The Unfolding Bond Market Crisis: What Investors Need To Know

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The Inverse Relationship Between Interest Rates and Bond Prices

The bond market operates on a fundamental inverse relationship between interest rates and bond prices. When interest rates rise, newly issued bonds offer higher yields, making them more attractive to investors. Consequently, existing bonds with lower coupon payments become less desirable, leading to a decrease in their market prices. This dynamic applies to various bond types, including government bonds (like Treasury bonds) and corporate bonds. For example, if a 10-year Treasury bond with a 2% coupon is issued, and interest rates subsequently rise, pushing new 10-year Treasury yields to 3%, the price of the existing 2% bond will fall to adjust its yield to reflect the current market rates.

- Higher interest rates make newly issued bonds more attractive. Investors seek higher returns, driving demand for newer bonds.

- Existing bonds with lower yields become less desirable, leading to price drops. This is the core principle of the inverse relationship.

- This impacts both corporate bonds and government bonds. Although government bonds are generally considered less risky, they are still susceptible to interest rate fluctuations.

- Duration risk explained – longer-term bonds are more sensitive to interest rate changes. A bond's duration measures its sensitivity to interest rate shifts. Longer-duration bonds experience greater price volatility than shorter-duration bonds.

The Federal Reserve's monetary policy plays a crucial role in influencing interest rates. The Fed's actions, such as increasing the federal funds rate, directly impact the overall interest rate environment and consequently, the bond market. Different types of bonds exhibit varying sensitivities to interest rate changes. For instance, longer-term corporate bonds tend to be more volatile than short-term government bonds.

Inflation's Erosive Effect on Bond Returns

Real vs. Nominal Yields: Understanding the Impact of Inflation

Inflation significantly impacts bond returns. The difference between nominal yield (the stated interest rate on a bond) and real yield (the nominal yield adjusted for inflation) is critical. High inflation erodes the purchasing power of bond yields, reducing the real return an investor receives. For example, a bond with a 5% nominal yield will have a much lower real yield if inflation is at 4%.

- High inflation erodes the purchasing power of bond yields. This means your investment's return may not keep pace with rising prices.

- Investors demand higher yields to compensate for inflation. This increased demand pushes bond prices down.

- This leads to increased pressure on bond prices. As investors seek higher yields, they sell bonds with lower yields, depressing their prices.

- Unexpected inflation spikes can significantly impact bond returns. Unforeseen surges in inflation can lead to substantial losses for bondholders.

Inflation-protected securities (TIPS), which adjust their principal based on inflation, offer a potential hedge against inflation risk. However, even TIPS are not entirely immune to broader market forces and interest rate changes. Monitoring current inflation rates and projections is crucial for assessing the potential impact on your bond investments.

Geopolitical Uncertainty and its Influence on Bond Markets

Global Events and Market Volatility

Geopolitical events introduce uncertainty and volatility into the bond market. Times of war, political instability, or major economic sanctions often trigger increased risk aversion among investors. This can lead to a flight to safety, where investors move away from riskier assets, potentially including bonds, and seek refuge in perceived safe havens such as government bonds of stable economies or even gold.

- War, political instability, and economic sanctions can trigger significant market volatility. These events create uncertainty and lead to rapid price fluctuations.

- Investors seek safe haven assets, potentially leading to a flight from bonds. Depending on the perceived risk, investors may shift their investments towards assets deemed safer.

- This impact varies across different bond markets. Emerging market bonds tend to be more susceptible to geopolitical risks than developed market bonds.

Recent geopolitical events, such as the ongoing conflict in Ukraine and rising global tensions, have demonstrably influenced bond market performance. Analyzing the impact of these events on different bond types and markets is crucial for making informed investment decisions.

Strategies for Navigating the Bond Market Crisis

Diversification and Risk Management

Effective diversification is key to navigating the complexities of the current bond market. This involves spreading investments across different bond types, maturities, and credit ratings to mitigate risk.

- Diversify across different bond types, maturities, and credit ratings. Don't put all your eggs in one basket; spread your investment across different asset classes.

- Consider alternative investments to reduce overall portfolio risk. Explore options like real estate, commodities, or alternative assets to provide diversification.

- Explore hedging strategies to protect against potential losses. Using derivatives or other hedging techniques can mitigate downside risk.

Specific strategies include laddering bonds (purchasing bonds with staggered maturities), investing in short-term bonds to minimize interest rate risk, and utilizing bond exchange-traded funds (ETFs) for diversification and ease of trading. Consult with a financial advisor to determine the best strategies for your individual circumstances and risk tolerance.

Conclusion

The unfolding bond market crisis presents significant challenges, but also opportunities, for investors. Understanding the interplay of rising interest rates, persistent inflation, and geopolitical uncertainty is crucial for making informed decisions and mitigating potential losses. By diversifying portfolios, carefully managing risk, and staying informed about market developments, investors can navigate this challenging environment and potentially profit from strategic adjustments. Don't let the complexities of the current bond market crisis overwhelm you. Take control of your investments by actively monitoring market conditions and adapting your strategies to the evolving landscape. Learn more about effective bond market investment strategies to protect and grow your portfolio.

