Trump's Influence On XRP: A Look At Institutional Participation

Table of Contents

Trump's Policies and their Indirect Impact on Cryptocurrency

Trump's presidency, marked by significant policy shifts, inevitably influenced the broader economic landscape, impacting investor sentiment toward all asset classes, including cryptocurrencies like XRP.

Regulatory Uncertainty and its Effect on XRP Investment

The Trump administration's approach to cryptocurrency regulation was characterized by a lack of clear, comprehensive guidelines. This regulatory uncertainty created a challenging environment for institutional investors, who generally prefer clear legal frameworks before committing significant capital.

- Examples of regulatory ambiguity: The lack of a unified federal regulatory body for cryptocurrencies, inconsistent statements from government officials regarding crypto's legal status, and ongoing debates about security token offerings all contributed to uncertainty.

- Impact on investor confidence: This ambiguity led many institutional investors to adopt a wait-and-see approach, delaying or reducing investments in XRP and other cryptocurrencies. Risk-averse institutional investors prioritize regulatory clarity to mitigate potential legal and financial risks.

- Risk aversion in institutional investing: Large financial institutions are subject to stringent regulatory scrutiny and must adhere to strict risk management protocols. Uncertainty in the regulatory landscape makes XRP a less attractive investment compared to more established asset classes.

Economic Policies and their Ripple Effect on XRP

Trump's economic policies, such as significant tax cuts and trade disputes, created a complex macroeconomic environment. These policies influenced overall market sentiment and indirectly impacted the cryptocurrency market, including XRP.

- Macroeconomic factors: Tax cuts could have theoretically increased disposable income, potentially leading to higher investment in riskier assets like XRP. However, trade wars simultaneously introduced uncertainty, affecting global economic growth and potentially dampening investor enthusiasm.

- Market trends during Trump's presidency: The cryptocurrency market experienced significant price volatility throughout Trump's term, making it difficult to isolate the direct influence of any specific policy. A thorough analysis would require isolating the effects of Trump's policies from other global events.

- Correlation analysis: While a direct correlation between specific Trump policies and XRP's price is difficult to definitively establish, a comprehensive econometric study considering multiple variables could shed light on any potential indirect links.

Trump's Social Media Presence and its Influence on XRP Sentiment

Trump's frequent and often unpredictable use of social media significantly impacted market sentiment across various sectors, including cryptocurrencies. While he never directly mentioned XRP, his broader online activity could have influenced investor behavior.

Direct or Indirect Mentions of Cryptocurrencies

While Trump never publicly commented on XRP specifically, his statements on Bitcoin and the broader cryptocurrency space undoubtedly influenced market sentiment. Any such pronouncements, positive or negative, could have created ripple effects impacting investor decisions, including those related to XRP.

- Absence of direct mentions: The lack of direct mentions of XRP might indicate a lack of direct influence. However, the overall market sentiment surrounding cryptocurrencies, influenced by Trump’s general pronouncements, could have played a role.

- Sentiment analysis of posts: A detailed analysis of Trump’s tweets and social media activity during his presidency regarding the economy or related topics could reveal indirect impacts on overall market sentiment that might have spilled over into the XRP market.

- Impact on XRP price following mentions: Any correlation between Trump’s statements about cryptocurrencies and subsequent price movements in XRP would require rigorous statistical analysis to confirm a causal relationship and rule out the influence of other market factors.

The Broader Impact of Trump's Online Activity on Market Volatility

Trump's social media activity was often associated with significant market volatility across various asset classes. This increased volatility likely influenced institutional investors' risk appetite regarding XRP.

- General market volatility: The increased uncertainty and volatility created by Trump's tweets likely impacted investment decisions, causing institutional investors to favor less volatile assets.

- Relationship between social media sentiment and cryptocurrency price fluctuations: Research suggests a correlation between social media sentiment and cryptocurrency price swings. Trump's unpredictable online behavior likely amplified this effect, influencing the price of XRP and other cryptocurrencies.

- Risk management strategies of institutional investors: Institutional investors employ sophisticated risk management strategies. High volatility, as often triggered by Trump’s tweets, leads to a more cautious approach to investments in volatile assets like XRP.

Analysis of Institutional XRP Holdings and Investments

Tracking institutional XRP holdings presents significant challenges due to the decentralized and pseudonymous nature of cryptocurrencies. However, we can attempt to assess potential trends.

Tracking Institutional Investment in XRP

Accurately tracking institutional XRP holdings is difficult because of the decentralized nature of blockchain technology and the lack of transparent reporting requirements for cryptocurrency investments.

