Trump Administration Greenlights Nippon-U.S. Steel Merger

Table of Contents

Details of the Nippon-U.S. Steel Merger

The merger agreement between Nippon Steel and U.S. Steel combines two industry giants, creating a global powerhouse in steel production. While precise financial details remain partially undisclosed, the transaction represents a substantial investment, signifying a significant shift in the global steel market. Key aspects of the agreement include:

- Transaction Value: (Insert estimated or actual transaction value if available. If unavailable, state "The exact financial terms of the merger have not yet been fully disclosed.")

- Ownership Structure Post-Merger: (Describe the ownership structure – e.g., percentage ownership by each entity, creation of a new parent company).

- Anticipated Closing Date: (Insert anticipated closing date if available; otherwise, state expected timeline).

- Key Executives Involved: (List key executives from both companies involved in the merger process and their new roles, if known).

Trump Administration's Approval and Rationale

The Trump administration's approval of this merger was a pivotal decision with far-reaching consequences. While official statements emphasized potential benefits, the underlying rationale likely involved a complex interplay of factors:

- National Security Implications: The administration likely weighed the potential impact on the U.S.'s steel supply chain, considering its strategic importance to national security and infrastructure projects.

- Potential Job Creation: The merger could lead to job creation through increased efficiency and investment in U.S. steel production facilities. The administration may have seen this as a positive economic impact.

- Impact on Domestic Steel Production: The merger might bolster domestic steel production, reducing reliance on foreign steel imports and strengthening the U.S. steel industry’s competitive position.

- Competitive Landscape Considerations: The administration likely assessed the impact on competition within the U.S. steel market. While antitrust concerns were a factor, the potential benefits likely outweighed these concerns in the administration's view.

- Addressing Antitrust Concerns: The approval suggests that the administration deemed the potential benefits to outweigh any perceived antitrust issues. This may have involved concessions or commitments from the merging companies to address competitive concerns.

Impact on the U.S. Steel Industry

The Nippon-U.S. Steel merger is poised to significantly impact the U.S. steel industry, both in the short term and long term. Potential consequences include:

- Changes in Market Share: The combined entity will undoubtedly command a substantial market share, potentially altering the competitive dynamics within the industry.

- Impact on Steel Prices: The merger could influence steel prices – potentially leading to both price increases and decreases depending on factors like increased efficiency and global supply.

- Job Creation or Loss: While the merger may create jobs in some areas through increased efficiency and new investments, it might also lead to job losses in other sectors due to consolidation and restructuring.

- Increased Competitiveness (or Lack Thereof): The merger could either enhance the competitiveness of the U.S. steel industry on the global stage or, conversely, stifle competition depending on the strategies employed by the merged entity.

- Impact on Smaller Steel Producers: Smaller steel producers in the U.S. may face increased pressure from the newly formed giant, leading to potential mergers, acquisitions, or business failures.

Global Implications of the Nippon-U.S. Steel Merger

The implications of this merger extend far beyond the U.S. borders, impacting the global steel market in several ways:

- Shift in Global Steel Production Capacity: The merger creates a significantly larger steel producer, altering the distribution of global steel production capacity.

- Changes to Global Steel Pricing: The combined entity’s influence on global steel supply could significantly impact international steel pricing, affecting businesses and consumers worldwide.

- Impact on International Trade Relations: The merger could spark discussions about fair trade practices and potentially lead to trade disputes between nations.

- Competition with Other Global Steel Producers: The merger may intensify competition among global steel giants, leading to further mergers, acquisitions, or strategic alliances.

Conclusion

The Trump administration's approval of the Nippon-U.S. Steel merger marks a pivotal moment for the global steel industry. This deal will undoubtedly impact steel production, pricing, and the competitive landscape both domestically and internationally. The merger's long-term consequences remain to be seen, but its immediate effects on market share, employment, and international trade are already apparent. What will be the lasting impact of the Trump Administration's greenlight on the Nippon-U.S. Steel merger? Stay tuned for further updates on this landmark deal in the steel industry.

