Trump's Tariff Policy: A 10% Baseline With Exceptions

Table of Contents

The 10% Tariff Baseline: A Broad Stroke

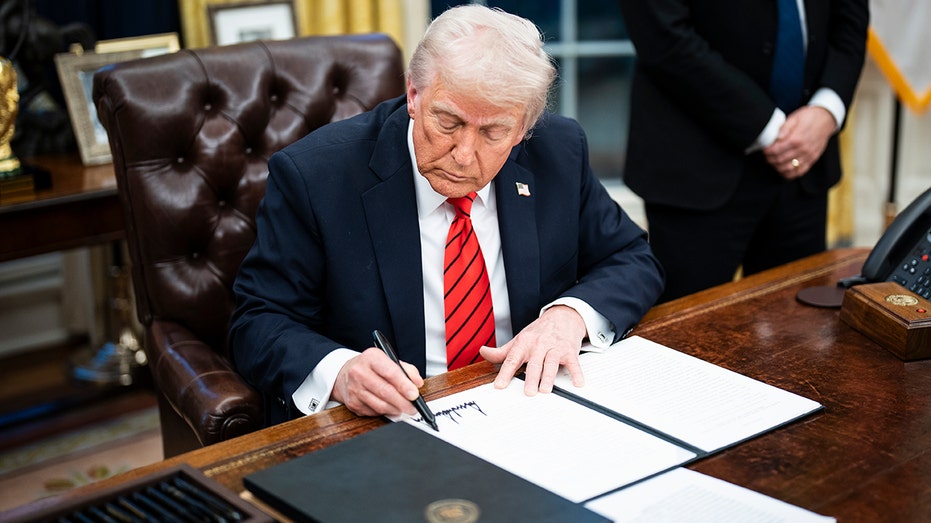

The initial announcement of a 10% tariff on a wide range of imported goods aimed to address what the Trump administration perceived as unfair trade practices and trade imbalances. The stated goals included protecting American jobs, boosting domestic industries, and strengthening US manufacturing. This 10% tariff rate, presented as a significant move in the ongoing trade war, aimed to renegotiate trade deals and improve the US trade deficit. The economic context was one of growing concerns about globalization and the perceived loss of American manufacturing jobs.

- Specific examples of goods initially subject to the 10% tariff: This initial wave included various consumer goods, ranging from electronics to textiles, impacting numerous industries and consumers.

- Initial reaction from affected industries and countries: Many countries responded with retaliatory tariffs, escalating the trade tensions and impacting global trade relations. Affected industries in the US saw increased costs and faced competitive pressures.

- Analysis of the stated economic rationale behind the policy: The administration argued that the tariffs would level the playing field, making US goods more competitive and encouraging domestic production. However, economists debated the effectiveness and long-term consequences of this approach.

Key Exceptions and Exemptions to the 10% Tariff

Despite the initial broad stroke of a 10% tariff, numerous exceptions and exemptions were granted to specific products or countries. These exemptions, often granted through a formal process of requesting tariff exclusions, significantly altered the policy's final impact. The criteria for granting these exemptions were often opaque, leading to accusations of favoritism and inconsistency. The process involved navigating complex bureaucratic procedures, leading to delays and uncertainties for businesses.

- Explanation of the process for requesting tariff exclusions: Companies could petition for exemptions based on factors like the unavailability of domestic alternatives or undue economic hardship. The process involved providing substantial evidence to support their claims.

- Examples of product categories or countries that received exemptions: Certain essential goods, crucial components for various industries, and products from key allies often received exemptions. These exceptions frequently stemmed from political and economic considerations, further highlighting the policy's complexity.

- Discussion of the political and economic factors influencing the granting of exceptions: Political alliances, lobbying efforts, and perceived national security interests played a significant role in determining which sectors and countries received exemptions.

- Analysis of the impact of these exceptions on specific industries: The existence of exemptions created uneven playing fields, benefiting some industries while others faced increased costs and reduced competitiveness.

National Security Exemptions and their Impact

A significant category of exemptions centered around national security. Section 232 of the Trade Expansion Act of 1962 provided a legal basis for imposing tariffs on goods deemed to threaten national security. This provision was invoked extensively, particularly in the case of steel and aluminum imports.

- Details of Section 232 and its application in Trump's trade policy: Section 232 allows the President to impose tariffs if a product is found to threaten national security. This broad definition was used to justify tariffs on steel and aluminum from various countries.

- Specific examples of countries and products affected by national security tariffs: Steel and aluminum tariffs targeted numerous countries, leading to retaliatory measures and further exacerbating global trade tensions.

- Analysis of the economic and geopolitical consequences of these exemptions: These tariffs triggered considerable economic fallout, including job losses in some sectors and increased prices for downstream industries. Geopolitically, they strained relationships with key allies.

Economic Consequences and Global Impact of Trump's Tariff Policy

Trump's 10% tariff policy, despite its exceptions, had profound economic consequences, both domestically and internationally. While intended to stimulate domestic production and reduce trade deficits, the actual impact was far more complex. The imposition of tariffs led to increased costs for consumers and businesses, causing inflation and uncertainty in the market.

- Impact on US inflation and consumer prices: Tariffs increased the cost of imported goods, contributing to inflation and impacting consumer purchasing power.

- Effects on US businesses and employment: While some sectors might have benefited from reduced competition, others faced increased costs, reduced competitiveness, and job losses due to retaliatory tariffs.

- Global responses and retaliatory tariffs from other countries: Many countries retaliated with their own tariffs, impacting global trade flows and escalating trade tensions.

- Long-term consequences for global trade relations: The policy left a legacy of distrust and uncertainty in global trade relations, making international cooperation on trade more challenging.

Conclusion

This article has dissected the complexities of Trump's 10% baseline tariff policy, revealing the significant impact of exceptions and exemptions. Initially presented as a sweeping measure, the policy's implementation revealed a far more nuanced approach with profound implications for the US economy and global trade relations. The interplay of economic, political, and national security considerations shaped the policy's ultimate form and consequences. Understanding the intricacies of this policy highlights the interconnected nature of global trade and the far-reaching effects of protectionist measures.

To further understand the intricate details of Trump's tariff policy and its lasting consequences, explore additional resources and analyses on US trade policy and the impact of Trump's 10% tariff and its exceptions. Understanding the nuances of tariff policy is crucial for navigating the complexities of international trade.

Featured Posts

-

Analyzing Dakota Johnsons Role Selection Martins Influence

May 10, 2025

Analyzing Dakota Johnsons Role Selection Martins Influence

May 10, 2025 -

Troubled Nhs Trust Boss Cooperates With Nottingham Attacks Investigation

May 10, 2025

Troubled Nhs Trust Boss Cooperates With Nottingham Attacks Investigation

May 10, 2025 -

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 10, 2025

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 10, 2025 -

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Speak Out

May 10, 2025

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Speak Out

May 10, 2025 -

Universitaria Transgenero Arrestada Uso De Bano Femenino Y La Ley

May 10, 2025

Universitaria Transgenero Arrestada Uso De Bano Femenino Y La Ley

May 10, 2025