Trump's Remarks Boost Canadian Dollar: Carney Deal Speculation

Table of Contents

Trump's Statements and Market Reactions

Trump's seemingly innocuous statement regarding [insert specific Trump statement here, e.g., a positive comment about the Canadian economy or a softened stance on trade negotiations] triggered a positive market response. Investors interpreted this as a sign of improved US-Canada relations and increased the likelihood of a future trade agreement beneficial to Canada. This positive sentiment rapidly translated into tangible market movements.

- CAD Appreciation: The Canadian dollar appreciated significantly against the US dollar (USD), gaining [insert percentage change, e.g., 1.5%] within hours of Trump's remarks. This sharp increase reflected investor confidence in the Canadian economy and its potential for growth.

- Impact on other Instruments: The positive news also influenced other related financial instruments. Canadian bond yields [increased/decreased – choose relevant], and certain Canadian stock indices experienced a noticeable [rise/fall – choose relevant].

- News Sources: Major financial news outlets like Bloomberg, Reuters, and the Financial Times reported on the CAD's surge, citing Trump's comments as a key contributing factor. [Insert relevant quotes from news sources].

The "Carney Deal" Speculation

The rapid appreciation of the CAD fueled speculation about a potential "Carney Deal," a behind-the-scenes agreement purportedly orchestrated by Mark Carney to improve US-Canada economic relations. While no concrete evidence supports this theory, the timing of Trump's comments and the CAD's subsequent surge has led many analysts to consider the possibility.

- Potential Deal Elements: Such a hypothetical deal might involve revised trade agreements, increased economic cooperation on specific sectors, or a commitment to resolving outstanding trade disputes.

- Likelihood of Materialization: The likelihood of a "Carney Deal" remains uncertain. The current geopolitical climate and the differing political agendas of both countries make such a deal challenging to materialize. [Discuss geopolitical factors and potential obstacles].

- Benefits and Drawbacks: A successful deal could bring significant benefits to both countries through increased trade, economic stability, and enhanced bilateral relations. However, potential drawbacks could include compromises on national interests and potential political backlash.

Impact on Canadian Economy

A stronger CAD has both positive and negative consequences for the Canadian economy.

- Short-Term Effects: A stronger CAD can make Canadian exports more expensive, potentially impacting sectors like manufacturing and agriculture. However, it also reduces the cost of imports, benefiting consumers.

- Long-Term Effects: Long-term impacts depend on several factors, including the overall global economic climate and the sustainability of the CAD's appreciation. A persistently strong CAD could negatively affect export-oriented industries, while simultaneously benefiting import-dependent businesses and consumers.

- Fluctuating Exchange Rate: The volatility associated with a fluctuating exchange rate creates uncertainty for businesses and investors, making long-term planning challenging.

Alternative Explanations for CAD's Rise

While Trump's comments and "Carney Deal" speculation contributed to the CAD's rise, other factors might have played a role.

- Global Economic Trends: Positive global economic indicators or shifts in investor sentiment towards emerging markets could have independently increased demand for the CAD.

- Interest Rate Changes: Changes in Canadian interest rates relative to other major currencies could also have affected the CAD's value.

- Geopolitical Events: Other geopolitical events unrelated to US-Canada relations might also have influenced investor confidence and the CAD's performance.

Future Outlook and Predictions

Predicting the future trajectory of the CAD is inherently complex. However, several factors could influence its performance in the coming months.

- US-Canada Relations: The future of US-Canada relations and the potential for new trade agreements will significantly impact the CAD.

- Global Economic Growth: The strength of global economic growth will affect investor sentiment towards the CAD.

- Interest Rate Differentials: The divergence in interest rates between Canada and other major economies will play a crucial role in shaping the CAD's future value.

- Expert Opinions: Many financial analysts [cite sources and their predictions].

Conclusion: Understanding the Trump Effect on the Canadian Dollar

Trump's remarks, coupled with speculation about a "Carney Deal," undeniably contributed to the recent surge in the Canadian dollar. However, it's crucial to recognize that currency fluctuations are rarely attributable to a single factor. Global economic trends, interest rate policies, and other geopolitical events all play important roles. Understanding the interplay of these factors is key to navigating the complexities of the foreign exchange market. Stay tuned for further updates on Trump's remarks and their impact on the Canadian dollar. For more in-depth analysis on currency trading and economic forecasts, consider exploring resources from reputable financial institutions and economic research firms.

Featured Posts

-

Daily Lotto Results Friday April 18th 2025

May 02, 2025

Daily Lotto Results Friday April 18th 2025

May 02, 2025 -

The Poignant Tribute From Poppys Family A Manchester United Fans Legacy

May 02, 2025

The Poignant Tribute From Poppys Family A Manchester United Fans Legacy

May 02, 2025 -

Mental Health In Ghana A Nation Facing A Psychiatrist Crisis

May 02, 2025

Mental Health In Ghana A Nation Facing A Psychiatrist Crisis

May 02, 2025 -

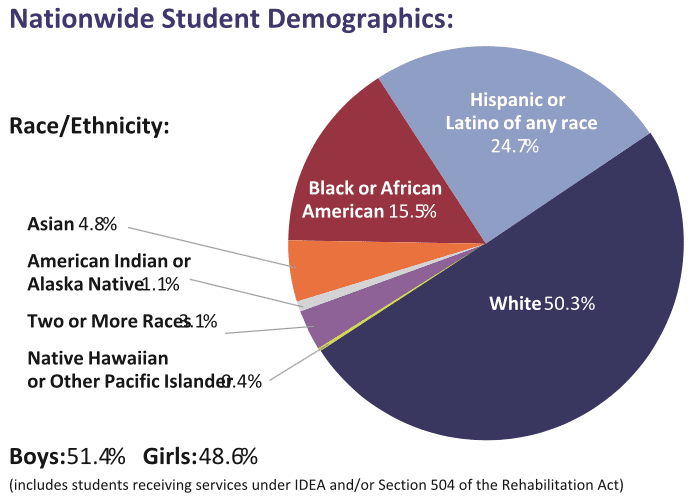

The Negative Impact Of School Suspensions Evidence And Solutions

May 02, 2025

The Negative Impact Of School Suspensions Evidence And Solutions

May 02, 2025 -

Kad Sam Se Vratio Ti Si Se Udala Zdravkova Prva Ljubav I Njena Odluka

May 02, 2025

Kad Sam Se Vratio Ti Si Se Udala Zdravkova Prva Ljubav I Njena Odluka

May 02, 2025

Latest Posts

-

Arkema Premiere Ligue Victoire Difficile Du Psg Contre Dijon

May 10, 2025

Arkema Premiere Ligue Victoire Difficile Du Psg Contre Dijon

May 10, 2025 -

Psg Met Fin A La Serie De Dijon En Arkema Premiere Ligue

May 10, 2025

Psg Met Fin A La Serie De Dijon En Arkema Premiere Ligue

May 10, 2025 -

Arkema Premiere Ligue Le Psg Terrasse Dijon Apres Une Rencontre Haletante

May 10, 2025

Arkema Premiere Ligue Le Psg Terrasse Dijon Apres Une Rencontre Haletante

May 10, 2025 -

Trois Hommes Agresses Sauvagement Pres Du Lac Kir A Dijon

May 10, 2025

Trois Hommes Agresses Sauvagement Pres Du Lac Kir A Dijon

May 10, 2025 -

Lac Kir Dijon Triple Agression Etat Des Victimes

May 10, 2025

Lac Kir Dijon Triple Agression Etat Des Victimes

May 10, 2025