Tracking The Net Asset Value Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Where to Find the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Accessing real-time and historical NAV data for the Amundi MSCI World II UCITS ETF USD Hedged Dist is straightforward. Several reliable sources provide this crucial information:

- The Amundi Website: The official source for the most accurate data. Amundi, as the ETF provider, publishes daily NAV updates on their investor relations section. Look for dedicated fund fact sheets or performance pages.

- Major Financial News Websites: Reputable financial news sources like Bloomberg, Yahoo Finance, and Google Finance usually offer real-time and historical NAV data for many ETFs, including the Amundi MSCI World II UCITS ETF USD Hedged Dist. Search for the ETF's ticker symbol to find the information.

- Dedicated ETF Tracking Platforms: Several platforms specialize in providing comprehensive ETF data. These often include advanced charting tools, historical data, and performance analysis features. Examples include dedicated ETF research sites and brokerage platforms.

It’s important to note potential minor discrepancies between sources. These small differences usually arise from timing differences in data updates or different calculation methodologies. Always prioritize the official Amundi website for the most accurate and up-to-date NAV.

Factors Influencing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Several factors significantly impact the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV. Understanding these factors is essential for interpreting NAV changes correctly.

- MSCI World Index Performance: The ETF tracks the MSCI World Index, a benchmark representing large and mid-cap equities across developed markets. Positive performance in the underlying index directly translates to a higher NAV. Conversely, negative market movements lead to a lower NAV.

- Currency Fluctuations (USD Hedged): The "USD Hedged" aspect aims to minimize the impact of currency exchange rate fluctuations between your base currency and the US dollar. While it reduces the risk associated with currency volatility, unexpected shifts can still have some effect on the NAV.

- Market Movements and Global Economic Events: Global economic events, such as interest rate changes, geopolitical instability, and unexpected economic reports, can significantly affect market sentiment and thus the NAV. Volatility in the broader market will directly impact the ETF's NAV.

- Expenses and Management Fees: The ETF's expense ratio (management fees) deducts a small percentage from the assets under management. While seemingly minor, these fees slightly reduce the NAV over time and are essential to consider when assessing long-term performance.

Interpreting and Using the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Data

Understanding NAV changes is crucial for assessing the ETF’s performance and making informed investment decisions.

- Performance Assessment: Track the NAV over time to evaluate the ETF's growth and compare it to its benchmark (MSCI World Index). Look for consistent upward trends indicating strong performance.

- Portfolio Performance Analysis: Use NAV data to calculate your overall portfolio returns, considering the contribution of the Amundi MSCI World II UCITS ETF USD Hedged Dist.

- Risk Management: Monitor NAV fluctuations to gauge the ETF's volatility. Large and frequent swings might indicate higher risk and potential for losses.

- Investment Decisions (Buy/Sell Signals): While not the sole determinant, NAV trends can inform your buy/sell decisions. Consider buying when the NAV is relatively low and selling when it’s reached a desirable level based on your investment strategy. Remember to also consider the market price, which may differ slightly from the NAV due to the bid-ask spread. The difference between the market price and the NAV represents the premium or discount.

Tools and Resources for Tracking Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Several tools can streamline your NAV tracking process:

- Spreadsheet Software (Excel, Google Sheets): Manually input NAV data to track performance. This is suitable for basic tracking.

- Portfolio Management Software: Dedicated portfolio management software and mobile apps offer automated tracking features and often include advanced charting tools.

- Brokerage Platforms: Many brokerage accounts provide tools for monitoring your ETF holdings, including real-time NAV updates. Most will allow you to set up alerts for significant NAV changes.

Automated tracking systems save time and allow for efficient monitoring, alerting you to significant changes that warrant your attention.

Conclusion: Mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Tracking

Regularly tracking the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is vital for effective investment management. By utilizing the resources and techniques outlined in this article, you can make informed decisions based on accurate and timely data. Understanding the factors that influence the NAV allows for better risk assessment and improved investment performance. Start tracking the Net Asset Value of your Amundi MSCI World II UCITS ETF USD Hedged Dist holdings today for optimal investment performance!

Featured Posts

-

Leeds United Target Kyle Walker Peters Transfer News

May 24, 2025

Leeds United Target Kyle Walker Peters Transfer News

May 24, 2025 -

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025 -

Dayamitra Mtel And Merdeka Battery Mbma Prospek Investasi Usai Pencatatan Msci

May 24, 2025

Dayamitra Mtel And Merdeka Battery Mbma Prospek Investasi Usai Pencatatan Msci

May 24, 2025 -

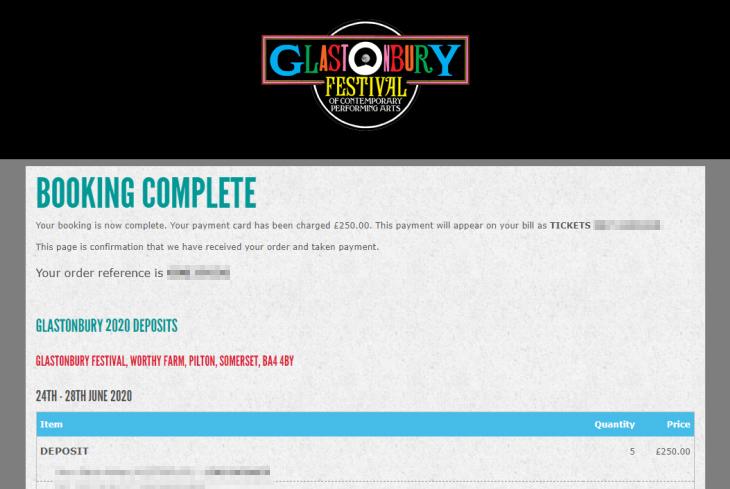

Us Band Hints At Glastonbury Performance Unofficial Confirmation Creates Buzz

May 24, 2025

Us Band Hints At Glastonbury Performance Unofficial Confirmation Creates Buzz

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Daily Nav Updates And Analysis

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav Updates And Analysis

May 24, 2025

Latest Posts

-

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025 -

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025 -

Leeds United And Kyle Walker Peters Transfer Update

May 24, 2025

Leeds United And Kyle Walker Peters Transfer Update

May 24, 2025 -

Latest On Kyle Walker Peters Potential Transfer To Leeds

May 24, 2025

Latest On Kyle Walker Peters Potential Transfer To Leeds

May 24, 2025