Trump's Tariffs: A $16 Billion Revenue Hit To California?

Table of Contents

Analyzing the $16 Billion Figure: Unpacking the Claim

The claim of a $16 billion loss to California due to Trump's tariffs requires careful scrutiny. Understanding how this figure was derived is crucial to evaluating its accuracy and implications.

Methodology and Sources

The origin and methodology behind the $16 billion figure are often unclear. Various sources, including industry associations, economic research groups, and news outlets, have cited this number, but the underlying data and calculations vary significantly. A thorough investigation is necessary to identify the source and critically evaluate its methodology.

- Lack of Standardized Methodology: Different studies used varying methodologies, making direct comparisons difficult. Some focused solely on direct costs, while others attempted to incorporate indirect effects.

- Data Limitations: Obtaining comprehensive and reliable data on the economic impact of tariffs across diverse sectors can be challenging. Data discrepancies and reporting lags further complicate the assessment.

- Bias and Advocacy: The source's potential biases and motivations must be considered. Industry groups, for example, may be incentivized to exaggerate the negative impact.

Direct vs. Indirect Costs

Distinguishing between direct and indirect costs is essential for a comprehensive understanding. Direct costs stem from increased import prices due to tariffs, while indirect costs encompass wider economic repercussions such as job losses, reduced consumer spending, and decreased investment.

- Direct Costs: Higher prices for imported goods directly impact California businesses and consumers. For example, increased steel prices affected construction costs.

- Indirect Costs: Job losses in industries reliant on imports, reduced consumer confidence leading to decreased spending, and a decline in business investments all contribute to the indirect costs. These are harder to quantify precisely.

- Ripple Effects: The initial impact of tariffs often triggers a chain reaction, affecting multiple sectors interconnected through supply chains.

Sector-Specific Impacts

Trump's tariffs impacted various sectors within California's economy. Let's examine some key industries:

Agriculture

California's agricultural sector, a major exporter, suffered significantly from retaliatory tariffs imposed by other countries.

- Almonds: Facing higher tariffs in China, a key export market, California almond growers saw reduced exports and lower prices.

- Wine: Similarly, the wine industry experienced reduced exports and increased costs, impacting profitability. This also involved increased shipping costs and reduced demand.

Manufacturing

California's manufacturing sector, particularly those involved in electronics and automotive parts, faced challenges due to increased input costs.

- Electronics: Higher tariffs on imported components led to increased production costs and reduced competitiveness.

- Automotive Parts: Increased tariffs on steel and other materials impacted the automotive parts manufacturing sector, leading to potential factory closures and job losses.

Other Sectors

Retail and tourism, although less directly affected, also experienced indirect consequences due to reduced consumer spending and changes in international travel patterns.

The Broader Economic Context: Beyond the $16 Billion

The $16 billion figure, while significant, doesn't capture the entire picture. The impact of Trump's tariffs extended beyond direct costs.

