UK Inflation Report: Pound Gains As BOE Cut Bets Diminish

Table of Contents

Inflation Figures and Market Reaction

The recently released UK Inflation Report revealed a Consumer Price Index (CPI) figure of [insert actual CPI figure]%, and a Retail Price Index (RPI) of [insert actual RPI figure]%. These figures represent [explain the percentage change compared to previous months/years – e.g., a significant decrease, a slight fall, etc.]. This was lower than the market consensus forecast of [insert market forecast]%, triggering a swift and decisive market response.

- Unexpectedly lower-than-anticipated inflation figures: The lower-than-expected inflation data surprised economists and analysts alike, prompting a reassessment of the economic outlook.

- Market response: Pound Sterling strengthens against major currencies (USD, EUR): The pound immediately strengthened against major global currencies, such as the US dollar and the Euro, reflecting increased investor confidence in the UK economy. GBP/USD saw a rise of [insert percentage change], while GBP/EUR experienced a [insert percentage change] increase.

- Reduced expectations of further BOE rate cuts: The improved inflation figures significantly reduced market expectations of further interest rate cuts by the Bank of England. Traders adjusted their forecasts, pricing in a lower probability of future monetary easing.

- Impact on government bonds (gilts): The unexpected positive news also impacted government bond yields (gilts), with yields [rising/falling] reflecting the shift in expectations regarding future interest rates.

The market's interpretation of this data hinges on the reduced likelihood of further monetary stimulus. Lower inflation reduces the pressure on the BOE to cut interest rates further, thereby supporting the pound and boosting investor sentiment.

Bank of England's Response and Future Outlook

The Bank of England's response to the UK Inflation Report will be closely scrutinized in the coming weeks. While a formal statement is pending, early indications suggest [mention any initial comments or hints from the BOE].

- BOE's likely stance on future monetary policy: The BOE is likely to maintain a watchful approach, carefully monitoring inflation data and economic indicators before making any significant changes to its monetary policy stance.

- Potential implications for interest rates in the coming months: The reduced need for immediate rate cuts does not necessarily mean interest rates will remain static. The BOE might pause rate changes or even consider a future hike depending on the economic climate.

- Analysis of the BOE's forward guidance: The BOE's forward guidance will be closely analyzed for clues about its future policy intentions. Any shift in language regarding inflation targets or economic growth will be significant.

- Mention any press conferences or statements relevant to the report: The governor's press conference following the release of the report will be crucial for gaining further insight into the BOE's thinking.

The implications for UK borrowing costs and economic growth are significant. Reduced expectations of rate cuts will likely lead to marginally higher borrowing costs for businesses and consumers, while also impacting investment decisions.

Impact on the UK Economy and Consumers

The UK Inflation Report and its implications have far-reaching consequences for the UK economy and its consumers.

- Effects on consumer spending and confidence: Lower inflation could potentially boost consumer spending and confidence, as households face less pressure on their budgets.

- Impact on businesses and investment decisions: Businesses might adjust investment decisions based on the changing economic outlook, potentially impacting job creation and economic growth.

- Potential implications for employment and wages: The impact on employment and wages will depend on the interplay of various factors, including consumer demand and business investment.

- Long-term effects on economic growth: The long-term impact on economic growth is uncertain and will depend on the sustained trajectory of inflation and other economic indicators.

The easing of inflation pressure on households provides a welcome relief, but the longer-term economic effects require continued monitoring and analysis.

The Role of Global Factors

Global economic conditions significantly influence the UK Inflation Report and the pound's performance.

- Impact of global energy prices: Fluctuations in global energy prices have a direct impact on UK inflation, and these price movements are largely beyond the BOE's control.

- Influence of international trade and supply chains: Disruptions to international trade and supply chains can affect UK inflation and economic growth.

- Effect of global economic growth or slowdown: Global economic growth or a slowdown also directly impacts the UK economy, influencing its inflation rate and currency value.

The interplay of these international factors necessitates a nuanced understanding of the UK economic context when interpreting the UK Inflation Report. The BOE must carefully consider these global factors when formulating its monetary policy.

