Trump's Economic Legacy: A Cost-Benefit Analysis

Table of Contents

The Tax Cuts and Jobs Act of 2017: A Boon or a Bane?

The Tax Cuts and Jobs Act (TCJA) of 2017 was a cornerstone of Trump's economic policy. It implemented significant tax cuts for corporations and individuals, aiming to stimulate economic growth through increased investment and consumer spending.

Short-Term Economic Stimulus

- Significant corporate tax cuts: The TCJA reduced the corporate tax rate from 35% to 21%, a substantial decrease intended to boost business investment and competitiveness.

- Increased consumer spending due to tax rebates: Individual tax cuts, including increased standard deductions and child tax credits, led to increased disposable income for many households, resulting in a short-term boost in consumer spending.

- Initial boost in GDP growth: In the immediate aftermath of the TCJA, GDP growth experienced a temporary surge. However, this growth was not solely attributable to the tax cuts, and isolating their specific effect is challenging.

The immediate effects of the tax cuts included a noticeable increase in business investment and consumer confidence, contributing to a period of relatively strong GDP growth. However, this initial boost did not sustain itself in the long term and came at a cost.

Long-Term Fiscal Implications

- Increased national debt: The TCJA significantly increased the national debt due to reduced tax revenue. This added to the already considerable US national debt, raising concerns about long-term fiscal sustainability.

- Potential for inflation: The increased government spending and consumer demand fueled by the tax cuts raised concerns about potential inflationary pressures. However, inflation remained relatively low during the Trump administration.

- Impact on future government spending: The increased debt burden left less fiscal space for future government spending on crucial programs like infrastructure, education, and healthcare.

The long-term consequences of the TCJA remain a subject of debate. While proponents argue it stimulated economic growth, critics point to the increased national debt as a significant risk to future economic stability. The debate continues regarding the trade-off between short-term economic gains and long-term fiscal health.

Deregulation and its Impact on Growth and the Environment

The Trump administration pursued a policy of significant deregulation across various sectors of the economy. The goal was to reduce the regulatory burden on businesses, thereby promoting economic growth and job creation.

Stimulating Business Activity

- Reduced regulatory burdens on businesses: Numerous regulations were rolled back or weakened, affecting sectors such as finance, energy, and environmental protection.

- Potential for increased investment and job creation: Proponents argued that deregulation led to increased business investment and job creation by freeing businesses from burdensome regulations.

- Impact on specific industries (e.g., energy, finance): The energy sector experienced significant deregulation, leading to increased fossil fuel production. The financial sector saw a relaxation of some Dodd-Frank Act regulations.

The impact of deregulation on business activity is complex and varied across different sectors. While some industries experienced increased investment and growth, others faced challenges adapting to the changed regulatory landscape.

Environmental Concerns and Public Health

- Weakening of environmental regulations: Numerous environmental regulations were weakened or repealed, including those related to air and water quality, emissions standards, and protection of endangered species.

- Potential impact on pollution levels: Critics argued that the deregulation led to increased pollution levels and environmental damage.

- Public health concerns linked to deregulation: The weakening of environmental regulations raised concerns about the potential impact on public health, particularly in communities located near polluting industries.

The environmental and public health consequences of deregulation remain a major point of contention. The long-term effects on air and water quality, climate change, and public health will require further investigation and monitoring.

Trade Wars and Their Economic Fallout

Trump's administration initiated a series of trade wars, notably with China, imposing tariffs on various imported goods. These actions aimed to protect American industries and reduce trade deficits.

Impact on Specific Industries

- Effects on agriculture, manufacturing, and other sectors significantly impacted by tariffs and trade disputes: The agricultural sector, particularly soybean farmers, was heavily impacted by retaliatory tariffs imposed by China. Manufacturing industries also faced challenges due to increased input costs and reduced export markets.

- Winners and losers: Some industries benefited from the tariffs, while others suffered significant losses. The effects were highly unevenly distributed across the economy.

The trade wars resulted in significant disruptions to global supply chains and caused uncertainty for businesses and consumers.

Global Economic Uncertainty and Retaliation

- Global economic slowdown: The trade wars contributed to increased global economic uncertainty, hindering international trade and investment.

- Retaliatory tariffs from other countries: Other countries responded to Trump's tariffs with their own, escalating the trade conflict and leading to a decline in global trade.

- Disruption of supply chains: The trade disputes significantly disrupted global supply chains, leading to increased costs and delays for businesses.

The overall effect of the trade wars was a significant increase in global economic uncertainty and a reduction in international trade. The long-term consequences are still unfolding.

