Uber's Double-Digit April Rally: Reasons Behind The Surge

Table of Contents

Increased Rider Demand and Revenue Growth

The most significant driver of Uber's April stock surge was the undeniable increase in rider demand and subsequent revenue growth. This wasn't just a temporary blip; it reflects a broader trend pointing towards a strong recovery and positive future outlook for the company.

Post-Pandemic Recovery and Travel Boom

The resurgence of travel and in-person events post-pandemic played a crucial role in boosting Uber's ride-sharing services. People were eager to return to normal life, leading to a significant uptick in demand.

- Increased air travel: Many travelers used Uber for airport transfers, contributing to higher ridership.

- Return to offices: The return to in-person work led to increased commuting via Uber, especially in major metropolitan areas.

- Concerts and events: The revival of live events and entertainment boosted demand for rides to and from venues.

Data released by Uber itself showed a significant year-over-year increase in ride volume during April, exceeding pre-pandemic levels in many key markets. This substantial increase in Uber ride demand directly translated into significant revenue growth. The post-pandemic travel recovery is proving to be a strong tailwind for the company's financial performance, significantly impacting Uber revenue growth.

Effective Pricing Strategies and Dynamic Pricing

Uber's dynamic pricing model proved highly effective in capitalizing on the increased demand. By adjusting prices based on real-time supply and demand, Uber maximized revenue generation during peak periods.

- Dynamic pricing effectively managed surges in demand during rush hour and weekends, optimizing pricing for maximum profitability.

- The data clearly shows a correlation between the implementation of refined dynamic pricing and the overall increase in Uber revenue growth.

- While critics often point to the sometimes high cost of rides during peak times, the overall impact on revenue suggests that the model remains effective for Uber. Further analysis of price elasticity of demand during this period could shed further light on this strategy's effectiveness.

Improved Operational Efficiency and Cost-Cutting Measures

Beyond the surge in demand, Uber's improved operational efficiency and cost-cutting measures also contributed to the positive market reaction. The company has been actively investing in technology and streamlining its operations, leading to significant cost savings.

Technological Advancements and Automation

Uber's ongoing investment in technology has played a significant role in enhancing its operational efficiency and reducing costs. This includes several key areas:

- Improved route optimization: Sophisticated algorithms now create more efficient routes for drivers, reducing travel time and fuel consumption.

- AI-driven dispatch systems: AI optimizes driver allocation, ensuring faster pickup times and reducing wait times for riders.

- Driver management tools: Improved tools for driver communication and management have streamlined operations, improving driver satisfaction and reducing administrative costs.

These technological advancements have resulted in quantifiable cost savings for Uber, strengthening its profitability and positively impacting its stock price. The ongoing focus on Uber technology is a key factor in the company's improved financial performance.

Focus on Driver Retention and Engagement

High driver turnover is a major cost for ride-sharing companies. Uber's efforts to improve driver satisfaction and retention have yielded positive results, contributing to improved operational efficiency.

- Improved pay structures: Uber has implemented initiatives to increase driver earnings, making the job more attractive and reducing turnover.

- Increased benefits: Some initiatives offer drivers benefits such as health insurance or other perks.

- Improved communication and support: Increased driver support and feedback mechanisms have also improved driver satisfaction.

Data suggests that Uber's efforts in driver retention are paying off, leading to lower recruitment and training costs and improved overall operational cost management. A more satisfied and stable driver base leads to higher service quality and fewer operational disruptions.

Positive Investor Sentiment and Market Factors

The positive market reaction to Uber's April performance was also fueled by improved investor sentiment and favorable market conditions.

Strong Earnings Reports and Positive Future Outlook

Uber's strong earnings reports, showcasing significant revenue growth and improved profitability, boosted investor confidence.

- The company's recent earnings release highlighted substantial increases in revenue, surpassing analyst expectations.

- The positive financial results, combined with the company's optimistic future projections, significantly influenced investor sentiment.

- Many financial analysts issued positive reviews, contributing to the overall positive outlook for Uber's stock.

Broader Market Trends and Economic Factors

While Uber's performance was a key driver of the stock rally, broader market trends and economic factors also played a role.

- A generally positive market sentiment during April contributed to the upward momentum of technology stocks, including Uber.