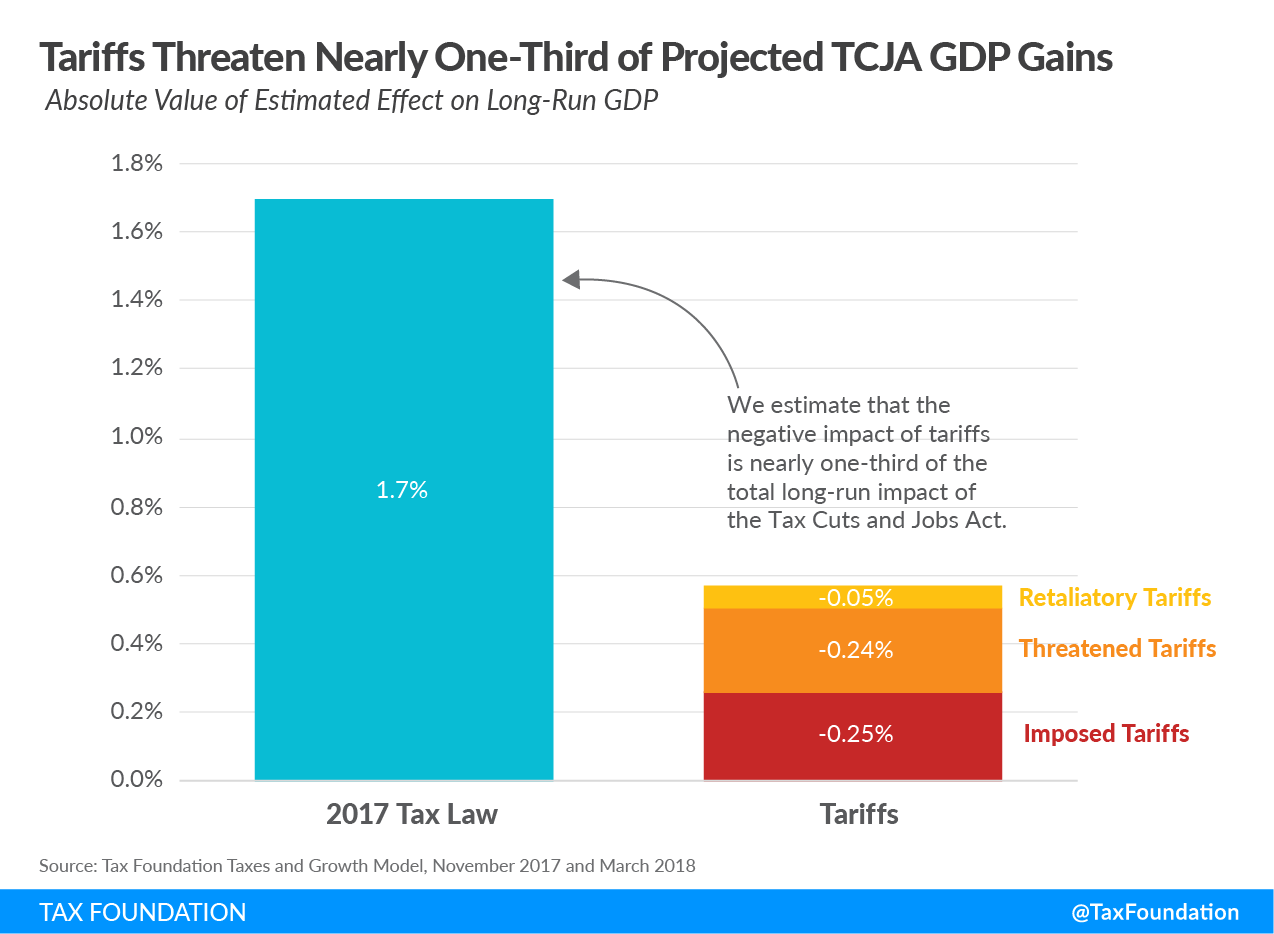

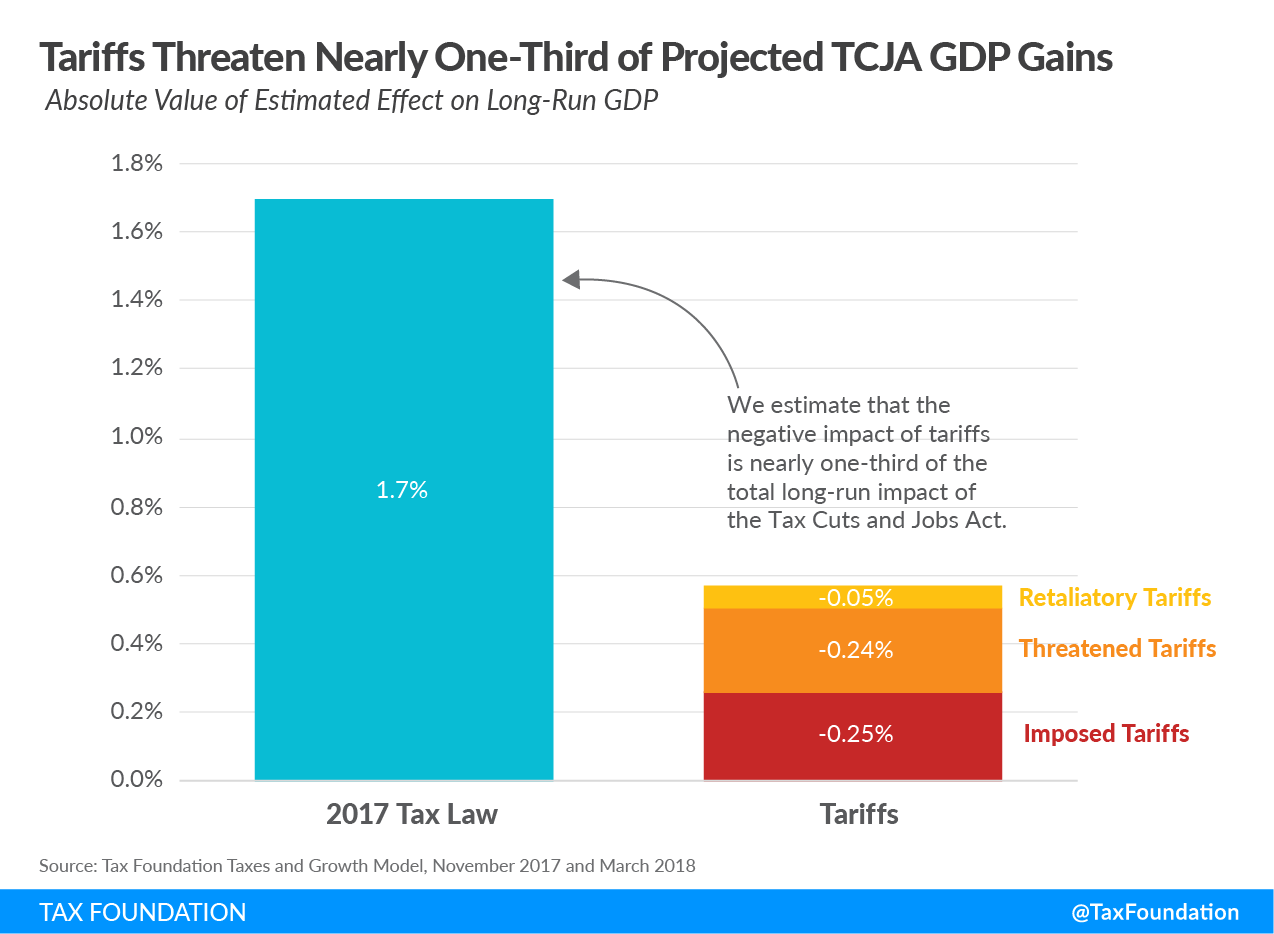

Global Trade Wars and Their Ripple Effects

Trump's tariffs triggered retaliatory measures from other countries, escalating into trade wars that further hampered California's economy. These retaliatory tariffs created a complex web of interconnected economic consequences.

Long-Term Consequences

The long-term effects of Trump's tariffs on California's economic growth, investment, and international trade relationships remain a subject of ongoing debate and study. This includes analyzing lasting shifts in global supply chains and the potential for decreased competitiveness.

Policy Responses and Mitigation Strategies

California implemented some measures to address the economic challenges caused by tariffs, including exploring alternative trade partners and offering financial assistance to affected industries.

Conclusion: Evaluating the True Cost of Trump's Tariffs on California

While the precise figure of $16 billion remains debatable due to the complexities of economic modeling and data availability, the significant impact of Trump's tariffs on various California industries is undeniable. Understanding the direct and indirect costs, along with the ripple effects of global trade wars, paints a far more comprehensive picture than a single headline number can. Analyzing the cost of Trump's tariffs requires