Uber's April Surge: Understanding The Double-Digit Rally

Table of Contents

Improved Financial Performance and Earnings Beat

Uber's Q1 2024 earnings significantly exceeded analyst predictions, surpassing expectations across key metrics such as revenue growth and profitability. This strong performance was a major catalyst for Uber's April surge.

Exceeding Analyst Expectations

- Stronger-than-anticipated growth in ride-hailing and delivery services: Uber's core businesses showed remarkable resilience and growth, exceeding initial projections. This indicates a strong recovery from previous challenges and a robust demand for their services. Increased ridership and order volumes directly translated into higher revenue streams.

- Improved operational efficiency leading to higher profit margins: Uber implemented effective cost-cutting measures and optimized its operations, resulting in improved profit margins. This demonstrated the company's ability to manage expenses effectively and enhance profitability. Focus on streamlining processes and leveraging technology played a key role.

- Successful cost-cutting measures contributing to bottom-line improvements: Strategic initiatives to reduce operational costs, such as optimizing driver payouts and streamlining logistics, significantly contributed to the positive bottom line. These cost savings were a crucial factor in the overall improved financial performance.

Positive Revenue Trends

Consistent revenue growth across various segments signals strong market demand and the success of Uber's strategic initiatives. This sustained growth fueled investor confidence and contributed significantly to Uber's April surge.

- Expansion into new markets and service offerings: Uber's expansion into new geographical areas and the introduction of new services diversified its revenue streams, reducing reliance on any single market or product. This strategic diversification mitigated risk and contributed to growth.

- Increased market share in existing regions: Uber successfully gained market share in established regions, demonstrating its competitive edge and ability to capture a larger portion of the ride-sharing and delivery markets. This aggressive market penetration strategy contributed substantially to revenue growth.

- Effective pricing strategies and promotional campaigns: Strategic pricing adjustments and targeted promotional campaigns helped stimulate demand and optimize revenue generation. This demonstrated Uber's ability to dynamically manage pricing based on market conditions and consumer preferences.

Positive Market Sentiment and Investor Confidence

The positive market sentiment in April, coupled with improved investor confidence in Uber, played a crucial role in driving the stock price increase. This positive outlook was a significant contributor to Uber's April surge.

Overall Market Trends

The broader market's positive performance in April likely amplified the increased investor enthusiasm surrounding Uber.

- Correlation with broader technology sector growth: The positive trend in the technology sector generally boosted investor confidence in tech companies, including Uber. This positive industry sentiment created a favorable environment for Uber's stock.

- Improved investor sentiment towards the ride-sharing industry: A more positive outlook on the ride-sharing industry as a whole, reflecting recovery from pandemic-related disruptions and growing acceptance of the services, contributed to the increased optimism.

Strategic Initiatives and Future Outlook

Investors responded positively to Uber's announced strategic initiatives, indicating confidence in the company's long-term growth strategy. This forward-looking optimism contributed significantly to Uber's April surge.

- Investments in autonomous vehicle technology: Investments in autonomous driving technology signaled to investors Uber's commitment to innovation and future growth potential. This long-term vision inspired investor confidence.

- Expansion into new mobility services (e.g., electric scooters, bike sharing): Diversification into related mobility services demonstrated Uber's adaptability and strategic thinking, enhancing investor confidence in its long-term vision.

- Focus on enhancing customer experience and loyalty programs: Improving customer satisfaction and loyalty through enhanced services and rewards programs signaled a commitment to long-term customer relationships and sustainable growth.

Addressing Previous Concerns and Challenges

Uber's proactive approach to addressing previous challenges also contributed to the improved investor sentiment and Uber's April surge.

Driver Concerns and Labor Relations

Uber's efforts to improve driver relations and address concerns about compensation and benefits likely played a role in the positive investor response.

- Improved driver pay and benefits packages: Enhanced compensation and benefit offerings for drivers improved their working conditions and reduced negative publicity surrounding the company's labor practices.

- Initiatives to enhance driver support and working conditions: Investing in driver support programs improved driver satisfaction and created a more positive public image for the company.

Regulatory Scrutiny and Legal Battles

Positive resolutions or reduced regulatory pressures could have further boosted investor confidence.

- Favorable rulings in ongoing legal disputes: Positive outcomes in legal battles reduced uncertainty and potential liabilities, boosting investor confidence.

- Reduced regulatory uncertainty: Easing regulatory pressures created a more stable and predictable environment for Uber's operations, leading to increased investor confidence.

Conclusion

Uber's April surge resulted from a combination of factors: exceeding earnings expectations, positive market sentiment, and progress in addressing past challenges. The double-digit rally reflects a renewed investor confidence in Uber's future. To stay informed about Uber's performance and predict future market movements, continue monitoring their financial reports and industry news. Understanding the nuances of Uber's April surge provides valuable insights into the ride-sharing market and aids in forecasting future trends. Keep analyzing the elements driving Uber's performance to interpret future stock price movements effectively. Stay updated on future developments related to Uber's April surge and similar market events by consistently following industry news and financial reports.

