Thousands No Longer Need To File HMRC Tax Returns Due To Rule Change

Table of Contents

Understanding the New HMRC Rule Changes

The recent simplification of the UK tax system has resulted in a significant change to HMRC tax return filing requirements. This change, implemented as part of the [Insert Legislation or Policy Number if available, e.g., Finance Act 2024, Clause X], aims to reduce the administrative burden for both taxpayers and HMRC. The reasoning behind this alteration is twofold: streamlining the tax system for greater efficiency and reducing the number of individuals needing to complete complex self-assessment forms.

- Key changes implemented: The primary change involves raising the income threshold for mandatory self-assessment filing for individuals whose income derives solely from employment.

- Date of implementation of the changes: [Insert Date]

- Target audience affected by the changes: The changes primarily affect employed individuals whose total income from employment falls below a specified threshold. This excludes those with additional income sources like rental properties, self-employment, or investments.

Who is Exempt from Filing HMRC Tax Returns?

Exemption from filing HMRC tax returns now applies to employed individuals whose total income from employment, including benefits in kind, does not exceed £[Insert Income Threshold]. This threshold is crucial in determining eligibility. It's important to accurately calculate your total income from all employment sources.

Examples of individuals who qualify for exemption include:

- Those employed with a single employer, earning solely a salary below the threshold.

- Those with multiple employers, where the combined income from all employment remains below the threshold.

However, it’s critical to understand the limitations:

- Specific income levels that qualify for exemption: Income from employment must be below £[Insert Income Threshold]. Any income above this, from any source, requires filing.

- Types of employment or income sources that still require filing: Self-employment income, rental income, dividends, capital gains, and income from other sources will still necessitate the submission of a self-assessment tax return.

- Examples of individuals exempted and those who are not: A teacher earning £40,000 solely from their employment might be exempt (depending on the threshold). However, a freelance writer with employment income and self-employment income would still need to file, even if their employment income were below the threshold.

What to Do if You're Exempt from Filing HMRC Tax Returns

If you believe you are exempt, you should take the following steps:

- Checking your eligibility using HMRC's online tools: Use the HMRC online self-assessment tool to confirm your eligibility. This tool will guide you through the process and determine whether you need to file a tax return.

- Understanding the implications of not filing when required: It's crucial to accurately assess your eligibility. Filing when not required is unnecessary paperwork, but failing to file when required can result in penalties.

- Contacting HMRC if you have questions or require clarification: If you have any doubts about your eligibility, contact HMRC directly for clarification to avoid potential penalties. If you mistakenly file a return, contact HMRC immediately to rectify the situation and request a refund of any payments.

Potential Implications and Future Considerations

This rule change significantly impacts HMRC's resources, potentially allowing for more efficient allocation of personnel to more complex cases. This simplification also improves tax compliance for millions, reducing the administrative burden on individuals.

- Impact on HMRC resources and efficiency: HMRC can re-allocate resources from processing simpler tax returns to other areas requiring attention.

- Potential future adjustments to the exemption criteria: Future adjustments to the income threshold are possible, based on economic conditions and government policy.

- How this change simplifies tax compliance for individuals: Thousands of individuals will now save time and effort by not having to complete and submit self-assessment tax returns.

Conclusion

This significant change to HMRC tax return regulations exempts thousands of individuals from the annual self-assessment process. Understanding the criteria for exemption is vital. If your employment income falls below the specified threshold and meets all other conditions, you likely do not need to file. However, carefully review your income from all sources and utilize the HMRC website to verify your eligibility.

Check your eligibility for exemption from filing HMRC Tax Returns using the official HMRC website. Don't delay; simplify your tax obligations today!

