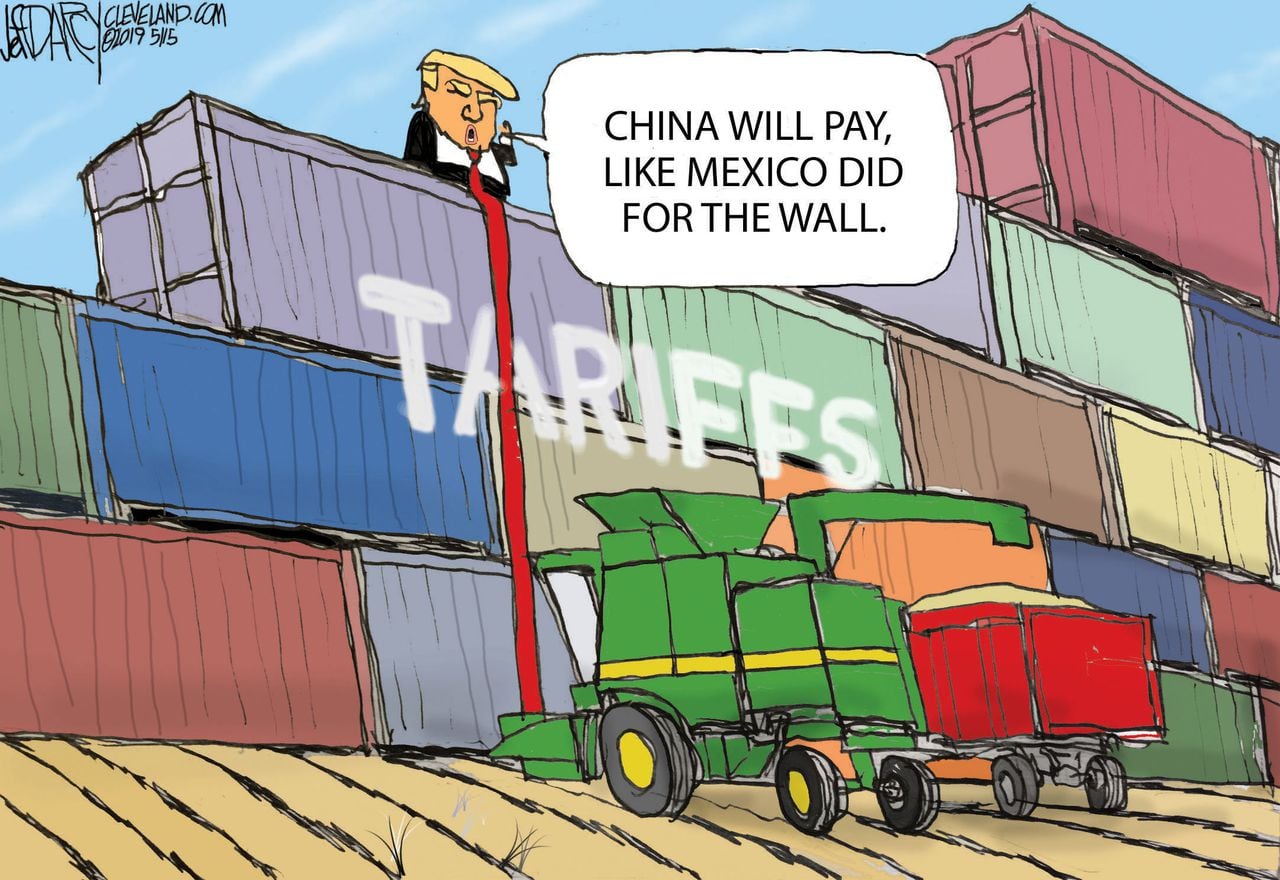

Trump's 10% Tariff Threat: Baseline Unless Exceptional Offer Received

Table of Contents

The 10% Tariff: A Closer Look

The 10% tariff, announced [Date of announcement], targets specific goods imported from [Specify Country/Countries]. This is not merely a symbolic gesture; it represents a significant shift in US trade policy and carries substantial implications for both domestic and international markets.

- Specific goods or countries targeted: The 10% tariff specifically impacts [List specific goods, e.g., steel products, aluminum products, certain consumer electronics]. The focus is on goods deemed to pose a threat to US industries.

- Tariff implementation timeline: The tariff was initially implemented on [Date], with [Mention any phased implementation or extensions].

- How the tariff is levied: The tariff is levied on importers at the point of entry into the US, increasing the cost of imported goods.

- Potential impact on consumer prices: Consumers can expect to see price increases on goods affected by the tariff, potentially impacting purchasing power and overall economic sentiment.

