Trump's China Tariffs: Projected To Stay At 30% Through 2025

Table of Contents

The Initial Imposition of Trump's China Tariffs (2018-2020): A Recap

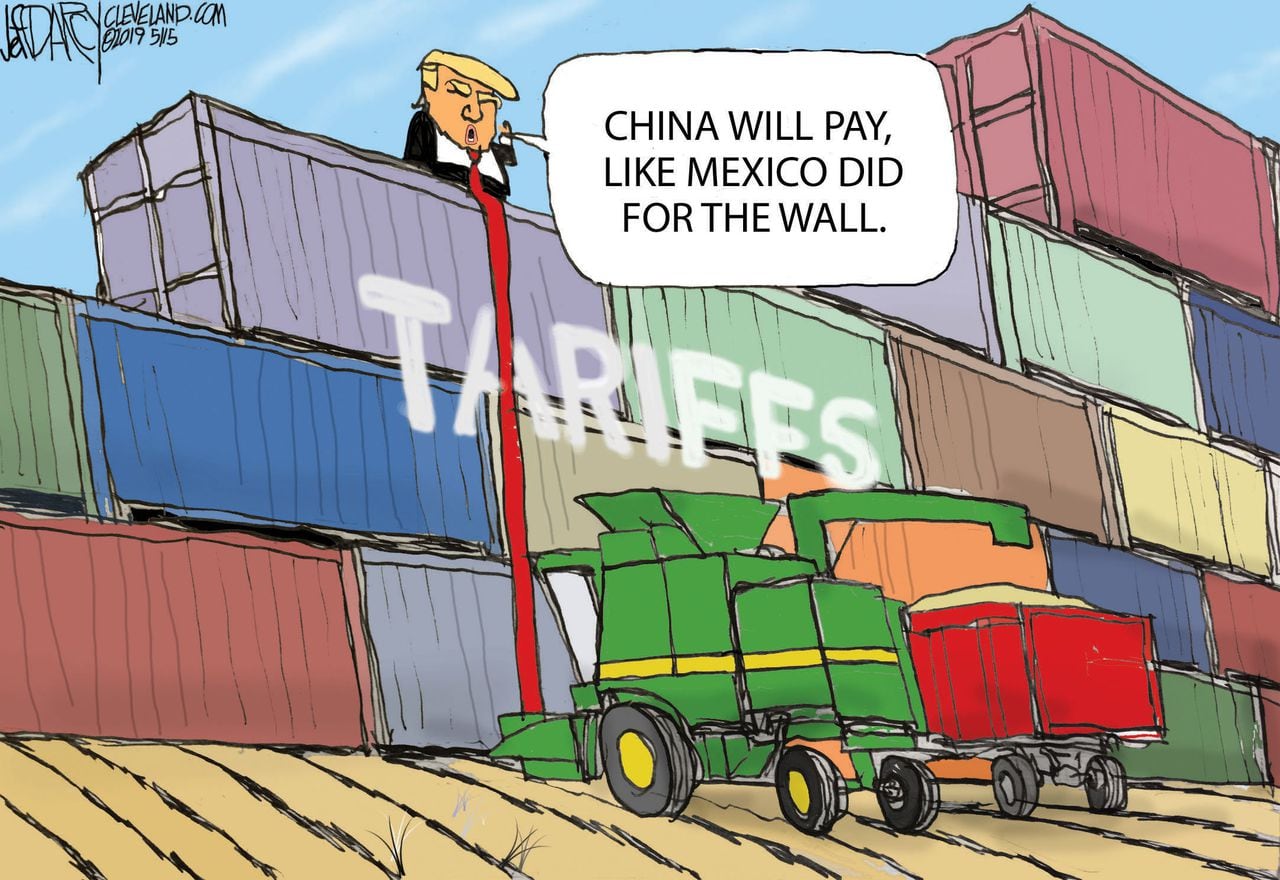

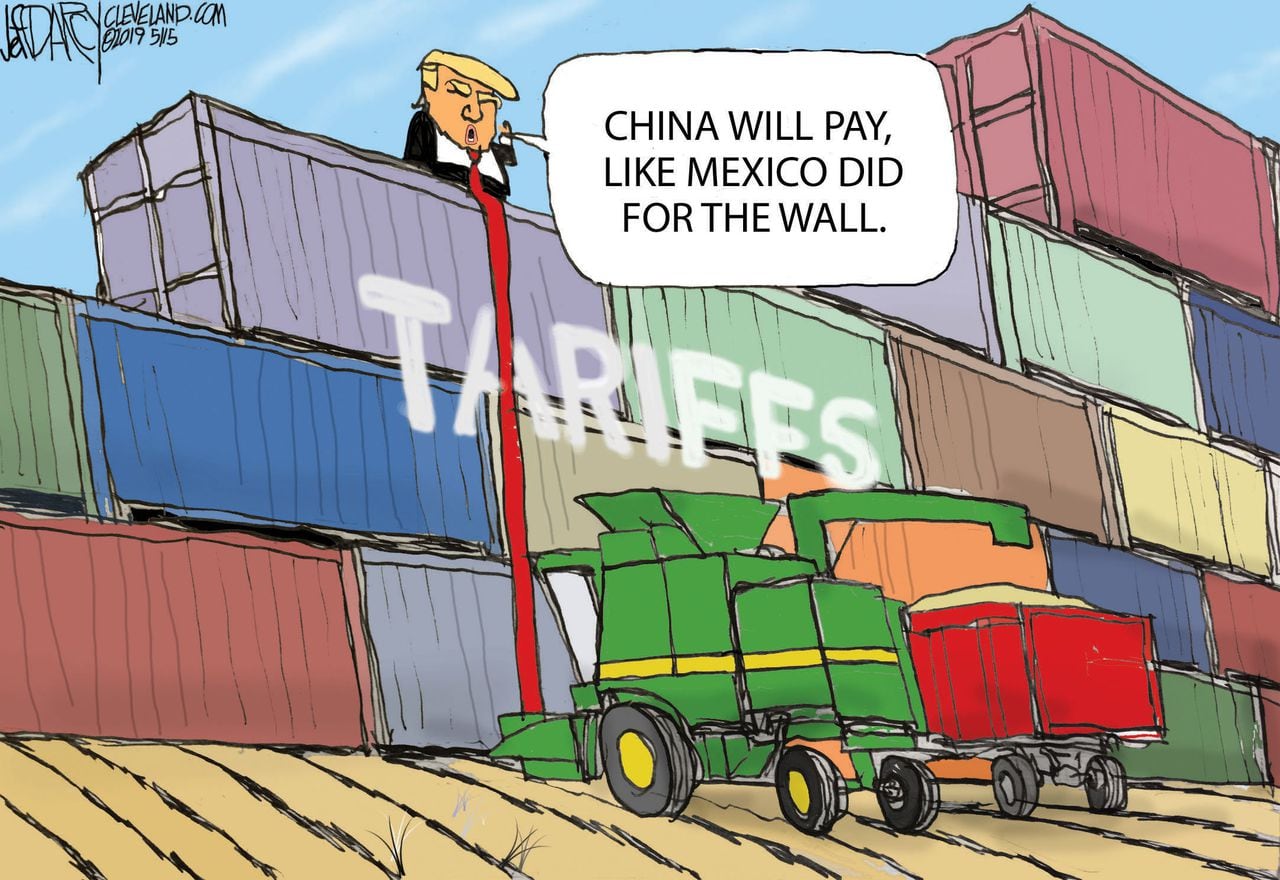

The initial imposition of Trump China tariffs began in 2018, escalating throughout 2019 and 2020. The stated rationale was to address what the administration perceived as unfair trade practices by China, including intellectual property theft and forced technology transfer. These import tariffs were implemented in phases, targeting a wide range of goods.

- Specific industries targeted: Steel, aluminum, consumer electronics, agricultural products (soybeans), textiles, and many other sectors experienced significant impacts from these 30% tariffs.

- The stated goals of the tariffs: The Trump administration aimed to protect American jobs, reduce the US trade deficit with China, and level the playing field for American businesses. The goal was to force China to renegotiate trade deals more favorable to the US.

- Initial reactions from businesses and consumers: Businesses faced increased costs for imported goods, leading to price hikes for consumers. Some businesses relocated production outside of China, while others absorbed the increased costs, impacting their profitability. Consumer prices for many goods increased.

- Short-term economic impacts: The short-term impacts included increased inflation, uncertainty in the markets, and disruptions to global supply chains. Some sectors experienced job losses, while others benefited from increased domestic production.

