Uber Stock Performance During Economic Downturns: A Deep Dive

Table of Contents

Uber's Performance During Past Recessions

Uber, as a publicly traded company, only has data available from after its IPO in 2019. Therefore, we cannot directly analyze its stock performance during the 2008 financial crisis. However, we can examine its performance during the COVID-19 pandemic, a period of significant economic disruption.

- Comparing Uber's Stock Performance to the Broader Market: During the initial stages of the COVID-19 pandemic (2020), Uber's stock price, like many others, experienced a sharp decline. However, it also demonstrated a quicker recovery than some other sectors, partly due to the sustained demand for its food delivery services (Uber Eats). This showcases the resilience of its diversified business model.

- Industry Trends Impacting Uber's Performance: The pandemic saw a massive shift towards remote work and stay-at-home orders, drastically reducing demand for ride-sharing services. This initially impacted Uber's revenue significantly. Conversely, the demand for food delivery skyrocketed, providing a crucial buffer.

- Reduced Consumer Spending Impact: Reduced consumer spending directly correlated with lower ride requests. Uber’s response included cost-cutting measures and strategic pivoting towards its food delivery and freight businesses.

- Business Model and Strategy Changes: Uber adapted by enhancing its safety protocols, promoting contactless delivery, and expanding its delivery services beyond food to encompass groceries and other essential goods. This agility proved vital to its survival during the economic downturn.

Factors Influencing Uber's Resilience During Economic Downturns

The Impact of Essential Services

Uber's diversified business model, offering essential services like ride-sharing and food delivery, plays a crucial role in its resilience during economic downturns.

- Demand for Services During Recessions: Even during economic hardship, people still require transportation and food. While demand might decrease, it doesn't disappear entirely. This inherent demand provides a safety net for Uber's revenue streams.

- Price Elasticity of Demand: Uber's services exhibit varying degrees of price elasticity. Ride-sharing demand is more elastic than food delivery, meaning that price increases can significantly impact ridership but might have less effect on food delivery orders (particularly for essential groceries).

- Adapting Pricing Strategies: Uber can adapt its pricing strategies to accommodate economic fluctuations. Offering discounts or promotions during downturns can stimulate demand and maintain revenue.

Cost-Cutting Measures and Operational Efficiency

Uber's ability to manage costs effectively during economic downturns significantly impacts its stock performance.

- Layoffs and Restructuring: Uber has a history of implementing layoffs and restructuring initiatives to streamline operations and reduce expenses during challenging economic times. This, although difficult, can improve its long-term financial health.

- Technological Advancements in Cost Reduction: Technological advancements in areas like route optimization, driver management, and automated customer service help reduce operational costs.

- Optimizing Operations for Efficiency: Uber constantly works on improving operational efficiency, from optimizing its logistics network to improving its internal processes. This enhances profitability even amidst economic uncertainty.

Predicting Future Uber Stock Performance During Economic Downturns

Analyzing Current Financial Health

Assessing Uber's current financial position is essential for predicting its future resilience.

- Debt Levels and Cash Reserves: Examining Uber's current debt-to-equity ratio and the level of its cash reserves provides insights into its financial strength and ability to withstand potential economic shocks.

- Profitability and Revenue Growth: Analyzing Uber's profit margins and revenue growth trajectory reveals its overall financial health and its ability to generate revenue even during economic downturns.

- Anticipated Regulatory Changes: Future regulatory changes in the ride-sharing and food delivery industries could significantly influence Uber's profitability and market share.

Considering Macroeconomic Factors

Macroeconomic factors significantly impact Uber's stock performance during economic downturns.

- Impact of Inflation: Inflation can affect Uber’s operational costs (fuel, wages) and consumer spending, impacting both ride-sharing and food delivery demand.

- Influence of Interest Rate Hikes: Interest rate hikes can increase borrowing costs and reduce investor sentiment, potentially leading to lower stock prices.

- Impact of Geopolitical Events: Geopolitical instability and global events can negatively affect consumer confidence and overall economic conditions, indirectly impacting Uber's performance.

Conclusion

Understanding Uber stock performance during economic downturns requires a multifaceted analysis. While Uber's diversified business model offers some resilience, its stock price is still susceptible to macroeconomic factors and consumer spending patterns. Its past performance during the COVID-19 pandemic demonstrated a degree of adaptability, but future performance will depend heavily on its ability to manage costs, innovate, and navigate unpredictable economic landscapes. Diversifying your investment portfolio and conducting thorough research are crucial before investing in any stock, especially during times of economic uncertainty.

