Tracking The Net Asset Value: Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV

The Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the collective value of the 30 companies comprising the Dow Jones Industrial Average, adjusted for expenses and other factors. Understanding this value is essential for assessing the ETF's performance and making informed investment decisions.

- NAV Definition: Simply put, the NAV is the total value of the ETF's holdings (stocks in this case) minus liabilities, divided by the number of outstanding shares.

- Factors Influencing NAV Fluctuations: Daily changes in the prices of the 30 Dow Jones Industrial Average components directly influence the ETF's NAV. Other factors include currency fluctuations (if holdings are in different currencies), dividend payments, and management fees.

- Importance for Buy/Sell Decisions: Comparing the NAV to the market price of the ETF helps determine if it's trading at a premium or discount, influencing buy or sell decisions.

- NAV vs. Market Price: The NAV is the theoretical value, while the market price reflects the actual trading price on the exchange. Differences can arise due to supply and demand.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Accessing real-time and historical Amundi Dow Jones Industrial Average UCITS ETF NAV data is straightforward thanks to various reliable sources.

- Amundi's Official Website: The official Amundi website is the primary source for accurate and up-to-date information, including daily NAV figures.

- Major Financial News Websites: Reputable financial news sites like Bloomberg, Yahoo Finance, and Google Finance often provide real-time and historical NAV data for various ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

- Brokerage Platforms: Most brokerage platforms that offer the ETF will display the current NAV alongside the market price, providing a convenient way for investors to track the value of their holdings.

- Dedicated ETF Data Providers: Specialized financial data providers offer comprehensive ETF data, often including historical NAV charts and analytics.

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF NAV Trends

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF NAV trends over time provides valuable insights into the ETF's performance and the underlying market conditions.

- Using Charts to Visualize NAV Performance: Graphical representations of the NAV over various timeframes (daily, weekly, monthly, yearly) allow for easy identification of trends.

- Identifying Long-Term and Short-Term Trends: Analyzing both short-term fluctuations and long-term patterns helps investors understand the ETF's overall performance and potential future trajectory.

- Correlation with Dow Jones Industrial Average: Since the ETF tracks the Dow Jones Industrial Average, its NAV will generally correlate closely with the index's performance.

- Economic Factors: Macroeconomic factors, such as interest rate changes, inflation, and geopolitical events, can significantly impact the NAV.

NAV and Investment Strategy for the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF NAV plays a crucial role in shaping investment strategies.

- Dollar-Cost Averaging and NAV: Using dollar-cost averaging involves investing a fixed amount at regular intervals, regardless of the NAV. This strategy mitigates the risk of investing a large sum at a market peak.

- Market Timing and NAV: While attempting to time the market based on NAV fluctuations can be risky, some investors might strategically buy low (when NAV is relatively low) and sell high (when NAV is relatively high).

- NAV in Risk Management: Monitoring the NAV helps assess the risk associated with the investment and allows for adjustments to the portfolio as needed.

- NAV and Portfolio Rebalancing: Regularly reviewing the NAV and comparing it to other assets in the portfolio facilitates portfolio rebalancing to maintain the desired asset allocation.

Conclusion

Regularly monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for making informed investment decisions. Understanding NAV fluctuations, their causes, and their impact on investment strategies allows investors to optimize their portfolio performance and manage risk effectively. By utilizing the resources outlined above for Amundi Dow Jones Industrial Average UCITS ETF NAV tracking, monitoring Amundi Dow Jones Industrial Average UCITS ETF NAV, and understanding Amundi Dow Jones Industrial Average UCITS ETF NAV performance, you can make well-informed choices and achieve your investment goals. Start tracking your Amundi Dow Jones Industrial Average UCITS ETF NAV today!

