The Ultra-Wealthy's Haven: Navigating Market Uncertainty In Luxury Real Estate

Table of Contents

Luxury Real Estate as a Hedge Against Inflation

Inflation erodes the purchasing power of traditional investments. However, luxury real estate often stands strong, acting as a robust inflation hedge. This is primarily due to its nature as a tangible asset.

Tangible Asset Protection

Physical property, especially luxury real estate, provides a tangible asset that generally holds its value better than other investments during inflationary periods. Unlike stocks or cryptocurrencies, a luxury property remains a physical entity. Its inherent value is less susceptible to the dramatic swings of the market.

- Increased rental income in times of inflation: Rental income from luxury properties can be adjusted to reflect inflation, providing a consistent stream of income that keeps pace with rising prices.

- Appreciation potential surpassing inflation rates in desirable locations: Prime luxury properties in sought-after locations historically appreciate at a rate that outpaces inflation, offering substantial long-term growth potential.

- Tangible asset diversification away from volatile stocks and bonds: Luxury real estate offers a tangible asset diversification strategy, reducing overall portfolio volatility by offsetting the risk associated with more volatile investments.

Strategic Geographic Locations for Luxury Real Estate Investment

Choosing the right location is paramount when investing in luxury real estate. The most successful investments are often in prime locations known for their stability and growth potential.

Prime Locations & Global Citizenship

Investing in prime locations offers more than just financial security. Many high-end properties offer access to global citizenship or residency programs, opening doors to new opportunities and lifestyles.

- Top-tier cities offering strong rental yields (e.g., London, New York, Hong Kong): These established hubs provide consistent rental income and significant capital appreciation.

- Emerging markets with high growth potential (e.g., Dubai, Singapore): These dynamic areas offer rapid growth opportunities, although with potentially higher risk.

- Tax havens and jurisdictions with favorable property laws: Careful consideration of tax implications and legal frameworks is crucial for maximizing returns and minimizing liabilities.

Navigating Market Volatility with Expert Guidance

The luxury real estate market is complex. Navigating its intricacies and making informed investment decisions requires expert guidance.

The Role of Experienced Brokers and Advisors

Working with experienced luxury real estate brokers and advisors is essential. These professionals possess specialized knowledge and access to exclusive opportunities.

- Due diligence and market analysis expertise: They conduct thorough due diligence to identify properties with strong potential and analyze market trends to inform investment strategies.

- Negotiation skills and access to off-market opportunities: Their expertise ensures you secure the best possible terms and gain access to exclusive, off-market properties not publicly listed.

- Understanding legal and financial implications: They guide you through the complex legal and financial aspects of high-value property transactions.

Beyond Bricks and Mortar: The Lifestyle Factor in Luxury Real Estate

Luxury real estate is not just about financial returns; it's also about lifestyle. The intangible benefits—exclusive amenities, enhanced lifestyle, and access to exclusive networks—add significant value.

Amenities, Exclusivity, and Lifestyle Investment

Beyond the bricks and mortar, owning a luxury property provides access to a lifestyle most can only dream of.

- Private amenities (e.g., golf courses, spas, private beaches): Many high-end properties offer access to exclusive amenities, enriching the homeowner's experience.

- Strong sense of community and networking opportunities: Luxury communities often foster strong social networks, providing valuable connections and enriching experiences.

- Improved quality of life and increased well-being: Owning a luxury property can dramatically improve one's quality of life, contributing to overall well-being.

Conclusion

Luxury real estate offers a compelling investment strategy for UHNWIs seeking a secure haven amidst market volatility. Its ability to act as an inflation hedge, its potential for long-term growth in strategic locations, and the importance of expert guidance are key takeaways. The lifestyle benefits further enhance its appeal. Ready to secure your future in the resilient world of luxury real estate? Contact our team of experts today to discuss your investment goals and explore high-end real estate investment opportunities tailored to your specific needs. Let us help you navigate the world of luxury property and find the perfect investment for your portfolio.

Featured Posts

-

Top Rated Online Casino Canada Why 7 Bit Casino Is 1

May 17, 2025

Top Rated Online Casino Canada Why 7 Bit Casino Is 1

May 17, 2025 -

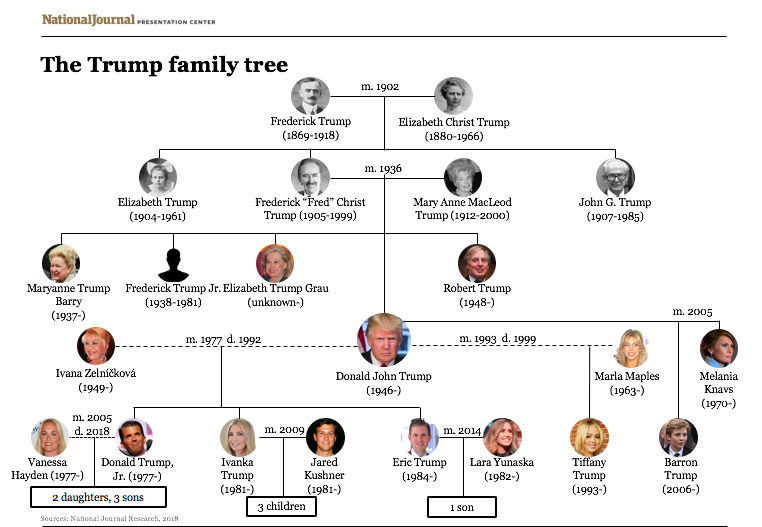

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025 -

Private Equity Buys Boston Celtics For 6 1 Billion What Does This Mean For The Future

May 17, 2025

Private Equity Buys Boston Celtics For 6 1 Billion What Does This Mean For The Future

May 17, 2025 -

Reflecting On Setbacks A Weekly Review Of Challenges And Growth

May 17, 2025

Reflecting On Setbacks A Weekly Review Of Challenges And Growth

May 17, 2025 -

Significant Tariff Reductions Canada And The Us Reach Near Zero Tariff Agreement

May 17, 2025

Significant Tariff Reductions Canada And The Us Reach Near Zero Tariff Agreement

May 17, 2025