Call to Action: Understanding Uber stock performance during economic downturns is vital for informed investment decisions. Continue your research and stay updated on the latest news and financial reports to make sound judgments regarding your Uber stock investments during future economic uncertainty. Learn more about effective strategies for navigating the volatility of Uber stock performance during economic downturns and building a resilient investment portfolio.

Featured Posts

-

Snls Latest Cold Open Republican Senators Crash A Teen Group Chat

May 18, 2025

Snls Latest Cold Open Republican Senators Crash A Teen Group Chat

May 18, 2025 -

Stan Wyjatkowy Podcast Onetu I Newsweeka Analiza Wydarzen

May 18, 2025

Stan Wyjatkowy Podcast Onetu I Newsweeka Analiza Wydarzen

May 18, 2025 -

Selena Gomez And Taylor Swift Feud A Wake Up Call Over Justin Baldoni Lawsuit

May 18, 2025

Selena Gomez And Taylor Swift Feud A Wake Up Call Over Justin Baldoni Lawsuit

May 18, 2025 -

Spring Breakout Rosters 2025 Unveiled

May 18, 2025

Spring Breakout Rosters 2025 Unveiled

May 18, 2025 -

Dutch Prefer De Escalation Over Retaliation Regarding Trump Tariffs

May 18, 2025

Dutch Prefer De Escalation Over Retaliation Regarding Trump Tariffs

May 18, 2025

Latest Posts

-

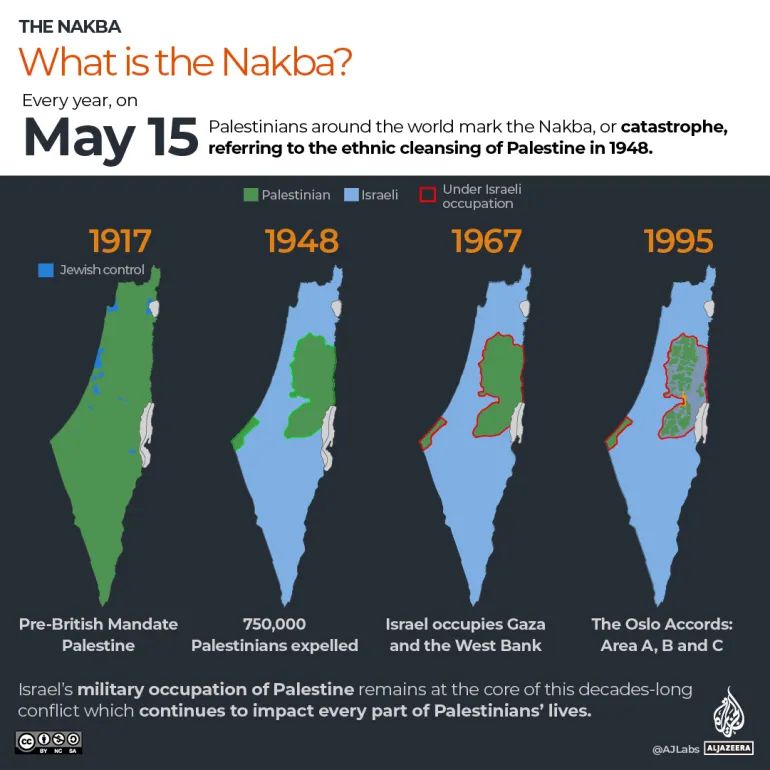

Infografis Krisis Israel Palestina Laporan Pbb Dan Peran Diplomasi Indonesia

May 18, 2025

Infografis Krisis Israel Palestina Laporan Pbb Dan Peran Diplomasi Indonesia

May 18, 2025 -

Abd Li Derginin Suriye Deki Tuerkiye Israil Catismasina Iliskin Uyarisi

May 18, 2025

Abd Li Derginin Suriye Deki Tuerkiye Israil Catismasina Iliskin Uyarisi

May 18, 2025 -

Penghargaan Oscar Untuk No Other Land Sebuah Refleksi Konflik Israel Palestina

May 18, 2025

Penghargaan Oscar Untuk No Other Land Sebuah Refleksi Konflik Israel Palestina

May 18, 2025 -

Infografis Pandangan Pbb Indonesia Dan Jalan Buntu Perdamaian Israel Palestina

May 18, 2025

Infografis Pandangan Pbb Indonesia Dan Jalan Buntu Perdamaian Israel Palestina

May 18, 2025 -

Abd Li Dergi Tuerkiye Israil Catismasi Ve Erdogan Netanyahu Karsilasmasi

May 18, 2025

Abd Li Dergi Tuerkiye Israil Catismasi Ve Erdogan Netanyahu Karsilasmasi

May 18, 2025