Uber Stock's Double-Digit April Gain: A Deep Dive

Table of Contents

April saw Uber stock experience a remarkable double-digit jump, leaving many investors surprised and eager to understand the reasons behind this significant surge. This in-depth analysis explores the key factors contributing to this unexpected growth, examining market trends, Uber's Q1 2024 performance, and the company's future prospects. We'll delve into the potential for continued growth and assess what this means for future investment in Uber stock.

Analyzing Uber's Q1 2024 Earnings Report

Exceeding Expectations

Uber's Q1 2024 earnings report significantly surpassed analyst predictions, setting the stage for the April stock price increase. Key performance indicators (KPIs) showcased impressive growth across the board.

- Revenue Growth: Uber reported a [Insert Percentage]% increase in year-over-year revenue, exceeding expectations by [Insert Percentage]%.

- Increased Bookings: Total bookings surged by [Insert Percentage]%, demonstrating strong demand for both ride-sharing and food delivery services.

- Improved Profitability: Uber demonstrated significant improvements in its profitability metrics, showing a positive trend towards sustainable growth. [Insert specific data on improved margins or EBITDA].

- Positive EBITDA: The company achieved a positive EBITDA, indicating operational efficiency and strong financial health. [Insert specific EBITDA figures and comparisons to previous quarters].

This robust performance, marked by significant increases in revenue and bookings and positive EBITDA, signaled a turning point for the company and greatly influenced investor sentiment. The operational efficiency improvements suggest strategic cost-cutting measures are working effectively, contributing to the improved profitability.

Strong Growth in Ride-Sharing and Uber Eats

The positive Q1 results were driven by strong performance across both Uber's core segments:

- Ride-Sharing: Experienced a [Insert Percentage]% growth in active users, fueled by increased demand and successful marketing campaigns focusing on [mention specific campaigns or promotions]. Average trip values also increased by [Insert Percentage]%, indicating higher spending per ride. Expansion into new markets further contributed to this growth.

- Uber Eats: Showed a remarkable [Insert Percentage]% growth in active users and orders. The expansion of Uber Eats into new geographic areas and the introduction of new features like [Mention specific features e.g., subscription services, grocery delivery partnerships] boosted customer engagement and order frequency.

Uber's strategic focus on improving the rider and driver experience, coupled with effective marketing initiatives, has demonstrably contributed to its success in both the ride-sharing and food delivery sectors. The successful expansion into new markets showcases the company's adaptability and growth potential.

Favorable Market Conditions and Investor Sentiment

Improving Economic Outlook

The broader economic environment played a significant role in Uber's April stock surge. An improving economic outlook, characterized by the following factors, boosted investor confidence:

- Easing Inflation: Decreasing inflation rates reduced concerns about consumer spending and overall economic uncertainty.

- Positive Economic Indicators: Positive economic indicators, such as [mention specific indicators, e.g., employment figures, consumer confidence index], signaled a strengthening economy and increased consumer spending power.

- Increased Consumer Spending: A rise in consumer spending directly translated into increased demand for Uber's services, further bolstering the company's performance.

The positive correlation between macroeconomic improvements and Uber's stock price highlights the sensitivity of the stock to overall economic conditions. As the economy strengthens, investors are more willing to invest in growth stocks like Uber.

Shifting Investor Perception

Investor sentiment towards Uber, and the ride-sharing and delivery sectors in general, underwent a significant shift.

- Positive Analyst Upgrades: Several prominent financial analysts upgraded their ratings on Uber stock, citing improved financial performance and future growth potential. [Mention specific analyst firms and their reports].

- Increased Institutional Investment: Large institutional investors increased their holdings in Uber stock, signaling a growing confidence in the company's future. [Mention specific institutional investors if possible].

- Reduced Risk Aversion: A decrease in overall market risk aversion allowed investors to allocate more capital towards growth stocks, benefiting companies like Uber.

Previously held concerns about Uber's profitability and competition were largely alleviated by the Q1 results, leading to a significant positive shift in investor sentiment. This positive feedback loop further amplified the upward momentum of the Uber stock price.