Featured Posts

-

Arcane Infostealer Malware Targets Gamers On You Tube And Discord

May 29, 2025

Arcane Infostealer Malware Targets Gamers On You Tube And Discord

May 29, 2025 -

Venlose Parkeerplaats Fnv Signaleert Ernstige Chauffeursuitbuiting

May 29, 2025

Venlose Parkeerplaats Fnv Signaleert Ernstige Chauffeursuitbuiting

May 29, 2025 -

Jozanne Van Der Velden Keert Terug Wethouderschap Als Doel

May 29, 2025

Jozanne Van Der Velden Keert Terug Wethouderschap Als Doel

May 29, 2025 -

Ubisofts Response To Harassment Allegations In Assassins Creed Shadows Of London

May 29, 2025

Ubisofts Response To Harassment Allegations In Assassins Creed Shadows Of London

May 29, 2025 -

A Lidl Elkepeszto Gyujtoi Arai Vasarlasi Utmutato

May 29, 2025

A Lidl Elkepeszto Gyujtoi Arai Vasarlasi Utmutato

May 29, 2025

Latest Posts

-

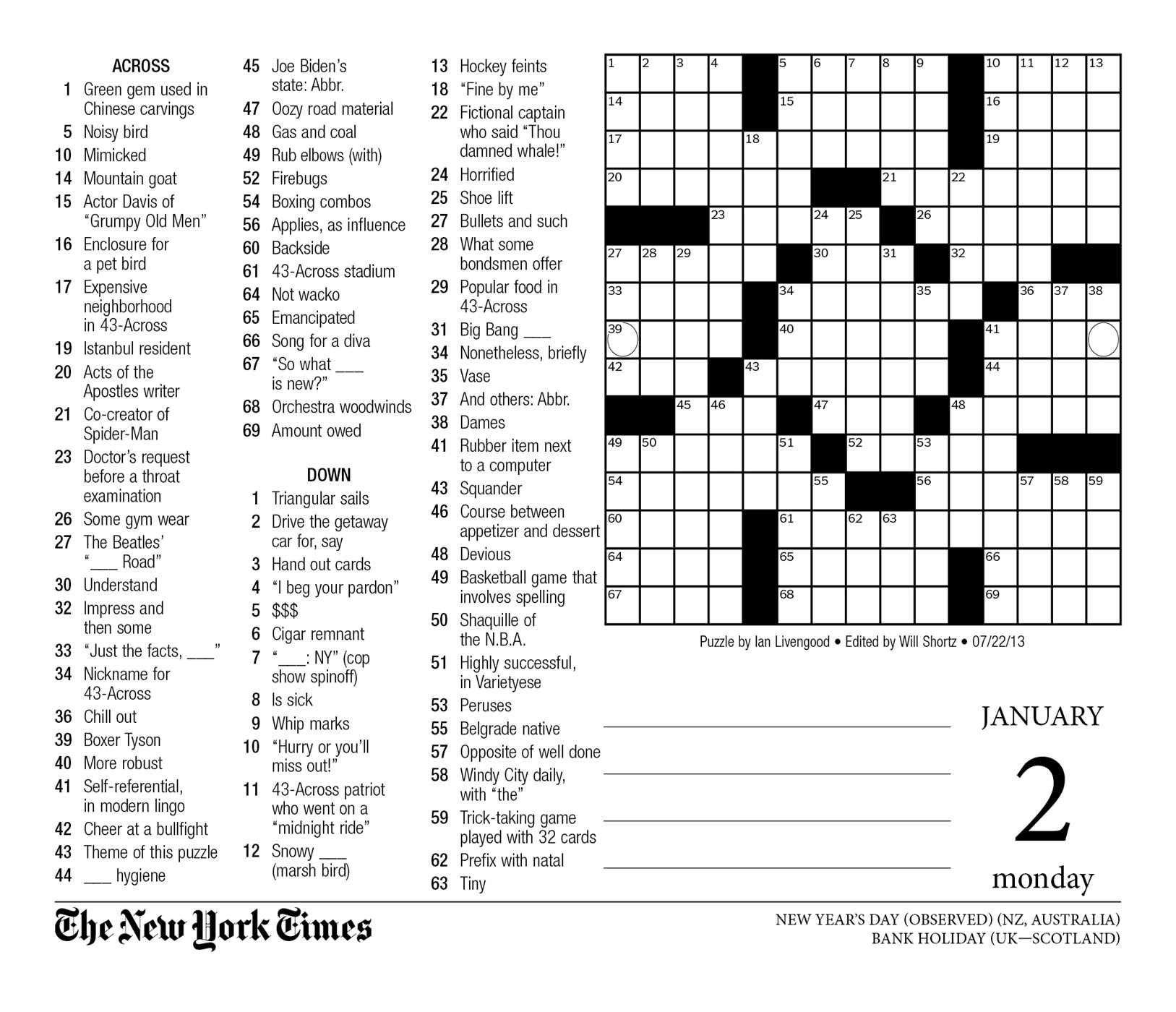

April 10th Nyt Mini Crossword Puzzle Clues And Solutions

May 31, 2025

April 10th Nyt Mini Crossword Puzzle Clues And Solutions

May 31, 2025 -

Tuesday March 18 Nyt Mini Crossword Solutions

May 31, 2025

Tuesday March 18 Nyt Mini Crossword Solutions

May 31, 2025 -

Nyt Mini Crossword March 30 2025 Complete Answers And Clues

May 31, 2025

Nyt Mini Crossword March 30 2025 Complete Answers And Clues

May 31, 2025 -

Solve The Nyt Mini Crossword May 7 Answers And Detailed Explanations

May 31, 2025

Solve The Nyt Mini Crossword May 7 Answers And Detailed Explanations

May 31, 2025 -

Todays Nyt Mini Crossword Answers March 24 2025

May 31, 2025

Todays Nyt Mini Crossword Answers March 24 2025

May 31, 2025