Trump Tariffs: Did They Kill The Affirm Holdings (AFRM) IPO?

Table of Contents

The Economic Climate During the Trump Tariff Era

The period surrounding Affirm's IPO was heavily influenced by the economic fallout from the Trump administration's imposition of tariffs on various imported goods. This created a climate of uncertainty that significantly impacted investor sentiment and market conditions.

Trade War Uncertainty and Investor Sentiment

The Trump Tariffs sparked a trade war, leading to retaliatory tariffs from other countries. This uncertainty rippled through global markets, creating volatility and impacting investor confidence. The constant threat of escalating trade disputes fueled anxieties among investors, reducing their risk appetite. This uncertainty negatively affected consumer spending, a key factor in the success of many businesses, including those in the fintech sector.

- Examples of specific tariffs imposed: The steel and aluminum tariffs, the tariffs on goods from China.

- Market reactions to tariff announcements: Stock market fluctuations, increased volatility indices (e.g., VIX).

- Decline in investor confidence indices: Lower consumer confidence scores, decreased business investment.

Impact on the Fintech Sector

The fintech sector, while innovative, wasn't immune to the effects of the trade war. Supply chain disruptions, increased costs of imported components, and reduced consumer spending all affected fintech companies. Furthermore, changes in interest rates, potentially influenced by the overall economic instability, could directly impact lending platforms like Affirm.

- Specific challenges faced by fintech companies due to tariffs: Increased costs of hardware or software components sourced internationally.

- Examples of affected supply chains: Delays in receiving crucial components for technological infrastructure.

Affirm Holdings (AFRM) and the IPO Process

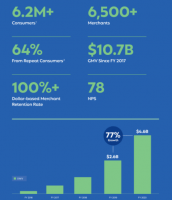

Affirm Holdings operates in a sector highly sensitive to macroeconomic conditions. Understanding its business model and its potential vulnerabilities is crucial to assessing the impact of the Trump Tariffs on its IPO.

AFRM's Business Model and Vulnerability to Economic Downturns

Affirm's business model relies heavily on consumer spending and borrowing. A slowdown in consumer spending, potentially exacerbated by the economic uncertainty caused by the Trump Tariffs, could negatively affect Affirm's revenue and profitability. Moreover, increased borrowing costs resulting from the broader economic environment would impact Affirm's operations and investor perception of its future growth.

- Key aspects of AFRM's business model: Buy now, pay later (BNPL) services, reliance on merchant partnerships.

- Reliance on consumer credit: Affirm's performance is directly tied to consumer credit availability and willingness to borrow.

- Sensitivity to interest rate changes: Changes in interest rates directly affect Affirm's borrowing costs and its ability to offer competitive lending rates.

Timing of the AFRM IPO in Relation to Tariff Implementation

The timing of AFRM's IPO in relation to the Trump Tariffs is a key factor to consider. The lingering effects of the trade war were still present when Affirm went public. This raised concerns for investors already grappling with economic uncertainty. Analyzing the IPO timeline against the backdrop of tariff announcements and their market impact can help determine if the timing or the valuation was affected.

- Specific dates of key events: Dates of significant tariff announcements, AFRM's IPO filing date, the IPO pricing date.

- Comparative analysis of IPOs in similar sectors during the same period: Comparing the performance of similar fintech IPOs during the same period to assess whether AFRM's performance was an outlier.

Analyzing the Correlation: Did Trump Tariffs Directly Impact AFRM's IPO?

Determining a direct causal link between the Trump Tariffs and the AFRM IPO's performance requires careful consideration of multiple factors. While a correlation might exist, isolating the impact of the tariffs from other influential economic variables is challenging.

Evidence Supporting a Correlation

Some arguments suggest that the economic uncertainty caused by the Trump Tariffs negatively affected investor sentiment, impacting the valuation and performance of the AFRM IPO. Analyzing the stock performance post-IPO against the backdrop of ongoing economic uncertainty can provide some evidence. However, this correlation must be interpreted cautiously due to the multiple factors at play.

- Stock price fluctuations: Analyzing AFRM's stock price performance in the months following the IPO.

- Investor reports: Examining reports from investment analysts and financial news outlets about the impact of trade uncertainty on the IPO.

- Expert opinions: Gathering perspectives from economists and financial analysts on the potential effects of the Trump Tariffs.

Evidence Suggesting Other Factors

It's crucial to acknowledge that factors beyond the Trump Tariffs could have influenced the AFRM IPO's performance. Broader market trends, competition within the fintech sector, and Affirm's internal challenges could have all played a significant role.

- Company-specific challenges: Internal operational issues or strategic decisions made by Affirm.

- General market trends: Overall market conditions and investor sentiment unrelated to tariffs.

- Competing IPOs: The performance of other companies going public in the same period and in the same sector.

Conclusion: The Trump Tariffs and the Affirm Holdings (AFRM) IPO – A Verdict

Determining whether the Trump Tariffs directly "killed" the Affirm Holdings IPO is an oversimplification. While the economic uncertainty generated by the trade war likely contributed to a challenging market environment, the impact on AFRM's IPO was likely indirect and influenced by multiple factors. Both evidence suggesting a correlation and evidence pointing to other contributing factors need to be considered. The overall market conditions, Affirm's business model, and competitive landscape played significant roles as well.