- Favorable economic indicators, such as stable employment rates, also boosted investor confidence in the overall economy and the potential for growth in the ride-sharing sector.

- Other contributing factors, such as reduced inflationary pressures, also created a positive environment for stock market performance.

Conclusion

Uber's double-digit April rally was a result of a combination of factors, including increased rider demand fueled by post-pandemic recovery, improved operational efficiency through technological advancements and cost-cutting measures, and positive investor sentiment driven by strong earnings and a promising outlook. Understanding these contributing elements provides valuable insights into Uber's growth trajectory and potential for future success. To stay updated on Uber’s performance and other significant market movements affecting the ride-sharing industry, continue following our analysis of Uber's April stock surge and other relevant market trends.

Featured Posts

-

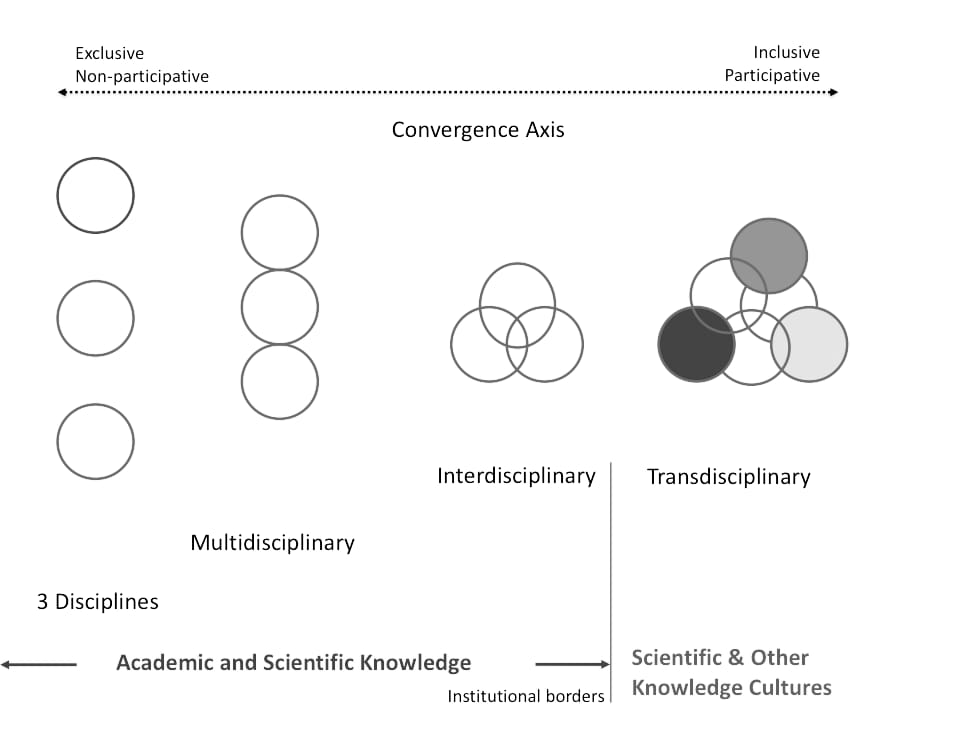

Understanding The Benefits Of Interdisciplinary And Transdisciplinary Collaboration

May 19, 2025

Understanding The Benefits Of Interdisciplinary And Transdisciplinary Collaboration

May 19, 2025 -

Kuzey Kibris In Lezzetleri Berlin De Bueyuek Ilgi Goerdue Itb 2024

May 19, 2025

Kuzey Kibris In Lezzetleri Berlin De Bueyuek Ilgi Goerdue Itb 2024

May 19, 2025 -

New Final Destination Bloodline Trailer A Look At Tony Todds Legacy

May 19, 2025

New Final Destination Bloodline Trailer A Look At Tony Todds Legacy

May 19, 2025 -

Investigation How Travel Blogger Jyoti Malhotra Shared Information With Pakistan

May 19, 2025

Investigation How Travel Blogger Jyoti Malhotra Shared Information With Pakistan

May 19, 2025 -

Testing Times Ny Mets Face Three Tough Series In May

May 19, 2025

Testing Times Ny Mets Face Three Tough Series In May

May 19, 2025