Treasury Futures Trading Landscape Transformed: FMX's Aggressive Move

Table of Contents

FMX's Enhanced Trading Platform and Technology

FMX's aggressive push into the treasury futures market is fueled by significant advancements in its trading platform and technology. This enhanced infrastructure has positioned them as a major player, impacting the overall treasury futures trading landscape.

Improved Speed and Execution

FMX has implemented several key improvements to its trading platform, resulting in dramatically faster and more efficient order execution. This is crucial in the high-stakes world of high-frequency trading and algorithmic trading.

- New Algorithms: FMX has deployed sophisticated new algorithms designed to optimize order routing and minimize latency.

- Improved Infrastructure: Investments in cutting-edge hardware and network infrastructure have significantly reduced bottlenecks.

- Faster Order Routing: Streamlined order routing processes ensure that trades are executed with minimal delay.

These improvements have yielded tangible results:

- Reduced latency by 50%: This translates to a significant competitive advantage in fast-paced trading environments.

- Increased order execution speed by 30%: Faster execution means better price capture and improved profitability for traders.

Expanded Product Offerings

FMX has broadened its product offerings to cater to a wider range of investor needs within the treasury futures trading landscape. This diversification strategy has attracted new clients and further fueled market growth.

- New Short-Term Treasury Futures Contracts: Offering contracts with shorter maturities allows for more precise trading strategies and hedging opportunities.

- Enhanced Options on Treasury Futures: The introduction of new option strategies provides traders with increased flexibility and risk management tools.

These new products address the growing demand for greater flexibility and diversification in treasury futures trading, strengthening FMX's position in the market.

