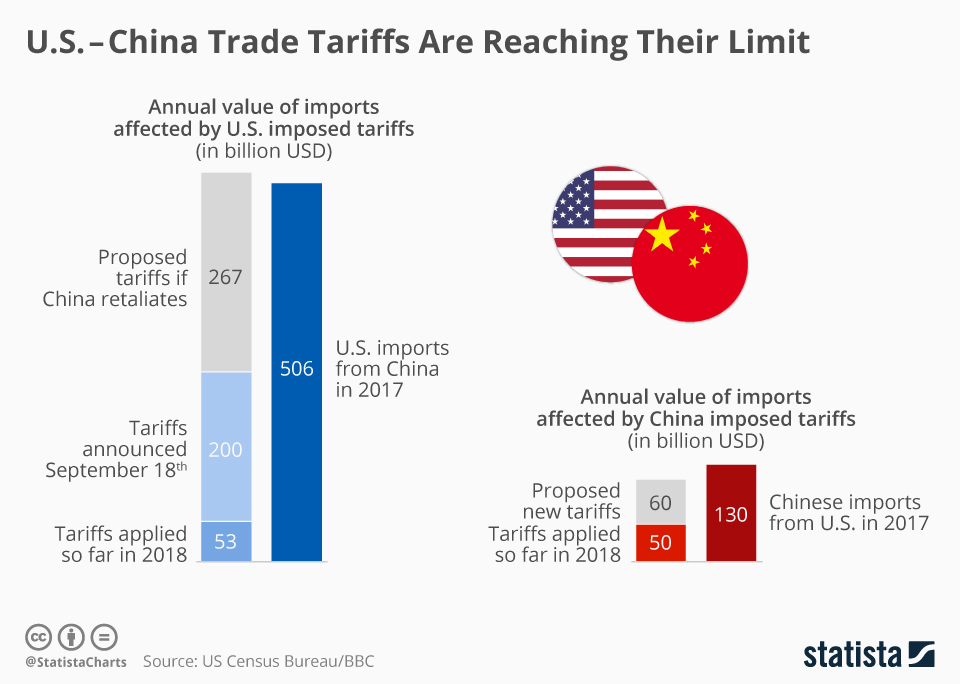

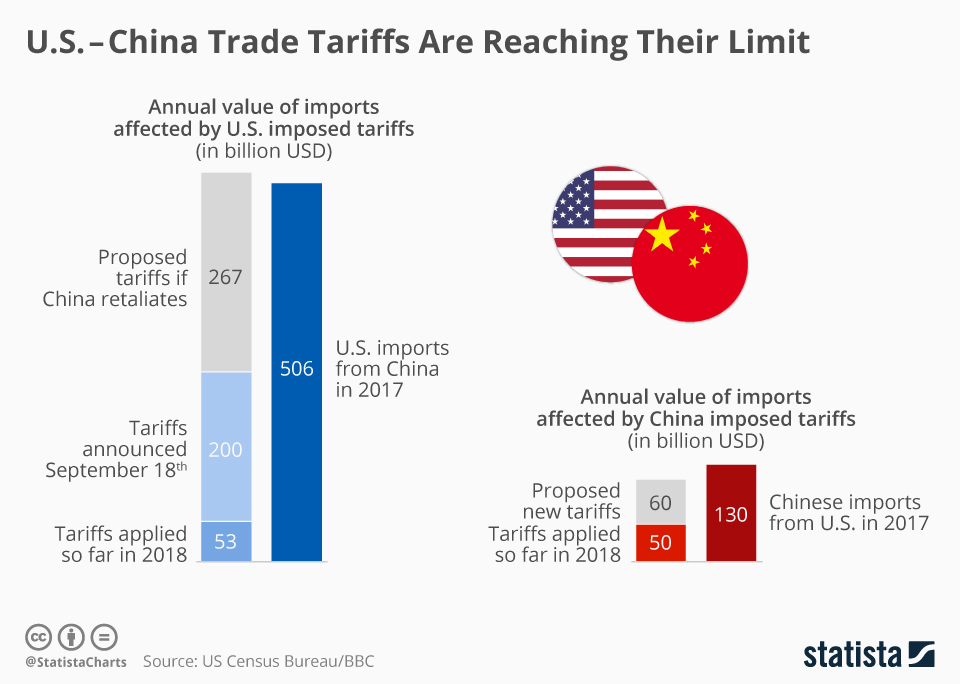

U.S.-China Tariff Rollback: Impact On The American Economy

Table of Contents

Impact on Consumer Prices

A U.S.-China tariff rollback would likely lead to significant changes in consumer prices. The reduction or elimination of tariffs on Chinese goods could trigger deflationary pressures, resulting in lower prices for consumers. This is because businesses would face reduced import costs, potentially leading them to lower their prices to remain competitive. Conversely, a rapid and significant rollback could disrupt markets, causing some temporary price instability.

- Lower prices for consumers: Consumers could see lower prices on a wide range of goods, including electronics, apparel, and household items, significantly impacting their purchasing power.

- Reduced import costs for businesses: Businesses that rely on imported Chinese goods would experience lower input costs, potentially boosting their profitability and competitiveness.

- Potential impact on inflation rates: The overall impact on inflation would depend on the scale and speed of the rollback, as well as other economic factors. A gradual rollback might lead to modest deflation, while a sudden and large-scale reduction could have more unpredictable effects.

- Specific product categories affected: The impact would vary across sectors. Electronics, apparel, and furniture are likely to see the most significant price reductions due to their high reliance on Chinese imports.

Effects on American Businesses and Industries

The effects of a U.S.-China tariff rollback on American businesses would be complex and varied. While some industries might benefit from increased competition and lower input costs, others might face challenges.

- Increased competitiveness for US manufacturers: Domestic manufacturers could find themselves competing more directly with cheaper Chinese imports, potentially leading to increased pressure on prices and profit margins.

- Potential job creation in affected industries: Depending on the industry, job creation could occur in sectors that benefit from the rollback, either through increased production or expansion into new markets.

- Impact on supply chains and logistics: Businesses would need to adjust their supply chains and logistics to account for the changes in import costs and tariffs, potentially increasing complexity and costs in the short term.

