The Unfolding Bond Crisis: What Investors Need To Know

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The Inverse Relationship Between Interest Rates and Bond Prices

Rising interest rates have a direct and often negative impact on the value of existing bonds. This is due to the inverse relationship between interest rates and bond prices. The yield curve, which illustrates the relationship between bond yields and their maturities, is a key indicator of this relationship. Understanding concepts like duration, a measure of a bond's sensitivity to interest rate changes, and interest rate risk is crucial for investors.

- The Inverse Relationship: When interest rates rise, newly issued bonds offer higher yields. This makes existing bonds with lower yields less attractive, causing their prices to fall. For example, if you hold a bond yielding 2% and new bonds are offering 4%, your bond becomes less desirable, hence its price drops.

- Longer-Term Bonds are More Susceptible: Longer-term bonds are significantly more sensitive to interest rate hikes than shorter-term bonds. Their prices fluctuate more dramatically due to their longer duration.

- Implications for Portfolio Diversification: Understanding this inverse relationship is vital for diversifying your bond portfolio. A diversified portfolio containing a mix of maturities and credit qualities can help mitigate the impact of interest rate fluctuations.

[Insert chart or graph illustrating the inverse relationship between interest rates and bond prices here]

Inflation's Role in the Bond Market Turmoil

Inflationary Pressures and Bond Yields

High inflation erodes the purchasing power of fixed-income investments like bonds. This is because the fixed interest payments from a bond become worth less as prices rise. This impacts real yields – the return on a bond after adjusting for inflation – making them less attractive to investors.

- Impact of Unexpected Inflation: Unexpected inflation is particularly damaging to bond values. If inflation rises faster than anticipated, the real return on a bond falls significantly.

- Central Banks' Response: Central banks often combat inflation by raising interest rates. While this can help curb inflation, it simultaneously impacts bond prices negatively as described above.

- Inflation-Protected Securities: Inflation-protected securities (TIPS) are designed to hedge against inflation. Their principal adjusts with inflation, offering a degree of protection against the erosion of purchasing power.

For example, countries like Argentina, which have experienced hyperinflation, have seen their bond markets severely impacted, with bond prices plummeting.

Geopolitical Risks and their Influence on Bond Markets

Global Uncertainty and Flight to Safety

Geopolitical events, such as wars, political instability, and trade disputes, significantly impact investor sentiment and capital flows. This uncertainty often leads to a "flight to safety," where investors move their money into perceived safe-haven assets, primarily government bonds of stable countries like the US or Germany.

- Flight to Safety: During periods of heightened geopolitical risk, demand for government bonds increases, driving their prices up and yields down.

- Impact of Sanctions and Trade Wars: Sanctions and trade wars can disrupt global supply chains and economic activity, leading to increased uncertainty and impacting bond markets negatively.

- Historical Precedents: History shows that major geopolitical events have consistently affected bond yields. The 2008 financial crisis and the COVID-19 pandemic are prime examples of how geopolitical uncertainty influenced bond markets.

The ongoing war in Ukraine, for instance, has significantly impacted global bond markets, causing increased volatility and influencing investor decisions.

Strategies for Navigating the Bond Crisis

Diversification and Risk Management

To mitigate the risks associated with the unfolding bond crisis, investors need to employ robust diversification and risk management strategies.