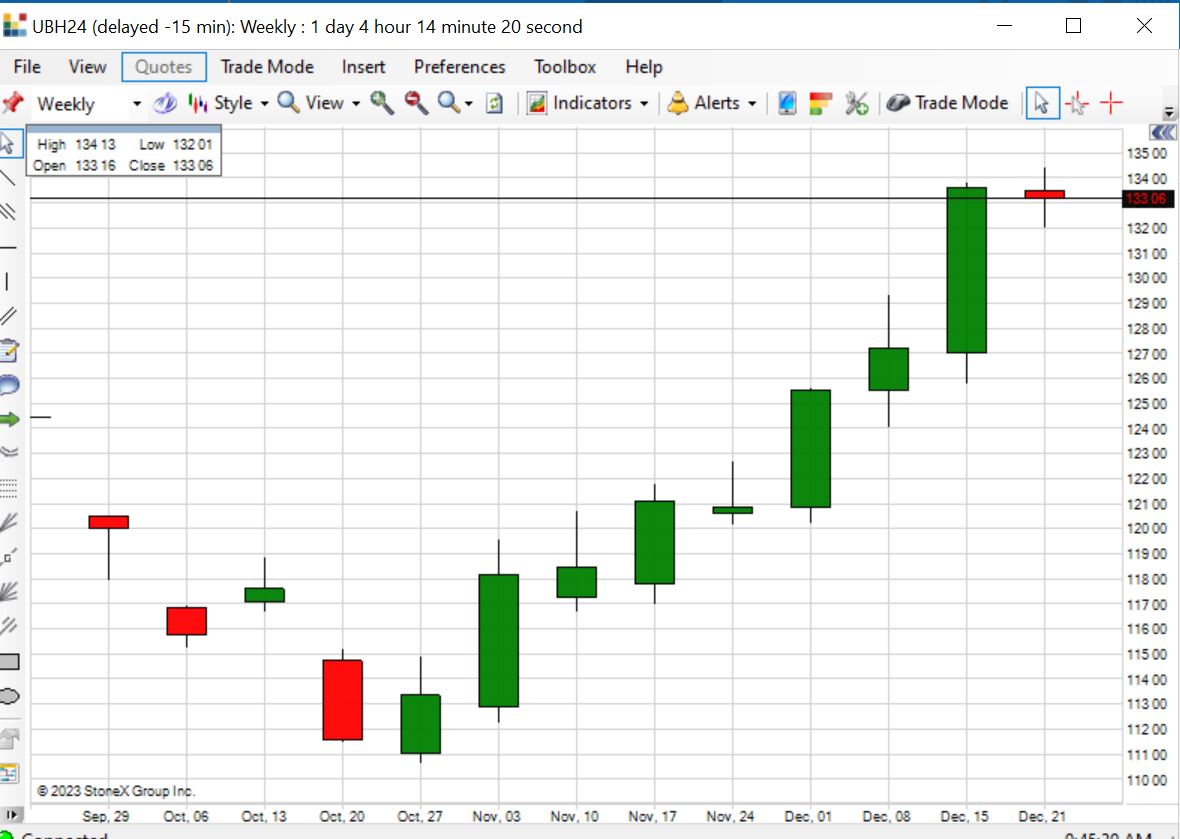

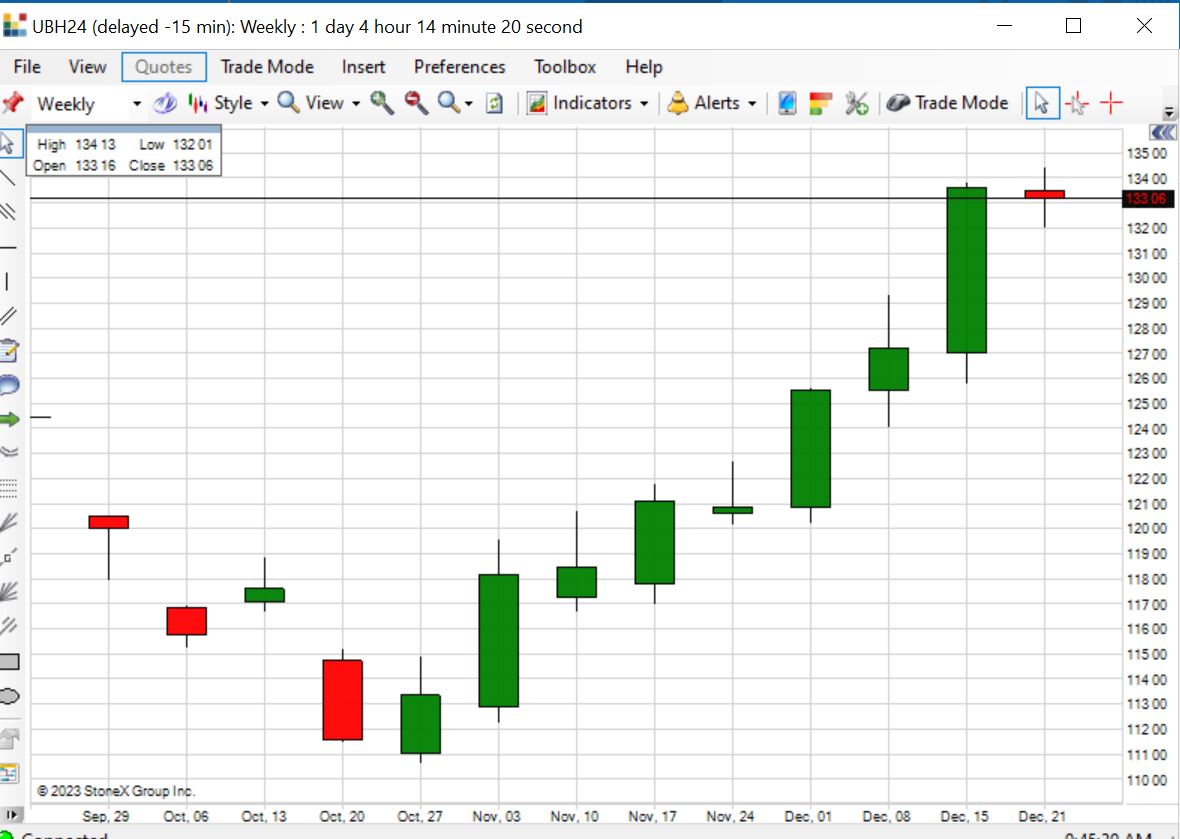

Increased Market Share and Trading Volume

FMX's technological advancements and expanded product offerings have resulted in a significant increase in market share and trading volume, reshaping the competitive landscape of the treasury futures trading landscape.