Job Creation and Unemployment During the Trump Presidency

The Trump administration emphasized job creation as a key economic goal.

Assessing Job Growth Numbers

- Analysis of job growth statistics during the Trump presidency: The economy did experience job growth during the Trump presidency, continuing a trend from the previous administration.

- Comparison to previous administrations: Comparing job growth rates to previous administrations requires careful consideration of various factors, including cyclical economic trends.

- Impact of automation and other factors: Automation and technological change also play a significant role in job creation and displacement, making it difficult to isolate the direct impact of any single administration's policies.

While there was job growth, attributing this solely to Trump's economic policies is difficult due to the complexity of economic factors.

The Quality of Jobs Created

- Discussion of the types of jobs created (high-paying vs. low-paying): The types of jobs created varied widely, with some being high-paying jobs in technology and others being low-paying jobs in the service sector.

- Consideration of the impact on income inequality: The impact on income inequality requires further analysis, as the job creation may not have equally benefited all segments of the population.

The quality of jobs created is crucial in assessing the overall impact of any economic policy. Simply looking at the number of jobs created without examining their quality provides an incomplete picture.

Conclusion

Assessing Trump's economic legacy requires a nuanced understanding of the interconnectedness of his policies. While the Tax Cuts and Jobs Act initially stimulated economic growth, the long-term fiscal implications, including increased national debt, remain a concern. Deregulation arguably boosted business activity in some sectors, but at the potential cost of environmental protection and public health. The trade wars created significant global economic uncertainty. Job growth occurred, but the quality of those jobs and their impact on income inequality require further study. The interplay of these policies and their long-term consequences makes a definitive assessment complex. Continue the conversation about Trump's economic impact and further explore the cost-benefit analysis of Trump's economic policies to form your own informed opinion based on the available evidence. Analyze the long-term effects of Trump's economic legacy – it’s a debate that will undoubtedly continue for years to come.

Featured Posts

-

New Signal Chat Exposes Hegseth Amidst Pentagon Chaos Allegations

Apr 22, 2025

New Signal Chat Exposes Hegseth Amidst Pentagon Chaos Allegations

Apr 22, 2025 -

Hegseths Signal Chat And Pentagon Chaos A Deeper Look

Apr 22, 2025

Hegseths Signal Chat And Pentagon Chaos A Deeper Look

Apr 22, 2025 -

Trump Administration Targets Harvard 1 Billion Funding Cut Imminent

Apr 22, 2025

Trump Administration Targets Harvard 1 Billion Funding Cut Imminent

Apr 22, 2025 -

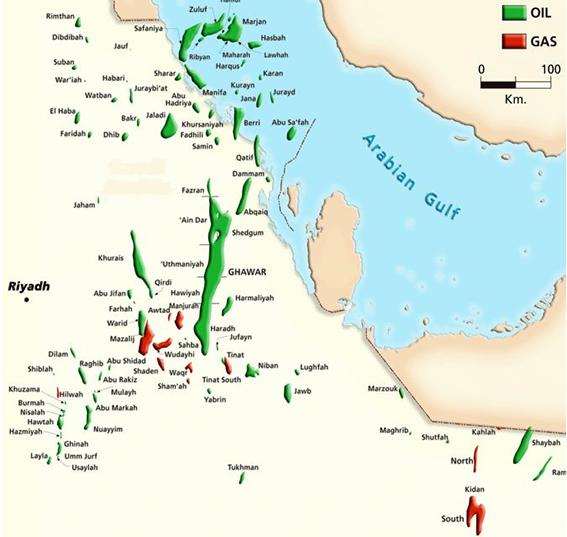

New Ev Technology Exploration Saudi Aramco And Byds Strategic Partnership

Apr 22, 2025

New Ev Technology Exploration Saudi Aramco And Byds Strategic Partnership

Apr 22, 2025 -

Ukraine War Fighting Resumes After Russias Easter Ceasefire

Apr 22, 2025

Ukraine War Fighting Resumes After Russias Easter Ceasefire

Apr 22, 2025

Latest Posts

-

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025 -

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025 -

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025 -

Overtime Thriller Oilers Beat Kings To Tie Western Conference Series

May 10, 2025

Overtime Thriller Oilers Beat Kings To Tie Western Conference Series

May 10, 2025 -

Leon Draisaitls Exceptional Season Hart Trophy Nomination And Oilers Success

May 10, 2025

Leon Draisaitls Exceptional Season Hart Trophy Nomination And Oilers Success

May 10, 2025