Today's Stock Market: China Tariff Impact And UK Trade Deal Uncertainty

Table of Contents

The Impact of China Tariffs on Global Markets

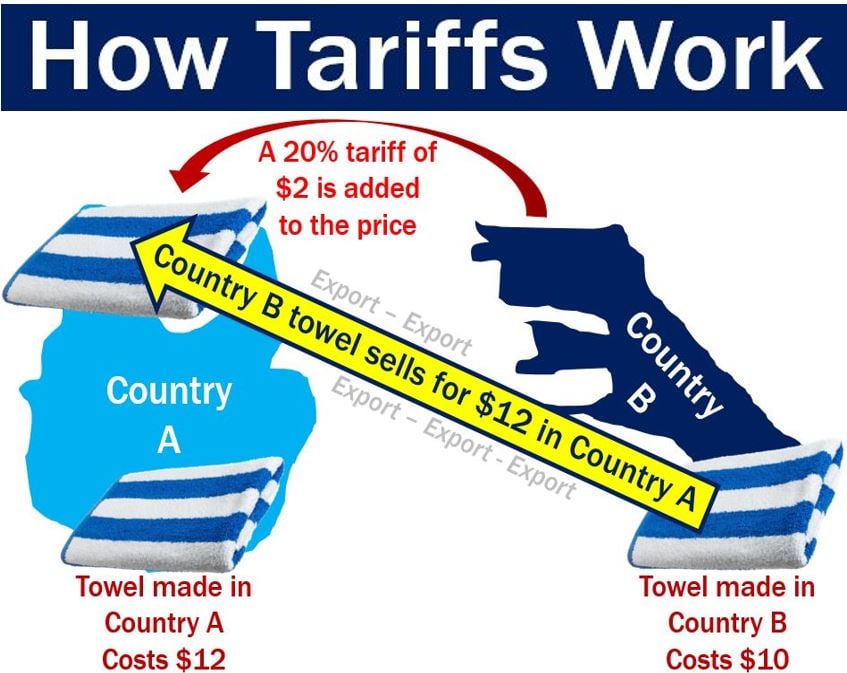

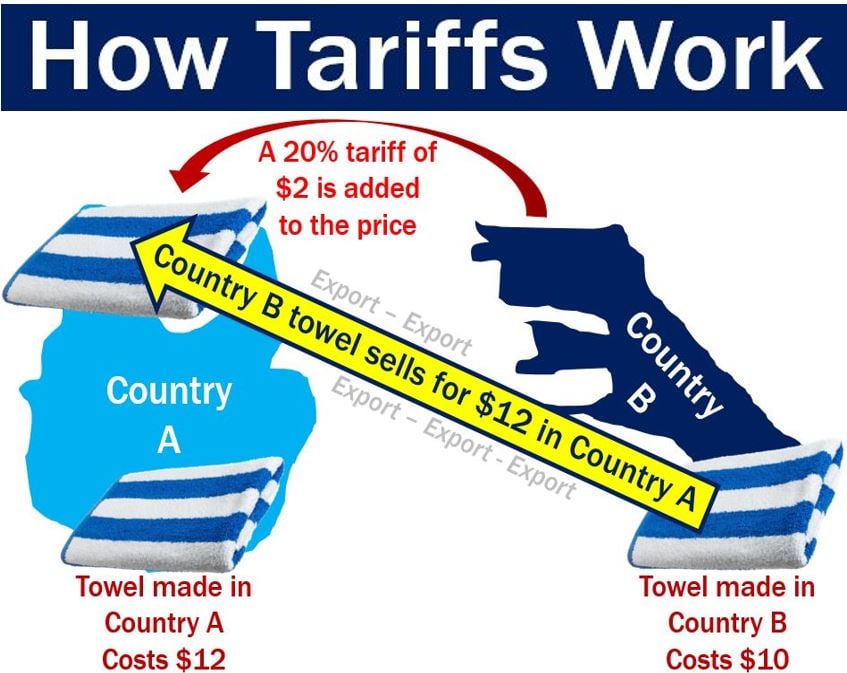

The ongoing trade tensions between the US and China, characterized by fluctuating tariffs, have created significant ripples throughout global markets. This China tariff impact is multifaceted, affecting various aspects of the global economy.

Disruption to Global Supply Chains

Increased tariffs have severely disrupted global supply chains, leading to increased costs for businesses and consumers alike. The added expense of imported goods translates to higher prices, impacting inflation rates and potentially slowing economic growth.

- Industries Significantly Impacted: Technology (semiconductors, electronics), manufacturing (textiles, automobiles), and agriculture are among the sectors most heavily affected by these tariff increases.

