Uber Stock: Weathering The Economic Storm? Analyzing Recession Resistance

Table of Contents

Uber's Diversified Revenue Streams: A Buffer Against Economic Downturns

Uber's business model is significantly more diversified than many might initially assume, offering a crucial buffer against economic downturns. This recession-resistant business model relies on multiple revenue streams, reducing dependence on any single sector and mitigating the risk associated with economic volatility. Instead of relying solely on ridesharing, Uber offers a diverse portfolio of services.

- Ridesharing: While ridesharing demand might decrease during a recession as people cut back on discretionary spending, it remains a core part of Uber's operations.

- Uber Eats: Food delivery often sees increased demand during economic downturns. As people choose to dine in more frequently due to budget constraints, the demand for food delivery services like Uber Eats can actually rise. This provides a counterbalance to potential declines in ridesharing revenue.

- Uber Freight: This segment provides a unique counter-cyclical element. During economic uncertainty, supply chains often undergo significant adjustments, leading to increased demand for efficient freight transportation solutions. Uber Freight is well-positioned to benefit from this increased demand.

- Uber One Subscription Service: Subscription services offer recurring revenue, further stabilizing the business and providing a predictable income stream, regardless of short-term economic fluctuations. This consistent revenue stream helps to mitigate the impact of downturns in other sectors. This element of Uber revenue diversification is vital to its overall economic resilience.

Pricing Strategies and Demand Elasticity in a Recession

Uber's ability to adjust pricing in response to changing demand is a key factor in its potential recession resistance. Understanding demand elasticity analysis is crucial here.

- Surge Pricing: Uber utilizes surge pricing during peak demand periods to offset lower demand times. This dynamic pricing model allows them to maintain profitability even when overall demand fluctuates.

- Historical Data: Analyzing Uber's recessionary pricing adjustments during previous economic slowdowns reveals valuable insights into their responsiveness to changing market conditions. Past performance doesn't guarantee future results, but studying these patterns can provide valuable clues.

- Price Sensitivity: The degree of price sensitivity among consumers during a recession is a crucial factor. Uber will need to carefully balance price increases with the potential for reduced demand to maintain a profitable equilibrium. This involves a complex interplay between pricing and consumer behavior.

Cost-Cutting Measures and Operational Efficiency

Uber's ability to control costs and enhance efficiency will be critical in navigating economic headwinds. Effective financial resilience strategies are essential.

- Past Initiatives: A review of past Uber cost-cutting initiatives and their effectiveness provides valuable insights into the company's capacity for fiscal prudence. This examination should analyze both successes and failures to inform future strategies.

- Future Strategies: Identifying and implementing operational efficiency improvements will be crucial. This could involve optimizing logistics, enhancing driver management systems, and streamlining administrative processes.

- Competitive Analysis: Analyzing Uber's operational efficiency compared to competitors helps assess its relative strength and identify areas for improvement. Benchmarking against rivals is a useful tool for identifying best practices.

External Factors Influencing Uber Stock Performance

Several macroeconomic factors can significantly impact Uber's stock performance, regardless of its internal resilience.

- Inflation: Inflation's effect on Uber stock is multifaceted. Rising inflation can increase operating costs (fuel, driver wages) and reduce consumer spending, impacting demand. However, it can also provide an opportunity for price increases to offset higher expenses.

- Interest Rates: Interest rate hikes affect Uber's borrowing costs and investor sentiment. Higher interest rates generally increase the cost of capital, potentially hindering growth and impacting stock valuation.

- Fuel Prices: Fluctuations in fuel prices directly influence both rider and driver costs. These price changes significantly impact operational expenses and can influence pricing strategies. Fuel price volatility is a persistent risk factor. The impact of these macroeconomic factors impacting Uber needs careful consideration.

Conclusion

Uber's potential for recession resistance is a complex issue. Its diversified revenue streams, dynamic pricing strategies, and potential for cost-cutting offer a degree of protection against recessionary pressures. However, external economic factors like inflation, interest rates, and fuel prices pose significant challenges. While the economic outlook remains uncertain, Uber's multifaceted business model offers a degree of protection. Further in-depth research and consideration of these factors are crucial before making any investment decisions regarding Uber stock. Continue your research into Uber stock recession resistance and related keywords to make informed choices.