Featured Posts

-

The Prince Of Monaco His Wealth Manager And A Major Corruption Investigation

May 26, 2025

The Prince Of Monaco His Wealth Manager And A Major Corruption Investigation

May 26, 2025 -

Best Nike Running Shoes 2025 Reviews And Recommendations

May 26, 2025

Best Nike Running Shoes 2025 Reviews And Recommendations

May 26, 2025 -

Urgent Coastal Flood Advisory In Effect For Southeast Pa Wednesday

May 26, 2025

Urgent Coastal Flood Advisory In Effect For Southeast Pa Wednesday

May 26, 2025 -

Funeral Service Held For Hells Angels Member Following Fatal Accident

May 26, 2025

Funeral Service Held For Hells Angels Member Following Fatal Accident

May 26, 2025 -

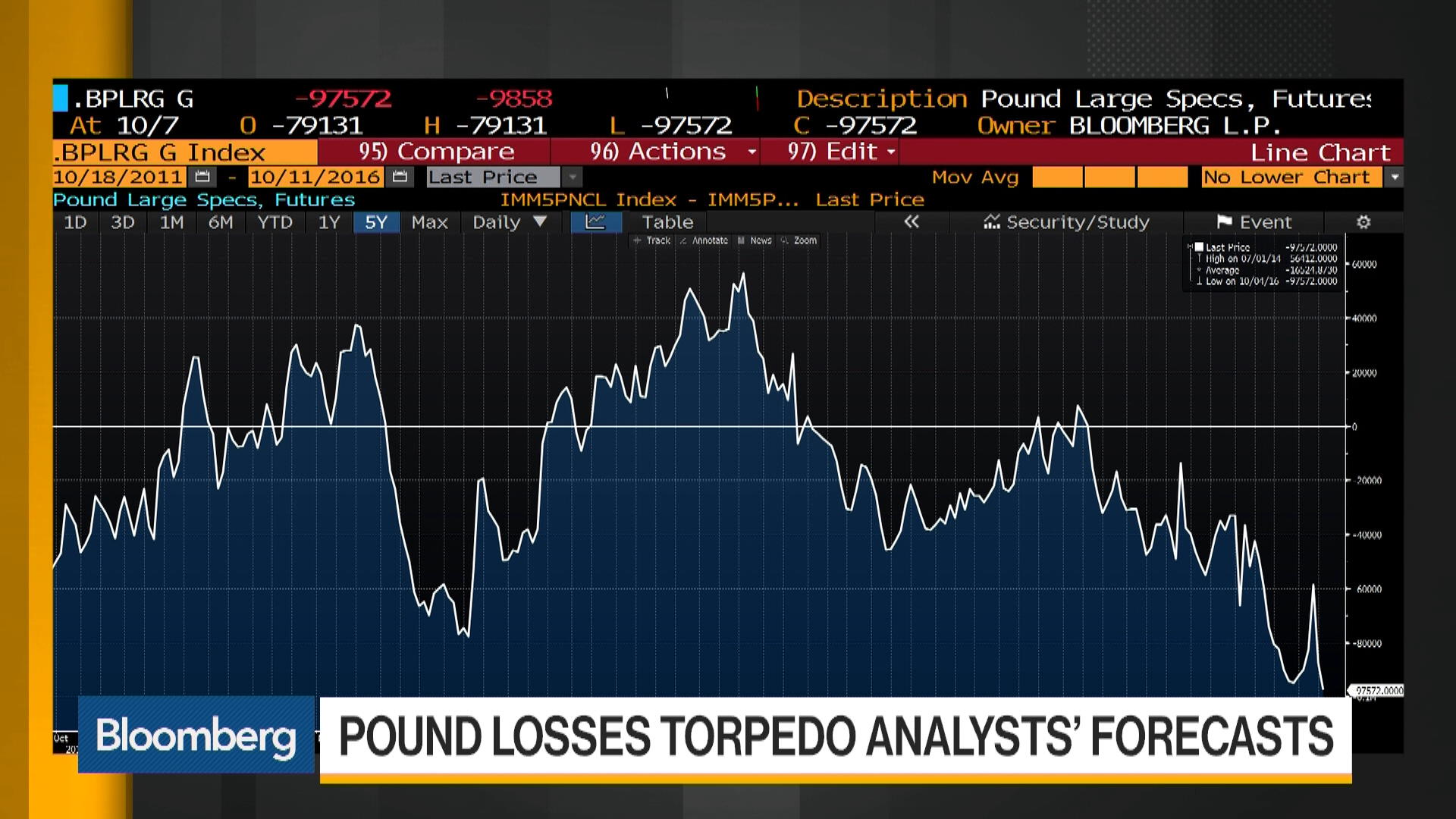

Inflation Report Impacts Boe Rate Cut Probabilities Boosting The Pound

May 26, 2025

Inflation Report Impacts Boe Rate Cut Probabilities Boosting The Pound

May 26, 2025