Today's Lowest Personal Loan Interest Rates: A Comprehensive Guide

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several key factors significantly impact the interest rate you'll receive on a personal loan. Understanding these factors is the first step towards securing the best possible deal.

Credit Score: The Cornerstone of Your Interest Rate

Your credit score is arguably the most important factor determining your personal loan interest rate. Lenders use your credit score, obtained from credit reporting agencies like Experian, Equifax, and TransUnion, to assess your creditworthiness. A higher credit score indicates a lower risk to the lender, resulting in a lower interest rate.

- Excellent Credit (750+): Expect the lowest interest rates available.

- Good Credit (700-749): You'll likely qualify for competitive rates.

- Fair Credit (650-699): Expect higher interest rates, and loan approval may not be guaranteed.

- Poor Credit (Below 650): Securing a personal loan might be difficult, and interest rates will be significantly higher. You may need to explore options like credit repair or secured loans.

Improving your credit score before applying for a loan can significantly lower your interest rate. This involves paying bills on time, keeping your credit utilization low, and avoiding opening too many new accounts.

Loan Amount and Term: Size and Time Matter

The amount you borrow and the length of your repayment term also influence your interest rate. Generally:

- Larger Loan Amounts: Often come with higher interest rates due to increased risk for the lender.

- Longer Repayment Terms: While offering lower monthly payments, longer terms generally lead to higher overall interest paid due to the extended borrowing period. Understanding loan amortization – how your payments are allocated to principal and interest over time – is crucial.

For example, a $10,000 loan over 3 years will have higher monthly payments but lower overall interest compared to the same loan spread over 5 years.

Debt-to-Income Ratio (DTI): A Measure of Financial Health

Your debt-to-income ratio (DTI) measures your monthly debt payments relative to your gross monthly income. A high DTI indicates you're already carrying a significant debt burden, making you a higher-risk borrower. Lenders prefer lower DTI ratios.

- Calculating DTI: Add up all your monthly debt payments (loans, credit cards, etc.) and divide by your gross monthly income.

- Lowering DTI: Pay down existing debt, increase your income, or both, to improve your DTI.

A lower DTI significantly improves your chances of securing a loan with a favorable interest rate.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lender types offer varying interest rates and terms.

- Banks: Typically offer competitive rates but might have stricter lending criteria.

- Credit Unions: Often provide lower rates and more personalized service to members, but membership requirements might apply.

- Online Lenders: Can offer convenient application processes and potentially competitive rates, but carefully research their fees and customer service reputation.

How to Find Today's Lowest Personal Loan Interest Rates

Finding the best personal loan interest rate requires diligent research and comparison shopping.

Online Comparison Tools: Your First Stop

Numerous online loan comparison websites simplify the process of comparing offers from multiple lenders simultaneously. These tools allow you to input your desired loan amount and term, then compare APRs and fees from various lenders. Remember to:

- Use Reputable Websites: Stick to well-established websites with positive reviews.

- Compare Multiple Offers: Never settle for the first offer you see; always compare at least three to five different options.

Shop Around and Negotiate: Don't Be Afraid to Ask

Contacting multiple lenders and negotiating is crucial. Don't hesitate to:

- Highlight Better Offers: If you receive a lower interest rate from another lender, use it as leverage to negotiate a better deal.

- Ask About Fee Waivers: Inquire about the possibility of waiving or reducing certain fees.

Check for Pre-qualification Offers: A Risk-Free First Step

Many lenders offer pre-qualification options. This allows you to check your potential interest rate and loan eligibility without affecting your credit score.

- Pre-qualification vs. Pre-approval: Pre-qualification is a preliminary assessment; pre-approval involves a more thorough review of your credit and financial history and often requires a hard credit pull.

Understanding APR and Other Fees

It's vital to understand all associated costs before committing to a personal loan.

Annual Percentage Rate (APR): The True Cost of Borrowing

The Annual Percentage Rate (APR) represents the total annual cost of your loan, including interest and fees. It's a crucial metric for comparing loan offers. The APR will almost always be higher than the stated interest rate, as it includes other charges.

- Read the Fine Print: Carefully review all loan documents to understand all associated fees and charges.

Origination Fees and Other Charges: Hidden Costs

Beware of additional fees that can significantly increase your overall loan cost. Common fees include:

- Origination Fees: A percentage of the loan amount charged by the lender to process your application.

- Late Payment Fees: Penalties for missing payments.

- Prepayment Penalties: Fees for paying off your loan early.

Conclusion

Securing today's lowest personal loan interest rates requires careful planning and comparison shopping. By understanding the factors influencing interest rates, utilizing online comparison tools, and negotiating effectively, you can significantly reduce the overall cost of your loan. Remember to compare multiple offers, thoroughly understand the APR and all associated fees, and don't hesitate to shop around for the best deal. Don't settle for high interest rates! Use the information in this guide to find today's lowest personal loan interest rates and secure the best financial deal for your needs. Start comparing offers today!