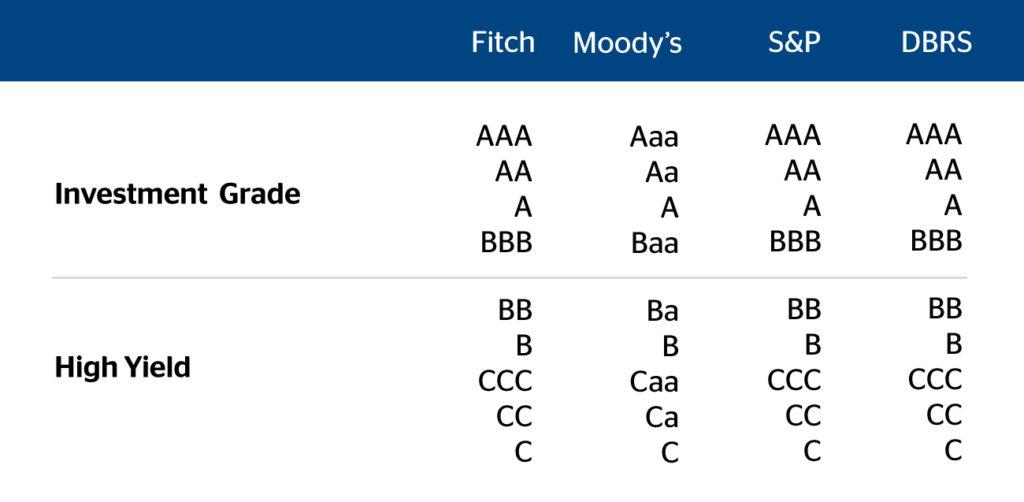

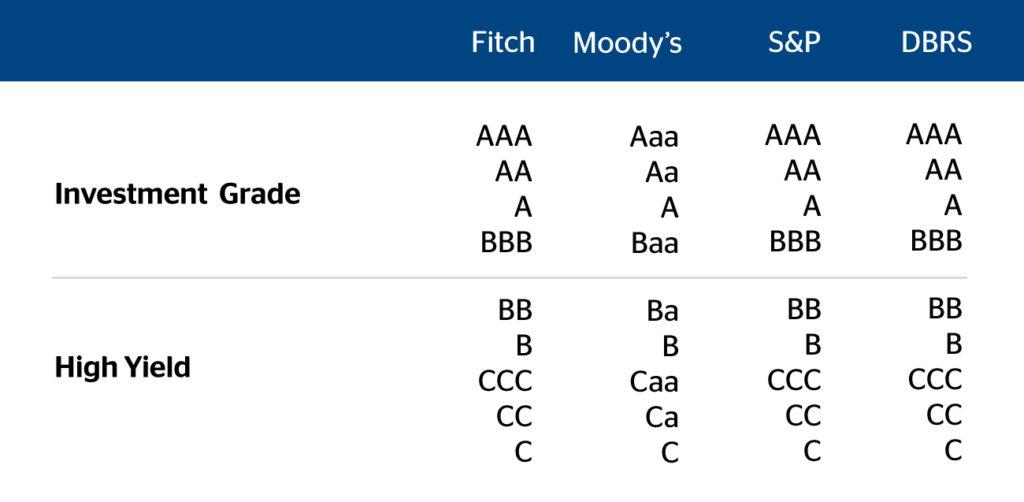

- Diversified Bond Portfolio: A diversified portfolio, including bonds with varying maturities and credit ratings, can reduce the overall impact of interest rate fluctuations and credit defaults.

- Hedging Against Interest Rate Risk: Using financial derivatives like interest rate swaps or futures can help hedge against interest rate risk.

- Understanding Your Risk Tolerance: Investors should carefully assess their risk tolerance and adjust their bond holdings accordingly.

For example, diversifying into investment-grade corporate bonds alongside government bonds can offer a potentially higher yield while maintaining a relatively low risk profile.

Conclusion: Preparing for the Future of the Bond Market

This article has highlighted the key factors driving the current bond crisis: rising interest rates, inflationary pressures, and geopolitical risks. Understanding the inverse relationship between interest rates and bond prices, the impact of inflation on real yields, and the "flight to safety" phenomenon is crucial. We’ve also explored strategies for mitigating risk, emphasizing diversification and risk management techniques.

Key Takeaways: Investors need to remain vigilant, proactively manage risk, and adapt their strategies to the evolving market conditions. The current bond market instability necessitates a thorough understanding of your investment portfolio and its susceptibility to these risks.

Call to Action: Understanding the unfolding bond crisis is crucial for protecting your investments. Consult with a financial advisor to develop a robust bond investment strategy that aligns with your risk tolerance and long-term financial goals. Don't wait for the crisis to deepen; take proactive steps to safeguard your bond portfolio today.