Featured Posts

-

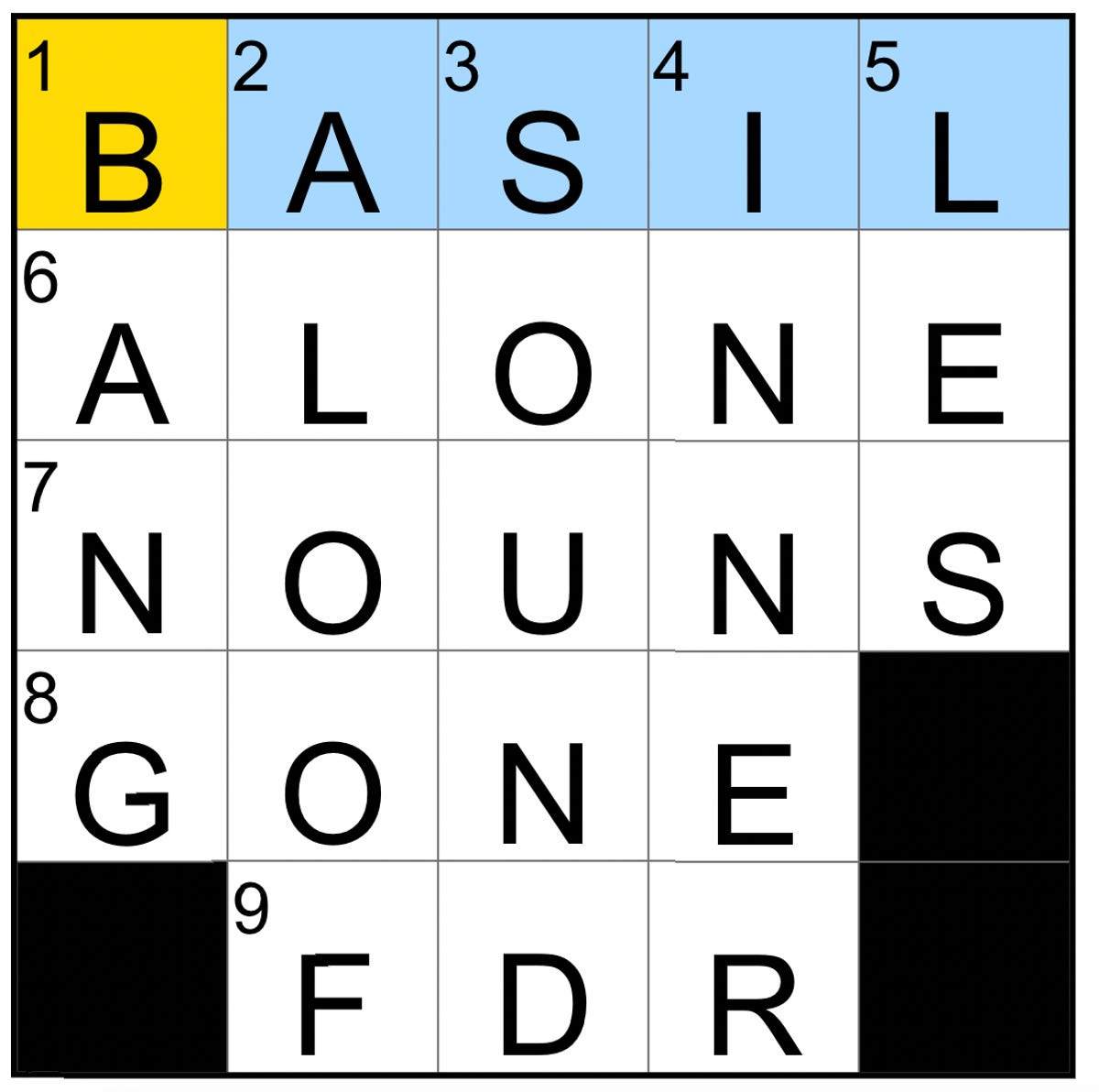

Nyt Mini Crossword Solutions For March 20 2025

May 20, 2025

Nyt Mini Crossword Solutions For March 20 2025

May 20, 2025 -

Beiers Double Propels Borussia Dortmund Past Mainz

May 20, 2025

Beiers Double Propels Borussia Dortmund Past Mainz

May 20, 2025 -

Stade Toulousain Et Jaminet Trouvent Un Accord Sur Le Remboursement De 450 000 E

May 20, 2025

Stade Toulousain Et Jaminet Trouvent Un Accord Sur Le Remboursement De 450 000 E

May 20, 2025 -

Delving Into The Psychology Of Agatha Christies Poirot

May 20, 2025

Delving Into The Psychology Of Agatha Christies Poirot

May 20, 2025 -

Dzhennifer Lourens Znovu Stala Mamoyu

May 20, 2025

Dzhennifer Lourens Znovu Stala Mamoyu

May 20, 2025