Tracking The Billions: Musk, Bezos, And Zuckerberg's Post-Inauguration Losses

Table of Contents

Elon Musk's Post-Inauguration Wealth Decline

Elon Musk, the CEO of Tesla and SpaceX, experienced a notable decrease in his net worth following the inauguration. This decline can be attributed to several interconnected factors.

Tesla Stock Volatility

The impact of market sentiment, policy changes, and competition significantly influenced Tesla's stock price post-inauguration.

- Increased Regulatory Scrutiny: New policies regarding electric vehicle subsidies and environmental regulations created uncertainty, impacting investor confidence and leading to a Tesla stock plunge.

- Competition Intensifies: The emergence of strong competitors in the EV market put pressure on Tesla's market share, affecting its stock valuation.

- Elon Musk's Public Statements: Controversial tweets and public statements by Musk himself also contributed to the volatility of Tesla's stock price, causing significant swings in his net worth. The correlation between Musk's tweets and Tesla's stock performance is well-documented. For example, a specific tweet on [insert date and brief description of tweet] led to a [percentage]% drop in Tesla's stock price within [timeframe]. This highlights the significant impact of public perception on Musk's net worth.

These factors combined resulted in a substantial decrease in Musk's net worth, demonstrating the vulnerability of fortunes tied heavily to single company performance. The post-inauguration market impact on Tesla significantly impacted Musk's overall financial standing.

SpaceX Investments and Future Projections

While SpaceX's ongoing projects and future prospects offer potential for substantial growth, their impact on Musk's immediate post-inauguration wealth was less direct.

- Long-Term Investments: SpaceX operates on a longer time horizon, with significant investments in Starlink and other projects not yet generating substantial returns. The SpaceX valuation is impressive, but it's largely based on future potential rather than current profitability.

- Funding Rounds and Dilution: Future funding rounds for SpaceX could potentially dilute Musk's ownership stake, slightly offsetting any gains from increased valuation. His diversification strategy, while significant, is still heavily reliant on Tesla's performance.

- Risk Factors in Space Exploration: The inherent risks associated with space exploration could impact SpaceX’s valuation and, consequently, Musk's net worth. The competitive landscape in the private space industry is also a key risk factor.

Jeff Bezos's Post-Inauguration Financial Landscape

Jeff Bezos, the founder of Amazon, also saw fluctuations in his net worth following the inauguration.

Amazon Stock Performance

Amazon's stock performance post-inauguration was influenced by several macroeconomic factors and company-specific challenges.

- Economic Slowdown: A potential economic slowdown impacted consumer spending, affecting Amazon's sales and profitability. Amazon's stock fluctuations closely mirror broader economic trends.

- Increased Competition: Increased competition from other e-commerce giants and brick-and-mortar retailers put pressure on Amazon's margins. The impact of regulation on Amazon's valuation is a constant factor influencing its stock price.

- Regulatory Scrutiny: Increased regulatory scrutiny regarding antitrust issues and labor practices created uncertainty for investors.

These combined factors contributed to a less-than-stellar performance for Amazon's stock post-inauguration, impacting Bezos's wealth. The overall impact on Bezos's wealth after the inauguration was a mixed bag, with some gains and losses depending on the specific timeframe considered.

Blue Origin and Diversification

Bezos's investments in Blue Origin and other ventures provided some degree of diversification, mitigating the impact of Amazon's stock performance.

- Blue Origin's Long-Term Vision: Blue Origin, focusing on space tourism and exploration, represents a long-term investment with a potential for significant future returns. However, the current impact on Bezos's net worth is limited.

- Diversification Strategy: Bezos's investments across various sectors helped cushion the blow from Amazon's stock performance volatility. This diversification strategy reduces reliance on any single asset.

- Space Tourism's Emerging Market: The burgeoning space tourism market offers potential for substantial revenue growth for Blue Origin in the future, influencing Bezos's long-term financial prospects.

Mark Zuckerberg's Post-Inauguration Wealth Shifts

Mark Zuckerberg, CEO of Meta (formerly Facebook), also experienced changes in his net worth after the inauguration.

Meta's Stock Market Performance and Challenges

Meta's stock performance post-inauguration reflected challenges in its core business and the broader advertising market.

- Advertising Revenue Slowdown: Changes in online advertising regulations and a general slowdown in the advertising market impacted Meta's revenue growth. The impact of social media competition on Meta's profits is a persistent issue.

- Competition from Other Platforms: Increased competition from other social media platforms like TikTok and Instagram (which Meta owns, but whose growth doesn't always translate directly to Meta's stock price) pressured Meta's user engagement and advertising revenue.

- Regulatory Hurdles: Continued regulatory scrutiny regarding data privacy and antitrust concerns created additional uncertainty for investors. Zuckerberg's net worth decline partially reflects this challenging environment.

These combined factors led to a period of instability for Meta's stock price and impacted Zuckerberg’s wealth significantly.

