The Trump Tax Cut Bill: A Breakdown Of The House Republican Proposal

Table of Contents

Individual Income Tax Changes Under the Trump Tax Cut Bill

The Trump Tax Cut Bill implemented sweeping changes to the individual income tax system. These alterations impacted taxpayers across various income brackets and family structures.

Reduced Tax Rates:

The bill significantly reduced individual income tax rates. Here's a summary of the changes:

- Pre-Tax Cut Rates: A multi-bracket system with rates ranging from 10% to 39.6%.

- Post-Tax Cut Rates: Rates were lowered to seven brackets, ranging from 10% to 37%.

- Impact: This reduction directly translated to lower tax bills for most individuals, although the extent of savings varied depending on income level. For example, someone in the 39.6% bracket saw a substantial decrease, while those in lower brackets saw more modest savings. Detailed analyses from organizations like the Tax Policy Center offered specific calculations for various income levels.

Standard Deduction and Personal Exemptions:

The Trump Tax Cut Bill significantly increased the standard deduction while eliminating personal exemptions.

- Standard Deduction: The standard deduction was nearly doubled, providing a larger tax break for many taxpayers, especially those with lower incomes.

- Personal Exemptions: The elimination of personal exemptions offset some of the benefits of the increased standard deduction for larger families.

- Overall Effect: While the increased standard deduction benefited many, the elimination of personal exemptions meant that the net tax savings varied significantly based on family size and income. Families with many children might have experienced less of a benefit than individuals or smaller families.

Child Tax Credit:

The bill also modified the Child Tax Credit (CTC).

- Increased Credit: The maximum CTC amount was increased.

- Refundability: A portion of the CTC became refundable, meaning that eligible families could receive a portion of the credit as a refund even if they owed no taxes.

- Impact: The changes to the CTC provided more substantial tax relief for families with children, particularly low-to-moderate-income families. However, there were still limitations and phase-outs based on income levels.

Corporate Tax Rate Reductions in the Trump Tax Cut Bill

A cornerstone of the Trump Tax Cut Bill was the dramatic reduction in the corporate tax rate.

Lowering the Corporate Tax Rate:

- Pre-Tax Cut Rate: The top U.S. corporate tax rate was 35%.

- Post-Tax Cut Rate: The bill reduced the top corporate tax rate to 21%.

- Impact: This significant reduction aimed to boost corporate profits, encourage investment, and stimulate economic growth. Proponents argued that it would lead to increased job creation and higher wages.

Implications for Businesses and the Economy:

The corporate tax cut had far-reaching implications for businesses and the overall economy.

- Increased Investment: Many businesses used the savings to increase investments in equipment, technology, and expansion.

- Stock Buybacks: A significant portion of the savings was also directed toward stock buybacks, benefitting shareholders.

- Economic Growth: The impact on economic growth remains a topic of ongoing debate. While some sectors experienced increased investment and job creation, others saw little to no impact. Studies examining the economic consequences of the tax cuts offer varying conclusions. Analyzing GDP growth in relation to the tax cuts is an important aspect of this ongoing discussion.

Controversial Aspects and Long-Term Effects of the Trump Tax Cut Bill

Despite its intended benefits, the Trump Tax Cut Bill sparked significant controversy and raised concerns about its long-term effects.

Increased National Debt:

The tax cuts resulted in substantial revenue losses for the federal government, contributing to a significant increase in the national debt.

- Budget Deficits: The annual budget deficits widened considerably following the enactment of the bill.

- Long-Term Consequences: The increased national debt raises concerns about future fiscal sustainability and the potential for higher interest rates. Understanding fiscal policy and the long-term implications of increased national debt are key aspects of evaluating the legislation's success.

Income Inequality:

