The Tesla-Dogecoin Connection: Analyzing The Recent Market Volatility

Table of Contents

Elon Musk's Influence on Dogecoin's Price

Elon Musk's tweets and public statements are frequently cited as the primary drivers of significant price spikes and dips in Dogecoin. His pronouncements, often seemingly capricious, hold an outsized influence over the cryptocurrency's market capitalization. This "tweet effect" highlights the unique vulnerabilities of Dogecoin to manipulation through social media influence.

-

The Tweet Effect in Action: Numerous instances exist where a single tweet from Musk has directly correlated with dramatic Dogecoin price movements. For example, [insert specific example with date and tweet content, linking to the original tweet if possible, and showing a before-and-after chart of the price]. Such events underscore the power of a single individual's social media presence to sway market sentiment.

-

Ethical Implications and Market Manipulation: The ethical implications of such significant influence on a volatile asset like Dogecoin are profound. Questions arise regarding potential market manipulation and the fairness of such a system where a single person can wield such power. Regulatory bodies are grappling with the challenge of overseeing and potentially regulating this aspect of the cryptocurrency market.

-

Regulatory Challenges: The unpredictable nature of Musk's pronouncements and their immediate impact on Dogecoin's price pose a significant challenge for regulators. Establishing clear guidelines and frameworks to address this level of social media influence on market behavior is crucial to ensure fair and transparent trading practices.

Tesla's Acceptance of Dogecoin (Past and Present)

Tesla's past acceptance of Dogecoin as a payment method for certain merchandise added another layer to the complex relationship between the electric vehicle giant and the meme-based cryptocurrency.

-

A Bold Business Decision (or PR Stunt?): Tesla's decision to accept Dogecoin, though short-lived in some instances, garnered significant media attention and boosted Dogecoin's visibility. The business rationale behind this move remains a subject of debate, with some suggesting it was primarily a marketing strategy rather than a serious attempt to integrate a volatile cryptocurrency into its payment system.

-

Impact on Adoption and Legitimacy: The temporary acceptance of Dogecoin by a prominent company like Tesla had a significant short-term impact on its adoption and, arguably, its perceived legitimacy. However, this boost proved transient, demonstrating the challenges of integrating volatile digital assets into established business models.

-

Shifting Payment Policies: Tesla's subsequent changes to its Dogecoin payment policy highlight the inherent risks and uncertainties associated with accepting cryptocurrencies as payment. The fluctuating value of Dogecoin makes it an unpredictable and potentially unprofitable method of payment for businesses.

The Broader Cryptocurrency Market's Impact on Dogecoin

Dogecoin's price is not only influenced by Elon Musk's actions but also by the overall performance and sentiment within the broader cryptocurrency market.

-

Bitcoin's Influence: A strong correlation exists between Bitcoin's price movements and Dogecoin's price. When Bitcoin experiences a surge, Dogecoin often follows suit, although usually to a lesser extent. Conversely, Bitcoin downturns tend to impact Dogecoin negatively as well.

-

Market Sentiment and Altcoin Performance: Overall market sentiment—bullish or bearish—significantly affects Dogecoin's performance. During bullish periods, investors often pour capital into altcoins like Dogecoin, driving up its price. Bearish markets, however, often lead to significant sell-offs.

-

Dogecoin Volatility Compared to Other Altcoins: Dogecoin remains significantly more volatile than many other established altcoins like Ethereum. This heightened volatility makes it a riskier investment for many, although its appeal lies in its potential for substantial short-term gains.

Analyzing the Risks of Investing in Dogecoin

Investing in Dogecoin carries significant risks. Potential investors should undertake thorough due diligence before committing capital.

-

High Volatility and Unpredictable Price Swings: The cryptocurrency's price is notoriously volatile, subject to dramatic fluctuations influenced by tweets, news, and overall market sentiment. This makes it a highly speculative investment.

-

Lack of Intrinsic Value: Unlike some cryptocurrencies with established use cases, Dogecoin lacks intrinsic value or a clear utility beyond its meme status. This makes its long-term sustainability questionable for many investors.

