Trump Tariffs Weigh On Infineon (IFX): Sales Guidance Revised Downward

Table of Contents

The Impact of Trump Tariffs on Infineon's Supply Chain

The Trump administration's imposition of tariffs on various goods significantly disrupted Infineon's global supply chain. These import tariffs directly increased the cost of raw materials and components sourced internationally, impacting multiple stages of Infineon's manufacturing process. This ripple effect extended beyond mere cost increases; it also created disruptions to the timely delivery of essential components.

- Increased costs of imported components: Tariffs added a substantial percentage to the price of vital materials, squeezing Infineon's profit margins.

- Disruptions to global supply chains: The complexity of international trade was exacerbated by tariffs, leading to delays and uncertainties in securing necessary inputs.

- Potential for delays in product delivery: Supply chain bottlenecks resulted in potential delays in delivering finished products to customers, impacting order fulfillment and potentially jeopardizing client relationships.

- Pressure on profit margins: The combined effect of increased input costs and potential delivery delays put significant pressure on Infineon's overall profitability.

Specific tariffs on semiconductors and related materials, imposed as part of the broader trade war, directly contributed to these challenges. The increased costs associated with global trade, specifically import tariffs, placed Infineon at a competitive disadvantage. The complexities of navigating the semiconductor industry's intricate global supply chain were further compounded by these trade barriers.

Infineon's Revised Sales Guidance: A Deeper Dive

Infineon's recent downward revision of its sales guidance offers a stark illustration of the financial consequences of these challenges. While the company hasn't solely attributed the decline to Trump tariffs, the impact is undeniable. The revised forecast reflects a significant reduction in expected revenue for the current fiscal year.

- Specific financial figures illustrating the sales reduction: [Insert specific figures from Infineon's official announcement, e.g., a percentage decrease in sales forecast or a specific reduction in revenue figures].

- Reasons cited by Infineon for the downward revision beyond tariffs: Infineon likely cited macroeconomic factors such as slowing global demand and increased competition within the semiconductor market as contributing factors to the downward revision of their sales forecast and revenue decline.

- Impact on future investment and expansion plans: The reduced revenue projections will inevitably impact Infineon's investment and expansion plans, potentially delaying or scaling back future projects.

This revised earnings guidance highlights the substantial financial pressure faced by Infineon due to the confluence of Trump tariffs, macroeconomic headwinds, and competitive pressures. The company's financial performance is demonstrably affected by these factors.

Investor Response and Market Reaction to the News

The market reacted swiftly to Infineon's revised sales guidance. The announcement caused a notable dip in IFX stock price, reflecting investor concern about the company's future performance.

- Stock price fluctuations after the announcement: [Insert details about the stock price movement immediately following and in the days after the announcement. Include percentage changes].

- Analyst ratings and comments: [Summarize the reactions of financial analysts and their revised ratings for Infineon stock].

- Impact on investor confidence: The downward revision in sales guidance understandably eroded investor confidence in the short term, leading to a negative market sentiment surrounding IFX.

The volatility in the stock market following the announcement is indicative of the sensitivity of investor sentiment towards the ongoing impact of Trump tariffs on major players in the global semiconductor industry. Analyzing IFX stock performance provides a crucial perspective on the market's assessment of the situation.

Mitigation Strategies Employed by Infineon

Infineon is actively implementing various strategies to mitigate the negative effects of tariffs and navigate the challenging economic climate. These efforts focus on enhancing supply chain resilience and optimizing costs.

- Restructuring efforts: Infineon might be restructuring certain operations to improve efficiency and reduce costs.

- Cost-cutting measures: The company is likely implementing various cost-cutting initiatives to offset increased input costs.

- Diversification of supply chains: To reduce reliance on single sources and mitigate future disruptions, Infineon is likely diversifying its supply chain.

- Focus on higher-margin products: Shifting focus towards higher-margin products can help to offset the impact of increased costs on lower-margin offerings.

These risk management and cost optimization strategies are crucial to Infineon's long-term survival and success in a challenging global market. The company’s business strategy emphasizes building supply chain resilience in the face of future trade uncertainties.

Conclusion: The Long-Term Implications of Trump Tariffs on Infineon (IFX)

Trump tariffs have demonstrably impacted Infineon's performance, as evidenced by the recent downward revision of its sales guidance. The combined effects of increased input costs, supply chain disruptions, and macroeconomic factors present significant challenges for the company. However, Infineon's proactive mitigation strategies, including diversification of its supply chain and a focus on higher-margin products, offer a degree of optimism. The long-term implications of these trade policies remain to be seen, but Infineon’s response demonstrates its commitment to navigating this complex landscape. To stay updated on Infineon's response to Trump tariffs, monitor IFX stock performance, and follow the implications of trade wars on the semiconductor sector, continue to follow industry news and financial reports.