Conclusion

The UK Inflation Report has delivered a significant surprise, highlighting unexpectedly low inflation figures. This has led to a decrease in expectations of future Bank of England interest rate cuts and a strengthening of the pound. The market reacted decisively to the improved inflation data, leading to significant shifts in currency markets and bond yields. While the long-term implications require further observation, the immediate impact suggests a more positive economic outlook for the UK.

Call to Action: Stay informed about crucial developments impacting the UK economy by regularly reviewing our insightful analyses of future UK inflation reports and BOE monetary policy decisions. Understand the implications of the UK Inflation Report for your financial planning and investment strategies. Follow our updates for the latest news on the UK Inflation Report and its effect on the British economy.

Featured Posts

-

Porsche Macan Ev Fyrsta Rafmagnsutgafan Komin

May 24, 2025

Porsche Macan Ev Fyrsta Rafmagnsutgafan Komin

May 24, 2025 -

European Shares Rise On Trump Tariff Hints Lvmh Falls

May 24, 2025

European Shares Rise On Trump Tariff Hints Lvmh Falls

May 24, 2025 -

South Africa Praises Ramaphosas Composure Exploring Other Options During The White House Incident

May 24, 2025

South Africa Praises Ramaphosas Composure Exploring Other Options During The White House Incident

May 24, 2025 -

Assessing President Ramaphosas Actions Alternative Approaches To The White House Ambush

May 24, 2025

Assessing President Ramaphosas Actions Alternative Approaches To The White House Ambush

May 24, 2025 -

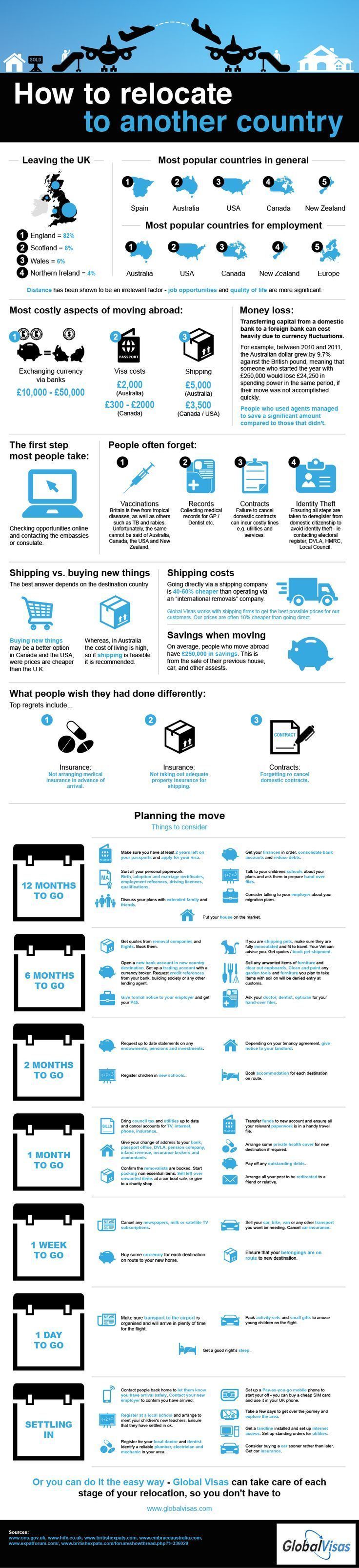

A Successful Escape To The Country Tips And Advice For Relocating

May 24, 2025

A Successful Escape To The Country Tips And Advice For Relocating

May 24, 2025

Latest Posts

-

Memorial Day Weekend 2025 Dates And Significance Of The Holiday

May 24, 2025

Memorial Day Weekend 2025 Dates And Significance Of The Holiday

May 24, 2025 -

Memorial Day 2025 Everything You Need To Know About The Observance

May 24, 2025

Memorial Day 2025 Everything You Need To Know About The Observance

May 24, 2025 -

Cheaper Gas Expected For Memorial Day Weekend Travel

May 24, 2025

Cheaper Gas Expected For Memorial Day Weekend Travel

May 24, 2025 -

When Is Memorial Day In 2025 Your Guide To The May Holiday Weekend

May 24, 2025

When Is Memorial Day In 2025 Your Guide To The May Holiday Weekend

May 24, 2025 -

Memorial Day 2025 Date History And Three Day Weekend

May 24, 2025

Memorial Day 2025 Date History And Three Day Weekend

May 24, 2025