Trade War Concerns Weigh On Markets: Dow Futures, Dollar Drop

Table of Contents

Impact of Trade War Concerns on Dow Futures

The relationship between trade wars and Dow Futures is undeniably intertwined. Escalating trade tensions often trigger a negative reaction in the market, as investors become hesitant and uncertainty rises. This uncertainty translates into downward pressure on Dow Futures, reflecting predictions of decreased corporate profits and slower economic growth. The Dow Jones Industrial Average, a key indicator of US economic health, directly reflects this sentiment.

- Specific examples of how recent trade actions have impacted Dow Futures: The announcement of new tariffs often leads to immediate drops in Dow Futures, as investors anticipate negative consequences for affected industries. For example, the recent tariff increases on [insert specific example of recent trade action and its impact on Dow Futures].

- Analysis of investor behavior in response to trade war headlines: News headlines concerning trade negotiations significantly impact investor behavior. Negative news typically leads to selling pressure, driving Dow Futures lower, while positive developments can lead to a rebound.

- Predictions for future Dow Futures performance based on trade developments: The trajectory of Dow Futures is highly dependent on future trade developments. A de-escalation of tensions could lead to a rally, while further escalation could trigger more significant declines. Analyzing future trade policy announcements and their potential impact is crucial for predicting future Dow Futures performance. Sophisticated futures trading strategies may help mitigate some of this risk.

Keywords: Dow Futures, trade war impact, investor sentiment, market prediction, futures trading, Dow Jones Industrial Average

The Weakening Dollar and Trade Wars

The US dollar's strength is often inversely correlated with escalating trade tensions. While typically viewed as a safe haven currency, the dollar’s status is challenged during times of heightened trade uncertainty. A weakening dollar can be a consequence of investor concerns about the negative economic impact of trade wars. This devaluation can impact US exports and imports, affecting different sectors of the US economy in varying ways.

- Specific examples of how the dollar has reacted to recent trade news: [Insert specific examples of how the US dollar reacted to significant trade news events. Include data points if possible.]

- Analysis of the impact on different sectors of the US economy: Industries heavily reliant on exports, such as agriculture and manufacturing, are particularly vulnerable to a weakening dollar. Conversely, industries that rely on imports may benefit from cheaper inputs.

- Potential long-term consequences of a sustained dollar decline: A prolonged decline in the dollar could lead to increased inflation and potentially hurt US consumers. It could also impact US international relations and its role in the global economy.

Keywords: US dollar, currency exchange rates, trade balance, import/export, safe haven currency, dollar devaluation, currency risk

Broader Global Market Reactions to Trade Disputes

Trade wars don't exist in a vacuum. Their ripple effects extend far beyond the US, impacting global markets significantly. Emerging markets and developing economies are particularly vulnerable to these disruptions, often facing increased economic uncertainty and potentially slower growth. International organizations play a crucial, albeit often limited, role in attempting to mitigate the negative consequences of these disputes.

- Examples of how specific countries or regions are affected: [Insert examples of how specific countries or regions have been affected by trade wars, providing data where possible.]

- Analysis of different strategies employed by governments to counter trade war impacts: Governments are employing various strategies to counter the negative effects, including diversification of trade partners, domestic stimulus packages, and negotiations to reach trade agreements.

- Predictions for the long-term effects on global trade and economic growth: The long-term consequences of prolonged trade wars remain uncertain, but many economists predict a slowdown in global trade and economic growth, potentially even a global recession if the situation worsens.

Keywords: global markets, international trade, emerging markets, economic growth, global recession, protectionism

Conclusion: Navigating Trade War Uncertainty

The impact of trade war concerns is multifaceted, influencing Dow Futures, the value of the US dollar, and the broader global economic landscape. Understanding the dynamic interplay between these factors is crucial for both investors and businesses. Navigating this uncertainty requires a proactive approach, including diversification of investment portfolios, robust risk management strategies, and a close watch on economic indicators.