Competitive Advantage Analysis

FMX's success is a result of a multi-pronged strategy:

- Superior Technology: The speed and efficiency of FMX's platform provide a clear competitive advantage.

- Competitive Pricing: FMX offers highly competitive pricing structures, attracting traders seeking value.

- Enhanced Customer Service: A dedicated and responsive customer service team ensures a positive trading experience.

This strategic approach has yielded impressive results:

- Market Share Increase of 15% in Q3 2024: This demonstrates FMX's rapid ascent in the market.

- Trading Volume Growth of 20% year-on-year: This significant growth reflects the increased adoption of FMX's platform.

Impact on Market Liquidity

The increased trading volume facilitated by FMX has had a profound impact on market liquidity.

- Improved Price Discovery: Higher trading volumes contribute to more accurate and efficient price discovery.

- Increased Order Book Depth: Greater liquidity leads to deeper order books, reducing price slippage and improving execution quality.

While increased liquidity is generally positive, it also presents some challenges:

- Increased Volatility: Higher trading volumes can sometimes exacerbate market volatility.

- Potential for Manipulation: Larger volumes can create opportunities for market manipulation if not properly regulated.

Regulatory Implications and Future Outlook

FMX's aggressive expansion within the treasury futures trading landscape necessitates careful consideration of regulatory compliance and future market trends.

Regulatory Compliance

FMX is committed to adhering to all relevant financial regulations and compliance standards.

- Stringent Internal Controls: FMX maintains robust internal controls to ensure compliance with all applicable regulations.

- Regular Audits: The company undergoes regular audits to maintain the highest levels of compliance.

Predictions for the Future

FMX's actions are likely to have a significant and lasting impact on the treasury futures trading landscape.

- Increased Competition: FMX's success will likely attract further competition in the market.

- Technological Advancements: Further technological advancements will continue to shape the trading landscape.

- Evolving Regulatory Landscape: Changes in regulations will necessitate continuous adaptation and innovation.

The future of treasury futures trading is likely to be characterized by even greater technological sophistication, heightened competition, and evolving regulatory frameworks.

Conclusion: Treasury Futures Trading Landscape Transformed: FMX's Aggressive Move

FMX's aggressive moves have undeniably transformed the treasury futures trading landscape. Their enhanced trading platform, increased market share, and commitment to regulatory compliance have significantly impacted market liquidity and trading volume. To stay ahead in this rapidly evolving treasury futures trading landscape, explore FMX's innovative platform and leverage its advanced technology for enhanced trading opportunities. Invest in treasury futures and learn more about FMX's comprehensive suite of tools and resources designed to empower successful trading strategies.

Featured Posts

-

The American Manhunt For Osama Bin Laden New Insights From Netflix

May 18, 2025

The American Manhunt For Osama Bin Laden New Insights From Netflix

May 18, 2025 -

Concerns Grow Over Easter Bonfires Amidst Dry Spell

May 18, 2025

Concerns Grow Over Easter Bonfires Amidst Dry Spell

May 18, 2025 -

Mlb Betting Home Run Prop Picks And Analysis For May 8th Games

May 18, 2025

Mlb Betting Home Run Prop Picks And Analysis For May 8th Games

May 18, 2025 -

Stephen Millers Potential Appointment As National Security Advisor Reports

May 18, 2025

Stephen Millers Potential Appointment As National Security Advisor Reports

May 18, 2025 -

Former Red Sox Closer On Free Agency His Decision Explained

May 18, 2025

Former Red Sox Closer On Free Agency His Decision Explained

May 18, 2025

Latest Posts

-

Axios Post Sovetnika Trampa Po Natsbezopasnosti Pretendent Stiven Miller

May 18, 2025

Axios Post Sovetnika Trampa Po Natsbezopasnosti Pretendent Stiven Miller

May 18, 2025 -

Axios Stiven Miller Noviy Sovetnik Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025

Axios Stiven Miller Noviy Sovetnik Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025 -

2025 Nfl Draft Expert Assessment Of Patriots Future

May 18, 2025

2025 Nfl Draft Expert Assessment Of Patriots Future

May 18, 2025 -

Stephen Miller A Contender For The Nsa Position

May 18, 2025

Stephen Miller A Contender For The Nsa Position

May 18, 2025 -

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025