- Case studies of specific businesses and their experiences: Analyzing the experiences of individual companies in different sectors would provide valuable insight into the diverse impact of a tariff rollback. For instance, manufacturers of electronics and furniture may initially benefit from cheaper components but may also face increased pressure from competitors.

The Role of the Agricultural Sector

The agricultural sector is particularly sensitive to trade policies. Previous trade disputes between the U.S. and China significantly impacted American farmers. A tariff rollback could potentially reverse some of this damage.

- Increased demand for American agricultural products: Removal of tariffs on Chinese imports could lead to increased purchasing power for Chinese consumers, potentially stimulating demand for American agricultural exports.

- Impact on farmer incomes and profitability: Increased export opportunities could translate into higher incomes and improved profitability for American farmers.

- Potential for new trade agreements and partnerships: A successful tariff rollback could pave the way for new trade agreements and partnerships between the U.S. and China in the agricultural sector.

- Comparison of pre- and post-rollback market conditions: A thorough comparison of market conditions before and after the tariff rollback would reveal the extent of the impact on the agricultural sector.

Geopolitical Implications and International Trade Relations

The geopolitical consequences of a U.S.-China tariff rollback extend beyond the economic sphere.

- Improved US-China relations and diplomatic ties: A successful tariff rollback could signal a thawing of relations between the two countries, leading to improved diplomatic ties and cooperation on other global issues.

- Potential impact on global trade patterns: The rollback could influence global trade patterns, potentially leading to increased trade between the U.S. and China and potentially impacting relationships with other trading partners.

- Ripple effects on other international trade agreements: The decision to roll back tariffs with China could have ripple effects on other international trade agreements and negotiations.

- Analysis of potential shifts in global power dynamics: The impact of the rollback on the global economic order and the power dynamics between the U.S. and China requires careful consideration.

Analyzing the Long-Term Economic Effects

The long-term effects of a U.S.-China tariff rollback are difficult to predict with certainty, but several potential scenarios exist.

- Long-term economic growth projections: A successful rollback could contribute to sustained economic growth in the U.S. by increasing consumer spending and business investment.