Strategic Initiatives and Future Growth Prospects

Technological Advancements and Innovation

Uber's continued investment in technology is a crucial driver of its future growth.

- AI Integration: Uber's integration of artificial intelligence into its operations, from optimizing routing to improving customer service, is expected to enhance efficiency and reduce operational costs.

- Improved Driver/Rider App Experience: Continuous improvements to the user experience on both the driver and rider apps are designed to increase user satisfaction and engagement.

- New Features and Services: The introduction of new features and services, such as [mention specific examples, e.g., expanded delivery options, new transportation modes], will cater to evolving customer needs and expand the addressable market.

These technological advancements are not only enhancing efficiency but are also creating a competitive advantage for Uber in the rapidly evolving ride-sharing and delivery landscape.

Expansion Plans and International Growth

Uber's ambitious expansion plans are crucial for its long-term growth trajectory.

- New Market Entries: Uber continues to expand into new markets globally, tapping into underserved areas and increasing its addressable market. [Mention specific regions or countries].

- Strategic Partnerships: Strategic partnerships with local businesses and transportation providers are helping Uber to establish a strong foothold in new markets and gain access to local expertise.

- Geographical Diversification: Geographic diversification reduces reliance on any single market, mitigating risk and promoting sustainable growth.

These expansion strategies, coupled with the ongoing technological improvements, position Uber for continued growth and success in the years to come. However, the company will need to navigate the challenges inherent in entering new markets, including regulatory hurdles and intense competition.

Conclusion

Uber stock's impressive double-digit gain in April was driven by a confluence of factors: strong Q1 2024 earnings exceeding expectations, positive market sentiment fueled by an improving economic outlook, a shift in investor perception, and Uber's ongoing strategic initiatives focused on technological advancement and international expansion. While past performance is not indicative of future results, the company's positive trajectory warrants further consideration. Understanding the reasons behind Uber's impressive April performance offers valuable insights for investors. Analyze Uber stock's current performance and make informed investment decisions. Learn more about investing in Uber stock and explore its future growth potential.

