Trump's Tariff Decision Sends Euronext Amsterdam Stocks Soaring 8%

Table of Contents

Understanding the Tariff Decision and its Immediate Impact

Trump's surprise decision involved a significant rollback of tariffs on certain goods imported from the European Union. This unexpected policy reversal, following years of trade war tensions, immediately impacted the Euronext Amsterdam exchange. The market reacted with a swift and sharp increase, demonstrating the sensitivity of European markets to US trade policy.

- Specific stocks that saw the most significant gains: Companies heavily involved in exporting goods previously subject to high tariffs saw the most dramatic gains. Examples include several companies in the automotive and agricultural sectors, which experienced double-digit percentage increases in their share prices.

- Trading volume increases post-announcement: Trading volume on Euronext Amsterdam spiked significantly in the hours following the announcement, indicating high investor activity and a scramble to adjust portfolios based on the new market conditions.

- Analyst reactions and initial predictions: Many analysts initially expressed surprise but cautiously welcomed the news, predicting further positive short-term impacts on specific sectors within the Euronext Amsterdam exchange. However, concerns were raised about the long-term sustainability of this positive trend.

Sectors Most Affected by the Tariff Shift on Euronext Amsterdam

The sectors that benefited most from the tariff changes were those directly involved in exporting goods to the US that were previously heavily impacted by tariffs.

- Examples of specific companies within these sectors and their performance: Companies in the Dutch agricultural sector, particularly those exporting dairy products and flowers, witnessed exceptionally strong performance. Similarly, automobile parts manufacturers experienced significant gains.

- Analysis of the relationship between the tariff change and stock price increases: The correlation between the tariff reduction and stock price increases was almost immediate and highly pronounced, highlighting the direct and significant influence of US trade policy on Euronext Amsterdam.

- Comparison with other European stock markets' reactions: While other European stock markets also experienced positive reactions, the impact on Euronext Amsterdam was notably more pronounced, likely due to the Netherlands' higher trade volume with the United States compared to other EU nations.

The Role of Investor Sentiment and Speculation

The tariff announcement profoundly impacted investor sentiment. The sudden shift from a period of trade uncertainty to a more favorable environment boosted confidence, leading to a surge in buying activity.

- Mention of any significant investor reports or analyses released after the announcement: Several major financial institutions released reports emphasizing the positive impact on European markets, further fueling the stock surge.

- Discussion of short-term vs. long-term investment strategies in light of the news: Many analysts advised caution, suggesting that while the short-term outlook was positive, long-term investment decisions should consider the potential for future shifts in trade policy.

- Examples of how investor sentiment affected trading patterns: The rapid increase in trading volume and the significant price increases in specific sectors are clear indicators of the powerful influence of investor sentiment and speculation.

Long-Term Implications and Future Outlook for Euronext Amsterdam Stocks

While the short-term outlook appears positive, the long-term implications remain uncertain. The sustainability of this market surge depends on several factors, including the stability of the new trade relationship between the US and the EU.

- Potential risks and uncertainties associated with the altered trade environment: Geopolitical risks and potential future changes in US trade policy remain significant uncertainties. The unexpected nature of this decision highlights the inherent volatility of the global trade environment.

- Predictions from financial experts regarding future stock performance: Financial experts offer varied predictions, with some suggesting sustained growth in affected sectors and others warning of a potential market correction.

- Strategies for investors considering the new market dynamics: A diversified investment strategy that considers the potential for both growth and volatility is recommended for investors navigating this dynamic market environment.

Global Market Reactions and Comparisons

While Euronext Amsterdam experienced a significant surge, other major global stock exchanges also showed positive responses, although the extent varied considerably.

- Comparison with indices such as the Dow Jones, NASDAQ, and FTSE 100: The Dow Jones and NASDAQ showed moderate positive reactions, while the FTSE 100’s response was less pronounced compared to Euronext Amsterdam.

- Analysis of factors that contributed to variations in global market responses: Differences in market response may be attributed to varying levels of exposure to US trade policy, differing sectoral compositions, and investor sentiment specific to each market.

- Discussion of potential spillover effects from Euronext Amsterdam to other markets: The positive reaction in Euronext Amsterdam could have a positive ripple effect on other European markets and globally, but the extent of these spillover effects remains to be seen.

Conclusion

Trump's recent tariff decision had a dramatic and immediate impact on Euronext Amsterdam stocks, causing an 8% surge. Specific sectors, particularly those heavily involved in exporting goods to the US, benefited enormously from the tariff rollback. However, the long-term effects remain uncertain, emphasizing the importance of cautious optimism and a diversified investment strategy. The interplay between investor sentiment, speculation, and the inherent volatility of global trade policy all contributed to this remarkable market shift.

