Uber Stock Performance During Economic Uncertainty

Table of Contents

Uber's Business Model and Vulnerability to Economic Downturns

Uber's business model, heavily reliant on discretionary spending, makes it susceptible to economic downturns. Analyzing its performance during periods of uncertainty requires examining both its core ride-hailing business and its newer ventures.

Impact of Recessions on Ride-Sharing Demand

During recessions, consumer spending often decreases. This directly impacts Uber's core ride-hailing business, as people reduce discretionary spending on non-essential services like ride-sharing.

- Decreased discretionary spending: Economic downturns lead to tighter budgets, with individuals prioritizing essential expenses over non-essential transportation.

- Increased reliance on public transport: As costs rise and disposable income falls, people may switch to cheaper alternatives such as public transportation.

- Layoffs impacting commuting patterns: Job losses during recessions directly reduce the number of people commuting, impacting daily ridership for Uber.

Historical data shows a clear correlation between economic recessions and a decline in Uber's ridership. For instance, during the 2008 financial crisis, many ride-sharing companies saw a significant drop in demand. While Uber didn't exist in its current form then, the general trend applies to its post-2008 operations.

Resilience of Uber Eats During Economic Uncertainty

While ride-hailing may suffer, Uber Eats, its food delivery service, demonstrates a degree of resilience during economic downturns. However, this resilience is not absolute and is subject to shifts in consumer behaviour.

- Increased demand for affordable meal options: During economic uncertainty, people may opt for home-cooked meals or cheaper delivery options, potentially benefiting services like Uber Eats.

- Potential shift towards grocery delivery: Economic hardship may lead consumers to increase their reliance on grocery delivery services for budget management and convenience.

- Impact of inflation on food delivery demand: High inflation significantly impacts consumer spending on non-essential items, potentially affecting the demand for food delivery even if it remains relatively resilient compared to ride-sharing.

Data from previous economic slowdowns suggests that Uber Eats has experienced less dramatic declines than its ride-hailing counterpart, indicating a degree of diversification within the Uber ecosystem.

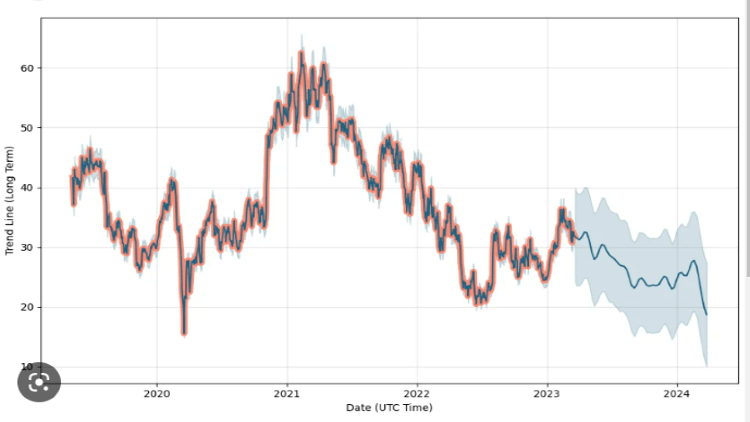

Analyzing Uber's Stock Performance Indicators During Periods of Uncertainty

Tracking specific financial metrics provides insights into Uber's performance during economic uncertainty. These indicators help investors assess the company's health and predict future stock movements.

Key Financial Metrics to Track

Several key financial metrics are crucial for evaluating Uber's stock performance during uncertain times:

- Revenue growth rates: Analyzing the rate of revenue growth provides insight into the company's ability to generate income despite economic headwinds.

- EPS trends: Earnings per share (EPS) indicate the profitability per share, providing valuable information about the company's financial health. A consistent or increasing EPS can be a positive sign.

- Operating profit margins: Operating profit margins show the efficiency of Uber's operations. Higher margins suggest better cost management.

- Debt-to-equity ratio: This ratio shows the proportion of Uber's funding coming from debt versus equity. High debt can increase risk during economic uncertainty.

