Uber Stock Soared In April: Key Factors Contributing To The Rally

Table of Contents

Strong Q1 2024 Earnings Beat Expectations

Uber's Q1 2024 earnings report significantly exceeded analyst predictions, providing a strong foundation for the April stock surge. Key metrics showcased impressive growth and profitability improvements, bolstering investor confidence in the company's future.

- Revenue Growth: Uber reported a year-over-year revenue growth exceeding [Insert Percentage]%, surpassing market expectations. This robust revenue growth signifies a healthy and expanding market for Uber's services.

- Profitability: Adjusted EBITDA showed a significant increase, demonstrating improved operational efficiency and cost management. Net income also exceeded predictions, signifying a positive shift in Uber's financial performance.

- Positive Guidance: The company's positive guidance for future quarters further fueled investor optimism, projecting continued growth and profitability in the coming months. This forward-looking perspective is crucial in driving investor confidence.

These strong Uber earnings, coupled with the positive Q1 results, signaled a healthy financial position and fueled the impressive gains seen in Uber's stock price. Analyzing Uber's revenue growth and profitability is crucial for understanding its overall financial performance.

Resurgence in Ride-Sharing Demand

A key driver of Uber's April stock rally was the resurgence in ride-sharing demand. This increase in consumer usage directly translated into higher revenues and contributed significantly to the company's strong Q1 performance. Several factors contributed to this upswing:

- Post-Pandemic Recovery: The continued global recovery from the pandemic led to increased mobility and travel, boosting ride-sharing demand.

- Easing of Travel Restrictions: The lifting of travel restrictions in many parts of the world further facilitated increased ridership.

- Increased Consumer Spending: Rising consumer confidence and spending power contributed to higher demand for ride-sharing services.

This translates to concrete numbers: Uber reported a [Insert Percentage]% increase in rides compared to the same period last year, with particularly strong growth in [mention specific geographic regions]. The return to office for many employees, a rise in events and tourism, all contributed to this increased demand within the mobility market. Understanding ride-sharing demand is crucial for comprehending Uber's growth trajectory.

Expansion into New Markets and Services

Uber's strategic expansion into new geographical areas and service offerings also played a significant role in the April stock price increase. This diversification strategy mitigates risk and positions Uber for continued long-term growth.

- Geographic Expansion: Uber continues to expand its reach into new cities and countries, tapping into previously underserved markets. [Mention specific examples].

- New Service Offerings: The continued expansion of Uber Eats and exploration into areas like Uber Freight demonstrates a commitment to diversification and capturing additional market share.

- Strategic Partnerships: Collaborations with other businesses contribute to Uber's expansion and reach. [Mention examples of successful partnerships].

This geographic diversification and the introduction of new services like Uber Eats and Uber Freight significantly contribute to Uber's revenue stream and market dominance. This expansion signifies Uber's growth ambitions and strengthens investor confidence in the company's future.

Positive Investor Sentiment and Market Conditions

The overall positive market sentiment towards tech stocks, coupled with specific positive news surrounding Uber, also contributed to the April rally.

- Tech Sector Optimism: A generally positive outlook for the tech sector, after a period of relative uncertainty, benefited Uber.

- Positive News and Announcements: Any positive news or announcements released by Uber itself (e.g., new partnerships, technological advancements, regulatory approvals) would have further bolstered investor confidence.

- Market Outlook: A positive market outlook increases risk appetite, making investors more likely to invest in growth stocks like Uber.

These factors collectively contributed to the improved investor sentiment surrounding Uber stock, leading to increased demand and driving up the price.

Conclusion: Understanding the Uber Stock Rally and Looking Ahead

The April surge in Uber stock price can be attributed to a combination of factors: strong Q1 earnings exceeding expectations, a resurgence in ride-sharing demand, successful expansion into new markets and services, and a positive overall market sentiment. These factors collectively highlight Uber's resilience and growth potential.

The findings underscore Uber's strong financial performance and its ability to adapt to changing market conditions. This makes Uber a compelling investment option for those interested in the transportation and delivery sectors. Stay informed about future Uber stock performance and consider how these factors might influence your investment decisions. The April rally in Uber stock serves as a reminder of the company's resilience and growth potential within the evolving transportation and delivery markets.