Featured Posts

-

The Impact Of Torpedo Bats On Modern Marlin Fishing Techniques

May 28, 2025

The Impact Of Torpedo Bats On Modern Marlin Fishing Techniques

May 28, 2025 -

Samsung Galaxy S25 Ultra 256 Go Test Et Avis Complet

May 28, 2025

Samsung Galaxy S25 Ultra 256 Go Test Et Avis Complet

May 28, 2025 -

Wes Anderson And The Phoenician A Venetian Architectural Influence

May 28, 2025

Wes Anderson And The Phoenician A Venetian Architectural Influence

May 28, 2025 -

Gubernur Bali Minta Bps Tidak Sertakan Canang Dalam Perhitungan Inflasi

May 28, 2025

Gubernur Bali Minta Bps Tidak Sertakan Canang Dalam Perhitungan Inflasi

May 28, 2025 -

Recensie Bert Natters Concentratiekamproman Dodelijk Vermoeiend Maar Indrukwekkend

May 28, 2025

Recensie Bert Natters Concentratiekamproman Dodelijk Vermoeiend Maar Indrukwekkend

May 28, 2025

Latest Posts

-

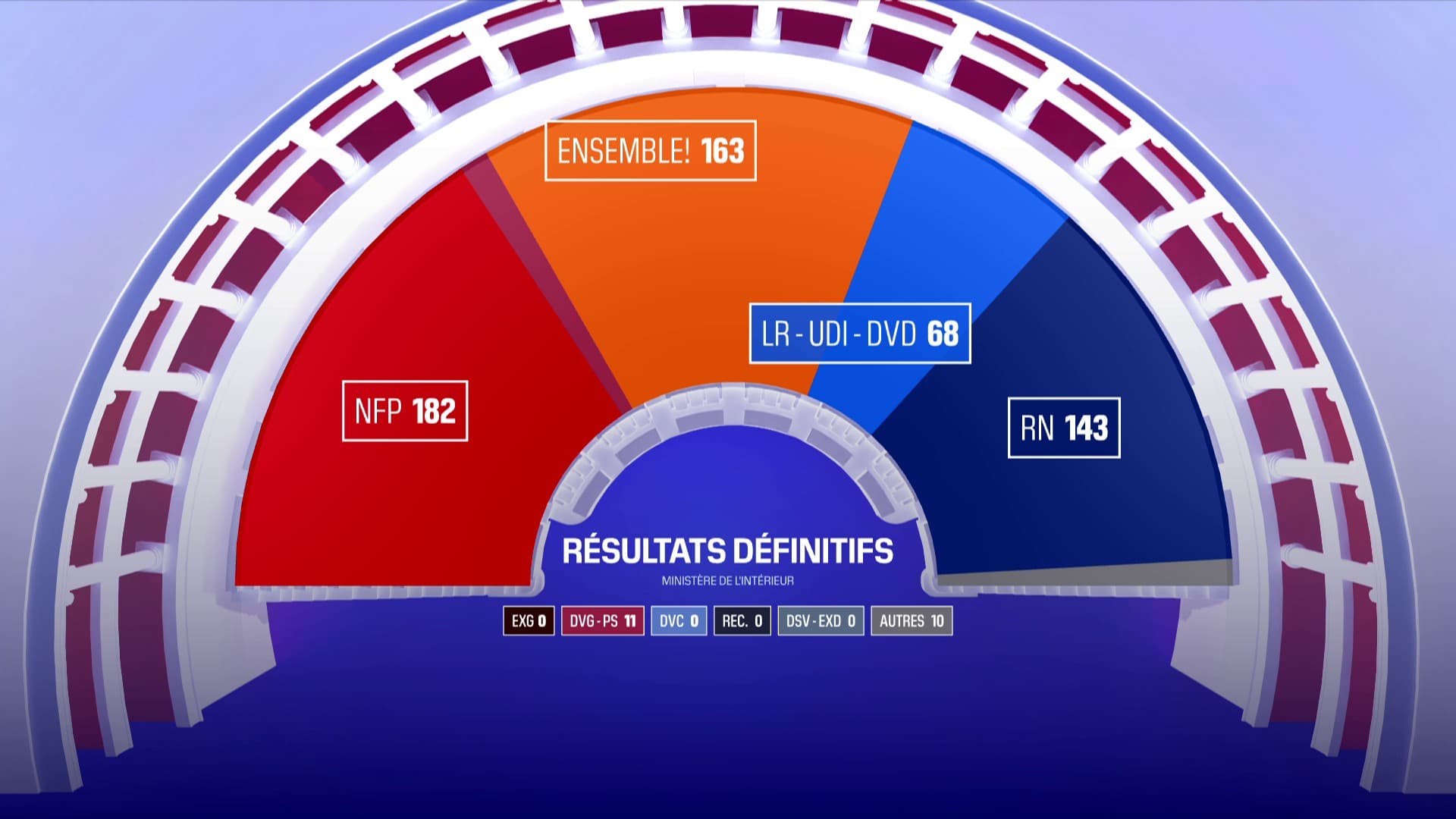

Rn Et Lfi A L Assemblee Nationale Un Bras De Fer Sur La Question Des Frontieres

May 30, 2025

Rn Et Lfi A L Assemblee Nationale Un Bras De Fer Sur La Question Des Frontieres

May 30, 2025 -

Problemes De Remplacement A Bouton D Or Les Parents S Expriment

May 30, 2025

Problemes De Remplacement A Bouton D Or Les Parents S Expriment

May 30, 2025 -

Elections Assemblee Nationale Le Rn Entre Frontieres Et Confrontation Avec Lfi

May 30, 2025

Elections Assemblee Nationale Le Rn Entre Frontieres Et Confrontation Avec Lfi

May 30, 2025 -

Manque De Professeurs Remplacants A L Ecole Bouton D Or Situation Critique

May 30, 2025

Manque De Professeurs Remplacants A L Ecole Bouton D Or Situation Critique

May 30, 2025 -

Assemblee Nationale Frontieres Et Desordre La Strategie Du Rn Face A Lfi

May 30, 2025

Assemblee Nationale Frontieres Et Desordre La Strategie Du Rn Face A Lfi

May 30, 2025