These metrics, when analyzed over time, reveal patterns and trends that shed light on Uber's response to changing economic conditions. For example, a sharp decline in revenue growth alongside a decreasing EPS would be a warning sign.

Investor Sentiment and Stock Volatility

Investor sentiment and market sentiment play a significant role in shaping Uber's stock price. News, events, and analyst predictions heavily influence investor decisions.

- Impact of news on Uber's stock price: Positive news, like the successful launch of a new service, usually leads to a rise in stock price. Conversely, negative news can cause a decline.

- Correlation with broader market indices: Uber's stock price often correlates with the performance of broader market indices, meaning economic downturns often affect it negatively.

- Analyst ratings and predictions: Analyst ratings and predictions contribute significantly to investor sentiment and subsequent stock price movements.

Historical stock charts clearly demonstrate periods of significant volatility in Uber's stock price, often mirroring the broader market's reactions to economic news and uncertainty.

Strategies Uber Employs to Mitigate Economic Risks

Uber employs various strategies to mitigate economic risks and ensure its long-term viability.

Cost-Cutting Measures and Efficiency Improvements

Uber actively engages in cost-cutting measures to improve efficiency and profitability during uncertain times:

- Driver incentives and compensation adjustments: Managing driver compensation is crucial for maintaining profitability without alienating the driver base.

- Operational streamlining: Improving internal processes and reducing operational overhead contribute to cost savings.

- Investment in automation technologies: Automation can potentially increase efficiency and reduce reliance on human labor.

These strategies aim to maintain profitability even when demand fluctuates.

Diversification of Revenue Streams

Uber's expansion beyond ride-sharing into other areas like freight and autonomous vehicles reduces its dependence on a single revenue source, mitigating economic risks:

- Growth of Uber Freight: Uber Freight provides an alternative revenue stream less affected by economic fluctuations in passenger transport.

- Investments in autonomous driving technology: Long-term investments in autonomous vehicles represent a potential future driver of growth and efficiency improvements.

- Potential impact of these ventures on overall stock performance: Success in these areas can cushion Uber against potential downturns in its ride-hailing business.

These diversification efforts are crucial in navigating economic uncertainty and enhancing the long-term stability of Uber's stock performance.

Conclusion

Uber's stock performance during economic uncertainty is a complex interplay of various factors. Monitoring key financial metrics, like revenue growth, EPS, and operating margins, alongside investor sentiment and broader market trends, is crucial for understanding its trajectory. Uber's strategic moves toward cost-cutting and diversification into other revenue streams are vital in mitigating economic risks. Ultimately, successfully navigating economic downturns depends on adaptability, operational efficiency, and a strategic approach to business diversification. Stay ahead of the curve by continuously analyzing Uber stock performance and its sensitivity to macroeconomic trends.

Featured Posts

-

Unexpected Twist Coming In Final Destination Bloodline Says Director

May 19, 2025

Unexpected Twist Coming In Final Destination Bloodline Says Director

May 19, 2025 -

Rafael Nadal Confirma La Muerte De Leyenda Del Tenis Y Campeon De Hamburgo

May 19, 2025

Rafael Nadal Confirma La Muerte De Leyenda Del Tenis Y Campeon De Hamburgo

May 19, 2025 -

O Erotas Os Tampoy Fygi Kai Syllipsi Stis Skies

May 19, 2025

O Erotas Os Tampoy Fygi Kai Syllipsi Stis Skies

May 19, 2025 -

Dimereis Sxeseis Kyproy Oyggarias Sigiarto Kompos Syzitoyn Kypriako And Proedria Ee

May 19, 2025

Dimereis Sxeseis Kyproy Oyggarias Sigiarto Kompos Syzitoyn Kypriako And Proedria Ee

May 19, 2025 -

Kibris Baris Suerecinde Stefanos Stefanu Nun Olasi Katkilari

May 19, 2025

Kibris Baris Suerecinde Stefanos Stefanu Nun Olasi Katkilari

May 19, 2025