Trump Tax Plan: House GOP Unveils Specifics

Table of Contents

Individual Income Tax Changes under the Trump Tax Plan

The proposed Trump tax plan, as detailed by the House GOP, includes several key changes to individual income tax. These alterations impact tax brackets, deductions, and credits, potentially affecting taxpayers across various income levels. Understanding these changes is crucial for effective tax planning.

Keywords: Individual income tax, tax brackets, standard deduction, child tax credit, itemized deductions

-

New Proposed Tax Brackets and Rates: The plan proposed adjustments to the existing tax brackets, aiming to simplify the system and potentially lower rates for some individuals. The specific rates and bracket thresholds would need to be examined carefully for their impact on different income levels. Exact figures should be referenced from official government documents for accuracy.

-

Changes to the Standard Deduction: A significant change involves the standard deduction. The proposal suggested either an increase or decrease (depending on the specific version of the plan) aimed at simplifying tax preparation for many individuals. This would affect those who currently itemize versus taking the standard deduction. The impact of this change varies significantly based on individual circumstances and filing status.

-

Modifications to the Child Tax Credit: The child tax credit, designed to provide financial relief to families, may see alterations in its amount and eligibility requirements under the Trump tax plan. Understanding these changes is particularly important for parents and guardians.

-

Impact on Itemized Deductions: Itemized deductions, including those for state and local taxes (SALT), mortgage interest, and charitable contributions, could also be affected. Some proposals aimed to limit or eliminate certain deductions, potentially increasing the tax burden for some taxpayers who currently itemize. Understanding the extent of these changes is essential for accurate tax planning.

Corporate Tax Rate Reduction in the House GOP's Proposal

A cornerstone of the House GOP’s Trump tax plan is a substantial reduction in the corporate tax rate. This reduction aims to boost business investment, create jobs, and enhance the global competitiveness of American businesses.

Keywords: Corporate tax rate, business tax cuts, tax competitiveness

-

Proposed Corporate Tax Rate: The proposed corporate tax rate represented a significant decrease compared to the previous rate. This reduction was intended to incentivize businesses to invest more, hire more employees, and ultimately stimulate economic growth.

-

Comparison to Previous Rates and International Rates: The proposed rate was compared to both historical US corporate tax rates and those of other developed nations to highlight its competitiveness in attracting foreign investment and encouraging domestic business expansion.

-

Potential Economic Impact on Businesses and the Overall Economy: Proponents argued that the reduction would lead to increased investment, higher wages, and improved economic growth. However, critics raised concerns about potential downsides, including increased income inequality and a larger national debt.

-

Arguments For and Against the Proposed Reduction: The debate surrounding the corporate tax rate reduction involves complex economic considerations. Arguments in favor emphasized increased competitiveness and economic growth. Conversely, arguments against highlighted potential negative consequences for income inequality and the national debt.

Impact on Different Income Groups and Families

The Trump tax plan's impact is not uniform across all income groups and family structures. Analyzing its effects on different demographics is essential to fully understand its potential consequences.

Keywords: Tax impact, income inequality, middle class, wealthy

-

Impact on Low-Income Families: The plan's effects on low-income families are complex and require careful analysis, considering changes to the standard deduction, child tax credit, and other relevant tax provisions.

-

Impact on Middle-Income Families: The impact on middle-income families is similarly multifaceted and depends on individual circumstances and the specific details of the proposed tax changes.

-

Impact on High-Income Families: The plan may disproportionately benefit high-income families depending on the specific changes to tax brackets, deductions, and credits.

-

Potential Impact on Income Inequality: Concerns exist regarding the potential to exacerbate income inequality, as some provisions may disproportionately benefit higher-income earners. This is a key area of ongoing debate and analysis.

