Ueda Cautious On Long-Term Yield Rise: Potential Economic Impacts Analyzed

Table of Contents

Governor Ueda's Concerns and the Bank of Japan's Stance

Governor Ueda's apprehension stems from the potential destabilization of the Japanese economy if long-term yields rise sharply and unexpectedly. The BOJ's current monetary policy, characterized by its yield curve control (YCC) policy and monetary easing, aims to maintain low borrowing costs to stimulate economic growth and achieve its inflation target. A significant increase in long-term yields directly challenges this strategy.

- Ueda's key quotes often emphasize the need for a gradual and controlled adjustment to interest rates, avoiding abrupt shocks to the market. His statements highlight the delicate balance between stimulating growth and managing inflation risks.

- Implications of his cautious stance: Ueda's cautious approach signals a preference for maintaining the status quo for the foreseeable future, unless compelling economic data necessitates a shift. This suggests that any changes to YCC will be incremental and data-dependent.

- BOJ's YCC limitations: The current YCC policy, which aims to keep the 10-year Japanese Government Bond (JGB) yield around zero, faces limitations. A persistent upward pressure on long-term yields could test the BOJ's ability to maintain control, potentially forcing a policy adjustment.

Potential Economic Impacts of Rising Long-Term Yields

Rising long-term yields have profound implications across various sectors of the Japanese economy. While some sectors might initially benefit, the overall effect could be negative.

- Impact on corporate investment: Higher borrowing costs directly translate to reduced capital expenditure and slower business expansion. Companies may postpone investment projects, leading to decreased productivity and economic growth. This is particularly relevant for businesses heavily reliant on debt financing.

- Effect on consumer spending: Increased mortgage rates and higher borrowing costs for consumer loans reduce disposable income and dampen consumer confidence. This can lead to decreased consumer spending, further hindering economic growth.

- Influence on government finances: The Japanese government has a massive national debt. A rise in long-term yields significantly increases debt-servicing costs, placing further strain on public finances.

- Potential for deflationary pressures: Reduced consumer demand and decreased business activity resulting from higher interest rates can reinforce deflationary pressures, counteracting the BOJ's efforts to achieve its inflation target.

Global Market Reactions and Interconnectedness

A rise in Japanese long-term yields has significant global repercussions, impacting foreign investment and the yen's exchange rate.

- Impact on the yen exchange rate: Rising yields could attract foreign investment into Japanese government bonds (JGBs), potentially strengthening the yen. However, this effect could be offset by capital flight if investors worry about the BOJ's ability to manage the situation.

- Consequences for foreign investors holding JGBs: A sudden and sharp rise in yields could lead to significant losses for foreign investors holding JGBs, potentially prompting them to sell their holdings, impacting market stability.

- Potential for capital flight from Japan: If investors lose confidence in the BOJ's ability to manage the situation, they may pull their investments out of Japan, weakening the yen and further destabilizing the economy.

- Spillover effects on other Asian economies: Given Japan's economic importance in Asia, any significant economic downturn in Japan could have substantial spillover effects on other Asian economies through trade and investment channels.

Alternative Scenarios and Policy Responses

The BOJ has several policy options if long-term yields continue to rise. However, each option comes with trade-offs.

- Adjustments to YCC: The BOJ could adjust its YCC target, allowing for a gradual increase in the 10-year JGB yield. This would signal a shift away from aggressive monetary easing but risks triggering market volatility.

- Further quantitative easing (QE) measures: The BOJ could increase its asset purchases to suppress long-term yields, but this could lead to concerns about the sustainability of this approach.

- Faster-than-expected exit from monetary easing: A more rapid exit from monetary easing could signal a greater confidence in the economy's resilience to higher interest rates, but it also carries the risk of triggering a sharper economic slowdown.

- Impact on inflation expectations: Policy responses aimed at controlling long-term yields could influence inflation expectations, potentially impacting the BOJ's ability to meet its inflation target.

Conclusion

Governor Ueda's caution regarding a sustained rise in long-term yields reflects a genuine concern about the potential for significant negative impacts on the Japanese economy. The interplay between the BOJ's monetary policy, global financial markets, and domestic economic conditions creates a complex and uncertain environment. The potential consequences, ranging from reduced investment and consumer spending to increased government debt burdens and deflationary pressures, are significant. Careful monitoring of the situation and a measured policy response are crucial. Understanding long-term yield implications and analyzing the impact of rising long-term interest rates are vital for investors and policymakers alike. Stay informed about the evolving situation by subscribing to our newsletter and following us on social media for the latest updates on the Bank of Japan's policy responses and their impact.