Metaverse Investments and Long-Term Strategy

Meta's significant investments in the metaverse represent a long-term bet with potentially high rewards but also substantial risks.

- Long-Term Vision: The metaverse is still in its early stages, and the long-term financial impact of Meta's investment remains uncertain. The impact of the metaverse on net worth is something that will only become clearer in the coming years.

- Potential Future Revenue Streams: Successful implementation of the metaverse could open new revenue streams for Meta in the future.

- Uncertain Returns: The metaverse investment represents a substantial financial commitment with significant risks attached, potentially impacting Zuckerberg’s net worth in the short term.

Conclusion

The post-inauguration period witnessed significant fluctuations in the net worth of Elon Musk, Jeff Bezos, and Mark Zuckerberg. These changes were primarily driven by stock market volatility, company-specific challenges, and broader economic conditions. Understanding these post-inauguration losses highlights the complex interplay between political events, market sentiment, and the fortunes of the world's wealthiest individuals. Tracking these trends requires a keen eye on a variety of factors, from regulatory changes to shifting consumer behavior and innovative technological developments.

Stay informed about the fluctuating fortunes of these tech giants and the broader implications of political and economic changes on global markets. Continue tracking the billions with us for future updates on their post-inauguration losses and financial strategies. Follow us for more insights into these and other impactful events affecting global wealth.