Featured Posts

-

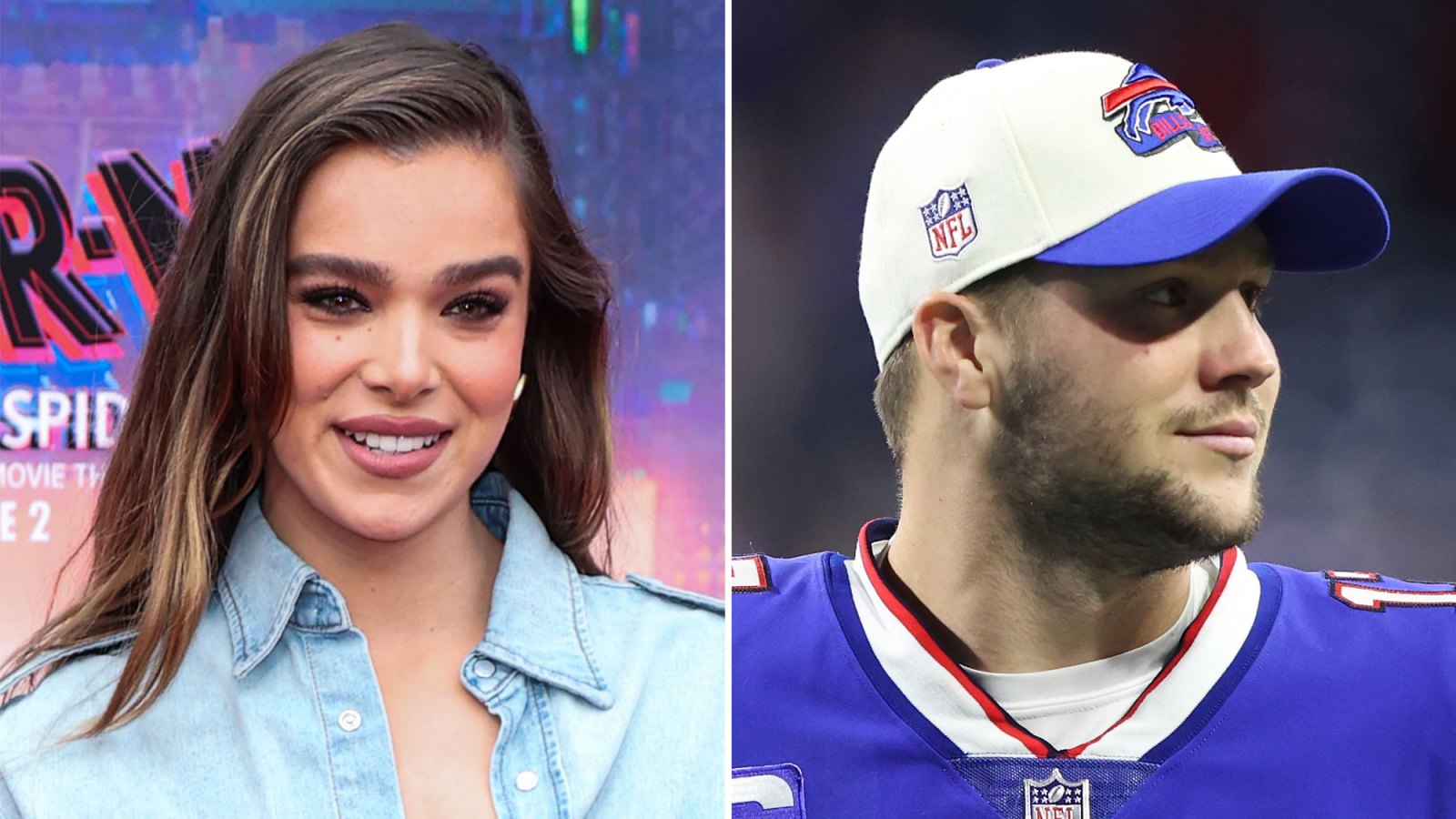

Hailee Steinfeld And Josh Allens Relationship Public Appearances And Speculation

May 28, 2025

Hailee Steinfeld And Josh Allens Relationship Public Appearances And Speculation

May 28, 2025 -

The Goldman Sachs Internal Critic Silencing Controversy

May 28, 2025

The Goldman Sachs Internal Critic Silencing Controversy

May 28, 2025 -

January 6th Fallout Ray Epps Defamation Suit Against Fox News Explained

May 28, 2025

January 6th Fallout Ray Epps Defamation Suit Against Fox News Explained

May 28, 2025 -

Canada Avoids Recession But Faces Flat Economic Growth In 2025 Oecd

May 28, 2025

Canada Avoids Recession But Faces Flat Economic Growth In 2025 Oecd

May 28, 2025 -

The End Of Revenge Travel In America Fear And Uncertainty Take Over

May 28, 2025

The End Of Revenge Travel In America Fear And Uncertainty Take Over

May 28, 2025

Latest Posts

-

Elon Musks Daughters New Career A Closer Look

May 30, 2025

Elon Musks Daughters New Career A Closer Look

May 30, 2025 -

From Silicon Valley To Runway Vivian Musks Journey

May 30, 2025

From Silicon Valley To Runway Vivian Musks Journey

May 30, 2025 -

Analysis Of Vivian Jenna Wilsons Modeling Debut And Family Life

May 30, 2025

Analysis Of Vivian Jenna Wilsons Modeling Debut And Family Life

May 30, 2025 -

A Public Feud Bill Gates Serious Allegations Against Elon Musk And The Response

May 30, 2025

A Public Feud Bill Gates Serious Allegations Against Elon Musk And The Response

May 30, 2025 -

The Musk Gates Dispute Accusations Of Negligence And Child Mortality

May 30, 2025

The Musk Gates Dispute Accusations Of Negligence And Child Mortality

May 30, 2025