Traders Pare Bets On BOE Cuts As Pound Climbs Following UK Inflation Data

Table of Contents

UK Inflation Data Surprises Markets

The latest UK inflation figures surprised markets by showing a lower-than-expected rate of inflation. This deviation from analyst forecasts led to a significant reassessment of the economic situation and the likelihood of further BOE intervention.

- Specific inflation rate reported: The Consumer Prices Index (CPI) inflation rate was reported at 6.8% for July, down from 7.9% the previous month.

- Comparison to previous month's data: This represents a 1.1% decrease from June's figure, a sharper fall than many economists predicted.

- Comparison to analyst forecasts: Analysts had generally anticipated a figure closer to 7.1%, indicating a more persistent inflationary pressure.

- Key contributing factors to the inflation numbers: The decline was primarily attributed to a fall in energy prices, though core inflation (excluding volatile energy and food prices) remained stubbornly high.

The market's initial reaction to the data release was swift and decisive. Traders quickly began adjusting their positions, reflecting the reduced need for further interest rate cuts to combat inflation.

Impact on BOE Rate Cut Expectations

The unexpectedly lower inflation data significantly influenced market expectations for future BOE interest rate decisions. The probability of further rate cuts, as reflected in financial markets, plummeted.

- Percentage change in probability of rate cuts: Market pricing, based on interest rate futures contracts, indicated a substantial reduction in the probability of a rate cut at the next Monetary Policy Committee (MPC) meeting. Estimates shifted from a roughly 40% chance of a cut to less than 15%.

- Analysis of market commentary from analysts and traders: Analysts across major financial institutions revised their forecasts, many suggesting that the BOE might hold interest rates steady or even consider a further increase depending on upcoming economic indicators.

- Discussion of potential implications for future monetary policy meetings: The lower inflation figure gives the BOE more leeway in its policy decisions. The central bank will now likely prioritize assessing the persistence of disinflationary trends before making any further adjustments to interest rates.

- Mention of any statements from BOE officials: While no immediate statements were made by BOE officials following the data release, the market reaction strongly suggests an altered perspective on the necessity of further rate cuts.

This shift in expectations also impacted UK government bond yields (gilts). The reduced likelihood of further rate cuts led to a rise in gilt yields, reflecting increased investor confidence in the stability of UK government debt.

Pound Strengthens Against Major Currencies

Following the release of the positive inflation data, the pound strengthened significantly against major currencies. This reflects renewed confidence in the UK economy.

- Percentage changes in GBP/USD, GBP/EUR exchange rates: The GBP/USD exchange rate rose by approximately 1.5%, while the GBP/EUR rate appreciated by around 1%.

- Explanation for the pound's appreciation: The pound's appreciation can be attributed to reduced risk aversion among investors, driven by the lower-than-expected inflation and the diminished likelihood of further BOE rate cuts. Increased investor confidence in the UK economy further bolstered the currency.

- Mention of potential impacts on UK businesses and consumers: The stronger pound could negatively impact UK exporters, making their products more expensive in foreign markets. Conversely, it could benefit consumers by reducing the price of imported goods.

The short-term outlook for the pound remains positive, contingent on continued economic stability and further favorable inflation data. The long-term outlook will depend on various factors, including global economic conditions and the BOE's future monetary policy decisions.

Geopolitical Factors and Their Influence

While the UK inflation data was the primary driver of market movements, it's important to acknowledge that geopolitical factors also play a role. Global economic uncertainty and ongoing tensions in various regions can influence investor sentiment and currency values. However, in this instance, the impact of the UK inflation data clearly overshadowed other geopolitical considerations.

Conclusion

The key takeaway from this analysis is the significant impact of unexpectedly low UK inflation data on market expectations regarding BOE rate cuts. The lower inflation, exceeding forecasts, led to a substantial reduction in the perceived need for further rate cuts, resulting in a strengthening of the pound against major currencies. The interplay between inflation data, market sentiment, and monetary policy expectations is clearly demonstrated in this case.