To gain a clearer understanding, further research is vital. Explore the impact of trade policies on various IPOs, analyze the long-term effects of the Trump Tariffs on the fintech industry, and compare AFRM's performance with that of similar companies. Share your insights and perspectives on the interplay between trade policy and IPO success using keywords like "Trump Tariffs," "Affirm Holdings IPO," and "AFRM IPO analysis." Let's continue this discussion!

Featured Posts

-

Top Ranked Sabalenka Triumphs At Madrid Open Against Mertens

May 14, 2025

Top Ranked Sabalenka Triumphs At Madrid Open Against Mertens

May 14, 2025 -

Nonna A Heartwarming Film With Lorraine Bracco And Brenda Vaccaro

May 14, 2025

Nonna A Heartwarming Film With Lorraine Bracco And Brenda Vaccaro

May 14, 2025 -

Remembering A Giants Legend

May 14, 2025

Remembering A Giants Legend

May 14, 2025 -

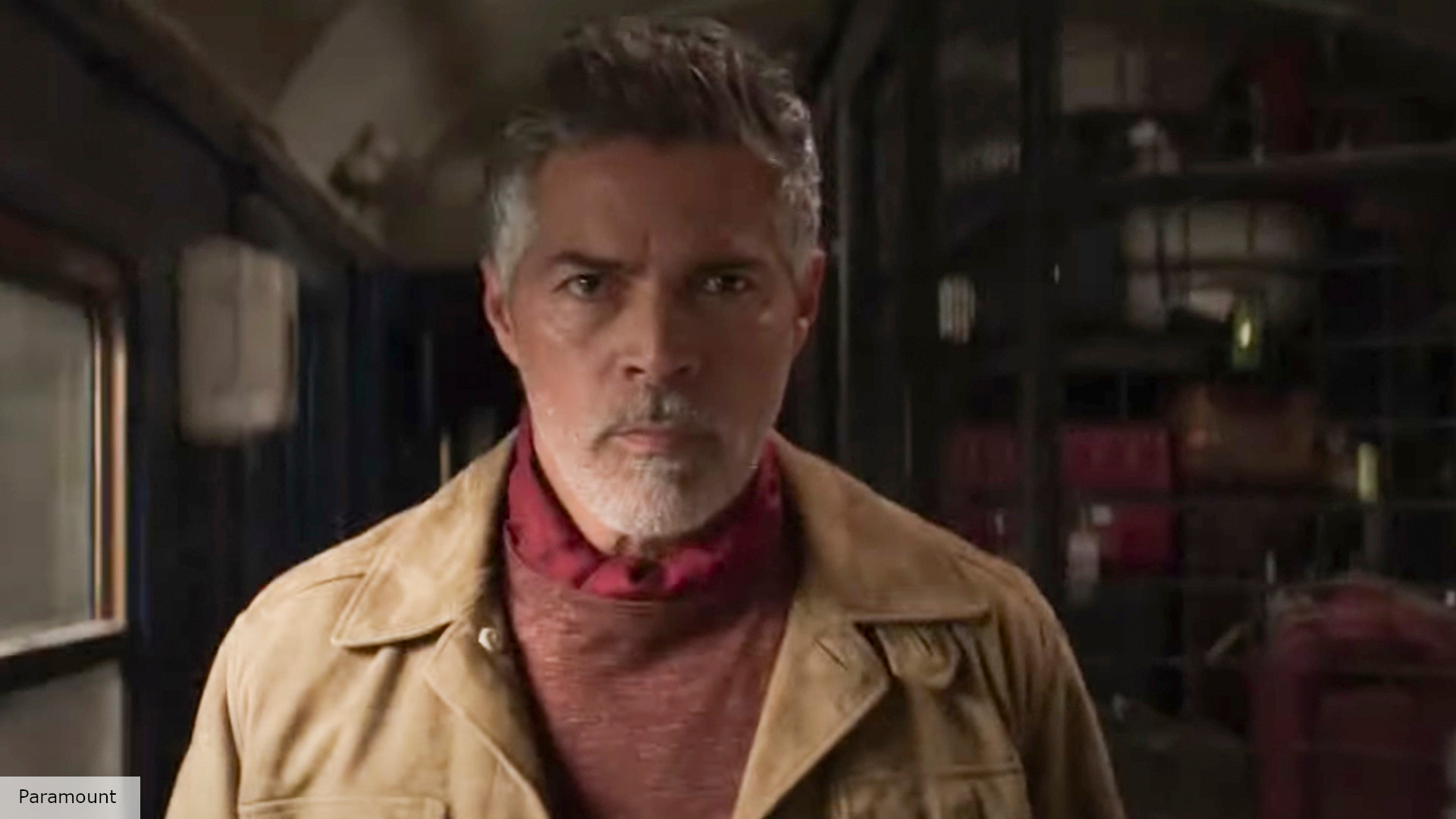

Mission Impossible 7s Cannes Debut A Look At The Premiere

May 14, 2025

Mission Impossible 7s Cannes Debut A Look At The Premiere

May 14, 2025 -

Sevilla Miercoles 7 De Mayo Tu Agenda De Actividades

May 14, 2025

Sevilla Miercoles 7 De Mayo Tu Agenda De Actividades

May 14, 2025