Trump On Powell: No Intention To Remove Fed Chair

Table of Contents

Trump's Past Criticism of Powell and the Context

President Trump's relationship with Jerome Powell has been far from smooth. The "Trump on Powell" dynamic has been defined by periods of intense public disagreement, primarily centered around the Federal Reserve's monetary policy decisions.

Interest Rate Hikes and Economic Concerns

Trump's previous criticisms largely stemmed from Powell's decisions regarding interest rate hikes. He consistently argued that these increases were detrimental to economic growth and job creation.

- Detail specific instances: In 2018, Trump publicly expressed his displeasure with interest rate hikes, tweeting criticisms and even calling Powell's actions "crazy." He voiced concerns that tighter monetary policy would stifle economic momentum and hurt the stock market.

- Analyze Trump's concerns: Trump's concern was rooted in a desire to maintain strong economic growth leading up to the 2020 election. Higher interest rates, he argued, would slow down borrowing and investment, potentially impacting key economic indicators.

- Link to relevant news articles and official statements: Numerous news articles from reputable sources like the New York Times, Wall Street Journal, and Reuters documented Trump's public criticisms. Searching for "Trump criticizes Powell interest rates" will yield many relevant results.

Political Pressure and the 2020 Election

The political context surrounding the "Trump on Powell" dynamic is significant. The looming 2020 election undoubtedly played a role in Trump’s calculations.

- Discuss the potential political fallout: Removing the Fed Chair so close to a presidential election would have been a highly controversial move, potentially damaging Trump's chances for re-election. The independence of the Federal Reserve is a cornerstone of the American economic system, and interfering with it could have been perceived as undermining this vital institution.

- Analyze the impact on investor confidence: Any move to replace Powell would likely have sent shockwaves through the financial markets, leading to increased volatility and potentially reduced investor confidence. The uncertainty surrounding such a decision could have negatively impacted the economy.

- Mention any polling data: Public opinion polls at the time could be analyzed to gauge public reaction to the potential removal of Powell and the broader implications for economic policy. Understanding public sentiment is crucial to the political calculation.

Recent Statements and Actions Indicating No Immediate Removal

Despite past tensions, recent evidence suggests a significant shift in the "Trump on Powell" narrative. The President's rhetoric and the lack of concrete action towards Powell's removal point to a de-escalation of the conflict.

Direct Denials and Public Statements

Recently, President Trump has refrained from making public criticisms of Jerome Powell. This silence, in contrast to previous outbursts, signals a shift in his stance.

- Cite specific quotes: While direct denials of plans to remove Powell might be hard to find in explicit statements, the absence of further criticisms speaks volumes. Analyzing the tone of his more recent public comments regarding the economy can give further insights.

- Analyze the implications of these statements (or lack thereof): The relative quiet on this front indicates a calculated decision by Trump to avoid further controversy. This avoidance could be interpreted as a sign that Powell’s position is, for now, secure.

- Link to official White House transcripts or press releases: Official statements released by the White House are crucial for a balanced view of the situation. Monitoring official channels is vital for tracking any changes in the narrative.

Actions and Inactions of the Administration

A critical aspect of this analysis is the lack of concrete actions taken by the Trump administration to initiate Powell's removal.

- Highlight any meetings or communications: While specific details of private communications between Trump and Powell are unlikely to be public, analyzing whether any official meetings took place can indicate the status of their relationship.

- Discuss the absence of formal processes: The absence of any formal processes to remove Powell, such as initiating the necessary paperwork or public announcements of such intentions, strongly suggests that removal is not currently being considered.

- Analyze the potential implications of inaction: The lack of action reinforces the conclusion that Trump's focus has shifted, and the issue of Powell's removal is not a current priority.

Implications for the US Economy and Markets

The "Trump on Powell" dynamic has had, and continues to have, substantial implications for the US economy and markets.

Impact on Investor Confidence

The uncertainty surrounding Powell's position inevitably impacted investor confidence and market stability.

