To Buy Or Not To Buy Palantir Stock Before May 5th: A Comprehensive Guide

Table of Contents

Palantir's Recent Performance and Financial Health

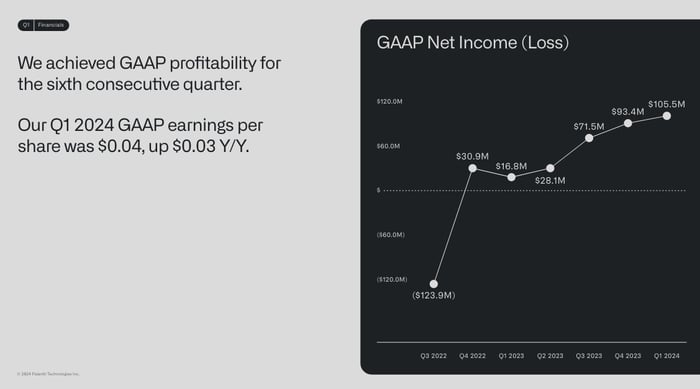

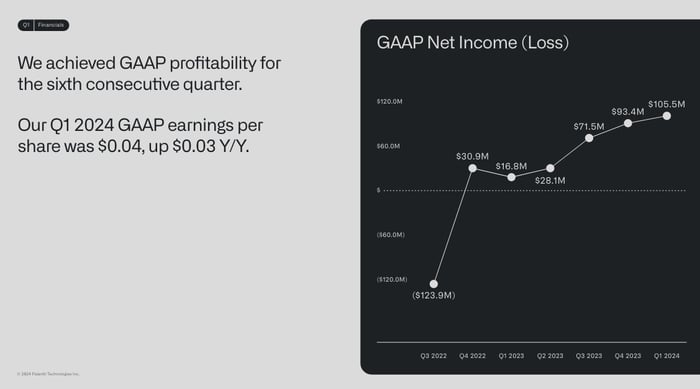

Palantir's financial health is a key factor influencing the "To Buy or Not to Buy Palantir Stock" question. Examining recent performance provides vital context for any investment decision.

Revenue Growth and Profitability:

Palantir's financial performance in recent quarters has shown a mixed bag. While revenue has generally trended upwards, profitability remains a key area of focus for investors. Analyzing key financial metrics such as revenue growth, operating margin, and free cash flow is crucial.

- Q4 2022 Revenue: [Insert Actual Figure] – a [percentage]% increase year-over-year.

- Full-Year 2022 Revenue: [Insert Actual Figure] – a [percentage]% increase year-over-year.

- Operating Margin: [Insert Actual Figure] – showing [improvement/decline] compared to the previous year.

- Free Cash Flow: [Insert Actual Figure] – indicating [strong/weak] cash generation capabilities.

Significant changes in revenue streams between the Government and Commercial sectors warrant close attention. A shift in reliance on one sector over the other could influence future growth projections and investor sentiment.

Key Partnerships and Contract Wins:

Strategic partnerships and significant contract wins are pivotal drivers of Palantir's future growth. These achievements can substantially impact the stock price. Recent successes include:

- [List major partnerships and contract wins, detailing their expected financial impact and strategic significance for Palantir.] For example: "The partnership with [Partner Name] is projected to contribute [estimated amount] to revenue over the next [timeframe]."

- [Highlight any significant government contracts and their long-term implications for revenue stability and growth.] For example: "The renewed contract with [Government Agency] secures a significant portion of Palantir’s revenue stream for the next [timeframe]."

Catalysts Affecting Palantir Stock Before May 5th

Several factors could significantly impact Palantir's stock price before the May 5th earnings report. Understanding these catalysts is vital for informed investment decisions.

Upcoming Earnings Report:

The May 5th earnings report is the most immediate catalyst. Analyst expectations and the actual results will heavily influence market reaction.

- Analyst Predictions: The consensus among analysts is for [insert consensus EPS and revenue estimates]. However, individual analyst predictions vary widely, ranging from [lowest estimate] to [highest estimate].

- Potential Scenarios: A beat on earnings and revenue expectations could trigger a significant stock price increase. Conversely, a miss could lead to a substantial decline. Any significant changes in guidance for future quarters will also be closely watched.

Market Sentiment and Industry Trends:

Broader market trends and sentiment towards technology stocks, particularly within the AI sector, will also affect Palantir's stock price.

- Overall Market Sentiment: The current macroeconomic climate, including interest rates and inflation, significantly influences investor risk appetite. A positive market outlook generally benefits tech stocks like Palantir.

- AI Sector Trends: Palantir's position within the rapidly evolving AI industry is a key consideration. Any major breakthroughs or setbacks in AI technology could impact investor sentiment towards Palantir.

- Competitive Landscape: Palantir faces competition from other data analytics and AI companies. Any significant competitive moves or market share shifts could influence investor confidence.

Risks and Considerations Before Investing in Palantir

Before investing in Palantir, it's crucial to acknowledge and understand the associated risks.

Volatility and Market Risk:

Palantir stock is known for its volatility. This inherent risk should be carefully considered.

- Price Fluctuations: Significant price swings can occur based on news, earnings reports, and broader market conditions.

- Geopolitical Risks: Global events and geopolitical instability can also significantly impact Palantir's business and stock price.

Competition and Future Growth:

Palantir operates in a competitive market. Maintaining its growth trajectory and market share presents ongoing challenges.

- Competitive Threats: Several established and emerging companies compete with Palantir in the data analytics and AI sectors.

- Long-Term Sustainability: Palantir's long-term growth prospects and the sustainability of its business model require careful assessment.

Technical Analysis and Trading Strategies (Optional)

While fundamental analysis is crucial, incorporating technical analysis can provide additional insights. (This section can be expanded if desired, including charts and indicators).

Conclusion

To Buy or Not to Buy Palantir Stock Before May 5th is a complex question with no easy answer. Palantir's recent performance shows a blend of progress and challenges. The upcoming earnings report is a significant catalyst, with potential for both substantial gains and losses. The inherent volatility of the stock and competitive pressures present considerable risks. Therefore, a thorough understanding of Palantir's financials, the broader market context, and your own risk tolerance is paramount. Based on the current analysis, [State your recommendation: e.g., "we recommend a cautious approach, suggesting investors wait for the May 5th earnings report and subsequent market reaction before making any significant investment decisions." or "we believe the potential upside outweighs the risks, recommending a measured buy before May 5th"]. Remember to always conduct thorough due diligence and consider diversifying your investment portfolio. To Buy or Not to Buy Palantir Stock Before May 5th ultimately remains your decision. Share your thoughts and analysis in the comments section below!

Featured Posts

-

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 10, 2025

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 10, 2025 -

Arkema Premiere Ligue Le Psg Terrasse Dijon Apres Une Rencontre Haletante

May 10, 2025

Arkema Premiere Ligue Le Psg Terrasse Dijon Apres Une Rencontre Haletante

May 10, 2025 -

Seattle Sports Events Boosting Business With Canadian Currency

May 10, 2025

Seattle Sports Events Boosting Business With Canadian Currency

May 10, 2025 -

Mayor Ras Baraka Faces Arrest During Ice Detention Center Demonstration

May 10, 2025

Mayor Ras Baraka Faces Arrest During Ice Detention Center Demonstration

May 10, 2025 -

Live Stock Market Updates 80 China Tariffs And Uk Trade Deal Developments

May 10, 2025

Live Stock Market Updates 80 China Tariffs And Uk Trade Deal Developments

May 10, 2025