- Potential for increased foreign investment: Improved relations between the U.S. and China could attract increased foreign investment in both countries.

- Impact on national debt and deficit: The impact on the national debt and deficit would depend on the interplay between increased economic activity and potential revenue gains from increased trade.

- Long-term sustainability of the economic effects: The long-term sustainability would depend on various factors, including maintaining stable trade relations, addressing underlying economic imbalances, and adapting to evolving global economic conditions.

Conclusion

The potential U.S.-China tariff rollback carries significant implications for the American economy. The impact will be felt across various sectors, including consumer prices, businesses, agriculture, and international trade relations. Understanding the potential effects on consumer purchasing power, industrial competitiveness, and agricultural exports is crucial for navigating the economic consequences. While a rollback could lead to lower prices for consumers, increased competition for some businesses, and a boost for the agricultural sector, it also carries potential risks and uncertainties. Understanding the complexities of the U.S.-China tariff rollback is crucial for navigating the future of American trade. Stay informed about developments in U.S.-China trade negotiations and the ongoing impact of tariff policy changes on the American economy. Analyzing the long-term consequences of these changes is crucial for policymakers and businesses alike.

Featured Posts

-

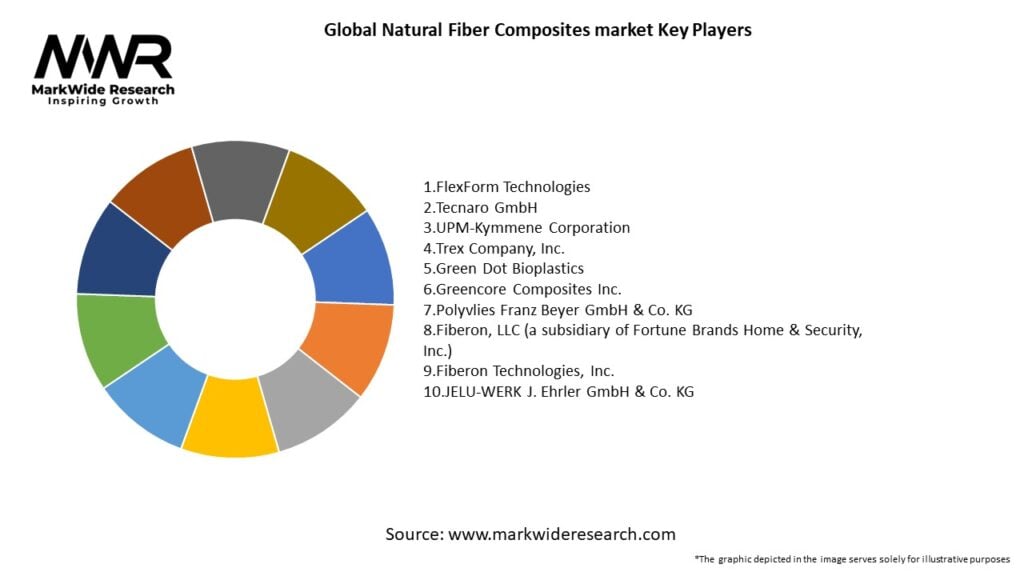

Natural Fiber Composites Market Global Forecast To 2029

May 13, 2025

Natural Fiber Composites Market Global Forecast To 2029

May 13, 2025 -

Resident Evil Afterlife Exploring The Characters And Their Journeys

May 13, 2025

Resident Evil Afterlife Exploring The Characters And Their Journeys

May 13, 2025 -

15 Year Old Stabbing Victims Funeral Service

May 13, 2025

15 Year Old Stabbing Victims Funeral Service

May 13, 2025 -

Inferno A Deep Dive Into Earth Series 1 Episode 1

May 13, 2025

Inferno A Deep Dive Into Earth Series 1 Episode 1

May 13, 2025 -

Kostyuk Prizval Sandu Snyat Zapret Na Vyezd Simiona V Moldovu Vizit Buduschego Prezidenta Rumynii V Kishinev

May 13, 2025

Kostyuk Prizval Sandu Snyat Zapret Na Vyezd Simiona V Moldovu Vizit Buduschego Prezidenta Rumynii V Kishinev

May 13, 2025