Trump's Tax Plan: The Challenges Of Passing Legislation In A Divided Congress

Table of Contents

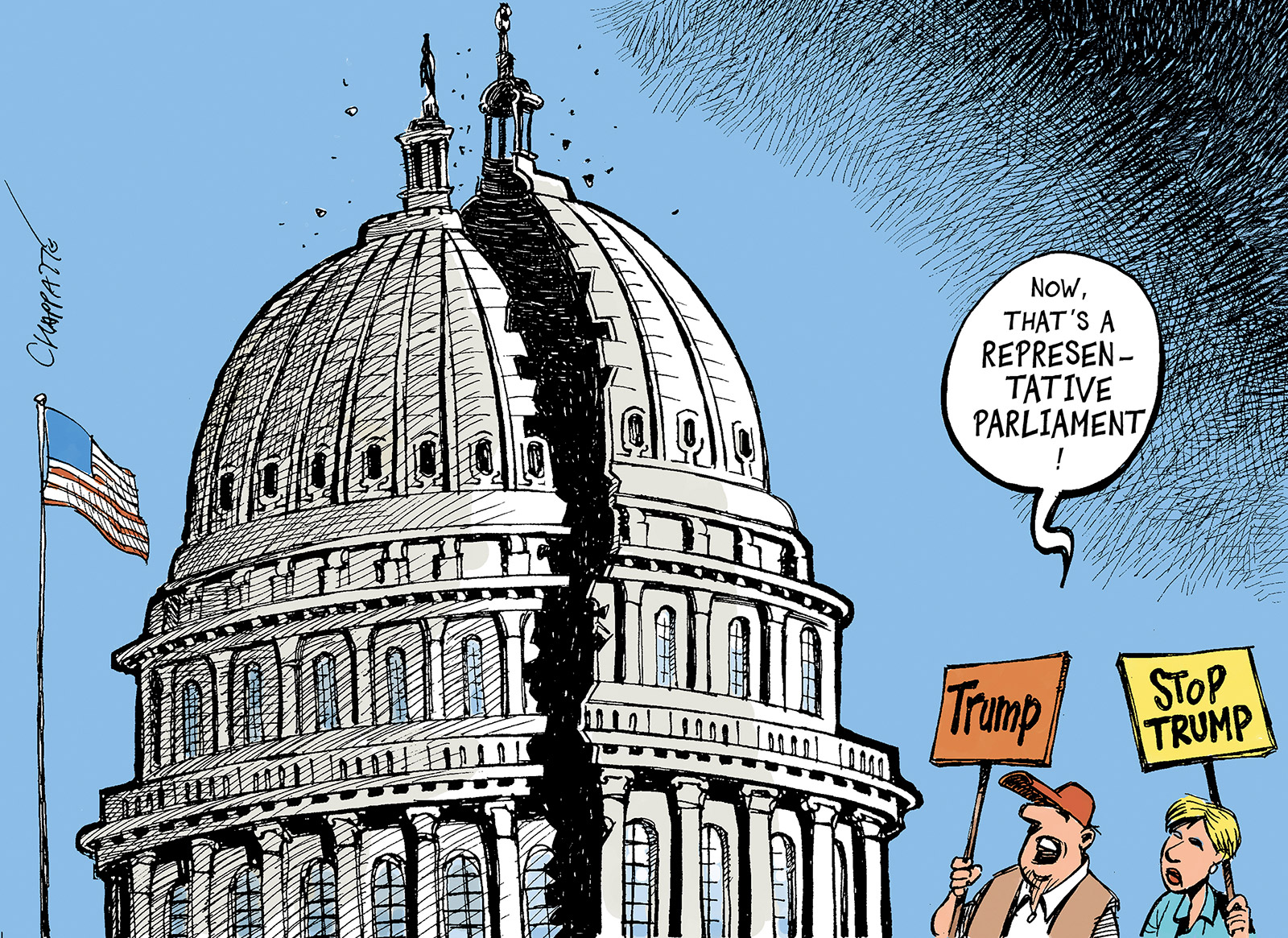

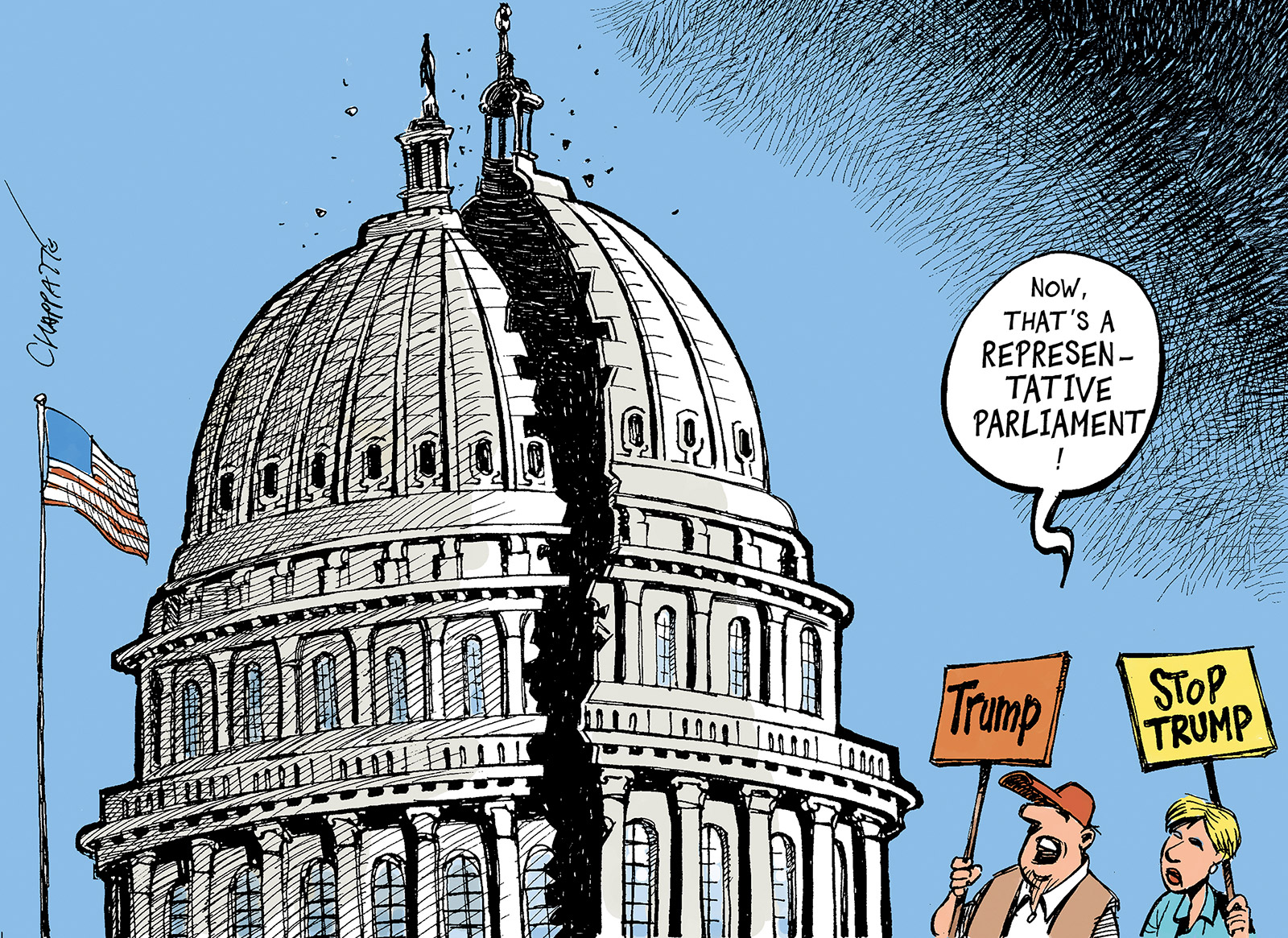

Partisan Divisions and Legislative Deadlock

Trump's tax proposals faced immediate and significant resistance from Democrats. The deep partisan divide in Congress created a major obstacle to the swift and smooth passage of the legislation. This ideological chasm stemmed from fundamentally different philosophies on taxation. Republicans largely favored lower taxes across the board, arguing it would stimulate economic growth through increased investment and job creation. Democrats, conversely, advocated for a more progressive tax system, arguing that tax cuts disproportionately benefited the wealthy while exacerbating income inequality.

- Differing philosophies on taxation: Republicans championed supply-side economics, while Democrats pushed for a more equitable distribution of wealth.

- Disputes over tax cuts for corporations vs. individuals: The plan's significant corporate tax cuts became a major point of contention, with Democrats arguing they would primarily benefit large corporations at the expense of individuals and small businesses.

- Debate regarding the impact on the national debt: Critics argued the tax cuts would dramatically increase the national debt, a concern that fueled opposition from fiscal conservatives within both parties.

- Filibusters and procedural roadblocks in the Senate: The narrow Republican majority in the Senate made the passage of the legislation extremely precarious. Democrats used procedural tactics, including the filibuster, to delay and obstruct the process.

