Trump And Oil Prices: Goldman Sachs' Assessment Of His Preferred Range

Table of Contents

Goldman Sachs' Analysis of Trump's Economic Policies and their Impact on Oil Prices

Goldman Sachs, a leading financial institution, employs sophisticated econometric models and in-depth policy analysis to assess the impact of government actions on various markets. Their assessment of Trump's preferred oil price range involved examining the interplay between his administration's policies and the subsequent shifts in oil prices. This methodology considered both direct and indirect effects.

Key Trump policies impacting oil, according to Goldman Sachs' analysis, included:

- Deregulation of the energy sector: Easing environmental regulations and streamlining permitting processes for oil and gas exploration.

- Emphasis on domestic energy production: Promoting fracking and other unconventional drilling techniques to boost US oil output.

- Withdrawal from international climate agreements: Reducing the pressure for a transition away from fossil fuels.

Goldman Sachs likely projected higher oil production under Trump's policies, potentially leading to a downward pressure on prices, all else being equal. However, this was counterbalanced by other factors (discussed below). Unfortunately, specific data and charts from Goldman Sachs reports are not publicly available for direct inclusion here. However, their published research on the impact of Trump's policies on energy markets should be consulted for a more detailed understanding.

The "Preferred" Oil Price Range: Identifying the Sweet Spot for the Trump Administration

Goldman Sachs' analysis likely identified a “sweet spot” oil price range preferred by the Trump administration. This range would balance several competing objectives:

- Energy independence: Maintaining high domestic production to reduce reliance on foreign oil.

- Consumer affordability: Keeping gasoline prices relatively low to avoid burdening consumers.

- Supporting the US oil and gas industry: Ensuring profitability for American energy companies without causing job losses.

- International competitiveness: Maintaining a strong US position in the global energy market.

This "sweet spot," if identified by Goldman Sachs, likely represented a compromise. Too low a price might discourage domestic production and investment, while too high a price could hurt consumers and harm the broader economy.

Critiques of Goldman Sachs' analysis might include insufficient consideration of unforeseen geopolitical events or potential limitations in their models' ability to accurately predict complex market behaviors. Alternative perspectives might emphasize the role of OPEC or other global factors as primary drivers of oil price fluctuations, downplaying the impact of Trump's policies.

Geopolitical Considerations and Oil Price Volatility under Trump

Oil prices are inherently volatile, influenced by numerous geopolitical factors. During the Trump administration, these factors significantly interacted with domestic policies to create unpredictable price swings.

Examples include:

- OPEC policies and production cuts: OPEC's decisions on oil production quotas directly impacted global supply and price.

- Tensions in the Middle East: Political instability and conflicts in major oil-producing regions created uncertainty and price spikes.

- US sanctions on certain oil-producing countries: Sanctions on Iran and Venezuela, for example, impacted global supply and pushed prices higher.

The volatility of oil prices under Trump was a product of both his domestic policies and external events. While his administration aimed for energy independence, global events repeatedly demonstrated the inherent limitations of controlling prices solely through domestic policy.

The Role of Shale Oil Production in Trump's Energy Strategy

Shale oil production played a central role in Trump's energy strategy. The expansion of shale oil extraction aimed to boost domestic production, lower reliance on foreign oil, and create jobs. However, this came with risks:

- Environmental concerns: Fracking's potential environmental impact, including water contamination and greenhouse gas emissions, generated significant debate.

- Economic vulnerability: The profitability of shale oil production is highly sensitive to price fluctuations, making the industry vulnerable to price shocks.

The emphasis on shale oil production undoubtedly influenced Goldman Sachs' assessment of Trump's preferred oil price range, as it represented a crucial element of his energy policy and a significant factor affecting domestic oil supply.

Conclusion

Goldman Sachs' assessment of Donald Trump's preferred oil price range, while not publicly detailed in full, likely considered a complex interplay of domestic policies, geopolitical events, and the inherent volatility of the oil market. The administration aimed for a balance between energy independence, consumer affordability, and supporting the domestic oil industry, particularly shale oil production. However, the significant influence of international factors underscores the limitations of any single government's ability to unilaterally control oil prices. Further research into the long-term impacts of Trump's energy policies on global oil markets is crucial for a complete understanding of this complex topic. We encourage readers to delve deeper into the relationship between "Trump and Oil Prices" by exploring Goldman Sachs' reports and other relevant resources.

Featured Posts

-

Is Creatine Safe And Effective Exploring The Evidence

May 15, 2025

Is Creatine Safe And Effective Exploring The Evidence

May 15, 2025 -

Toronto Maple Leafs Edge Out Avalanche With 2 1 Victory

May 15, 2025

Toronto Maple Leafs Edge Out Avalanche With 2 1 Victory

May 15, 2025 -

Earthquakes New Look Unveiled In Season Opener Vs Real Salt Lake

May 15, 2025

Earthquakes New Look Unveiled In Season Opener Vs Real Salt Lake

May 15, 2025 -

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025 -

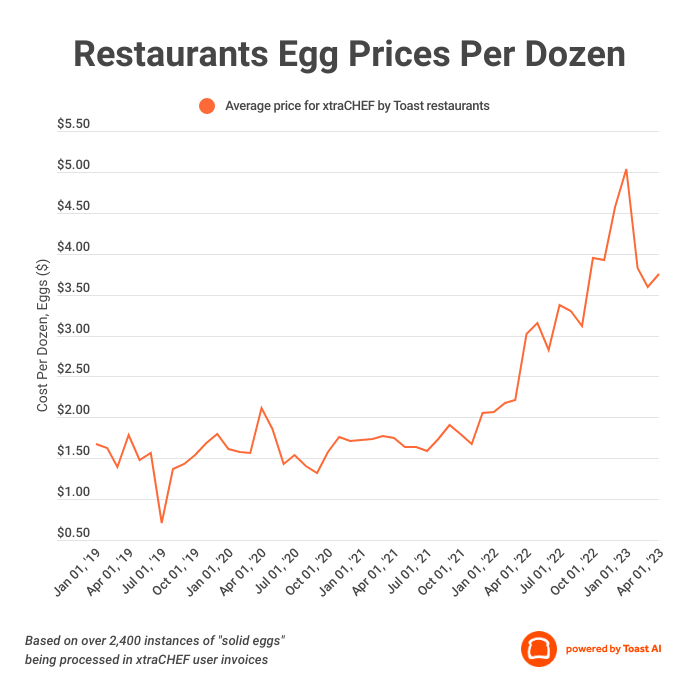

Record Egg Price Drop Now 5 A Dozen In The United States

May 15, 2025

Record Egg Price Drop Now 5 A Dozen In The United States

May 15, 2025