- Industries directly affected: The manufacturing, retail, and construction sectors are among the industries most directly impacted by the 10% tariff.

The specific implications of this 10% tariff are far-reaching. Increased import duties translate directly into higher costs for businesses reliant on imported materials. This may lead to reduced production, potential job losses, and a subsequent decrease in overall economic activity. The potential for inflation, driven by higher import prices, further exacerbates the situation. The ripple effects could be felt across various supply chains, ultimately impacting consumers through higher prices and potentially reduced choices.

Exceptional Offers: What Does it Mean?

The Trump administration has repeatedly stated that the 10% tariff is a baseline, subject to change only in response to "exceptional offers" from other countries. But what precisely constitutes an exceptional offer?

- Examples of potential trade concessions: These could include significant reductions in trade barriers, improved market access for US goods, stronger intellectual property protections, and commitments to address unfair trade practices.

- Significant improvement in trade relations: This is a subjective assessment, likely contingent on a combination of factors, including the scale and scope of concessions, and their perceived impact on the US economy and its strategic interests.

- Potential areas of negotiation: Negotiations might revolve around specific sectors, addressing issues like agricultural exports, industrial goods, or technological trade. Intellectual property rights and market access remain central to the discussions.

- Role of international trade organizations: Organizations like the WTO could play a role in mediating negotiations, promoting adherence to international trade rules, and ensuring fair and transparent processes.

An "exceptional offer" in the context of the Trump administration likely requires substantial concessions that directly address specific US concerns about trade imbalances, intellectual property theft, and unfair trade practices. The administration's negotiating strategy appears focused on achieving bilateral deals that prioritize US interests above multilateral agreements. The geopolitical implications are significant, potentially impacting global trade alliances and relationships.

The Economic Impact of the 10% Tariff

The economic consequences of the 10% tariff are complex and multifaceted, with potential impacts varying across different sectors and countries.

- Potential impact on inflation rates: The tariff could contribute to increased inflation, particularly affecting the prices of goods subject to the duty.

- Effect on the US trade deficit: The impact on the US trade deficit is uncertain and depends on various factors, including the response of trading partners.

- Projected changes in GDP growth: Economic models suggest potential negative impacts on GDP growth due to increased costs for businesses and reduced consumer spending.

- Potential job losses or gains: While some sectors might see job losses due to higher import costs, others might benefit from increased domestic production. The net effect is uncertain.

- Overall impact on market stability and investor confidence: The uncertainty surrounding trade policy can lead to market volatility and negatively impact investor confidence.

A thorough analysis of the economic implications requires considering multiple factors. Sophisticated economic models incorporating various scenarios are needed to accurately predict the impact. The ripple effect on global economies, particularly on trading partners, cannot be ignored. Short-term effects might differ considerably from long-term consequences, requiring careful monitoring and analysis.

Alternative Scenarios and Mitigation Strategies

The current situation presents challenges, but there are alternative scenarios and strategies to consider.

- Alternative trade agreements or policies: Exploring alternative trade agreements or a shift in trade policy could mitigate the impact of the tariffs.

- Strategies for businesses to mitigate the impact: Supply chain diversification, exploring alternative sourcing of goods, and engaging in strategic cost-cutting measures are crucial for mitigating risks.

- Potential role of government support: Government support for affected industries, such as financial assistance or tax breaks, could help mitigate job losses and ensure business continuity.

Businesses can employ several strategies to navigate this challenging landscape. Supply chain diversification can reduce reliance on specific suppliers, and exploring alternative sourcing of materials can lessen the impact of increased import costs. Government support programs, if available, can help offset financial losses.

Conclusion

Trump's 10% tariff threat serves as a baseline in ongoing trade negotiations, potentially impacting various sectors and triggering significant economic repercussions unless countered by exceptional trade offers. The potential for increased inflation, changes in GDP growth, and job losses underscores the gravity of this trade policy. Understanding the intricacies of the 10% tariff and exploring mitigation strategies are crucial for businesses and policymakers alike. To effectively navigate this complex situation, stay informed on the evolving situation, monitor trade negotiations closely, and consider proactive strategies to mitigate the risks associated with these import tariffs. Understanding the details of the 10% tariff policy and its implications for your business is paramount.