To mitigate the impact of trade war concerns, it is vital to remain informed about ongoing trade developments. Closely monitoring Dow Futures and currency exchange rates provides valuable insights into market sentiment. Seeking professional financial advice can help tailor investment strategies to minimize risks and maximize potential returns in this volatile environment. Don't underestimate the impact of trade war concerns on your financial future; take proactive steps to protect your investments. Keywords: trade war impact mitigation, investment strategies, risk management, financial planning, Dow Futures analysis, currency risk, trade war

Featured Posts

-

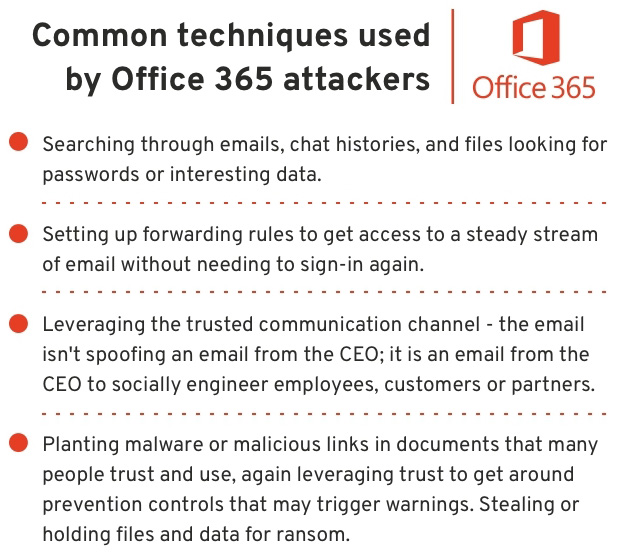

Office365 Executive Inboxes Targeted In Multi Million Dollar Cybercrime

Apr 22, 2025

Office365 Executive Inboxes Targeted In Multi Million Dollar Cybercrime

Apr 22, 2025 -

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 22, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 22, 2025 -

Harvard Faces 1 Billion Funding Cut Trump Administrations Ire

Apr 22, 2025

Harvard Faces 1 Billion Funding Cut Trump Administrations Ire

Apr 22, 2025 -

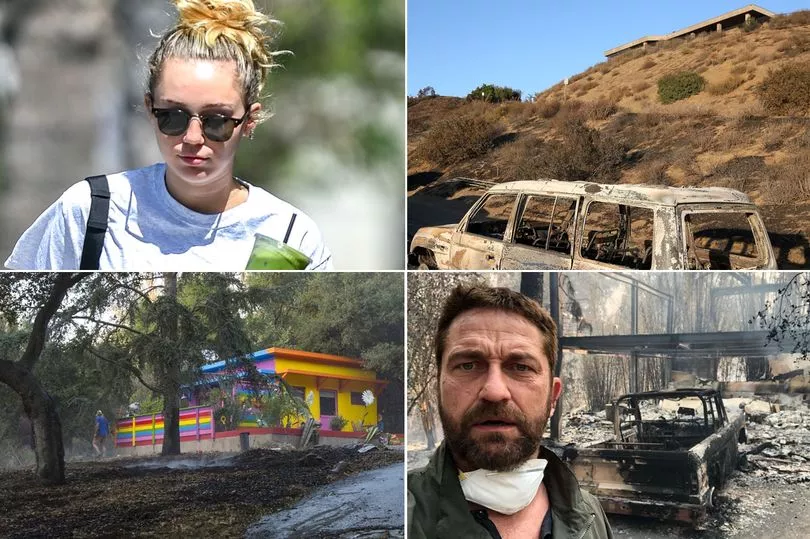

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025 -

Understanding Papal Conclaves History Secrecy And The Election Of The Pope

Apr 22, 2025

Understanding Papal Conclaves History Secrecy And The Election Of The Pope

Apr 22, 2025

Latest Posts

-

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025 -

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025 -

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025 -

Overtime Thriller Oilers Beat Kings To Tie Western Conference Series

May 10, 2025

Overtime Thriller Oilers Beat Kings To Tie Western Conference Series

May 10, 2025 -

Leon Draisaitls Exceptional Season Hart Trophy Nomination And Oilers Success

May 10, 2025

Leon Draisaitls Exceptional Season Hart Trophy Nomination And Oilers Success

May 10, 2025