Featured Posts

-

Nhanh Dau Miami Open 2025 Djokovic Va Alcaraz Ai Se Vao Chung Ket

May 18, 2025

Nhanh Dau Miami Open 2025 Djokovic Va Alcaraz Ai Se Vao Chung Ket

May 18, 2025 -

Snl Recreates Trump Zelensky Clash A Hilarious Yet Poignant Parody

May 18, 2025

Snl Recreates Trump Zelensky Clash A Hilarious Yet Poignant Parody

May 18, 2025 -

Hollywood At A Halt The Writers And Actors Joint Strike

May 18, 2025

Hollywood At A Halt The Writers And Actors Joint Strike

May 18, 2025 -

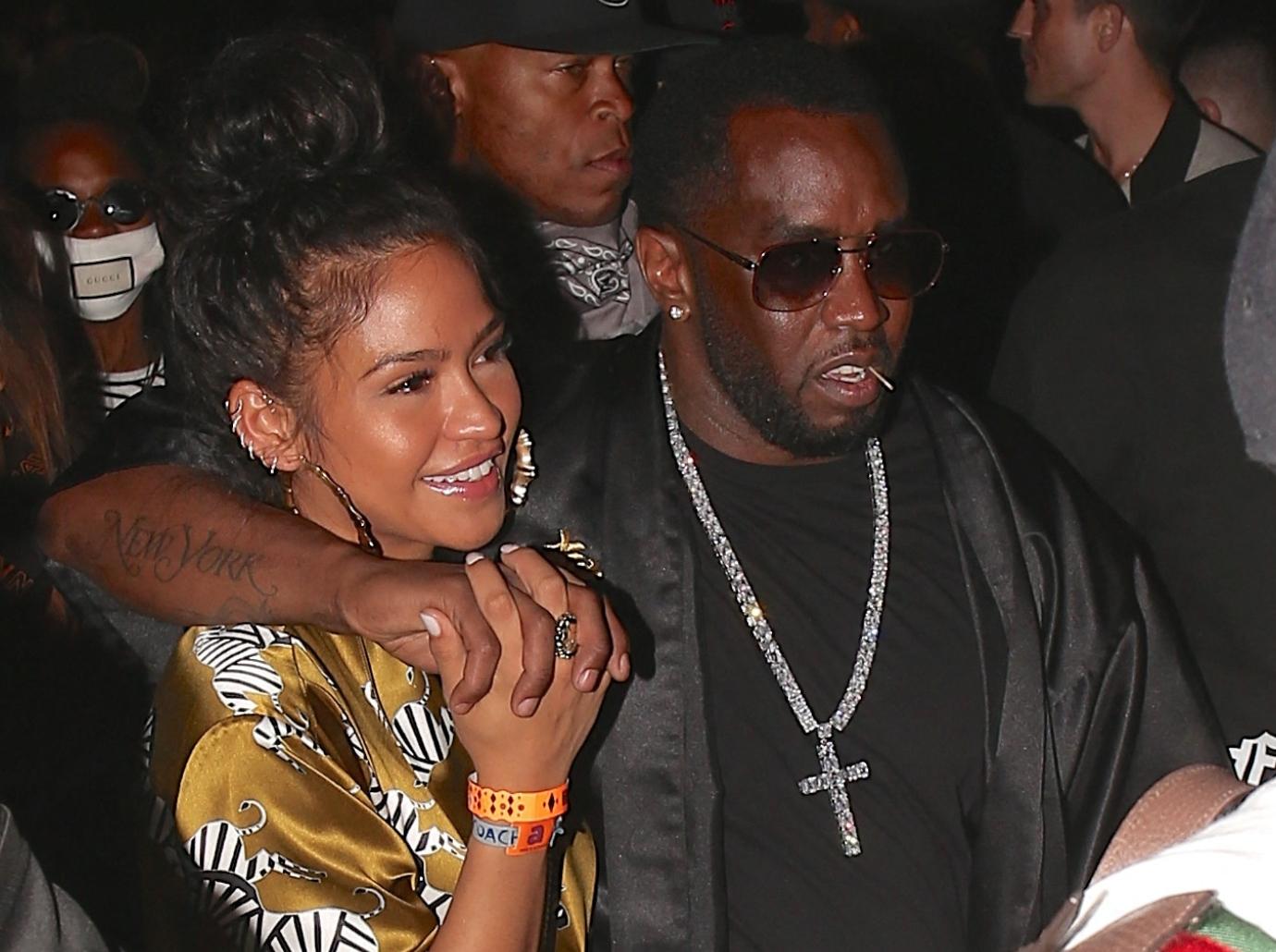

Analysis Of Testimony In The Sean Combs Trial Cassie Ventura And Dawn Richard

May 18, 2025

Analysis Of Testimony In The Sean Combs Trial Cassie Ventura And Dawn Richard

May 18, 2025 -

Find The Best No Deposit Bonus Codes May 2025

May 18, 2025

Find The Best No Deposit Bonus Codes May 2025

May 18, 2025

Latest Posts

-

Winning Daily Lotto Numbers Tuesday April 29 2025

May 18, 2025

Winning Daily Lotto Numbers Tuesday April 29 2025

May 18, 2025 -

29 April 2025 Daily Lotto Results Announced

May 18, 2025

29 April 2025 Daily Lotto Results Announced

May 18, 2025 -

Daily Lotto Winning Numbers For Monday April 28 2025

May 18, 2025

Daily Lotto Winning Numbers For Monday April 28 2025

May 18, 2025 -

Daily Lotto Tuesday 29 April 2025 Results

May 18, 2025

Daily Lotto Tuesday 29 April 2025 Results

May 18, 2025 -

Find The Daily Lotto Results For Monday April 28 2025

May 18, 2025

Find The Daily Lotto Results For Monday April 28 2025

May 18, 2025