-

Dependence on External Factors: Dogecoin's price is heavily reliant on external factors, primarily Elon Musk's actions and overall market sentiment, making it a risky investment for those seeking stability.

-

Importance of Research and Risk Assessment: Before investing in Dogecoin or any other cryptocurrency, extensive research and careful risk assessment are paramount. It's crucial to understand the inherent volatility and speculative nature of the asset before committing any funds.

Conclusion

The Tesla-Dogecoin connection highlights the significant impact of social media influence and market sentiment on cryptocurrency prices. Elon Musk's actions have repeatedly demonstrated a powerful influence on Dogecoin's price volatility, while its correlation with Bitcoin and overall market sentiment underscores the interconnectedness of the cryptocurrency ecosystem. The inherent volatility and lack of intrinsic value make Dogecoin a high-risk investment. Understanding the Tesla-Dogecoin connection is crucial for navigating the complexities of the cryptocurrency market. Further research and careful consideration of the risks are essential before investing in Dogecoin or any other volatile cryptocurrency. Stay informed about the latest developments in the Tesla-Dogecoin relationship to make informed investment decisions.

Featured Posts

-

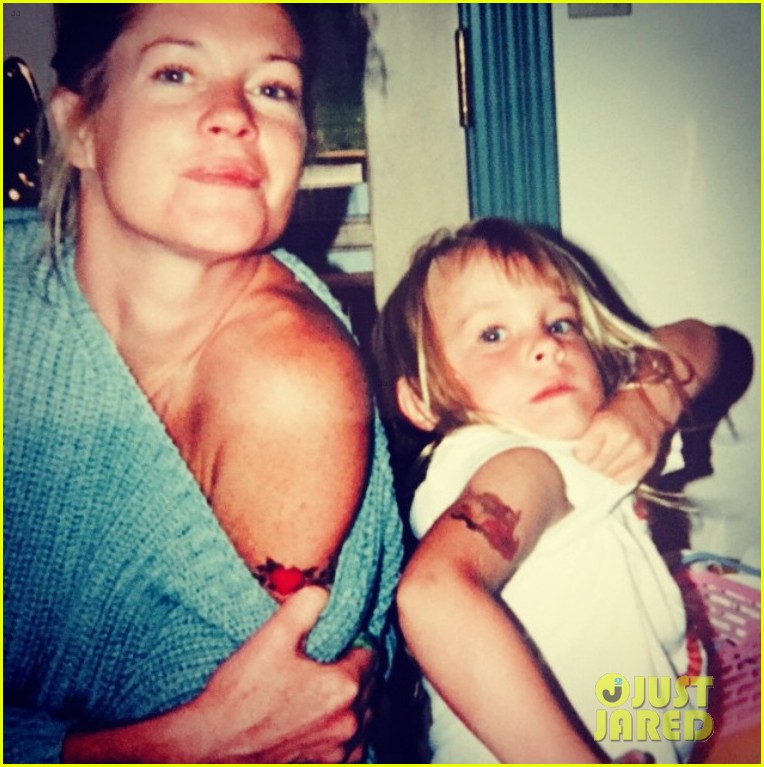

Dakota Johnson And Melanie Griffith A Mother Daughter Day Out In Spring Fashion

May 10, 2025

Dakota Johnson And Melanie Griffith A Mother Daughter Day Out In Spring Fashion

May 10, 2025 -

The Impact Of Broadcoms Extreme V Mware Price Hike At And Ts Perspective

May 10, 2025

The Impact Of Broadcoms Extreme V Mware Price Hike At And Ts Perspective

May 10, 2025 -

The Undervalued Asset How Middle Managers Contribute To Business Success And Employee Development

May 10, 2025

The Undervalued Asset How Middle Managers Contribute To Business Success And Employee Development

May 10, 2025 -

City Name Michigan A Students Guide To The Perfect College Town

May 10, 2025

City Name Michigan A Students Guide To The Perfect College Town

May 10, 2025 -

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025