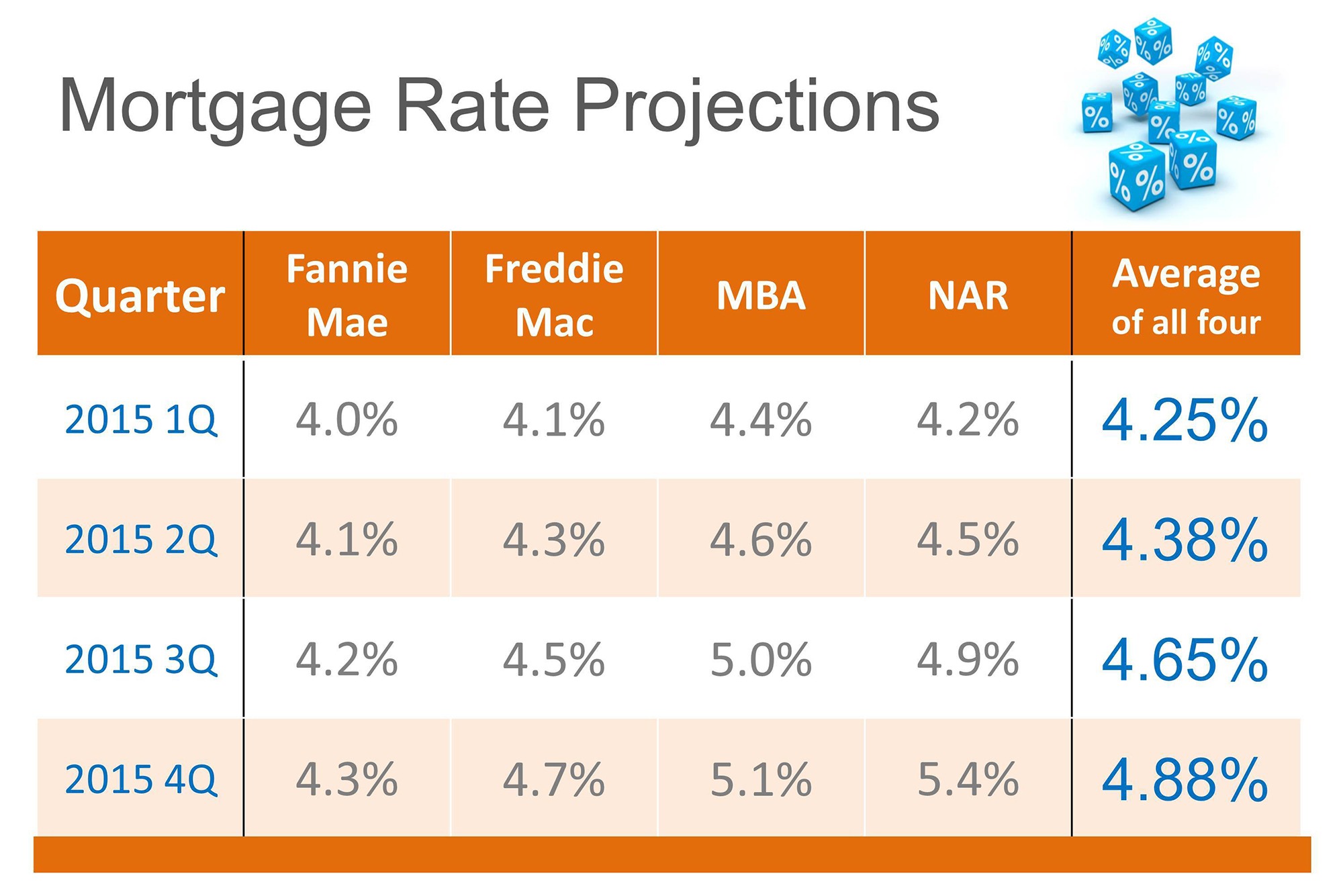

- Delayed homeownership: High student loan payments can make it difficult to save for a down payment and qualify for a mortgage, leading to delayed homeownership.

- Reduced savings: The significant monthly payments often leave little room for savings, hindering wealth accumulation and impacting retirement planning. Many borrowers find themselves struggling to build an emergency fund, making them vulnerable to unexpected financial setbacks.

- Impact on retirement: The long-term financial strain of student loan debt can significantly affect retirement savings, potentially leading to a less secure retirement. The financial burden may force individuals to delay or reduce contributions to retirement accounts.

These financial limitations restrict economic mobility and create a cycle of debt that can be difficult to break.

Macroeconomic Implications

The widespread accumulation of student loan debt has profound macroeconomic consequences.