Call to Action: Stay informed on the latest developments affecting Euronext Amsterdam stocks. Understand the complexities of Trump's tariff decisions and their implications for your investment portfolio. Continue to monitor the market for further shifts and seize investment opportunities arising from this market volatility. Learn more about navigating the impact of trade wars on your investments.

Featured Posts

-

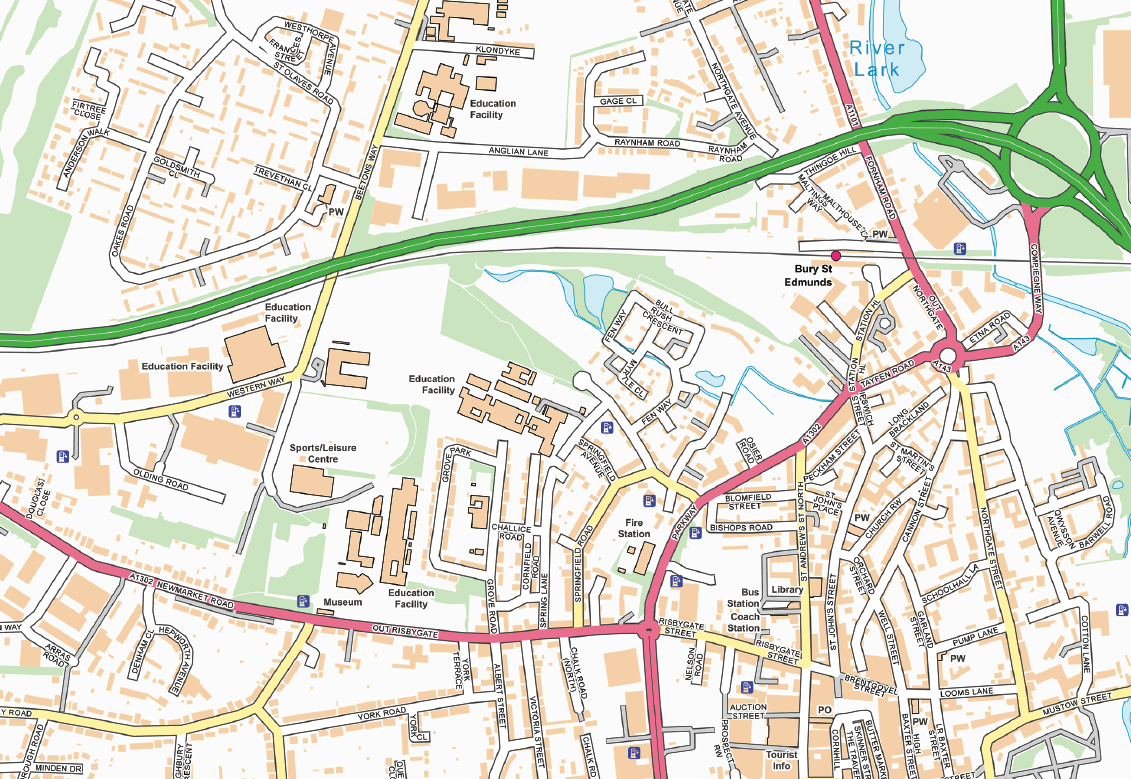

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025 -

Major Road Closed After Serious Accident One Person Hospitalized

May 24, 2025

Major Road Closed After Serious Accident One Person Hospitalized

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025 -

Models Night Out Annie Kilners Posts And Allegations Against Kyle Walker

May 24, 2025

Models Night Out Annie Kilners Posts And Allegations Against Kyle Walker

May 24, 2025 -

The Thames Water Bonus Scandal A Detailed Examination

May 24, 2025

The Thames Water Bonus Scandal A Detailed Examination

May 24, 2025

Latest Posts

-

Bipartisan Senate Resolution Honors Strong Canada U S Partnership

May 24, 2025

Bipartisan Senate Resolution Honors Strong Canada U S Partnership

May 24, 2025 -

Broadcoms V Mware Acquisition A 1050 Price Hike For At And T

May 24, 2025

Broadcoms V Mware Acquisition A 1050 Price Hike For At And T

May 24, 2025 -

Auto Dealers Intensify Fight Against Ev Sales Requirements

May 24, 2025

Auto Dealers Intensify Fight Against Ev Sales Requirements

May 24, 2025 -

Office365 Executive Email Compromise Leads To Multi Million Dollar Theft

May 24, 2025

Office365 Executive Email Compromise Leads To Multi Million Dollar Theft

May 24, 2025 -

Execs Office365 Accounts Breached Millions Made Feds Say

May 24, 2025

Execs Office365 Accounts Breached Millions Made Feds Say

May 24, 2025