U.S. Dollar's Troubled Start: Worst 100 Days Since Nixon?

Table of Contents

Weakening Dollar: Key Indicators and Trends

The decline of the U.S. dollar is evident across several key indicators. The U.S. Dollar Index (DXY), a measure of the dollar against a basket of other major currencies, has experienced a significant drop in [Insert timeframe and percentage]. This weakening is particularly pronounced against the Euro and the Yen, reflecting a shift in global market sentiment.

- Decline against Euro, Yen, and other major currencies: The dollar's value has fallen considerably against the Euro, reaching its lowest point in [Number] years. Similar declines are observed against the Japanese Yen and other major global currencies. This indicates a loss of confidence in the dollar as a safe-haven asset.

- Impact on imports and inflation: A weaker dollar makes imports more expensive, potentially fueling inflation within the U.S. This could further erode the dollar's purchasing power and put pressure on the Federal Reserve to take further action.

- Decreased purchasing power: The declining value of the dollar means that U.S. consumers can buy less with their money when purchasing imported goods. This translates to a lower standard of living for many Americans.

- Potential impact on US Treasury yields: A weakening dollar can affect investor confidence in U.S. Treasury bonds, potentially leading to higher yields as investors demand a greater return to compensate for the increased risk.

Comparison to the Nixon Shock of 1971

The Nixon shock, marked by the closure of the gold window in August 1971, sent the global monetary system into disarray. The subsequent period witnessed high inflation and significant uncertainty. While a direct comparison is complex, some parallels exist with the current situation.

- Comparison of inflation rates: While inflation rates are currently [Insert current inflation rate] and were [Insert inflation rate in 1971] after the Nixon shock, the direction and the speed of change are factors to consider. Both periods show considerable inflationary pressure.

- Analysis of global economic conditions then and now: Both the post-Nixon era and the current period are characterized by significant geopolitical uncertainty and a complex global economic landscape. However, the specific challenges differ considerably. The 1970s saw the oil crisis, while today's challenges are more multifaceted.

- Parallel impacts on international trade: In both instances, a weakening dollar has had a significant impact on international trade flows, affecting the competitiveness of U.S. exports and influencing global trade balances.

- Differences in monetary policy responses: The Federal Reserve's response to the current situation differs significantly from the policies implemented following the Nixon shock. Today, the focus is on managing inflation through interest rate hikes, a contrasting approach to the earlier period.

Underlying Factors Contributing to Dollar Weakness

Several factors contribute to the current weakness of the U.S. dollar. These include:

- Inflationary pressures and rising interest rates: Persistent inflation in the U.S., coupled with the Federal Reserve's aggressive interest rate hikes to combat it, has created uncertainty in the markets. Higher interest rates, while aiming to curb inflation, can also attract foreign investment, strengthening the dollar, creating a contradictory effect.

- Geopolitical risks and uncertainties: The ongoing war in Ukraine, tensions with China, and other geopolitical uncertainties contribute to investor risk aversion, leading to a flight from the dollar to perceived safer assets.

- Fiscal policy and government debt: The high levels of U.S. government debt raise concerns about the country's long-term fiscal sustainability, impacting investor confidence in the dollar.

- Impact of global economic slowdown: The threat of a global recession further weighs on investor sentiment, impacting the dollar's value.

The Role of the Federal Reserve

The Federal Reserve's response to the weakening dollar has been crucial. Their actions include:

- Interest rate hikes and their impact: The Fed has significantly raised interest rates to combat inflation, but this strategy can have a complex effect on the dollar, potentially strengthening or weakening it depending on global market conditions.

- Quantitative tightening measures: The reduction of the Fed's balance sheet aims to curb inflation, but it also impacts liquidity in the market, potentially affecting the dollar's value.

- Communication strategy and market expectations: The Fed's communication strategy plays a critical role in shaping market expectations and influencing investor behavior, which in turn, affects the dollar's value.