Featured Posts

-

Victor Fernandez Presente Y Futuro

May 29, 2025

Victor Fernandez Presente Y Futuro

May 29, 2025 -

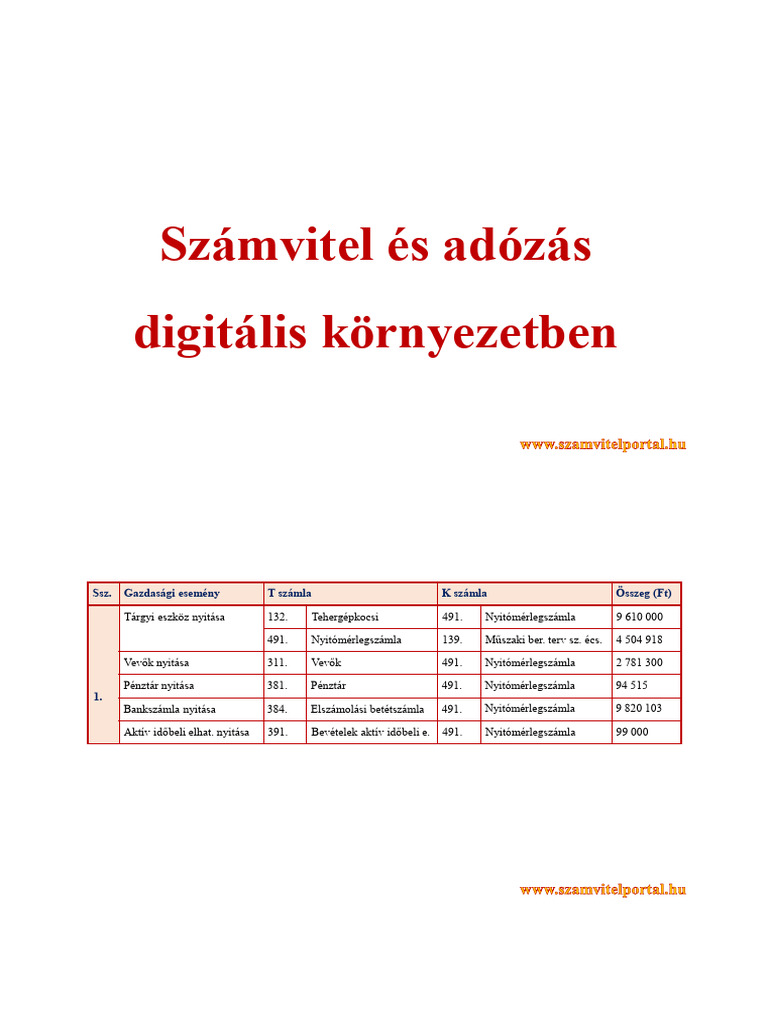

Bujkalo Kincsek Szazezres Erteket Erhetnek A Regisegek A Lakasodban

May 29, 2025

Bujkalo Kincsek Szazezres Erteket Erhetnek A Regisegek A Lakasodban

May 29, 2025 -

Draga Aukcios Tetelek A Vateran Ritkasagok Es Rekordarak

May 29, 2025

Draga Aukcios Tetelek A Vateran Ritkasagok Es Rekordarak

May 29, 2025 -

Live Nations Antitrust Battle Doj Claims Coercion Of Artists Through Venue Control

May 29, 2025

Live Nations Antitrust Battle Doj Claims Coercion Of Artists Through Venue Control

May 29, 2025 -

The Joshlin Case Kelly Smiths Emotional Response To Incrimination

May 29, 2025

The Joshlin Case Kelly Smiths Emotional Response To Incrimination

May 29, 2025

Latest Posts

-

Grigor Dimitrov Vliyanieto Na Kontuziyata Vrkhu Karierata Mu

May 31, 2025

Grigor Dimitrov Vliyanieto Na Kontuziyata Vrkhu Karierata Mu

May 31, 2025 -

Kontuziyata Na Grigor Dimitrov Aktualna Informatsiya I Analiz

May 31, 2025

Kontuziyata Na Grigor Dimitrov Aktualna Informatsiya I Analiz

May 31, 2025 -

Trumps Uncertainty What Made Him Question Elon Musk

May 31, 2025

Trumps Uncertainty What Made Him Question Elon Musk

May 31, 2025 -

Uncertainty And The End Trumps Doubts About Elon Before The Break

May 31, 2025

Uncertainty And The End Trumps Doubts About Elon Before The Break

May 31, 2025 -

Everything Revealed In The Star Trek Strange New Worlds Season 3 Teaser

May 31, 2025

Everything Revealed In The Star Trek Strange New Worlds Season 3 Teaser

May 31, 2025