The Role of Special Interests and Lobbying

The passage of Trump's tax plan was heavily influenced by intense lobbying efforts from various special interest groups. Corporations, unions, and advocacy groups all exerted considerable pressure to shape the final legislation to serve their interests.

- Corporate lobbying for lower tax rates: Large corporations lobbied heavily for lower corporate tax rates, which was a central feature of the Trump tax reform.

- Union lobbying for worker protections: Labor unions pushed for provisions to protect workers' rights and ensure that the tax cuts didn't lead to job losses or wage stagnation.

- Advocacy group lobbying for tax equity: Numerous advocacy groups lobbied against provisions they deemed unfair or regressive, arguing for greater tax equity and fairness.

This intense lobbying contributed to the final bill's complex and often contradictory provisions, reflecting the compromises made to secure enough votes for passage.

Economic and Political Considerations

Trump's tax plan was presented as a key element of his economic agenda, promising to boost economic growth and create jobs. Proponents argued the lower tax rates would incentivize investment, increase business activity, and lead to higher wages. However, critics countered that the tax cuts primarily benefited the wealthy and corporations, exacerbating income inequality and increasing the national debt.

- Impact on the national debt: The tax cuts significantly increased the national debt, a concern that continues to fuel political debate.

- Effects on different income brackets: The impact of the tax cuts varied across different income brackets, with higher-income earners receiving a larger share of the benefits.

- Political fallout for the ruling party: While the passage of the tax plan was a significant victory for the Republican party, it also faced criticism and contributed to political polarization.

Comparing Trump's Tax Plan to Previous Legislation

Trump's tax plan shared some similarities with previous tax reforms, particularly those enacted under Republican administrations. Like the Reagan tax cuts of the 1980s, it focused on lower tax rates for corporations and individuals. However, it also differed in certain aspects, such as the specific tax rates and the scope of deductions and credits.

- Similarities and differences in tax rates: While both aimed for lower rates, the specific percentages varied considerably across income brackets and corporate tax rates.

- Impact on specific sectors of the economy: Both plans had varying impacts on different sectors. For example, some sectors benefited disproportionately under Trump's plan compared to previous ones.

- Long-term economic consequences: The long-term economic effects of both Trump's plan and previous tax reforms are still debated, with differing conclusions among economists.

Analyzing the Legacy of Trump's Tax Plan and Future Implications

The passage of Trump's tax plan was marked by intense partisan conflict and significant lobbying efforts. The deep ideological divisions within Congress, coupled with the influence of powerful special interest groups, created a challenging legislative environment. The long-term economic and political ramifications of this legislation remain a subject of ongoing debate and analysis. Understanding Trump's Tax Plan is crucial for informed civic engagement. Continue your research using reputable sources to form your own opinion on its lasting effects.

Featured Posts

-

Interstate 83 Closed Following Produce Truck Accident

May 22, 2025

Interstate 83 Closed Following Produce Truck Accident

May 22, 2025 -

Dexter Resurrections Villain A Fan Favorite Resurfaces

May 22, 2025

Dexter Resurrections Villain A Fan Favorite Resurfaces

May 22, 2025 -

Ea Fc 24 Fut Birthday Comprehensive Tier List For The Best Players

May 22, 2025

Ea Fc 24 Fut Birthday Comprehensive Tier List For The Best Players

May 22, 2025 -

Financial Planning For Women Key Mistakes To Avoid

May 22, 2025

Financial Planning For Women Key Mistakes To Avoid

May 22, 2025 -

Lancaster County Fed Ex Truck Fire Closes Route 283

May 22, 2025

Lancaster County Fed Ex Truck Fire Closes Route 283

May 22, 2025

Latest Posts

-

Investigation Launched After Fed Ex Truck Fire On Route 283 Lancaster County

May 22, 2025

Investigation Launched After Fed Ex Truck Fire On Route 283 Lancaster County

May 22, 2025 -

Interstate 83 Closed Following Produce Truck Accident

May 22, 2025

Interstate 83 Closed Following Produce Truck Accident

May 22, 2025 -

Fed Ex Truck Catches Fire On Route 283 Lancaster County Traffic Delays

May 22, 2025

Fed Ex Truck Catches Fire On Route 283 Lancaster County Traffic Delays

May 22, 2025 -

Produce Truck Rollover Shuts Down Part Of Interstate 83

May 22, 2025

Produce Truck Rollover Shuts Down Part Of Interstate 83

May 22, 2025 -

I 83 Tractor Trailer Crash Involving Produce Shipment

May 22, 2025

I 83 Tractor Trailer Crash Involving Produce Shipment

May 22, 2025