Featured Posts

-

Stiven King Kritikuye Trampa Ta Maska Ostanni Novini

May 10, 2025

Stiven King Kritikuye Trampa Ta Maska Ostanni Novini

May 10, 2025 -

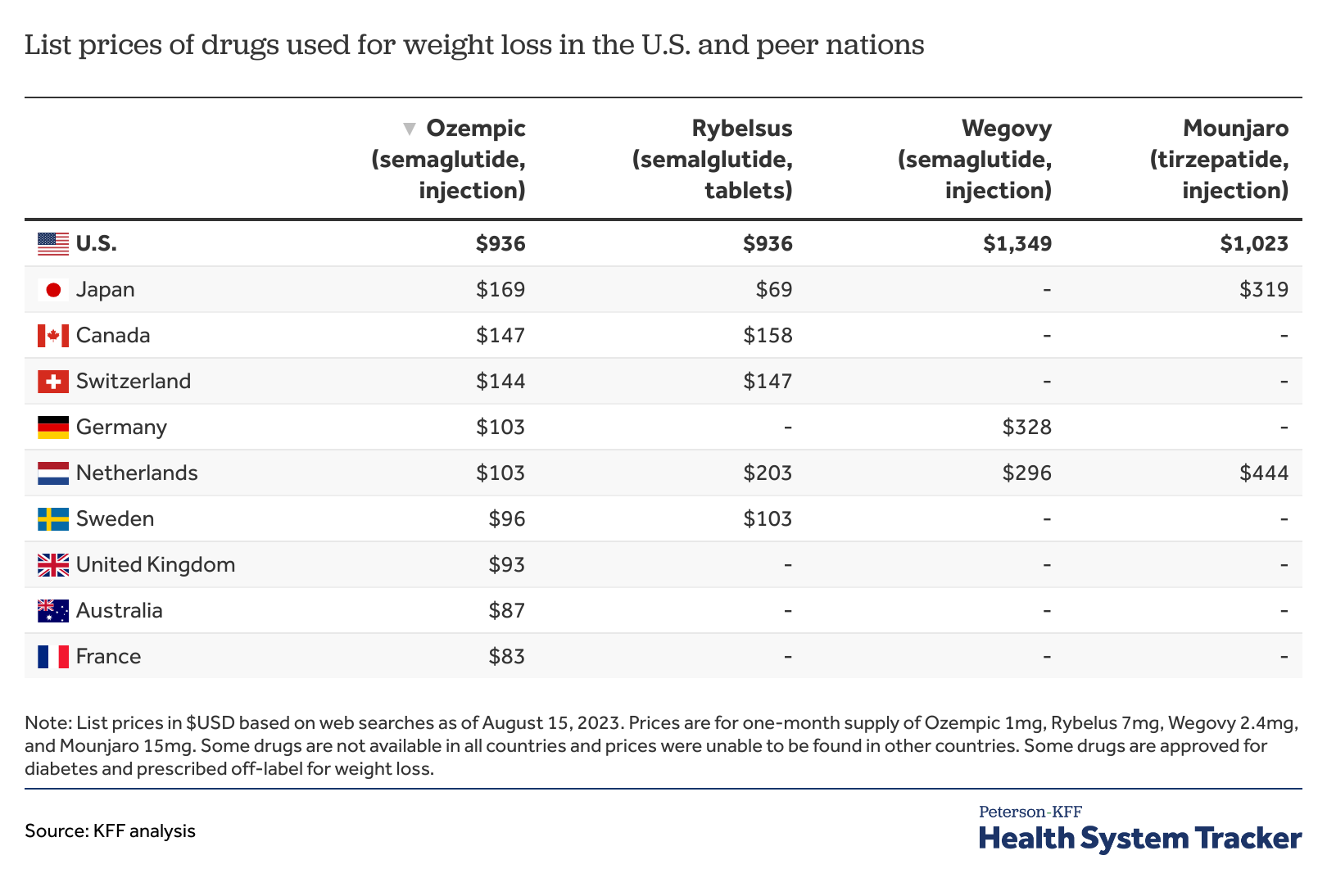

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs

May 10, 2025

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs

May 10, 2025 -

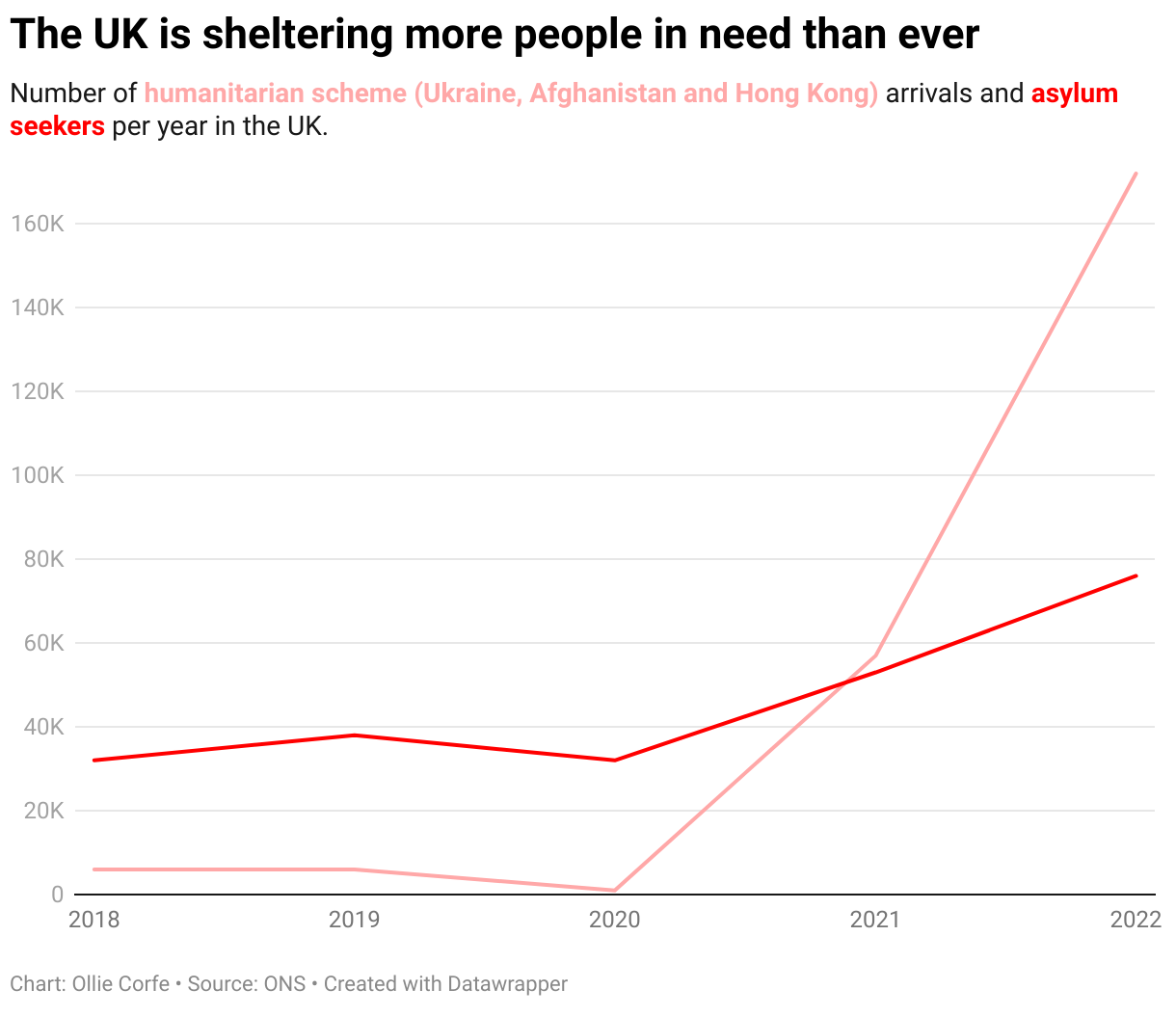

Uk Student Visas New Restrictions For Pakistani Applicants And Asylum Seekers

May 10, 2025

Uk Student Visas New Restrictions For Pakistani Applicants And Asylum Seekers

May 10, 2025 -

Death Of A Pioneer Remembering Americas First Nonbinary Individual

May 10, 2025

Death Of A Pioneer Remembering Americas First Nonbinary Individual

May 10, 2025 -

Nyt Strands Game 376 Solutions And Clues For March 14

May 10, 2025

Nyt Strands Game 376 Solutions And Clues For March 14

May 10, 2025