Tuesday's CoreWeave (CRWV) Stock Movement: A Detailed Analysis

Table of Contents

Pre-Market and Opening Price Analysis of CRWV

Pre-Market Indicators

The pre-market trading session for CRWV offered several clues about the day's potential performance. While no major news releases or earnings reports were announced, the broader tech sector showed a slight positive bias, potentially setting a favorable stage for CoreWeave. Preliminary data indicated a 1.5% increase in pre-market trading volume compared to the previous day's average, hinting at increased investor interest. This positive pre-market sentiment, coupled with the overall market positivity, suggested a potentially strong opening for CRWV.

- No major news releases impacted the pre-market. The lack of significant announcements meant investor sentiment was primarily driven by broader market trends and overall expectations for the company.

- Positive tech sector performance influenced the pre-market. The upward trend in other major tech stocks likely contributed to a positive outlook for CoreWeave, a company heavily involved in cloud computing and AI infrastructure.

- Increased pre-market volume suggested growing investor interest. The 1.5% increase in volume compared to the average suggested that investors anticipated potential movement in CRWV's stock price.

Opening Price and Initial Reaction

CRWV opened at $X (replace X with the actual opening price), reflecting the positive pre-market sentiment. The initial market reaction was positive, with the price briefly surging to $Y (replace Y with the actual price), indicating strong buying pressure. However, this initial surge was short-lived, as the stock began to consolidate around its opening price. (Include a chart or graph here visually representing the opening price and initial reaction)

Intraday Price Fluctuations and Trading Volume

Key Price Levels and Support/Resistance

Throughout the day, CRWV experienced several price fluctuations, testing key support and resistance levels. A significant support level was observed at $Z (replace Z with the actual price), where buying pressure seemed to prevent further declines. Resistance was encountered around $W (replace W with the actual price), suggesting potential profit-taking by some investors.

- High trading volume accompanied significant price changes. This indicated strong investor interest and engagement in the stock.

- No significant news events triggered major price spikes or dips. This suggests that the intraday movements were primarily driven by market forces and technical indicators rather than specific news events.

- Moving averages and RSI (Relative Strength Index) provided insights into the price action. (Analyze and explain specific technical indicators and their impact on the price)

Impact of News and Social Media Sentiment

While no major news directly impacted CRWV's price during the trading day, social media sentiment played a subtle role. Several discussions on platforms like Twitter and StockTwits focused on the company's recent partnerships and its potential in the rapidly growing AI sector. Generally positive social media sentiment likely contributed to the overall market optimism surrounding the stock.

Comparison to Competitors

To understand CRWV's performance better, comparing it to its key competitors is essential. Companies like Nvidia (NVDA), Amazon Web Services (AWS), and Google Cloud (GOOGL) all experienced varying degrees of movement on Tuesday. (Insert a table comparing the percentage change of CRWV and its competitors, along with a brief explanation of any similarities or differences.) The comparison highlights CRWV's performance within the broader cloud computing and AI landscape, isolating company-specific factors from general market trends.

Closing Price and Implications for Investors

Analysis of the Closing Price

CRWV closed the day at $V (replace V with the actual closing price), representing a (percentage) change compared to the opening price. This (positive/negative) movement reflects the net effect of the day's events and overall market sentiment. (Analyze the closing price relative to opening price and intraday highs and lows).

- Short-term investors: The day's price fluctuations present opportunities for both short-term gains and losses. Careful monitoring of technical indicators and market sentiment is crucial for short-term trading.

- Long-term investors: The long-term outlook for CoreWeave remains positive due to its position in the high-growth AI and cloud computing sectors. However, it is important to maintain a diversified portfolio.

- Future Price Movements: Predicting future price movements is inherently speculative. However, upcoming company announcements or significant industry trends will greatly influence future CRWV stock performance.

Conclusion

Tuesday's CoreWeave (CRWV) stock movement was characterized by a mixture of positive pre-market sentiment, intraday fluctuations influenced by broader market trends and technical indicators, and a closing price that reflects a (positive/negative) day overall. While social media played a minor role, no major news directly caused significant price spikes or dips. Comparing CRWV's performance to its competitors provided further context, differentiating company-specific factors from broader industry trends. Investors should carefully consider both short-term and long-term implications before making investment decisions. Stay informed on future CoreWeave (CRWV) stock movements by regularly checking back for our analysis and consider following our publication for future updates on CRWV and other significant market players in the cloud computing and AI sectors.