To stay informed about future developments concerning BOE rate cuts and their impact on the UK economy and currency, follow reputable financial news sources for the latest updates on UK inflation and BOE monetary policy decisions. Understanding the dynamics of BOE rate cuts and their ripple effects is crucial for effective financial planning and investment strategies.

Featured Posts

-

Partial Collapse Of Historic Chinese Tower Causes Tourist Evacuation

May 22, 2025

Partial Collapse Of Historic Chinese Tower Causes Tourist Evacuation

May 22, 2025 -

Akron And Cleveland Gas Prices Ohio Gas Buddy Updates And Reasons For The Increase

May 22, 2025

Akron And Cleveland Gas Prices Ohio Gas Buddy Updates And Reasons For The Increase

May 22, 2025 -

De Xuat Xay Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025

De Xuat Xay Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025 -

Tuerkiye Ve Italya Ya Ayni Goerev Nato Plani Ortaya Cikti

May 22, 2025

Tuerkiye Ve Italya Ya Ayni Goerev Nato Plani Ortaya Cikti

May 22, 2025 -

Clisson Le Festival Le Bouillon Et Ses Spectacles Engages

May 22, 2025

Clisson Le Festival Le Bouillon Et Ses Spectacles Engages

May 22, 2025

Latest Posts

-

The Border Mails James Wiltshire 10 Years Of Capturing Local Life

May 23, 2025

The Border Mails James Wiltshire 10 Years Of Capturing Local Life

May 23, 2025 -

James Wiltshires Photographic Legacy 10 Years With The Border Mail

May 23, 2025

James Wiltshires Photographic Legacy 10 Years With The Border Mail

May 23, 2025 -

Ten Years At The Border Mail Reflecting On A Photographers Journey With James Wiltshire

May 23, 2025

Ten Years At The Border Mail Reflecting On A Photographers Journey With James Wiltshire

May 23, 2025 -

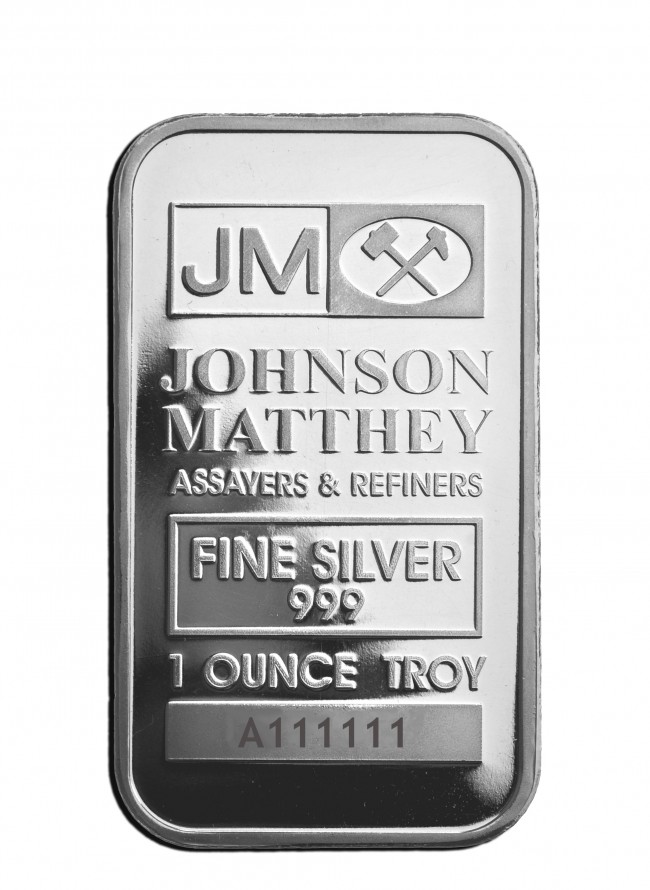

Analysis Johnson Matthey Unit Sale And Subsequent Bt Profit Rise

May 23, 2025

Analysis Johnson Matthey Unit Sale And Subsequent Bt Profit Rise

May 23, 2025 -

Financial Update Johnson Mattheys Honeywell Sale And Bt Profit

May 23, 2025

Financial Update Johnson Mattheys Honeywell Sale And Bt Profit

May 23, 2025