Trump's Student Loan Privatization Plan: What It Could Mean For Borrowers

Table of Contents

Potential Benefits of Student Loan Privatization

While controversial, some argue that student loan privatization could offer certain advantages.

Increased Competition and Lower Interest Rates

Proponents suggest that introducing private lenders into the student loan market could foster competition, ultimately driving down interest rates. This increased competition, they argue, would benefit borrowers by making loans more affordable.

- Example: A hypothetical reduction from the current federal average of 5% to a competitive 3% could save borrowers thousands of dollars over the life of their loan.

- Comparison: Analyzing current private loan rates against federal loan rates would provide a clearer picture of potential savings or increased costs.

- Projection: While difficult to predict, economic models could be used to project potential interest rate changes under a privatized system. However, these projections should be viewed with caution, as many factors would influence actual interest rates.

Innovation and Flexibility in Repayment Options

Private lenders, some suggest, might offer more flexible repayment plans tailored to individual borrowers’ circumstances.

- Income-Driven Repayment Variations: Private lenders might offer more nuanced income-driven repayment plans, better adapting to fluctuating incomes.

- Deferred Repayment Options: Increased flexibility in deferring payments during periods of unemployment or financial hardship could provide crucial breathing room.

- Drawbacks: This increased flexibility, however, could potentially lead to longer repayment periods and higher overall interest paid. Careful consideration of the terms of any private loan is paramount.

Potential Drawbacks of Student Loan Privatization

Despite the potential upsides, significant concerns exist regarding the privatization of student loans.

Higher Risk of Predatory Lending Practices

A major concern is the potential for an increase in predatory lending practices. Private lenders, without the same level of regulatory oversight as the federal government, might engage in practices harmful to borrowers.

- High Fees and Hidden Charges: Private loans often come with significantly higher fees and hidden charges than federal loans, increasing the overall cost.

- Aggressive Collection Tactics: Private lenders might employ more aggressive collection tactics compared to the federal government, creating undue financial stress for borrowers.

- Regulatory Landscape: The absence of robust federal regulations could leave borrowers vulnerable to exploitation.

Reduced Access to Student Loans for Low-Income Borrowers

Privatization could disproportionately impact low-income borrowers. Private lenders often have stricter lending criteria, potentially excluding those with lower credit scores or limited financial history.

- Stricter Lending Criteria: Higher credit score requirements and more stringent income verification could limit access for students from lower socioeconomic backgrounds.

- Data on Student Loan Borrowers: Analyzing the current demographics of student loan borrowers reveals a significant portion comes from lower-income families. Privatization could exacerbate existing inequalities.

Loss of Federal Protections and Borrower Relief Programs

The current federal student loan system offers crucial protections and relief programs that could be lost under privatization.

- Income-Driven Repayment Plans: These plans are designed to make repayment manageable for borrowers struggling financially. Privatization might eliminate or significantly alter these programs.

- Loan Forgiveness Programs: Certain professions or circumstances might qualify for loan forgiveness under the current system. These crucial safety nets may disappear under privatization.

- Impact on Borrowers Facing Financial Hardship: The loss of these federal protections could leave borrowers facing financial hardship with limited options.

Comparison to Current Federal Student Loan System

Understanding the differences between the current system and a potential privatized system is crucial.

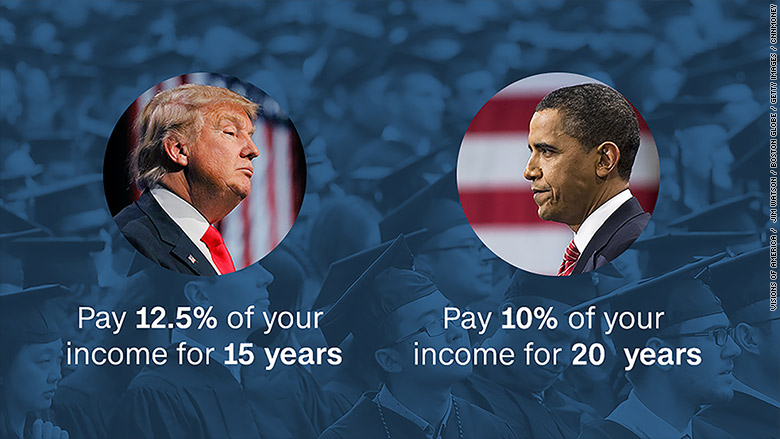

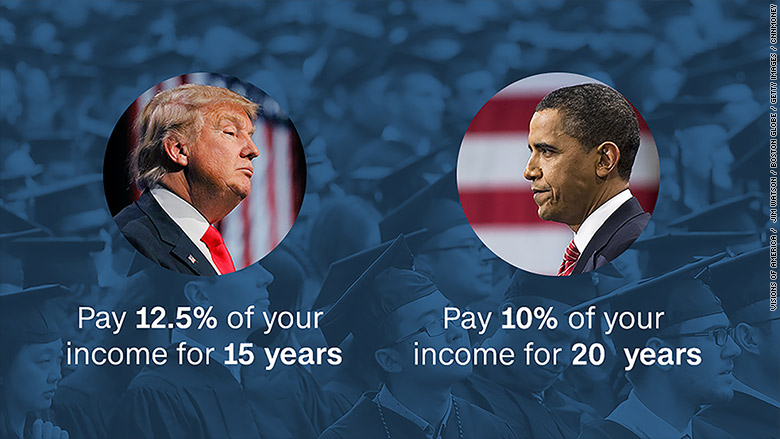

Interest Rates and Repayment Options

| Feature | Federal Student Loans | Potential Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower, subsidized options exist | Potentially higher, variable rates common |

| Repayment Options | Variety of income-driven plans available | Fewer options, potentially less flexible |

| Loan Forgiveness | Certain programs exist | Potentially limited or non-existent |

Borrower Protections and Regulations

The federal government provides numerous borrower protections, including:

- Clear and transparent lending terms

- Robust consumer protections

- Established processes for loan repayment and default resolution.

