Travelers Canada Sold To Definity For $3.3 Billion: Impact And Analysis

Table of Contents

Deal Details and Rationale

The Acquisition Price and Structure

The $3.3 billion acquisition of Travelers Canada by Definity is a significant transaction, reshaping the Canadian insurance sector. While precise payment methods and the exact closing date haven't been fully disclosed publicly, the deal signifies Definity's ambitious expansion strategy. Travelers Canada, prior to the sale, held a substantial market share in various insurance segments, making it a highly attractive asset. The acquisition likely involved a combination of cash and potentially stock, a common structure in large-scale mergers and acquisitions. Further details regarding the financial intricacies are expected to emerge as the deal progresses through regulatory approvals.

Definity's Strategic Objectives

Definity's acquisition of Travelers Canada is driven by a clear strategic vision. The company aims to solidify its position as a leading player in the Canadian insurance market. Several key objectives are apparent:

- Increased market share in Canada: Acquiring Travelers Canada substantially expands Definity's reach and customer base, allowing them to dominate a larger segment of the market.

- Access to new customer segments: Travelers Canada's existing clientele offers Definity access to new demographics and market segments, diversifying its risk portfolio.

- Expansion of product offerings: The acquisition integrates Travelers Canada's product lines into Definity's portfolio, providing a wider range of offerings to existing and new customers.

- Strengthened competitive position: The combined strength of Definity and Travelers Canada creates a powerful entity, significantly enhancing its competitive advantage against other major insurers in the Canadian market.

Impact on Travelers Canada Customers

Policy Changes and Service Continuity

For existing Travelers Canada customers, the immediate impact is likely to be minimal. Definity has publicly stated its commitment to ensuring service continuity. Policy terms and conditions should remain largely unchanged in the short term, although long-term adjustments are possible. Customers can expect continued access to claims services, customer support, and existing policy benefits. However, close monitoring of any policy updates or changes to premium rates is advised.

Potential Benefits and Drawbacks for Customers

The acquisition presents both potential benefits and drawbacks for Travelers Canada's customers:

Potential Benefits:

- Improved product offerings: Access to a broader range of insurance products offered by Definity.

- Enhanced digital services: Potential integration of improved digital platforms and online services.

- Expanded customer support network: Access to a potentially larger and more efficient customer service network.

Potential Drawbacks:

- Potential premium increases: While not guaranteed, there is a possibility of premium adjustments in the future.

- Changes to policy terms: Minor changes to policy terms and conditions are possible over time.

- Integration challenges: Initial disruptions are possible during the integration process of the two companies.

Impact on the Canadian Insurance Market

Increased Competition and Market Consolidation

The Travelers Canada sale signifies further consolidation in the Canadian insurance market. This acquisition reduces the number of major players, potentially leading to both increased competition and a more concentrated market. The impact on prices will depend on various factors, including regulatory oversight and the overall market dynamics. Increased competition could lead to improved services and more competitive pricing, while market consolidation could potentially lead to less choice for consumers.

Regulatory Scrutiny and Approval Process

The acquisition is subject to regulatory approvals from the Competition Bureau of Canada and other relevant authorities. The Competition Bureau will scrutinize the deal to ensure it doesn't lead to anti-competitive practices or harm consumers. Any potential delays or challenges during this regulatory process could impact the timeline of the acquisition.

Financial Implications and Future Outlook

Stock Market Reaction and Investor Sentiment

The announcement of the Travelers Canada acquisition has understandably generated considerable interest in the stock market. Investors will be closely watching the performance of both Definity and Travelers' stock following the completion of the deal. Positive investor sentiment will depend on the successful integration of the two entities and the overall market performance. Any significant changes in stock value will likely reflect the market's perception of the acquisition's long-term viability.

Long-Term Projections for Travelers Canada and Definity

Long-term projections for both Definity and Travelers Canada post-acquisition are positive, assuming a successful integration. Analysts expect synergies to create efficiencies and cost savings, leading to improved profitability. However, the integration process will require careful management to avoid disruptions and maintain customer satisfaction. The long-term success will depend heavily on Definity's ability to effectively manage the combined entity and navigate the evolving Canadian insurance market.

Conclusion

The $3.3 billion acquisition of Travelers Canada by Definity marks a significant turning point for the Canadian insurance market. This Travelers Canada acquisition has brought about increased market consolidation, potentially impacting both competition and consumer choices. While the deal offers potential benefits such as improved product offerings and enhanced services, customers should remain vigilant about potential changes in premium rates and policy terms. The success of this merger hinges on effective integration, regulatory approval, and deft navigation of the competitive landscape. Stay updated on the implications of the Travelers Canada sale and learn more about the future of the Canadian insurance market after this significant Definity acquisition. Further research into Definity's broader portfolio and its competitive strategies within the Canadian insurance sector is recommended.