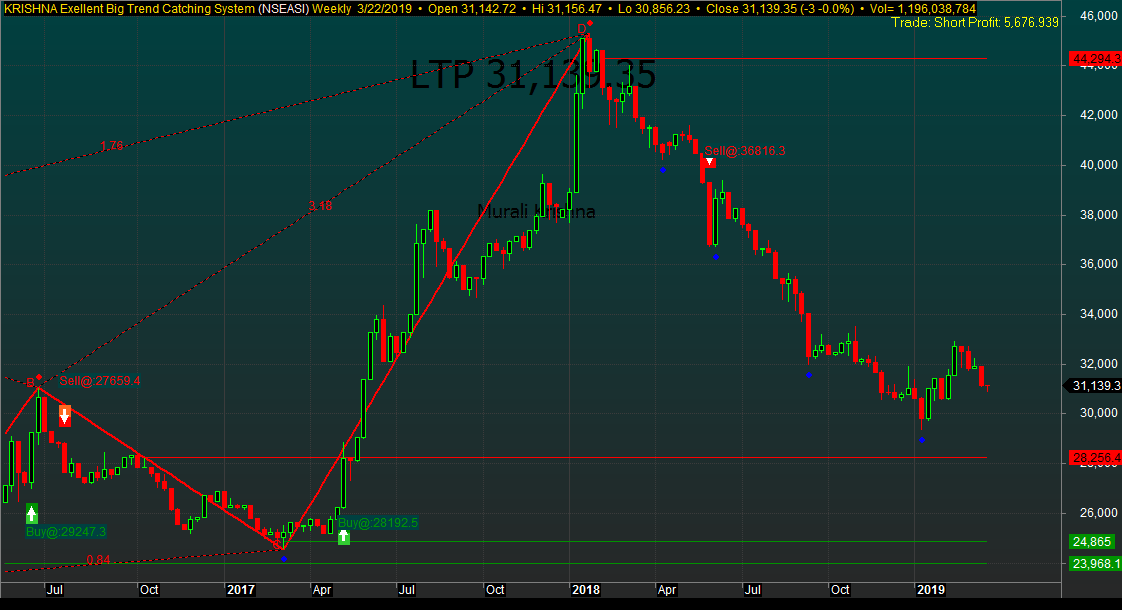

- Discuss potential effects on stock markets and bond yields: Periods of heightened uncertainty often lead to increased market volatility. Investors react to news and speculation about the Fed chair, impacting stock market performance and bond yields.

- Mention expert opinions: Financial analysts' views on the impact of the "Trump on Powell" situation on investor sentiment provide valuable insights.

- Link to relevant financial news sources: Reports from major financial news outlets, such as Bloomberg and the Financial Times, are important for understanding the market's reaction to the evolving situation.

Monetary Policy and Future Economic Outlook

Powell's continued leadership has implications for the Federal Reserve's monetary policy and the future economic outlook.

- Analyze potential changes or continuities: Continued leadership under Powell likely means a continuation of the current monetary policy, or at least a gradual shift, rather than a sudden and dramatic change.

- Discuss the impact on inflation and unemployment: Monetary policy significantly impacts inflation and unemployment rates. Powell's approach to these key economic indicators will influence the overall economic health of the country.

- Consider long-term economic implications: The long-term consequences of the "Trump on Powell" situation extend beyond the immediate market reactions and influence the overall trajectory of the US economy.

Conclusion

Despite past tensions and public criticisms, current indications strongly suggest that President Trump does not intend to remove Jerome Powell from his position as Federal Reserve Chairman. This analysis has covered Trump's past criticisms, recent statements denying removal, and the substantial implications for the US economy and markets. The "Trump on Powell" narrative has been a significant factor in recent economic and political discourse, but for now, the focus seems to have shifted.

Call to Action: Stay informed on the evolving relationship between President Trump and Fed Chair Powell. For continued updates and analysis on "Trump on Powell," subscribe to our newsletter or follow us on social media to stay ahead of the curve on this dynamic situation.

Featured Posts

-

Bitcoin Btc Market Analysis Trump The Fed And Price Movement

Apr 24, 2025

Bitcoin Btc Market Analysis Trump The Fed And Price Movement

Apr 24, 2025 -

Houston Isd Mariachis Road To Uil State A Viral Whataburger Success Story

Apr 24, 2025

Houston Isd Mariachis Road To Uil State A Viral Whataburger Success Story

Apr 24, 2025 -

Nba Launches Formal Probe Into Ja Morant Incident

Apr 24, 2025

Nba Launches Formal Probe Into Ja Morant Incident

Apr 24, 2025 -

Canadian Dollars Mixed Performance A Comprehensive Analysis

Apr 24, 2025

Canadian Dollars Mixed Performance A Comprehensive Analysis

Apr 24, 2025 -

Is Betting On Wildfires Like The La Fires A Sign Of The Times

Apr 24, 2025

Is Betting On Wildfires Like The La Fires A Sign Of The Times

Apr 24, 2025