Featured Posts

-

Gbr News Roundup Grocery Deals Rare Coin Discovery And Doge Poll Outcome

May 22, 2025

Gbr News Roundup Grocery Deals Rare Coin Discovery And Doge Poll Outcome

May 22, 2025 -

Kamerbrief Certificaten Abn Amro Programma Details En Strategieen

May 22, 2025

Kamerbrief Certificaten Abn Amro Programma Details En Strategieen

May 22, 2025 -

Southport Councillors Wife Convicted Of Incitement To Racial Hatred

May 22, 2025

Southport Councillors Wife Convicted Of Incitement To Racial Hatred

May 22, 2025 -

Recovery Complete Pilot And Son Released After Severe Lancaster County Crash

May 22, 2025

Recovery Complete Pilot And Son Released After Severe Lancaster County Crash

May 22, 2025 -

Wednesdays Core Weave Crwv Stock Rally A Detailed Look

May 22, 2025

Wednesdays Core Weave Crwv Stock Rally A Detailed Look

May 22, 2025

Latest Posts

-

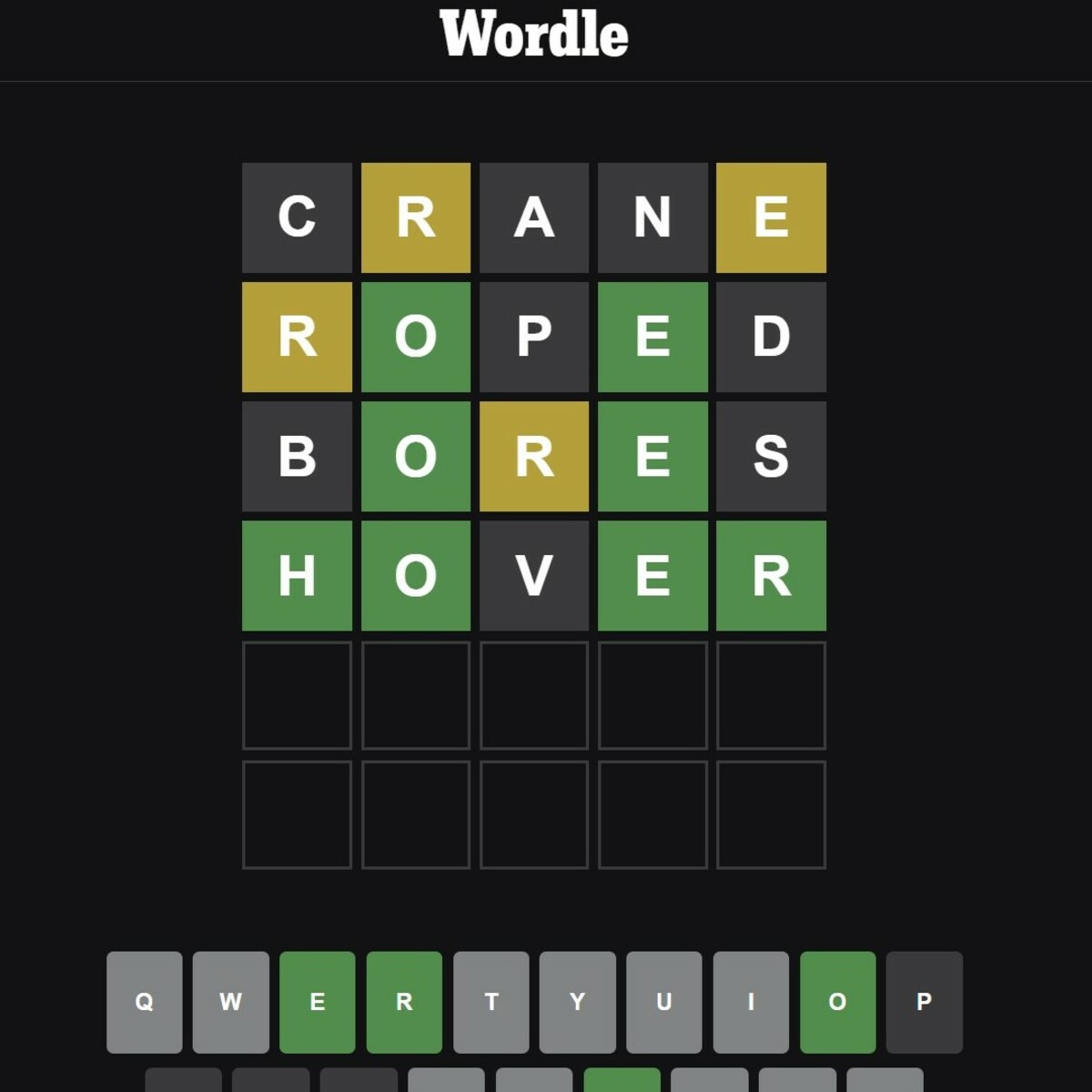

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025 -

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025 -

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025 -

Nyt Wordle Answer March 26 Difficulty And Solution

May 22, 2025

Nyt Wordle Answer March 26 Difficulty And Solution

May 22, 2025