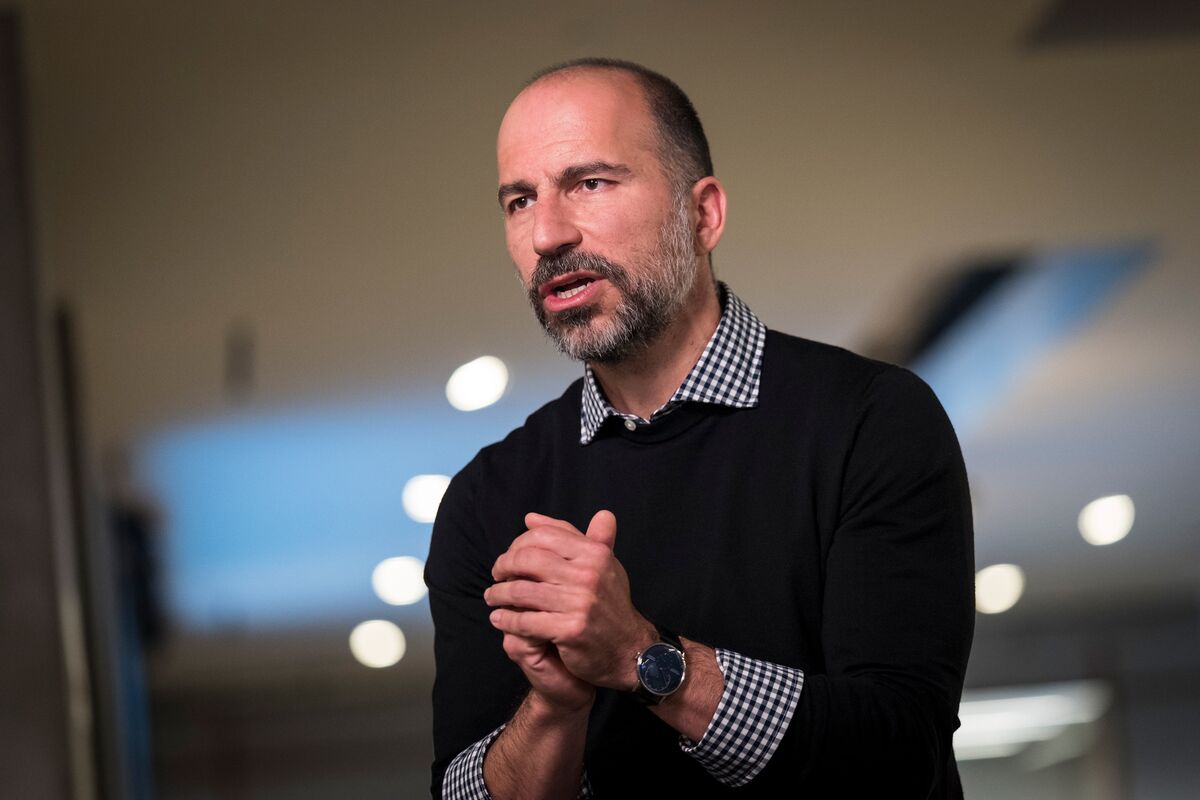

Uber Stock: A Recession-Resistant Investment?

Table of Contents

Uber's Business Model and Recessionary Pressures

Uber's core business revolves around connecting riders with drivers (ride-hailing) and consumers with restaurants (food delivery). However, its success during a recession hinges on several critical factors.

Demand Elasticity

A key concern is demand elasticity – how consumer spending on ride-sharing and food delivery changes during economic downturns.

- Ride-hailing: Recessions often lead to decreased discretionary spending. People may opt for cheaper transportation options like public transit or carpooling, impacting Uber's ride-hailing revenue.

- Uber Eats: While food delivery might seem recession-resistant, consumers often shift towards cheaper, value-oriented choices during hardship. This could mean less spending on premium restaurant meals delivered through Uber Eats.

- Counterpoint: Conversely, a recession might increase demand for affordable transportation options, potentially benefiting Uber's lower-cost ride options. This is a nuanced factor requiring careful analysis.

Pricing Strategies and Competitiveness

Uber's ability to dynamically adjust pricing is crucial during recessions.

- Maintaining Profitability: Lowering prices to maintain demand while managing driver compensation becomes a delicate balancing act.

- Competitive Landscape: Price wars with competitors like Lyft could severely impact profit margins, potentially outweighing any gains from increased demand for affordable rides.