- Reduced consumer spending: High levels of student loan debt can reduce consumer spending, as individuals allocate a greater portion of their income towards loan repayments. This reduced spending can negatively impact overall economic growth.

- Hindered economic growth: The inability of young adults to fully participate in the economy due to high debt burdens restricts economic growth. Delayed purchases, reduced investment, and decreased entrepreneurial activity all contribute to a less robust economy.

- Systemic risk: A large number of loan defaults could pose a systemic risk to the financial system. This risk highlights the importance of addressing the student loan crisis proactively to prevent a potential financial crisis.

The cumulative effect of these factors represents a serious challenge to long-term economic prosperity.

Impact on Specific Sectors

The student loan crisis also affects particular sectors of the economy.

- Housing market: The difficulty many borrowers face in securing mortgages directly impacts the housing market, potentially dampening demand and slowing down growth.

- Small businesses: The lack of capital due to student loan debt may limit the ability of young adults to start or expand small businesses, thus hindering job creation and economic diversification.

Potential Solutions and Policy Recommendations

Government Intervention and Loan Forgiveness Programs

Government intervention is crucial in addressing the student loan crisis. Policy options include loan forgiveness programs and income-driven repayment plans.

- Loan forgiveness: While potentially providing immediate relief to borrowers, loan forgiveness programs also have significant financial implications for taxpayers.

- Income-driven repayment: Income-driven repayment plans tie monthly payments to borrowers' income, making repayment more manageable. However, these plans can extend repayment periods significantly, potentially increasing the total interest paid.

Careful consideration must be given to the financial implications and potential unintended consequences of any large-scale policy intervention.

Addressing the Root Causes

Addressing the root causes of the crisis is equally important. This requires focusing on making higher education more affordable and accessible.

- Increased public funding: Increased funding for public universities could help keep tuition costs down.

- Promoting vocational training: Expanding access to vocational training and alternative educational pathways can provide students with valuable skills without incurring massive debt.

- Expanding scholarships: Expanding scholarship opportunities and grant programs could help reduce the reliance on student loans.

- Tuition reform: Exploring innovative models for tuition pricing and funding could help mitigate tuition increases.

Conclusion

The Student Loan Crisis is a multifaceted problem with serious economic consequences. The soaring cost of higher education, coupled with the increasing reliance on student loans, has created a significant burden for millions of Americans, impacting personal finances, hindering economic growth, and creating systemic risks. Addressing this crisis requires a multi-pronged approach, encompassing government intervention, loan forgiveness programs, and a fundamental shift in how we approach higher education affordability. The student loan debt relief and solutions to solving the student loan crisis are vital for the economic well-being of individuals and the nation as a whole. Take action today to learn more about available resources and advocate for solutions to this looming economic threat. Contact your elected officials and demand effective policies to manage your student loan burden and ensure a brighter financial future for all.

Featured Posts

-

The Garnacho Transfer Speculation Examining His Options

May 28, 2025

The Garnacho Transfer Speculation Examining His Options

May 28, 2025 -

Manchester Uniteds Garnacho Chelseas Pursuit And Potential Deal

May 28, 2025

Manchester Uniteds Garnacho Chelseas Pursuit And Potential Deal

May 28, 2025 -

Low Personal Loan Interest Rates Today Top Lender Options

May 28, 2025

Low Personal Loan Interest Rates Today Top Lender Options

May 28, 2025 -

Garnachos Future Man Utd Stars Response To Potential Chelsea Bid

May 28, 2025

Garnachos Future Man Utd Stars Response To Potential Chelsea Bid

May 28, 2025 -

French Open 2025 Sinner Dominates Rinderknech In Straight Sets Victory

May 28, 2025

French Open 2025 Sinner Dominates Rinderknech In Straight Sets Victory

May 28, 2025

Latest Posts

-

Ticketmaster Entendiendo El Precio Final De Tus Entradas

May 30, 2025

Ticketmaster Entendiendo El Precio Final De Tus Entradas

May 30, 2025 -

Cambios En La Politica De Precios De Boletos De Ticketmaster

May 30, 2025

Cambios En La Politica De Precios De Boletos De Ticketmaster

May 30, 2025 -

Nuevos Cambios En La Politica De Precios De Ticketmaster

May 30, 2025

Nuevos Cambios En La Politica De Precios De Ticketmaster

May 30, 2025 -

Ticketmaster Ofrece Mayor Transparencia En El Precio De Las Entradas

May 30, 2025

Ticketmaster Ofrece Mayor Transparencia En El Precio De Las Entradas

May 30, 2025 -

Mas Claridad Sobre Los Precios De Boletos De Ticketmaster

May 30, 2025

Mas Claridad Sobre Los Precios De Boletos De Ticketmaster

May 30, 2025