The US And Canada: An Economic Interdependence Analysis

Table of Contents

Trade Flows: The Cornerstone of Interdependence

The cornerstone of US-Canada economic interdependence is the massive volume of bilateral trade. The two nations are each other's largest trading partners, demonstrating an unparalleled level of economic integration.

Bilateral Trade Volume and Composition

The sheer volume of goods and services exchanged annually between the US and Canada is staggering. In 2022, bilateral trade exceeded $2 trillion, encompassing a vast array of sectors. Key areas include:

- Energy: Canada is a major exporter of oil and natural gas to the US, while the US supplies refined petroleum products and electricity to Canada.

- Automobiles: The automotive industry is deeply integrated, with significant cross-border production and trade of vehicles and parts. Both countries are major players in the North American automotive supply chain.

- Agriculture: Agricultural products flow freely across the border, with Canada exporting significant quantities of grains, meat, and dairy products to the US, and the US providing a range of agricultural goods to Canada.

This robust US-Canada trade is significantly shaped by the North American Free Trade Agreement (NAFTA), and its successor, the USMCA (United States-Mexico-Canada Agreement). Understanding the intricacies of this bilateral trade is key to comprehending the overall US-Canada economic interdependence.

Impact of the USMCA

The USMCA, which replaced NAFTA in 2020, has significantly impacted the US-Canada trade relationship. While building upon the foundations laid by NAFTA, the USMCA introduced several key changes:

- Dairy: The USMCA includes provisions that impact the Canadian dairy industry, leading to increased market access for US dairy products.

- Auto Manufacturing: The agreement sets new rules of origin for automobiles, aiming to increase regional content and support North American auto manufacturing jobs.

These changes, while aiming to enhance the overall efficiency and fairness of trade, have also presented challenges and opportunities for specific industries. The ongoing implementation and potential future negotiations surrounding the USMCA will continue to shape the future of US-Canada trade and overall economic interdependence.

Investment Flows: A Two-Way Street

Beyond trade, significant investment flows further cement the US-Canada economic interdependence. This is a truly two-way street, with both countries acting as major investors in each other's economies.

Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) between the US and Canada is substantial. Both countries attract significant investment in various sectors:

- Energy: Canadian energy companies invest heavily in US energy infrastructure and exploration, while US companies invest in Canadian energy resources.

- Technology: Both countries see substantial investment in the tech sector, with companies from both sides of the border establishing operations and research facilities.

- Manufacturing: The manufacturing sector, particularly in automotive and aerospace, experiences robust cross-border FDI.

This substantial FDI fosters economic growth, job creation, and technological advancement in both countries, strengthening the ties of US-Canada economic interdependence.

Portfolio Investment

Portfolio investment, encompassing stocks, bonds, and other financial instruments, plays a critical role in strengthening the financial links between the US and Canada. Cross-border portfolio investments:

- Increase market liquidity: Facilitating smoother capital flows and enhancing market stability.

- Diversify investment portfolios: Offering investors in both countries opportunities to reduce risk.

- Boost economic growth: By providing capital for investment in productive assets.

This interconnectedness reduces economic vulnerability and strengthens the overall resilience of both economies, further highlighting the depth of US-Canada economic interdependence.

Challenges and Risks to Interdependence

While the US-Canada economic relationship is largely beneficial, it's not without its challenges and risks.

Economic Shocks and Vulnerability

The high degree of economic integration between the US and Canada creates a level of vulnerability to economic shocks. A recession or significant economic downturn in either country can have significant spillover effects:

- Contagion effects: Economic difficulties in one country can quickly spread to the other due to deep trade and investment links.

- Reduced demand: A decline in economic activity in one country reduces demand for goods and services from the other.

- Price volatility: Fluctuations in commodity prices, such as oil and gas, can impact both economies.

Understanding and mitigating these risks is crucial for maintaining the stability of the US-Canada economic interdependence.

Geopolitical Factors

Geopolitical events and policy changes can significantly impact the US-Canada economic relationship.

- International trade disputes: Global trade tensions can affect the flow of goods and services between the two countries.

- Changes in global supply chains: Shifting global dynamics can impact the competitiveness of North American industries and alter trade patterns.

- Changes in government policies: Changes in either country's trade or investment policies can create uncertainty and potentially disrupt the established economic ties.

Navigating these complexities necessitates careful monitoring and proactive management of geopolitical factors to ensure the ongoing strength of US-Canada economic interdependence.

Conclusion

The economic interdependence between the US and Canada is a multifaceted relationship characterized by substantial trade and investment flows. While the USMCA has helped to solidify this relationship, challenges remain, including the vulnerability to economic shocks and the impact of geopolitical factors. Understanding the complexities of this US-Canada economic interdependence is crucial for policymakers, businesses, and investors navigating the North American landscape. Further research into specific sectors and potential future developments is essential for promoting sustainable and mutually beneficial growth. For deeper insights into this critical relationship, explore further resources on US-Canada bilateral trade and the impact of the USMCA.

Featured Posts

-

Cronica Del 0 0 Entre Everton Vina Y Coquimbo Unido

May 16, 2025

Cronica Del 0 0 Entre Everton Vina Y Coquimbo Unido

May 16, 2025 -

Bahia Derrota Al Paysandu 0 1 Cronica Completa Y Goles

May 16, 2025

Bahia Derrota Al Paysandu 0 1 Cronica Completa Y Goles

May 16, 2025 -

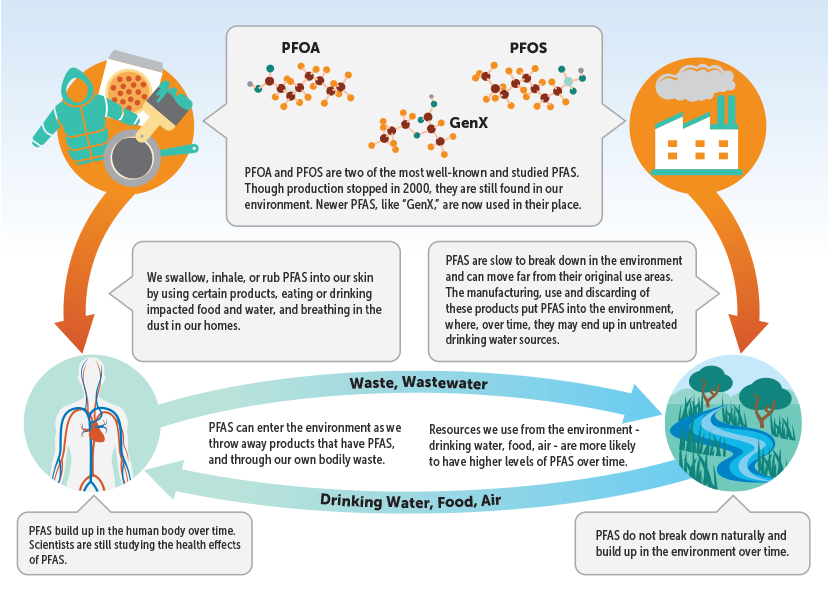

Blue Mountains Water Contamination Pfas Levels Nine Times Higher Than Safe

May 16, 2025

Blue Mountains Water Contamination Pfas Levels Nine Times Higher Than Safe

May 16, 2025 -

Donde Ver Crystal Palace Nottingham Forest Guia Para El Partido En Directo

May 16, 2025

Donde Ver Crystal Palace Nottingham Forest Guia Para El Partido En Directo

May 16, 2025 -

Rekord Ovechkina 12 E Mesto V Pley Off N Kh L

May 16, 2025

Rekord Ovechkina 12 E Mesto V Pley Off N Kh L

May 16, 2025