- Cost Optimization: Uber must prioritize cost optimization and efficiency improvements to offset reduced revenue and maintain profitability. This could involve streamlining operations and negotiating better deals with suppliers.

Impact on Driver Base

A significant challenge during a recession is the potential reduction in the number of active drivers.

- Driver Incomes: Lower demand could lead to reduced driver income, causing some to leave the platform.

- Service Availability: A shrinking driver base directly impacts service availability and potentially customer satisfaction.

- Retention Strategies: Uber needs effective strategies to retain existing drivers and attract new ones, potentially offering incentives or improved benefits.

Uber's Diversification and Resilience Factors

Uber's diversification beyond ride-sharing offers some resilience against economic downturns.

Multiple Revenue Streams

Uber's revenue streams extend beyond ride-hailing:

- Uber Eats: Food delivery can show more resilience than ride-hailing during a downturn, as people still need to eat.

- Uber Freight: The freight business can provide a more stable revenue stream, less susceptible to discretionary spending changes.

- Other Services: Expansion into other areas like micromobility (scooters, bikes) offers additional diversification. The performance of each segment during a recession needs individual analysis.

Technological Innovation and Cost Reduction

Uber's investment in technology can contribute to its resilience:

- Efficiency Improvements: Technological advancements can optimize routing, reduce fuel consumption, and improve operational efficiency.

- Automation & Autonomous Vehicles: The long-term potential of automation and self-driving cars could significantly reduce operational costs, boosting profitability during challenging times.

- Enhanced Customer Experience: Improved technology can create a superior customer experience, leading to increased loyalty and retention.

Global Reach and Market Diversification

Uber's global presence is a key resilience factor:

- Geographic Diversification: Operating in multiple markets mitigates the impact of localized economic shocks. If one region experiences a downturn, others might perform well.

- Emerging Markets: Growth opportunities in emerging markets can help offset weakness in mature markets.

- Currency Fluctuations: Exposure to various currencies presents both opportunities and risks. Fluctuations need to be carefully monitored.

Financial Performance and Valuation

Assessing Uber's past performance and current valuation is crucial for determining its recession-resistance.

Historical Performance During Previous Recessions

Analyzing Uber's performance during past economic downturns (if applicable) provides valuable insights. Examining key financial metrics like revenue growth, profitability, and cash flow are crucial. This analysis requires comparing figures to overall market performance during those periods.

Current Valuation and Investment Risk

The current market valuation of Uber stock reflects investor sentiment and market conditions.

- Stock Price Volatility: Uber's stock price can be volatile, influenced by factors such as news, competitive pressures, and overall market sentiment.

- Risk Assessment: Investors must carefully assess the inherent risks associated with Uber stock, considering various economic scenarios and potential downturns.

- Upside Potential: Despite the risks, Uber's potential for growth and market share expansion represents a significant upside.

Conclusion

Uber stock presents a complex investment case regarding its recession resistance. While its diversified business model and technological capabilities offer some resilience, factors like demand elasticity and competitive pressures remain significant considerations. A thorough analysis of Uber's historical performance, current financial health, and future growth prospects is crucial for determining its suitability within a broader investment portfolio. Ultimately, whether Uber stock is a viable recession-resistant investment depends on individual risk tolerance and a comprehensive understanding of the company's strengths and vulnerabilities. Further research into the company's financial reports and industry analysis is strongly recommended before making any investment decisions related to Uber stock or any other similar high-growth company.

Featured Posts

-

Barcelona And Arsenal Battle For Angelo Stiller Signing

May 17, 2025

Barcelona And Arsenal Battle For Angelo Stiller Signing

May 17, 2025 -

Millions Stolen Hacker Targets Executive Office365 Accounts Fbi Reports

May 17, 2025

Millions Stolen Hacker Targets Executive Office365 Accounts Fbi Reports

May 17, 2025 -

Canadas New Tariffs On Us Goods Plummet Near Zero Rates With Key Exemptions

May 17, 2025

Canadas New Tariffs On Us Goods Plummet Near Zero Rates With Key Exemptions

May 17, 2025 -

Best Online Casinos In New Zealand 7 Bit Casino Review And Top Picks

May 17, 2025

Best Online Casinos In New Zealand 7 Bit Casino Review And Top Picks

May 17, 2025 -

Cheap But Good Where To Find Quality On A Budget

May 17, 2025

Cheap But Good Where To Find Quality On A Budget

May 17, 2025