Featured Posts

-

Caso De Universitaria Transgenero Detenida Por Usar Bano Femenino

May 10, 2025

Caso De Universitaria Transgenero Detenida Por Usar Bano Femenino

May 10, 2025 -

Supporting Transgender Individuals Practical Allyship On International Transgender Day

May 10, 2025

Supporting Transgender Individuals Practical Allyship On International Transgender Day

May 10, 2025 -

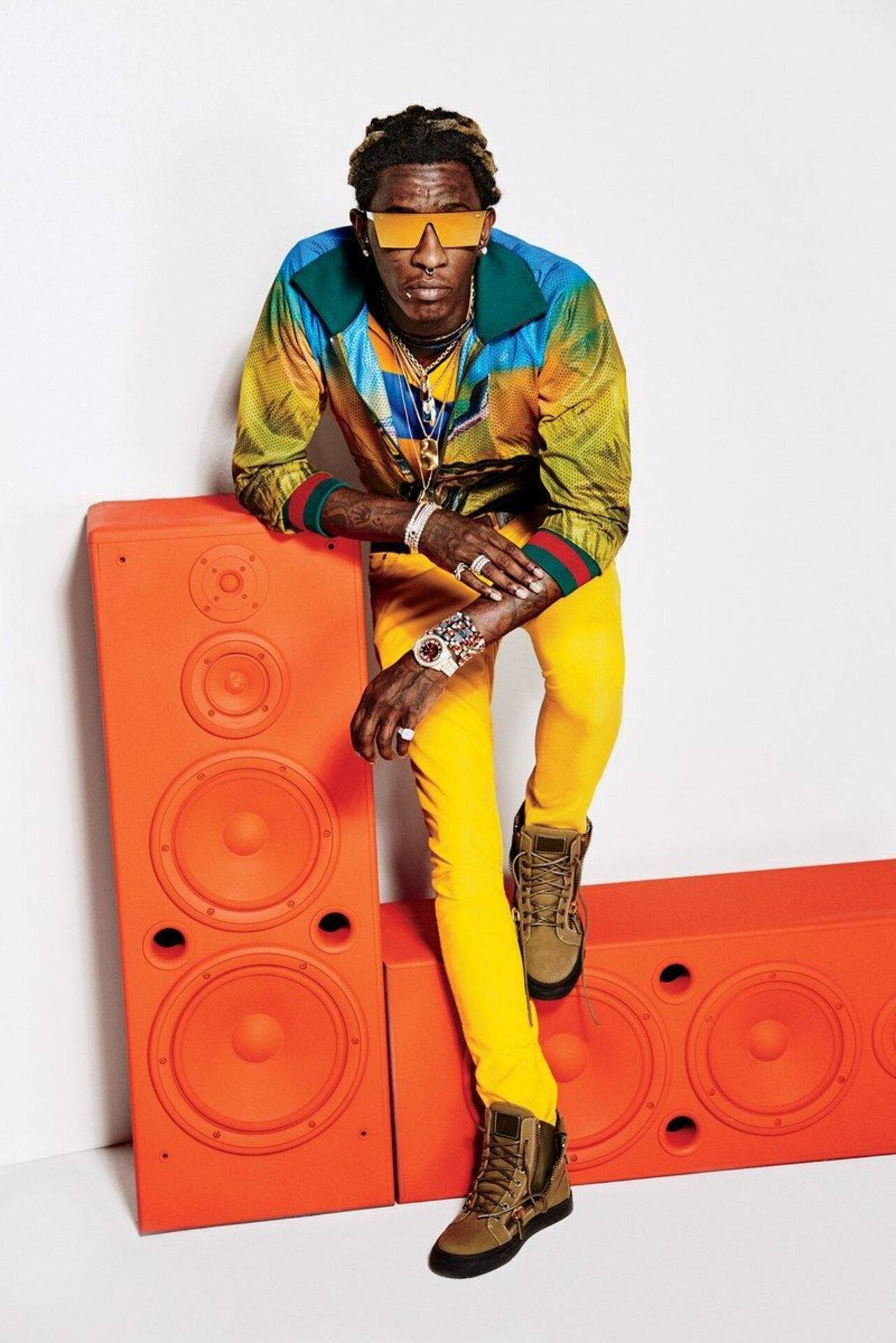

Young Thugs Back Outside Everything We Know About The Upcoming Album

May 10, 2025

Young Thugs Back Outside Everything We Know About The Upcoming Album

May 10, 2025 -

1889 A Year Of Divine Mercy Across Diverse Religious Communities

May 10, 2025

1889 A Year Of Divine Mercy Across Diverse Religious Communities

May 10, 2025 -

Jared Kushner Unofficial Advisor For Trumps Middle East Trip

May 10, 2025

Jared Kushner Unofficial Advisor For Trumps Middle East Trip

May 10, 2025