Top Deutsche Bank Executive Moves To Morgan Stanley: Distressed Sales Head Quits

Table of Contents

The Executive's Role and Responsibilities at Deutsche Bank

The departing executive held a crucial position within Deutsche Bank's distressed assets division, overseeing a significant portion of their distressed debt sales operations. Their expertise lay in navigating complex financial restructurings and managing portfolios of distressed debt. While the exact figures aren't publicly available, sources suggest the executive played a key role in numerous high-value deals, generating substantial revenue for Deutsche Bank through Deutsche Bank restructuring efforts and shrewd investment banking strategies within the financial markets. Their responsibilities included:

- Oversight of distressed asset sales teams, providing leadership and strategic guidance.

- Strategic planning for the management of Deutsche Bank's distressed debt portfolio, minimizing losses and maximizing returns.

- Cultivating and maintaining strong client relationships within the distressed assets sector, building trust and securing future business.

- Negotiating complex and often high-stakes deals involving distressed assets, requiring strong negotiation skills and financial acumen.

Reasons Behind the Move to Morgan Stanley

The reasons behind this high-profile move remain speculative, but several factors likely contributed to the executive's decision. The allure of career progression and a potentially more lucrative executive compensation package at Morgan Stanley are strong possibilities. Furthermore, differences in corporate culture and the attractiveness of Morgan Stanley's project portfolio and growth potential within the competitive landscape could have played significant roles. Potential reasons include:

- A significantly higher compensation package offered by Morgan Stanley, potentially reflecting the executive's value and market demand.

- More significant leadership opportunities and faster career progression within Morgan Stanley's organizational structure.

- A more attractive project portfolio and greater growth potential within Morgan Stanley's distressed assets division.

- A perceived better work-life balance and improved overall working environment at Morgan Stanley.

Impact on Deutsche Bank and Morgan Stanley

This departure carries significant implications for both Deutsche Bank and Morgan Stanley. For Deutsche Bank, the immediate impact is the potential loss of institutional knowledge and expertise in the crucial area of distressed debt sales. They face the challenge of swiftly and effectively filling this vacancy to maintain their market share and competitive advantage. The impact on team morale and the bank's overall reputation management also needs careful consideration.

For Morgan Stanley, the acquisition of this experienced executive represents a potential boost to their distressed debt sales capabilities. It strengthens their team's expertise and enhances their ability to compete effectively in the increasingly challenging distressed assets market. This move increases competition in the distressed assets market, potentially impacting pricing and deal flow for all players.

- Potential loss of institutional knowledge and expertise, potentially hindering Deutsche Bank's ability to execute complex deals.

- The need for Deutsche Bank to implement a robust and efficient talent acquisition strategy to find a suitable replacement.

- A significant boost to Morgan Stanley's distressed debt sales capabilities and potential gain in market share.

- Increased competition within the distressed assets market, requiring both banks to adapt their strategies.

The Distressed Assets Market Outlook

The distressed assets market is currently experiencing significant shifts due to global market volatility and economic uncertainty. This creates both challenges and opportunities. Increased credit risk in various sectors means a heightened demand for expertise in distressed debt investing. The current economic climate presents increased opportunities, while competition for talent in this niche field remains fierce.

- Global economic conditions, particularly interest rate hikes and inflation, significantly impact the volume of distressed assets available.

- Specific sectors, particularly those heavily impacted by economic downturns, present increased opportunities for distressed debt investing.

- Intense competition among investment banks for experienced professionals capable of managing and profiting from distressed assets.

- Advancements in technology, such as artificial intelligence and machine learning, are transforming distressed debt trading and analysis.

Conclusion: Top Deutsche Bank Executive Moves to Morgan Stanley: Distressed Sales Head Quits

The move of this high-ranking executive from Deutsche Bank to Morgan Stanley represents a significant development in the financial world. This Top Deutsche Bank Executive Moves to Morgan Stanley: Distressed Sales Head Quits situation underscores the intense competition for top talent in the distressed assets market. The impact on both institutions – the loss of expertise for Deutsche Bank and the gain for Morgan Stanley – is substantial. The implications extend beyond the two banks, shaping the competitive landscape and the overall dynamics of the distressed assets market. Stay tuned for further updates on this significant move in the financial sector and its ongoing implications for the distressed debt sales market. Follow us for continued coverage of executive changes and their impact on the distressed assets market.

Featured Posts

-

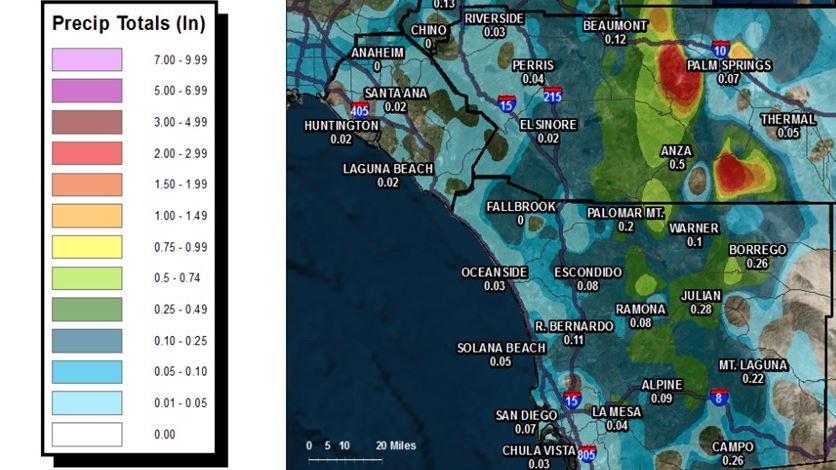

San Diego Rainfall Up To Date Totals From Cbs 8 Com

May 30, 2025

San Diego Rainfall Up To Date Totals From Cbs 8 Com

May 30, 2025 -

Bts Comeback Delayed Hybe Ceo On 2025 Return And Members Needs

May 30, 2025

Bts Comeback Delayed Hybe Ceo On 2025 Return And Members Needs

May 30, 2025 -

Optakt Til Danmark Portugal Kampanalyse Og Forventninger

May 30, 2025

Optakt Til Danmark Portugal Kampanalyse Og Forventninger

May 30, 2025 -

Prediksi Harga Kawasaki Ninja 500 Dan 500 Se 2025 Melebihi Rp 100 Juta

May 30, 2025

Prediksi Harga Kawasaki Ninja 500 Dan 500 Se 2025 Melebihi Rp 100 Juta

May 30, 2025 -

Gebrakan Baru Rm Bts Nominasi Artis K Pop Favorit Amas 2025

May 30, 2025

Gebrakan Baru Rm Bts Nominasi Artis K Pop Favorit Amas 2025

May 30, 2025