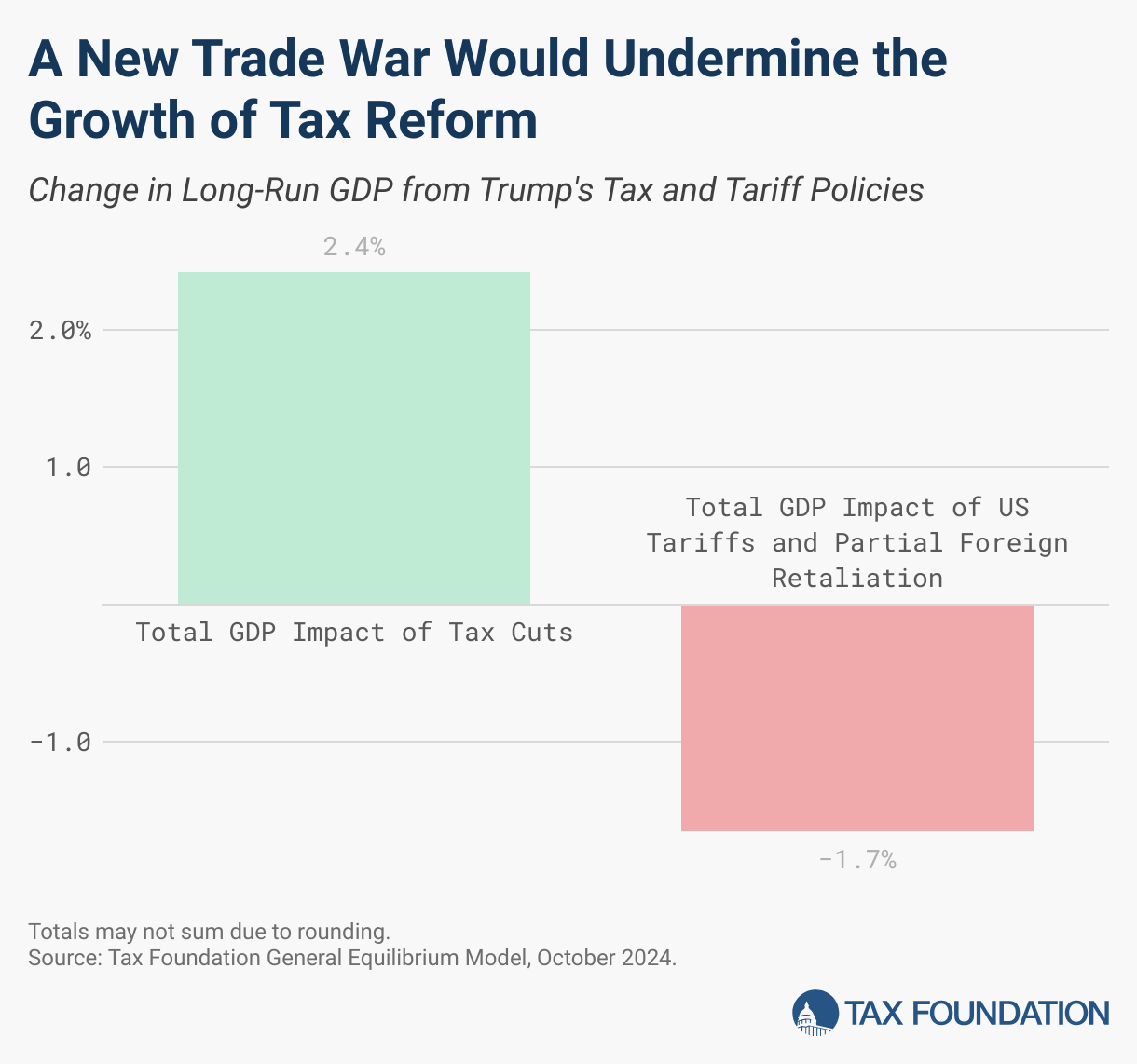

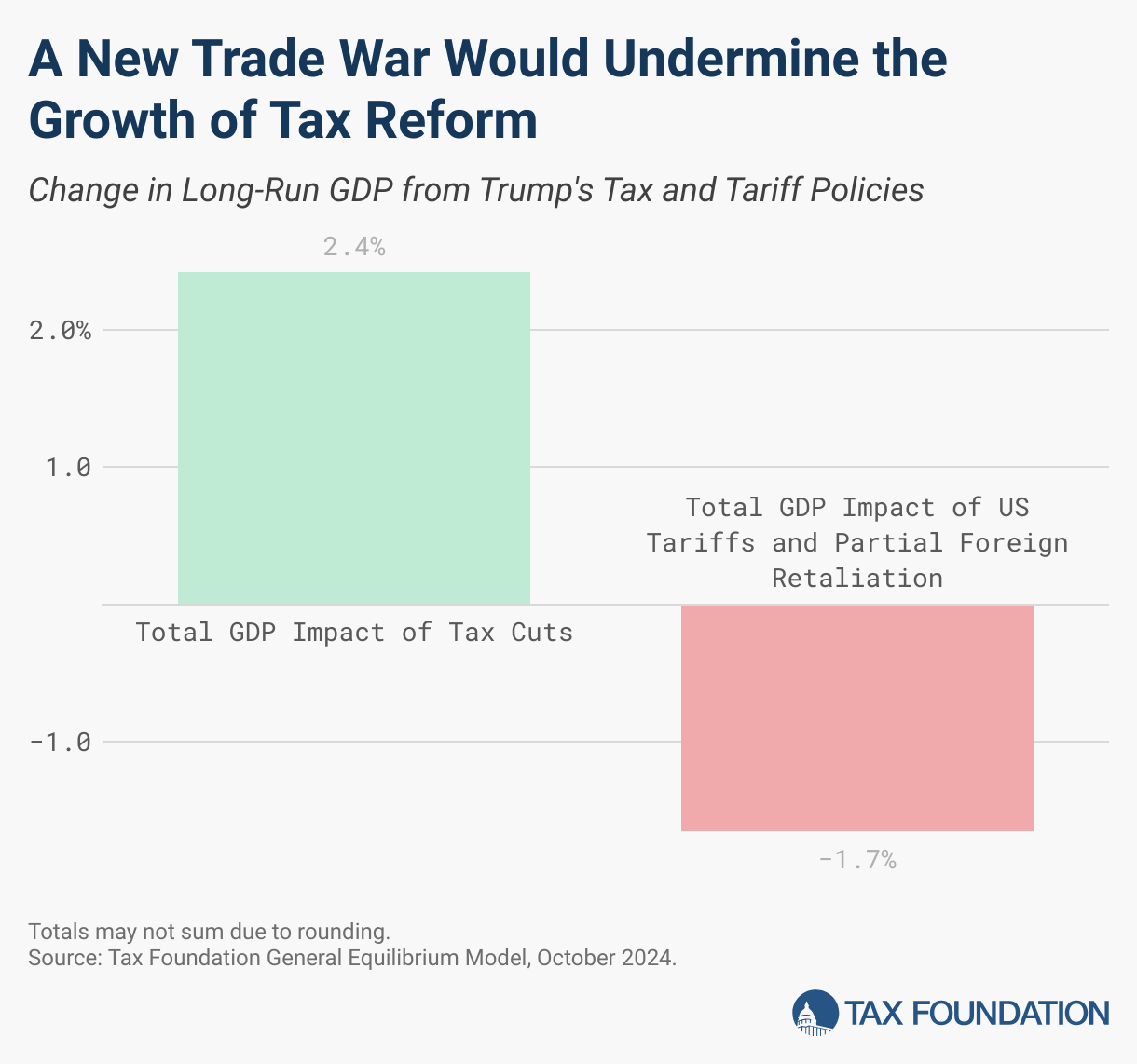

Potential Economic Consequences and Criticisms of the Trump Tax Plan

The Trump tax plan has faced significant scrutiny regarding its potential long-term economic consequences. Understanding these concerns is vital for a balanced perspective.

Keywords: Economic impact, national debt, tax revenue, budget deficit

-

Projected Impact on the National Debt: Concerns exist that the tax cuts, particularly the corporate tax rate reduction, could significantly increase the national debt. Projections and analyses vary greatly depending on underlying economic assumptions.

-

Projected Impact on Tax Revenue: The plan's impact on tax revenue is a critical element of the debate. Some analyses suggest that the revenue loss from tax cuts might be offset by economic growth, while others express concern about potential shortfalls.

-

Criticisms from Economists and Opposing Political Parties: The plan has drawn criticism from economists and opposing political parties who highlight potential risks to the national debt, the budget deficit, and the distribution of wealth.

-

Arguments in Defense of the Plan's Economic Impact: Proponents of the plan argue that its economic benefits, such as increased investment and job creation, outweigh the potential risks to the national debt. They point to supply-side economics to support their claims.

Conclusion