Featured Posts

-

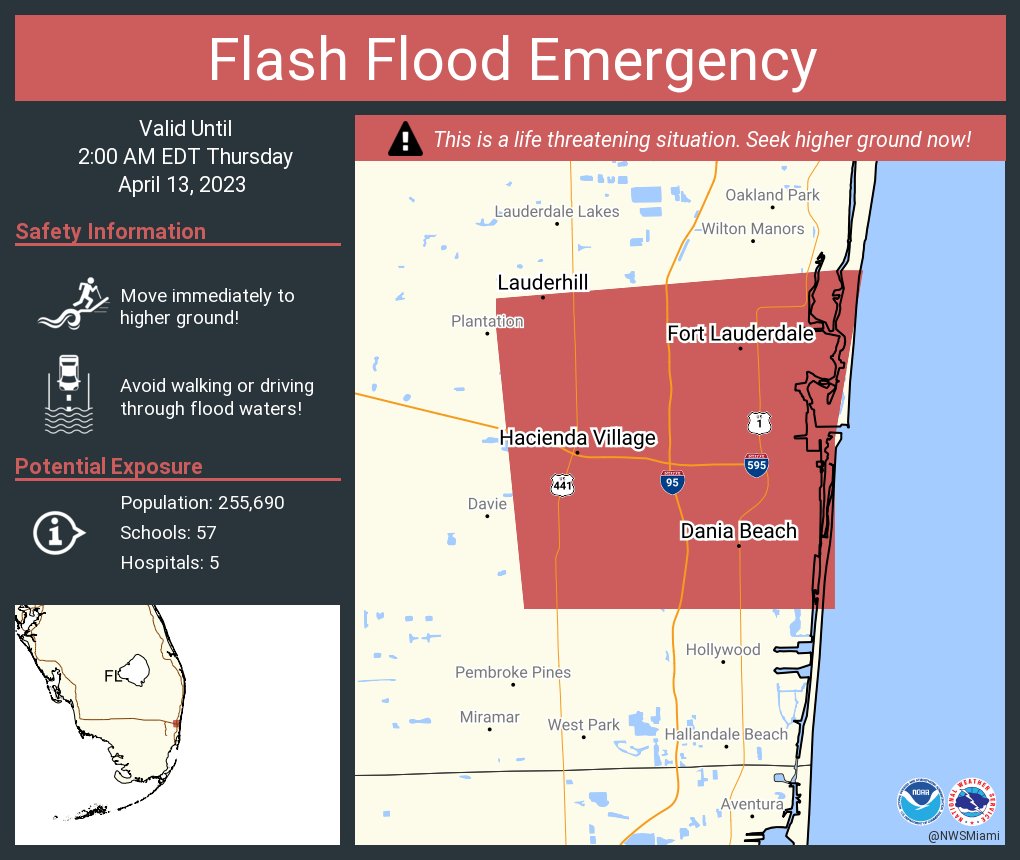

Flash Flood Emergency Preparedness A Step By Step Guide

May 25, 2025

Flash Flood Emergency Preparedness A Step By Step Guide

May 25, 2025 -

Mest Myagkovu I Satira V Filme Garazh Istoriya Sozdaniya

May 25, 2025

Mest Myagkovu I Satira V Filme Garazh Istoriya Sozdaniya

May 25, 2025 -

Lauryn Goodmans Unexpected Move To Italy New Details Emerge After Walkers Ac Milan Transfer

May 25, 2025

Lauryn Goodmans Unexpected Move To Italy New Details Emerge After Walkers Ac Milan Transfer

May 25, 2025 -

The Music Of Land Of Sometimes Tim Rices Contribution To The Lion King Legacy

May 25, 2025

The Music Of Land Of Sometimes Tim Rices Contribution To The Lion King Legacy

May 25, 2025 -

Kapitaalmarktrentes En Wisselkoers Euro Dollar Actuele Ontwikkelingen

May 25, 2025

Kapitaalmarktrentes En Wisselkoers Euro Dollar Actuele Ontwikkelingen

May 25, 2025