Featured Posts

-

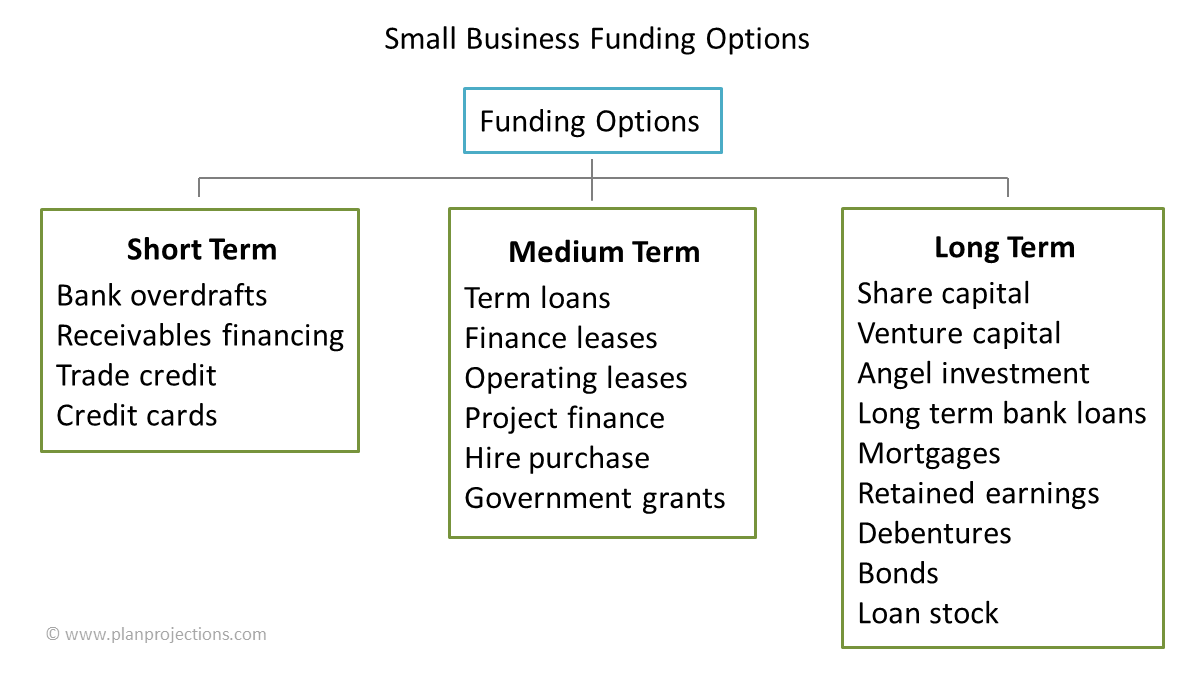

Sustainable Funding Options For Small And Medium Businesses

May 19, 2025

Sustainable Funding Options For Small And Medium Businesses

May 19, 2025 -

Analyzing Modern Life A Global Artworld Review 1850 1950

May 19, 2025

Analyzing Modern Life A Global Artworld Review 1850 1950

May 19, 2025 -

Millionkontrakt For Haaland Tynnplate As Innen Forsvarssektoren

May 19, 2025

Millionkontrakt For Haaland Tynnplate As Innen Forsvarssektoren

May 19, 2025 -

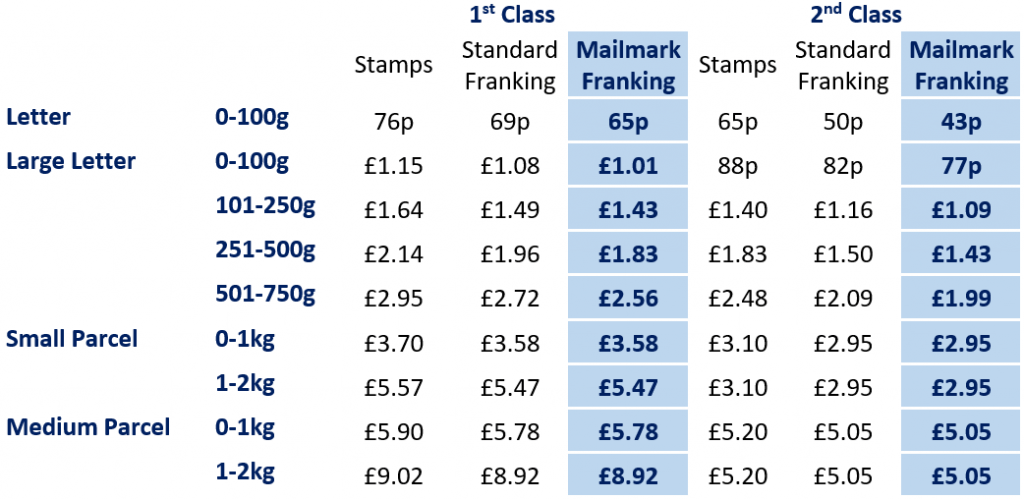

Royal Mail Doubles Stamp Prices Unfair Or Necessary

May 19, 2025

Royal Mail Doubles Stamp Prices Unfair Or Necessary

May 19, 2025 -

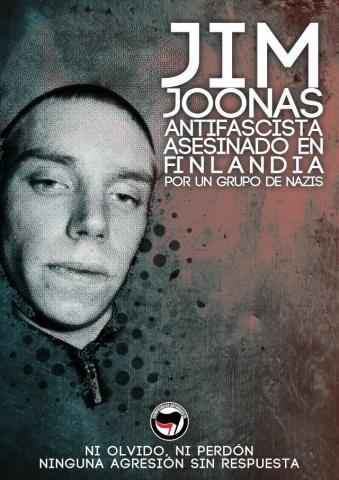

Eurovision 2024 La Sorprendente Eleccion De Un Grupo Finlandes Para Representar A Suecia En Sueco

May 19, 2025

Eurovision 2024 La Sorprendente Eleccion De Un Grupo Finlandes Para Representar A Suecia En Sueco

May 19, 2025