Potential Implications and Future Outlook

The weakening dollar has broad implications, both domestically and internationally:

- Impact on global markets: Fluctuations in the dollar's value have ripple effects across global markets, affecting exchange rates, trade, and investment flows.

- Effect on US trade balance: A weaker dollar can make U.S. exports more competitive but also makes imports more expensive, affecting the trade balance.

- Potential for currency wars: A sustained decline in the dollar could spark competitive devaluations by other countries, leading to currency wars.

- Long-term implications for the US economy: The long-term consequences of a persistently weak dollar are uncertain and depend on the interplay of various economic factors.

Conclusion

The U.S. dollar's recent decline is a significant event with global implications. While direct comparisons to the post-Nixon era require nuanced analysis, the current situation presents clear challenges. The interplay of inflation, geopolitical risks, and Federal Reserve policies contributes to the uncertainty surrounding the dollar's future trajectory. Whether this truly represents the "worst 100 days" since Nixon remains debatable, but the present volatility warrants close monitoring. Stay informed about the ongoing developments related to the U.S. dollar's performance, and consult with financial advisors to assess the implications for your personal financial decisions. Understanding the ongoing implications of the U.S. dollar's troubled start is crucial for navigating the complexities of the global financial landscape.

Featured Posts

-

The Luigi Mangione Movement Understanding The Supporters Platform

Apr 28, 2025

The Luigi Mangione Movement Understanding The Supporters Platform

Apr 28, 2025 -

Millions Lost Office365 Security Failure Fuels Cybercrime Investigation

Apr 28, 2025

Millions Lost Office365 Security Failure Fuels Cybercrime Investigation

Apr 28, 2025 -

The Grim Truth About Retail Sales Implications For Bank Of Canada Rates

Apr 28, 2025

The Grim Truth About Retail Sales Implications For Bank Of Canada Rates

Apr 28, 2025 -

Weezer Bassists Wife Shot Lapd Videos Show Chaos And Confusion

Apr 28, 2025

Weezer Bassists Wife Shot Lapd Videos Show Chaos And Confusion

Apr 28, 2025 -

New Partner Joins Bubba Wallace And 23 Xi Racing

Apr 28, 2025

New Partner Joins Bubba Wallace And 23 Xi Racing

Apr 28, 2025

Latest Posts

-

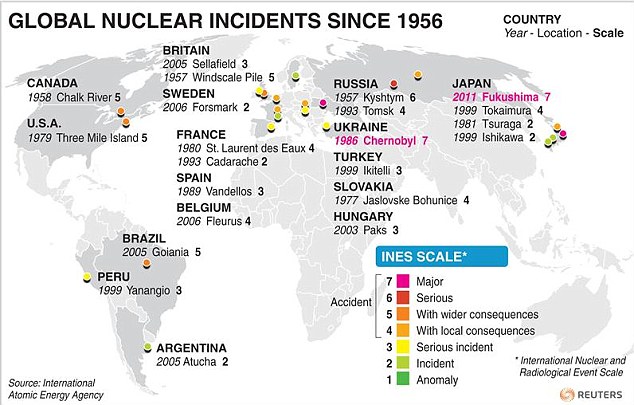

Faster Nuclear Power Plants Trump Administrations New Approach

May 11, 2025

Faster Nuclear Power Plants Trump Administrations New Approach

May 11, 2025 -

Nuclear Power Plant Construction Trump Team Weighs Faster Timeline

May 11, 2025

Nuclear Power Plant Construction Trump Team Weighs Faster Timeline

May 11, 2025 -

Trump Administration Considers Speeding Up Nuclear Power Plant Construction

May 11, 2025

Trump Administration Considers Speeding Up Nuclear Power Plant Construction

May 11, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 11, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 11, 2025 -

The Shrinking Chinese Market A Threat To Bmw Porsche And Competitors

May 11, 2025

The Shrinking Chinese Market A Threat To Bmw Porsche And Competitors

May 11, 2025