The Projected Persistence of 30% Tariffs Through 2025

Despite changes in administration, the 30% tariffs on Chinese goods are projected to remain in place through at least 2025. Several factors contribute to this persistence:

- Analysis of the current administration's stance on the tariffs: While the Biden administration has expressed concerns about the tariffs' impact on American consumers and businesses, a complete removal faces significant political hurdles and requires a complex reassessment of US-China trade relations.

- Influence of lobbying groups supporting or opposing tariff removal: Powerful lobbying groups representing various industries exert significant influence on policy decisions, creating a complex political landscape surrounding tariff removal or adjustments. Some groups benefit from protectionist measures, while others advocate for free trade.

- Economic and political factors influencing the decision to maintain the tariffs: Concerns about national security, intellectual property protection, and the ongoing trade imbalance with China all contribute to the decision to maintain these China trade war measures.

- Potential legal challenges to the tariffs: Although there have been legal challenges to the tariffs, their removal is ultimately a political decision, making legal challenges less influential in the short term.

Sector-Specific Impacts of the 30% Tariffs on the US Economy

The Trump China tariffs have had diverse and significant effects across various sectors of the US economy:

- Impact on manufacturing costs and competitiveness: US manufacturers reliant on Chinese components or inputs have faced significantly increased costs, reducing their competitiveness in the global market.

- Effect on consumer prices and purchasing power: Consumers have experienced higher prices for many goods, reducing their purchasing power. The impact is particularly pronounced on lower-income households.

- Consequences for specific industries: Technology companies importing components from China have faced significant cost increases, impacting their profitability and potentially hindering innovation. The agricultural sector, initially hit hard by tariffs on soybeans, has experienced a complex mix of impacts depending on specific crops and markets.

- Changes in supply chains due to tariffs: Businesses have sought to diversify their supply chains, moving production away from China to other countries such as Vietnam, Mexico, and India. This shift has had ripple effects throughout global trade networks.

The Geopolitical Implications of Persistent US-China Trade Tensions

The persistent US-China trade tensions, fueled by these tariffs, have broader geopolitical implications:

- The impact on US relations with China: The tariffs have strained US-China relations, creating uncertainty and tension in other areas of cooperation.

- The effect on other countries’ trade relationships with the US and China: Other countries have had to navigate the complexities of the US-China trade war, impacting their own trade relationships with both nations.

- Influence on global supply chains and manufacturing: Global supply chains have been significantly disrupted, leading to increased costs and uncertainty for businesses worldwide.

- The potential for further escalation or de-escalation of trade tensions: The future of US-China trade relations remains uncertain, with the potential for further escalation or de-escalation depending on political and economic developments.

Conclusion

The projected persistence of Trump's 30% tariffs on Chinese goods through 2025 presents a significant and complex challenge to the US economy and global trade. The wide-ranging impacts on various sectors, from manufacturing to agriculture and retail, are undeniable. The ongoing trade policy implications, coupled with the intricate dynamics of US-China trade relations, require ongoing monitoring and analysis.

Call to Action: Stay informed about the ongoing developments concerning Trump's China tariffs. Regularly check reputable news sources and economic analyses for updates on trade negotiations, policy changes, and their impact on businesses and consumers affected by these significant 30% tariffs. Understanding these ongoing developments is crucial for navigating the evolving landscape of US-China trade relations.

Featured Posts

-

Josh Cavallo Breaking Barriers After His Coming Out

May 17, 2025

Josh Cavallo Breaking Barriers After His Coming Out

May 17, 2025 -

Alkuvuoden Osakesijoitusten Tappiot Elaekeyhtioeillae

May 17, 2025

Alkuvuoden Osakesijoitusten Tappiot Elaekeyhtioeillae

May 17, 2025 -

Watch Celtics Vs Knicks Live Free Streaming Guide And Tv Channel Info

May 17, 2025

Watch Celtics Vs Knicks Live Free Streaming Guide And Tv Channel Info

May 17, 2025 -

V Mware Costs To Surge At And T Condemns Broadcoms Proposed Price Hike

May 17, 2025

V Mware Costs To Surge At And T Condemns Broadcoms Proposed Price Hike

May 17, 2025 -

Below Deck Down Under Season 2 Anthonys Replacement Revealed

May 17, 2025

Below Deck Down Under Season 2 Anthonys Replacement Revealed

May 17, 2025