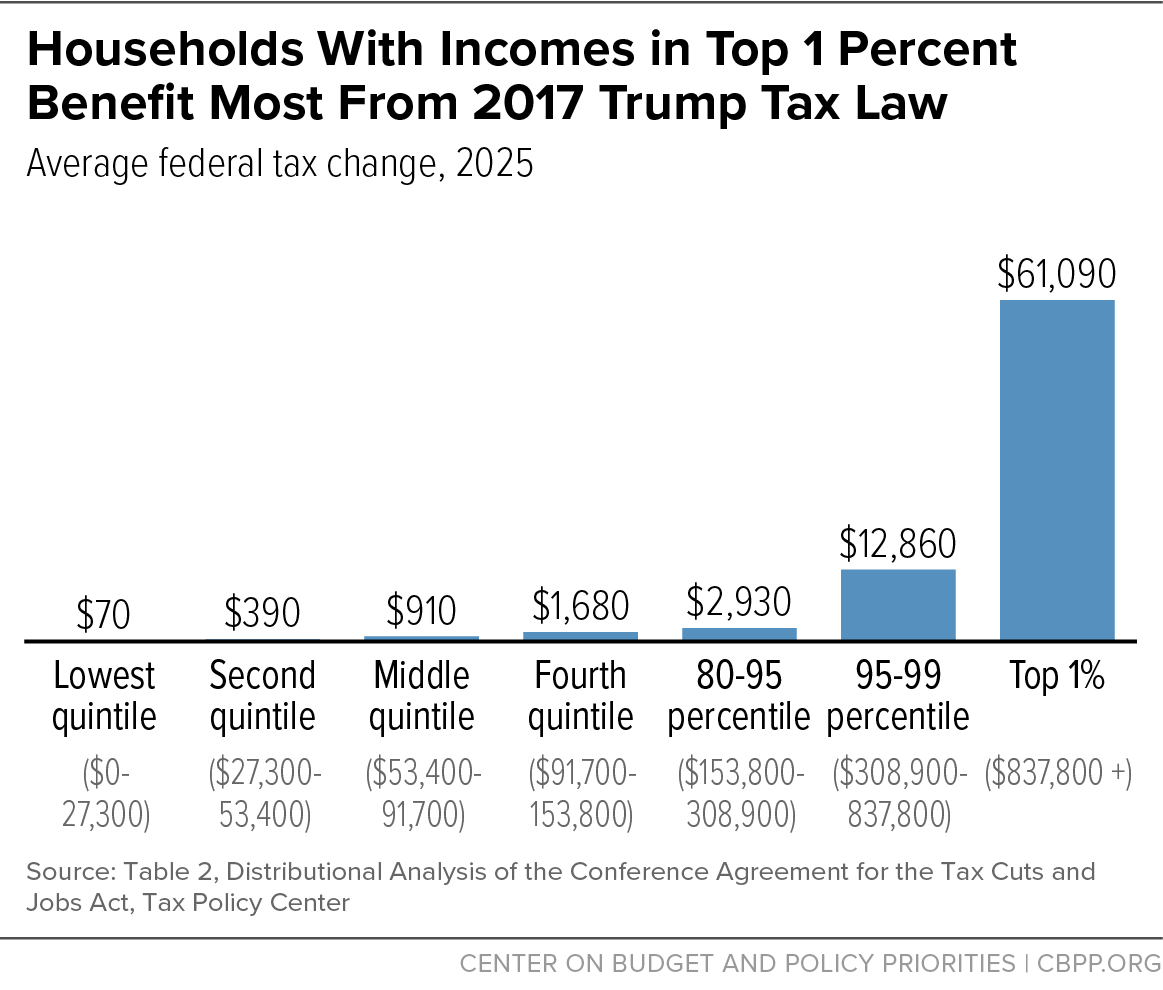

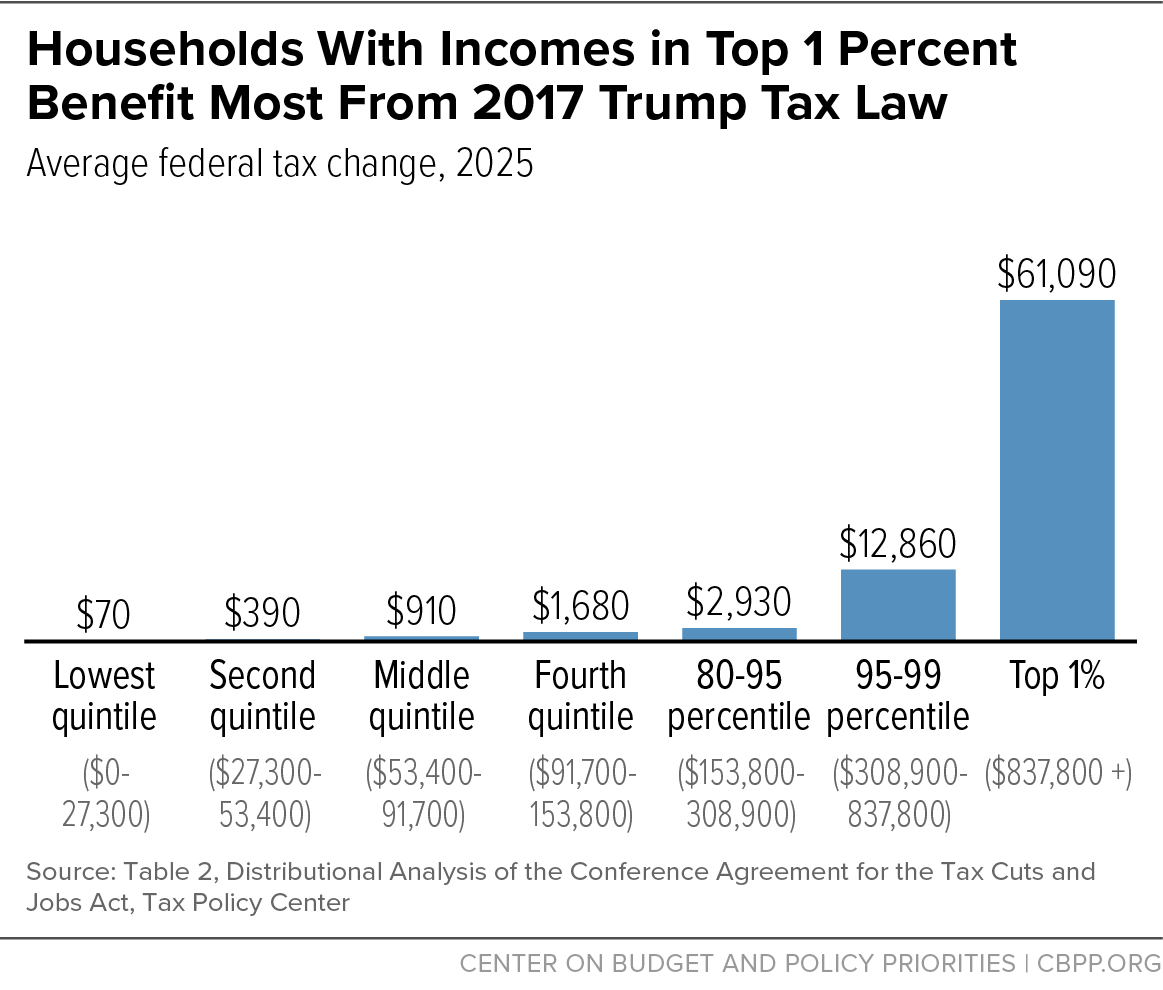

Critics argued that the tax cuts disproportionately benefited high-income earners and corporations, exacerbating income inequality.

- Benefits to the Wealthy: A significant portion of the tax savings went to those in higher income brackets and large corporations.

- Social Mobility: This concentration of benefits raised concerns about its impact on social mobility and economic fairness. The discussion of wealth inequality and economic justice is central to evaluating the social impact of the bill.

Conclusion: Assessing the Legacy of the Trump Tax Cut Bill

The Trump Tax Cut Bill significantly altered the U.S. tax code, leading to reduced individual and corporate tax rates, increased standard deductions, and changes to the child tax credit. While proponents lauded its potential to stimulate economic growth and create jobs, critics raised concerns about its impact on the national debt and income inequality. The long-term economic and social consequences of this legislation continue to be debated and analyzed. To further understand the complexities and lasting effects of the Trump Tax Cut Bill, explore the resources available on [relevant government website, e.g., the Congressional Budget Office website].