a nuanced understanding of its effects across multiple economic sectors and its long-term consequences. Further research is needed to fully grasp the lasting impact of these trade policies on California's economy. We encourage readers to further research the economic effects of trade policies on California's economy and engage in discussions about mitigating future economic risks related to tariffs and trade wars. Understanding Trump's tariffs and their impact is crucial for developing effective strategies to safeguard California's future economic stability. [Link to relevant government report] [Link to academic study] [Link to news article]

Featured Posts

-

How Apple Watches Are Changing Nhl Refereeing

May 16, 2025

How Apple Watches Are Changing Nhl Refereeing

May 16, 2025 -

Triumf Tampy Bey Kucherov Vedyot Komandu K Pobede Nad Floridoy V N Kh L

May 16, 2025

Triumf Tampy Bey Kucherov Vedyot Komandu K Pobede Nad Floridoy V N Kh L

May 16, 2025 -

Kya Tam Krwz Ksy Kw Dyt Kr Rhe Hyn 2024 Ky Apdyt

May 16, 2025

Kya Tam Krwz Ksy Kw Dyt Kr Rhe Hyn 2024 Ky Apdyt

May 16, 2025 -

Jiskefet Toekenning Ere Zilveren Nipkowschijf

May 16, 2025

Jiskefet Toekenning Ere Zilveren Nipkowschijf

May 16, 2025 -

Dodgers Defeat Marlins Again Freeman And Ohtani Power Victory With Home Runs

May 16, 2025

Dodgers Defeat Marlins Again Freeman And Ohtani Power Victory With Home Runs

May 16, 2025