A privatized system might lack these safeguards, leaving borrowers more vulnerable.

Conclusion

Trump's proposed student loan privatization plan presents both potential benefits and significant risks. While increased competition could lead to lower interest rates and more flexible repayment options, the potential for predatory lending, reduced access for low-income borrowers, and the loss of crucial federal protections are major concerns. The impact on different borrower groups could be substantial.

Therefore, it's crucial to stay informed about developments in student loan policy and advocate for policies that protect borrowers from predatory practices and ensure equitable access to higher education. Thoroughly research the details of any student loan privatization plan before making any financial decisions. Knowing the specifics of any student loan privatization plan is essential for effective financial planning.

Featured Posts

-

Is The Doctor Who Christmas Special Scrapped For 2024

May 17, 2025

Is The Doctor Who Christmas Special Scrapped For 2024

May 17, 2025 -

Alianza Lima Vs Talleres Goles Resumen Y Resultado Final 2 0

May 17, 2025

Alianza Lima Vs Talleres Goles Resumen Y Resultado Final 2 0

May 17, 2025 -

Positive News For Knicks Fans Mitchell Robinsons Status After Two Losses

May 17, 2025

Positive News For Knicks Fans Mitchell Robinsons Status After Two Losses

May 17, 2025 -

Seattle Mariners Vs Chicago Cubs Spring Training Free Online Streaming Options

May 17, 2025

Seattle Mariners Vs Chicago Cubs Spring Training Free Online Streaming Options

May 17, 2025 -

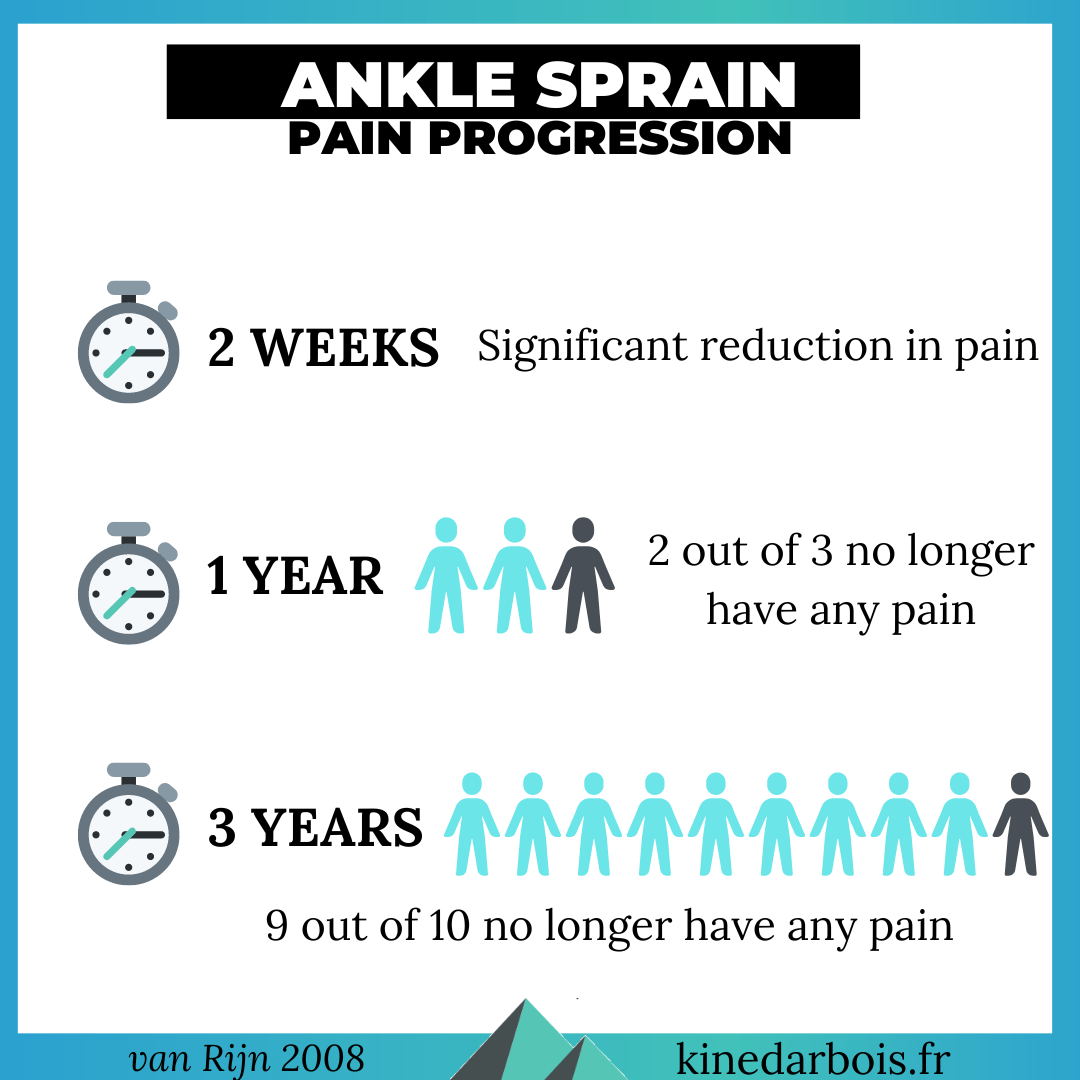

Knicks Robinsons Ankle Injury Recovery And Season Debut

May 17, 2025

Knicks Robinsons Ankle Injury Recovery And Season Debut

May 17, 2025