Featured Posts

-

Swiatek Falls To Ostapenko Again In Stuttgart Semifinal Clash

May 13, 2025

Swiatek Falls To Ostapenko Again In Stuttgart Semifinal Clash

May 13, 2025 -

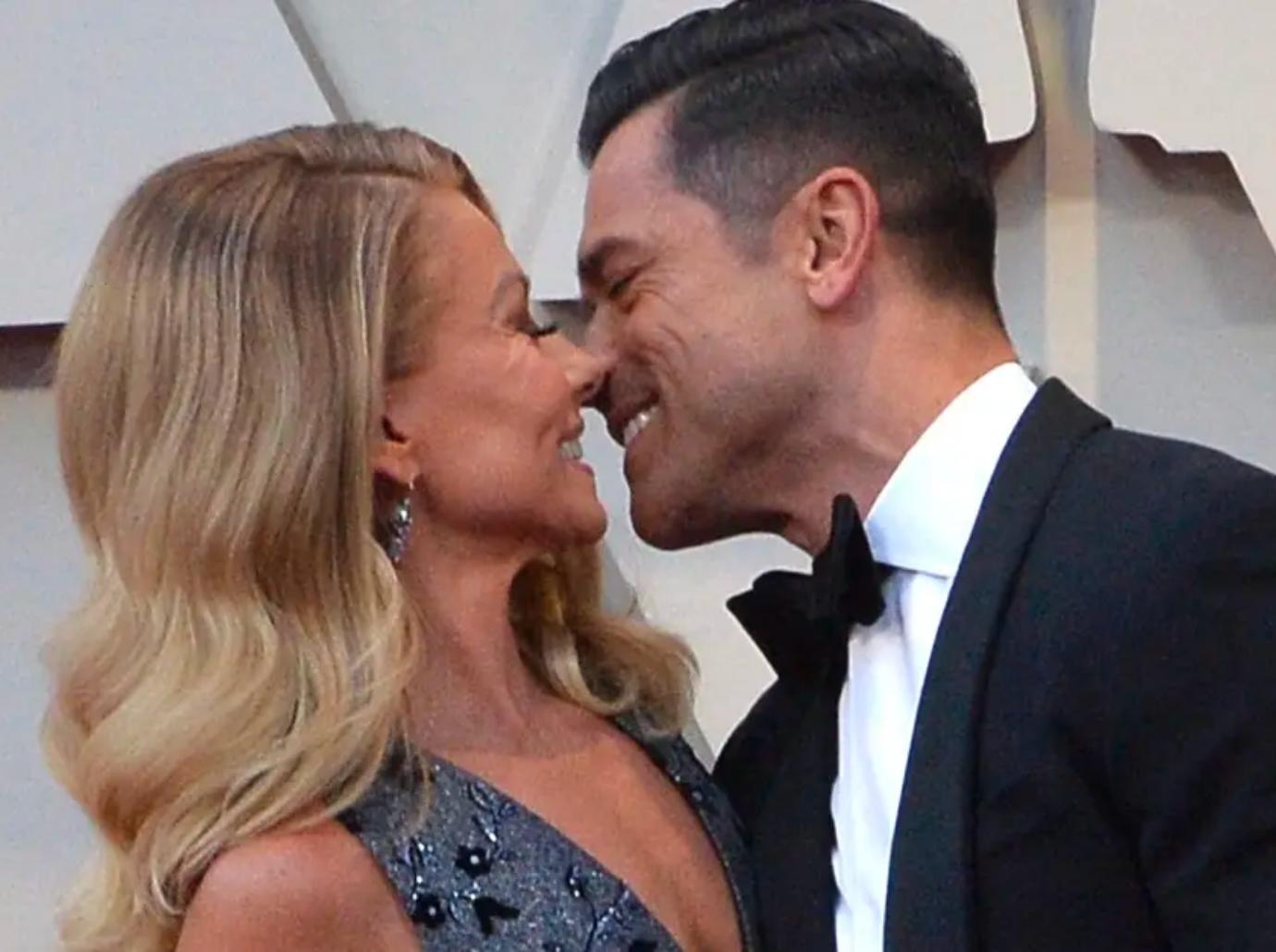

The Truth Behind Kelly Ripas Absence And Mark Consuelos Live Show

May 13, 2025

The Truth Behind Kelly Ripas Absence And Mark Consuelos Live Show

May 13, 2025 -

Chicago Cubs Win On Ian Happs Walk Off Hit Against Los Angeles Dodgers

May 13, 2025

Chicago Cubs Win On Ian Happs Walk Off Hit Against Los Angeles Dodgers

May 13, 2025 -

Gibraltar Sovereignty Dispute Intensifies Labour Leaders Firm Stance

May 13, 2025

Gibraltar Sovereignty Dispute Intensifies Labour Leaders Firm Stance

May 13, 2025 -

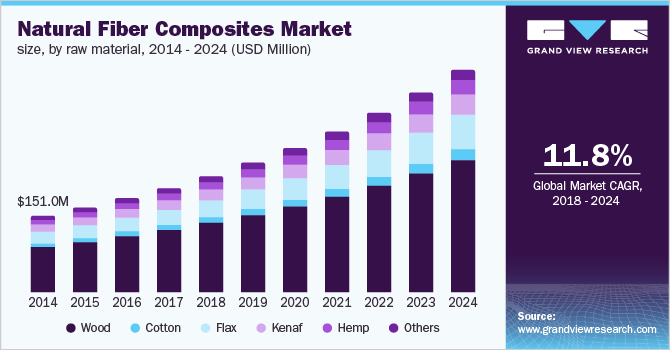

Global Natural Fiber Composites Market Outlook To 2029

May 13, 2025

Global Natural Fiber Composites Market Outlook To 2029

May 13, 2025