Featured Posts

-

Us Trade Court Rules Against Trump Era Tariffs

May 30, 2025

Us Trade Court Rules Against Trump Era Tariffs

May 30, 2025 -

The Impact Of Israeli Intelligence On Hezbollahs Activities In Southern Lebanon

May 30, 2025

The Impact Of Israeli Intelligence On Hezbollahs Activities In Southern Lebanon

May 30, 2025 -

Stock Market News Dow S And P 500 And Nasdaq May 29th

May 30, 2025

Stock Market News Dow S And P 500 And Nasdaq May 29th

May 30, 2025 -

Steffi Grafs Instagram Follows Ein Blick Hinter Die Kulissen

May 30, 2025

Steffi Grafs Instagram Follows Ein Blick Hinter Die Kulissen

May 30, 2025 -

Delving Into The Lost Potential A Pacific Rim Sequel Speculation

May 30, 2025

Delving Into The Lost Potential A Pacific Rim Sequel Speculation

May 30, 2025

Latest Posts

-

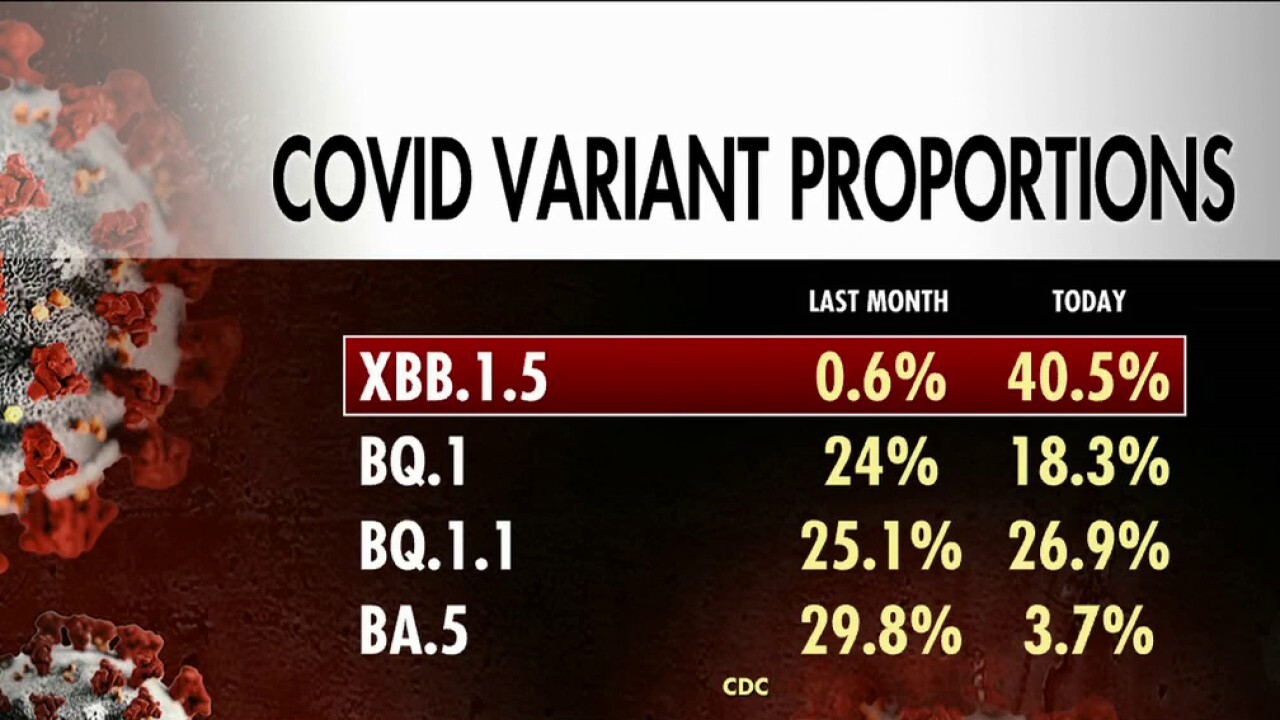

New Covid 19 Variant Lp 8 1 Expert Analysis And Updates

May 31, 2025

New Covid 19 Variant Lp 8 1 Expert Analysis And Updates

May 31, 2025 -

Who New Covid 19 Variant Fueling Case Rise In Some Regions

May 31, 2025

Who New Covid 19 Variant Fueling Case Rise In Some Regions

May 31, 2025 -

Covid 19 Jn 1 Variant Surge In India Recognizing And Preventing Infection

May 31, 2025

Covid 19 Jn 1 Variant Surge In India Recognizing And Preventing Infection

May 31, 2025 -

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025 -

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025