- Methods used to estimate institutional holdings: Analysts often rely on on-chain data analysis, examining large wallet addresses and trading patterns. However, this method is imperfect and subject to misinterpretation.

- Limitations of data analysis: Attributing large wallet holdings definitively to institutional investors remains a challenge. These wallets could belong to individual high-net-worth investors, exchanges, or other entities.

- Credible sources of information: Research from reputable cryptocurrency analytics firms can provide some insights, though it’s crucial to understand the limitations of the available data.

Comparing XRP Investment Trends with Trump's Presidency

Determining whether any correlation exists between institutional XRP investment trends and Trump's presidency requires comparing investment data with key events during his tenure.

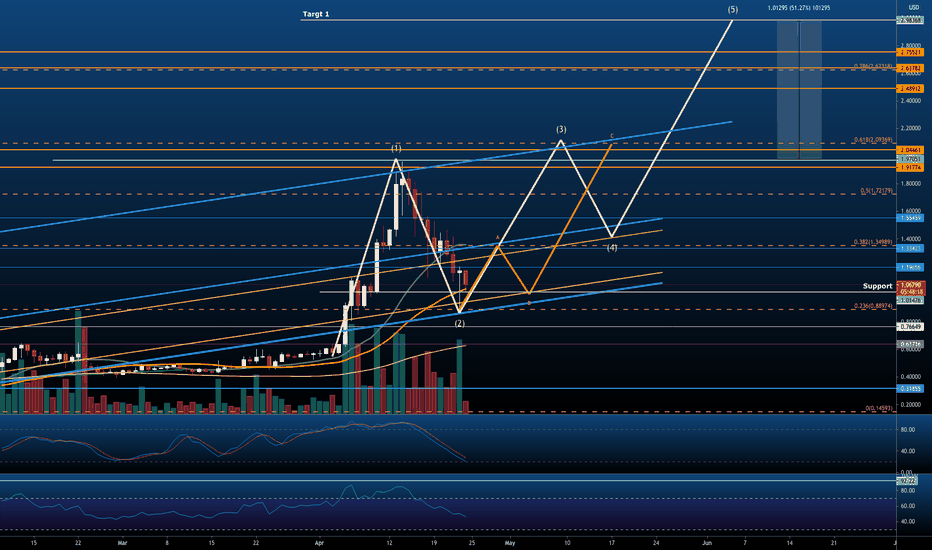

- Charts and graphs illustrating investment trends: Visual representations of XRP investment data alongside a timeline of significant political events during Trump’s presidency could help identify potential correlations.

- Statistical analysis of correlations: Statistical analysis could help determine the strength of any observed correlation, but it is important to remember that correlation does not equal causation. Other factors influencing XRP's price must be considered.

- Caveats about correlation vs. causation: Even if a correlation is observed, it doesn't necessarily mean that Trump's actions directly caused changes in institutional XRP investment. Other market forces and technological developments also influence cryptocurrency prices.

Conclusion

Analyzing the potential influence of Trump's presidency on institutional participation in XRP reveals a complex picture. While a direct causal link is difficult to definitively establish due to the limitations of data and the decentralized nature of cryptocurrencies, indirect influences through regulatory uncertainty, macroeconomic factors, and general market volatility fueled by Trump's social media presence are likely. Further research is needed to ascertain any definitive correlation. Understanding the potential connections between political figures and cryptocurrency investments is crucial. Continue to research the impact of Trump's legacy on XRP and institutional participation to stay ahead in this dynamic market. The evolving relationship between political events and the cryptocurrency market warrants continued observation and analysis regarding the future of XRP and institutional participation.

Featured Posts

-

Become Baba Yaga A John Wick Experience In Las Vegas

May 07, 2025

Become Baba Yaga A John Wick Experience In Las Vegas

May 07, 2025 -

15 April 2025 Daily Lotto Winning Numbers

May 07, 2025

15 April 2025 Daily Lotto Winning Numbers

May 07, 2025 -

Cobra Kai Josh Healds Original Series Pitch Revealed

May 07, 2025

Cobra Kai Josh Healds Original Series Pitch Revealed

May 07, 2025 -

Understanding The Conclave Choosing The Next Pope

May 07, 2025

Understanding The Conclave Choosing The Next Pope

May 07, 2025 -

Apple Watches On The Ice How Nhl Referees Use Smart Technology

May 07, 2025

Apple Watches On The Ice How Nhl Referees Use Smart Technology

May 07, 2025