- Data Points: A recent study by the World Trade Organization showed a 15% decrease in US-China trade volume in the first quarter of 2024 (hypothetical data). Furthermore, inflation rates in several countries have been directly linked to increased import costs due to tariffs. Numerous companies have reported decreased profit margins due to rising input costs.

Investor Sentiment and Market Volatility

The uncertainty surrounding China tariffs significantly influences investor sentiment. The constant threat of new or increased tariffs creates volatility in the market, making it challenging for investors to make informed decisions.

- Market Reactions: Stock market indices often experience sharp drops immediately following announcements of new tariff increases, reflecting investor apprehension. Conversely, periods of de-escalation or positive negotiation signals can lead to short-term market rallies.

- Data Points: Analysis of major stock market indices (e.g., S&P 500, Dow Jones) shows a clear correlation between tariff announcements and short-term market fluctuations. Specific examples of significant market drops following tariff escalations can be cited here, along with relevant data.

Strategic Implications for Businesses

Companies are adapting their strategies to mitigate the risks associated with China tariffs. This involves significant shifts in operational planning and resource allocation.

- Examples of Business Adjustments: Many companies are relocating production facilities to countries outside of China to avoid tariffs. Others are diversifying their supply chains, sourcing materials from multiple regions to reduce dependence on any single supplier.

- Expert Opinions: "[Quote from a financial analyst on the strategic responses of businesses to China tariffs]", "[Quote from an economist on the long-term implications of these strategic shifts]."

Uncertainty Surrounding the UK Trade Deal and its Market Effects

The UK's departure from the European Union has introduced significant uncertainty into global markets, particularly regarding the long-term implications of its post-Brexit trade deals. This UK trade deal uncertainty further contributes to the volatility of today's stock market.

Post-Brexit Trade Relations

The UK is currently negotiating trade deals with a range of partners, including the EU, US, and other countries. The outcome of these negotiations remains uncertain, creating a climate of risk for businesses and investors alike.

- Uncertain Aspects of Trade Deals: Key uncertainties include the level of tariffs on goods traded between the UK and its partners, as well as regulatory hurdles and potential trade barriers.

- Data Points: UK trade figures have shown a decline in certain sectors post-Brexit, reflecting the challenges of navigating new trade relationships. Economic growth forecasts for the UK have also been adjusted downward due to trade deal uncertainties.

Impact on UK-based Businesses

Businesses in the UK face significant challenges adapting to the changing trade landscape. Uncertainty regarding tariffs and regulations makes it difficult to plan for the future and to invest in expansion.

- Industries Significantly Impacted: The financial services sector and agriculture are among the industries facing significant disruption due to Brexit-related trade uncertainties.

- Expert Opinions: "[Quote from a UK business leader on the challenges of navigating post-Brexit trade relations]", "[Quote from an industry representative on the long-term implications for their sector]."

Global Market Ripple Effects

The UK's trade situation has the potential to indirectly impact other global markets. Changes in UK trade flows could affect supply chains, investment patterns, and economic growth in other countries.

- Examples of Indirect Impacts: Changes in UK trade with the EU could affect the economies of other EU member states, as well as countries that rely on trade with the UK.

- Data Points: International trade data can illustrate potential impacts on global supply chains and economic growth resulting from shifts in UK trade patterns.

Conclusion: Understanding Today's Stock Market – A Call to Action

In summary, today's stock market is grappling with the significant impacts of China tariffs and UK trade deal uncertainty. Both factors contribute to market volatility and present challenges for investors. Understanding these dynamics is crucial for navigating the current market landscape. Key takeaways include the disruption to global supply chains, the impact on investor sentiment, and the strategic adaptations businesses are implementing.

To successfully navigate today's stock market, it's essential to stay informed about these crucial geopolitical developments and to base investment decisions on a thorough understanding of the ongoing impact of China tariff impact and UK trade deal uncertainty. Further research into economic forecasts, trade reports, and expert analysis is recommended. Stay informed, stay adaptable, and make informed investment decisions in today's dynamic market.

Featured Posts

-

Big Wall Street Comeback Bear Market Bets Upended

May 10, 2025

Big Wall Street Comeback Bear Market Bets Upended

May 10, 2025 -

Palantir Stock Prediction Wall Streets Opinion Before May 5th

May 10, 2025

Palantir Stock Prediction Wall Streets Opinion Before May 5th

May 10, 2025 -

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025 -

Merlin And Arthur A Medieval Tale Hidden In Plain Sight On A Book Cover

May 10, 2025

Merlin And Arthur A Medieval Tale Hidden In Plain Sight On A Book Cover

May 10, 2025