The House GOP's Trump tax plan represents a significant overhaul of the US tax code, with potentially far-reaching consequences for individuals, businesses, and the economy as a whole. Understanding the proposed changes to individual income tax brackets, the corporate tax rate, and various deductions and credits is crucial for effective financial planning. The plan’s potential impacts on different income groups, the national debt, and income inequality are subjects of intense debate and ongoing analysis. Stay updated on the latest developments in the Trump tax plan and its potential impact on you. Consult with a tax professional for personalized advice to fully understand how the Trump tax plan could affect your finances. Understand the intricacies of the Trump tax plan to make informed decisions about your financial future.

Featured Posts

-

Nhl Minority Owner Suspended For Online Abuse Of Opposing Fan

May 15, 2025

Nhl Minority Owner Suspended For Online Abuse Of Opposing Fan

May 15, 2025 -

Chandler Simpsons Breakout Game Propels Rays To Series Sweep Against Padres

May 15, 2025

Chandler Simpsons Breakout Game Propels Rays To Series Sweep Against Padres

May 15, 2025 -

Maple Leafs Vs Rangers Prediction Picks And Odds For Tonights Nhl Game

May 15, 2025

Maple Leafs Vs Rangers Prediction Picks And Odds For Tonights Nhl Game

May 15, 2025 -

Amber Heards Twins The Elon Musk Fatherhood Controversy

May 15, 2025

Amber Heards Twins The Elon Musk Fatherhood Controversy

May 15, 2025 -

Disparities In Trust Examining The Impact Of Gender Race And Experience On Evanston Tap Water Consumption

May 15, 2025

Disparities In Trust Examining The Impact Of Gender Race And Experience On Evanston Tap Water Consumption

May 15, 2025