Featured Posts

-

Brooklyn Bridge Run Nyc Half Marathon Attracts Huge Crowd

May 18, 2025

Brooklyn Bridge Run Nyc Half Marathon Attracts Huge Crowd

May 18, 2025 -

Metamorfosi Tis Ellinikis Naytilias Odigos Gia Pagkosmio Kentro

May 18, 2025

Metamorfosi Tis Ellinikis Naytilias Odigos Gia Pagkosmio Kentro

May 18, 2025 -

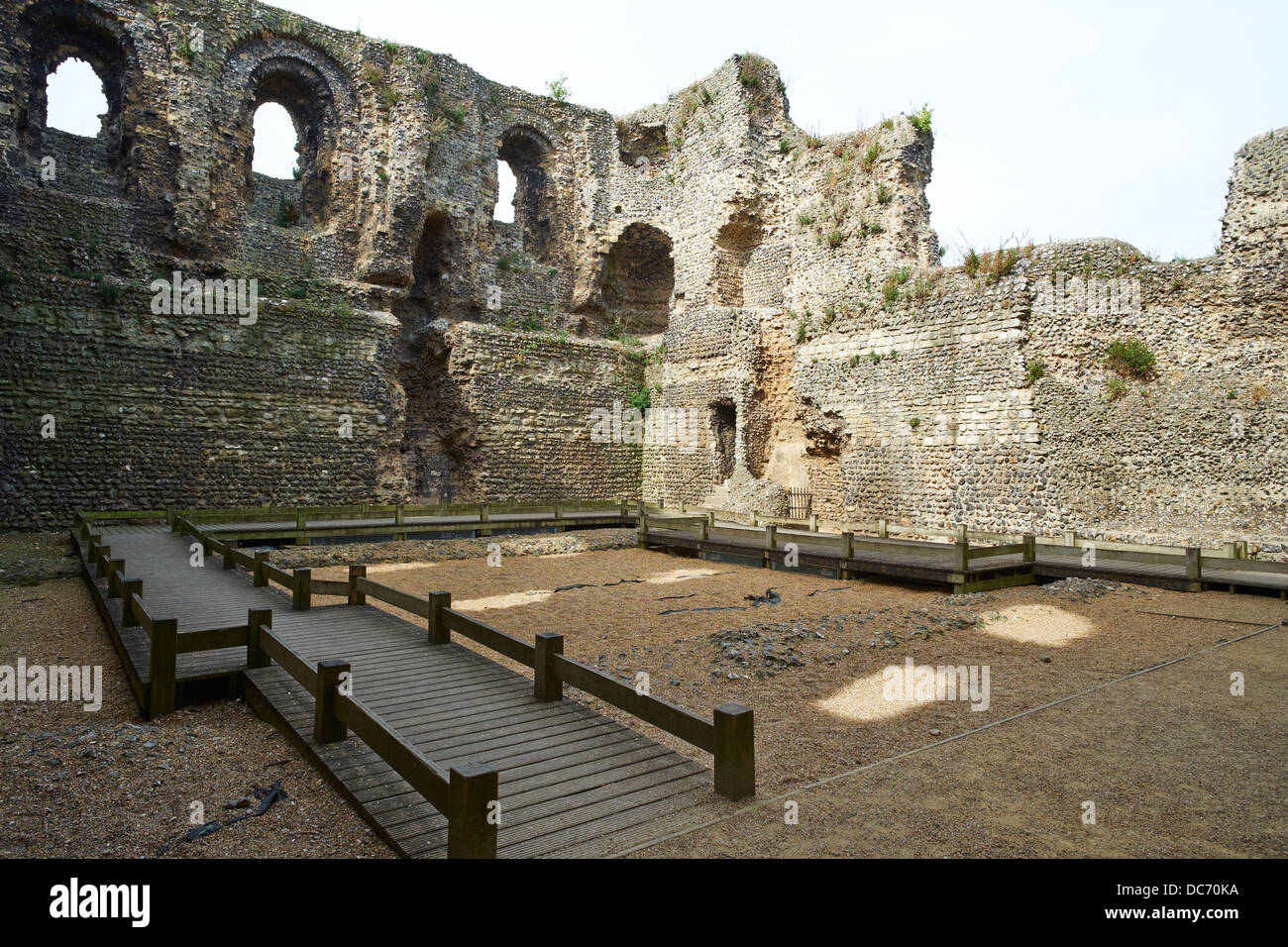

Canterbury Castle Sold For 705 499 A Historic Landmark Changes Hands

May 18, 2025

Canterbury Castle Sold For 705 499 A Historic Landmark Changes Hands

May 18, 2025 -

No Deposit Bonus Codes April 2025 Edition

May 18, 2025

No Deposit Bonus Codes April 2025 Edition

May 18, 2025 -

Novak Djokovic In Serveti 186 Milyon Dolarlik Gelirin Ayrintilari

May 18, 2025

Novak Djokovic In Serveti 186 Milyon Dolarlik Gelirin Ayrintilari

May 18, 2025

Latest Posts

-

Winning Daily Lotto Numbers Tuesday April 29 2025

May 18, 2025

Winning Daily Lotto Numbers Tuesday April 29 2025

May 18, 2025 -

29 April 2025 Daily Lotto Results Announced

May 18, 2025

29 April 2025 Daily Lotto Results Announced

May 18, 2025 -

Daily Lotto Winning Numbers For Monday April 28 2025

May 18, 2025

Daily Lotto Winning Numbers For Monday April 28 2025

May 18, 2025 -

Daily Lotto Tuesday 29 April 2025 Results

May 18, 2025

Daily Lotto Tuesday 29 April 2025 Results

May 18, 2025 -

Find The Daily Lotto Results For Monday April 28 2025

May 18, 2025

Find The Daily Lotto Results For Monday April 28 2025

May 18, 2025