Featured Posts

-

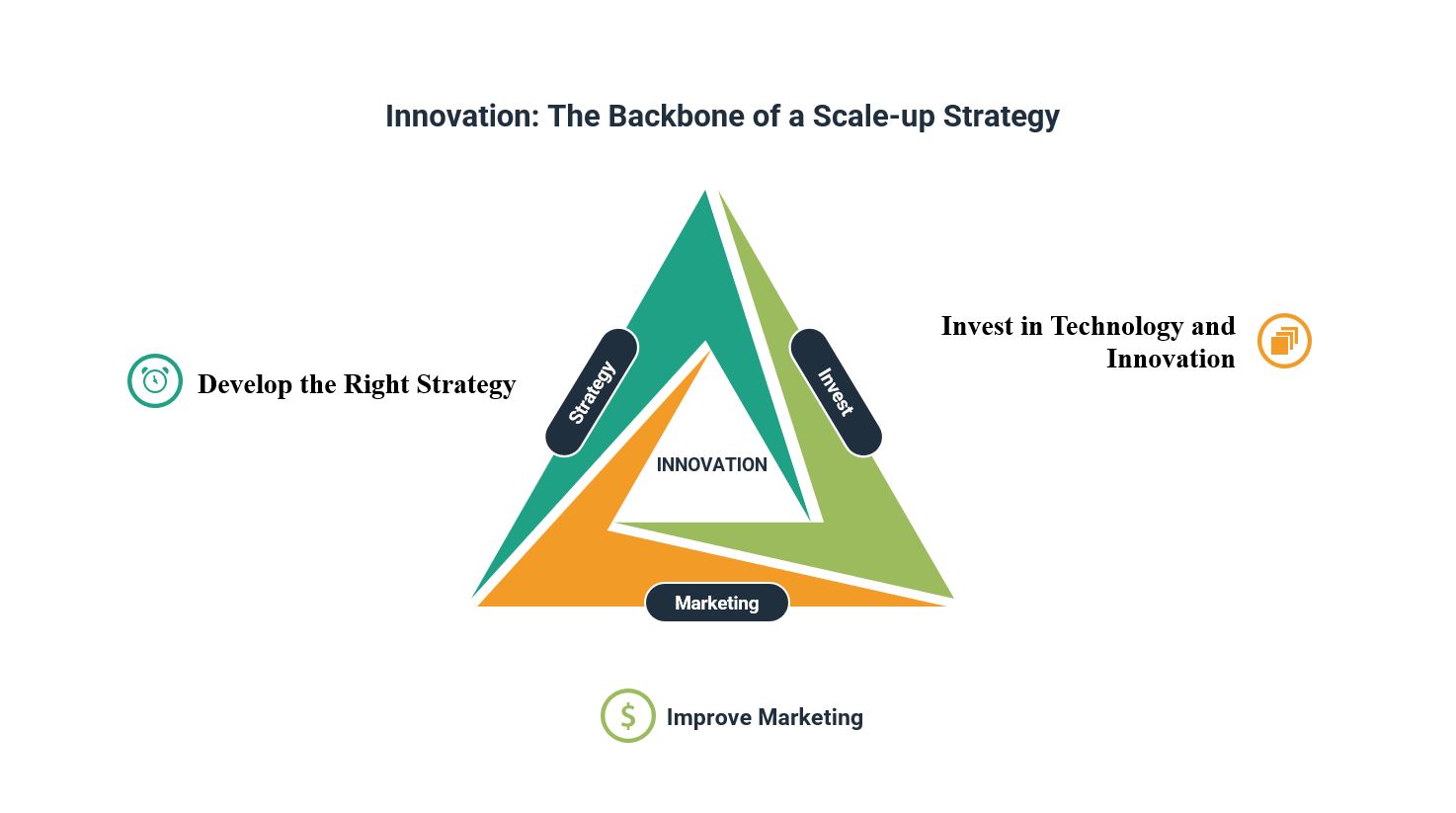

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025 -

Elisabeth Borne Et La Fusion Renaissance Modem Une Ligne Politique Plus Claire

May 10, 2025

Elisabeth Borne Et La Fusion Renaissance Modem Une Ligne Politique Plus Claire

May 10, 2025 -

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025 -

The Continued Relevance Of High Potential An 11 Year Assessment

May 10, 2025

The Continued Relevance Of High Potential An 11 Year Assessment

May 10, 2025 -

Solve Nyt Strands Game 354 Thursday February 20 Hints And Answers

May 10, 2025

Solve Nyt Strands Game 354 Thursday February 20 Hints And Answers

May 10, 2025