Featured Posts

-

Nyc Rush Hour Stabbing Man Attacked Near Brooklyn Bridge Subway

May 18, 2025

Nyc Rush Hour Stabbing Man Attacked Near Brooklyn Bridge Subway

May 18, 2025 -

Daily Lotto Results Thursday 1 May 2025

May 18, 2025

Daily Lotto Results Thursday 1 May 2025

May 18, 2025 -

Indonesia Drug Case American Basketball Player Could Face Execution

May 18, 2025

Indonesia Drug Case American Basketball Player Could Face Execution

May 18, 2025 -

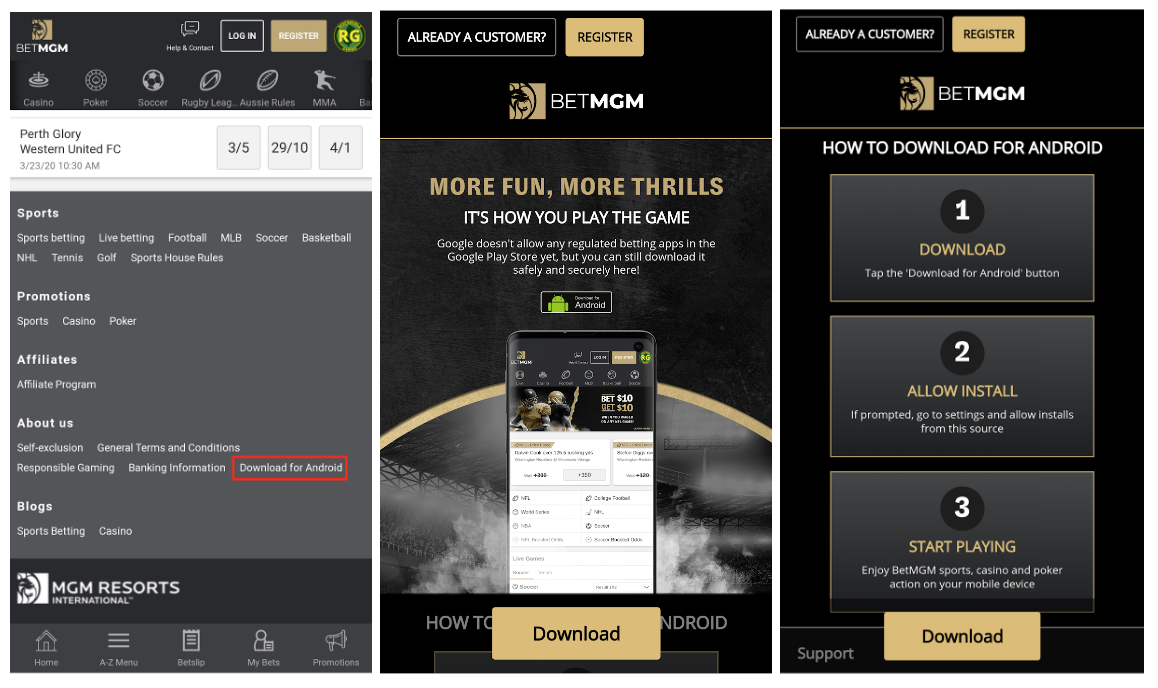

Unlock A 150 Bet Mgm Bonus With Code Cuse 150 Nj And Pa

May 18, 2025

Unlock A 150 Bet Mgm Bonus With Code Cuse 150 Nj And Pa

May 18, 2025 -

Jbss Batista Family Ends Banco Master Acquisition Negotiations

May 18, 2025

Jbss Batista Family Ends Banco Master Acquisition Negotiations

May 18, 2025

Latest Posts

-

Pedro Pascal Reveals Feelings For Jennifer Aniston Following Dinner

May 18, 2025

Pedro Pascal Reveals Feelings For Jennifer Aniston Following Dinner

May 18, 2025 -

Vstrecha Zelenskogo I Trampa Pedro Paskal Vyrazil Podderzhku Ukraine

May 18, 2025

Vstrecha Zelenskogo I Trampa Pedro Paskal Vyrazil Podderzhku Ukraine

May 18, 2025 -

Jennifer Aniston And Pedro Pascals Dinner The Aftermath

May 18, 2025

Jennifer Aniston And Pedro Pascals Dinner The Aftermath

May 18, 2025 -

Zustrich Zelenskogo Z Trampom Pedro Paskal Visloviv Pidtrimku Ukrayini

May 18, 2025

Zustrich Zelenskogo Z Trampom Pedro Paskal Visloviv Pidtrimku Ukrayini

May 18, 2025 -

Pedro Pascal On Jennifer Aniston I D Do Anything After Dinner Date

May 18, 2025

Pedro Pascal On Jennifer Aniston I D Do Anything After Dinner Date

May 18, 2025